- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Need some a answers... count find this anywhere. C...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need some a answers... count find this anywhere. Credit score dropped after CLI.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

@Anonymous wrote:

@Anonymous wrote:

Also be aware that there is not a single creditor, lender, or insurer that a single person here can name that references Vantage Score for any decision, period, ever. In history.

Not one.The last time you made this argument about a week ago, someone (I want to say TT) chimed in and provided an answer to this referencing at least one creditor that did use VS 3.0 and you never responded to his post or posted again in that thread. As I also recall in that thread, you called everyone "liars" that said that they had a VS 3.0 score used by a utility company, rental company or cell phone company.

I get it that relative to FICO scoring, VS 3.0 is next to irrelevant and I think it's fine to constantly echo that in this forum for those that may not be aware. The important part of that statement though IMO, is "next to" irrelevant. Some do believe based on what they've encountered throughout their credit-seeking days that VS 3.0 does provide some minor level of relevance.

Nah was me.

I don't know that any current creditors are using it, but historically Chase absolutely has and that's fairly well documented in media releases in addition to my own pre-recon Freedom denial which apparently is a pics or it didn't happen scenario (which to be fair I've used regarding CFA's and some other stuff recently, but I'm nearly 100% confident I didn't keep the letter, mea culpa; however, the Experian news release quoted earlier should be sufficient)... though AFAIK they stopped several years ago. I couldn't even find the old thread that I posted on it, found the Amex BCP from a similar time period but not the Freedom thread. There were other threads around that 2011-2013 time frame here and elsewhere so it wasn't an isolated occurrence, but there's admittedly a lack of posters from that era still here especially ones that were applying for entry level Chase cards around that time period. They most certainly were not using VS to the exclusion of either FICO or their internal score, basically they were trialing all three and the internal score won and/or was cost-effective enough compared to the other two.

I'm fine with saying no current creditor that we're aware of uses VS; however, it's a stretch to say that nobody uses it (as there are hundreds of lenders that never come up on this forum), and it's false to say no one has ever used it for a credit decisioning process.

That all said, I really wouldn't worry about VS much unless you're into that sort of thing. I just like it because it thinks I'm pretty ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

BBS -

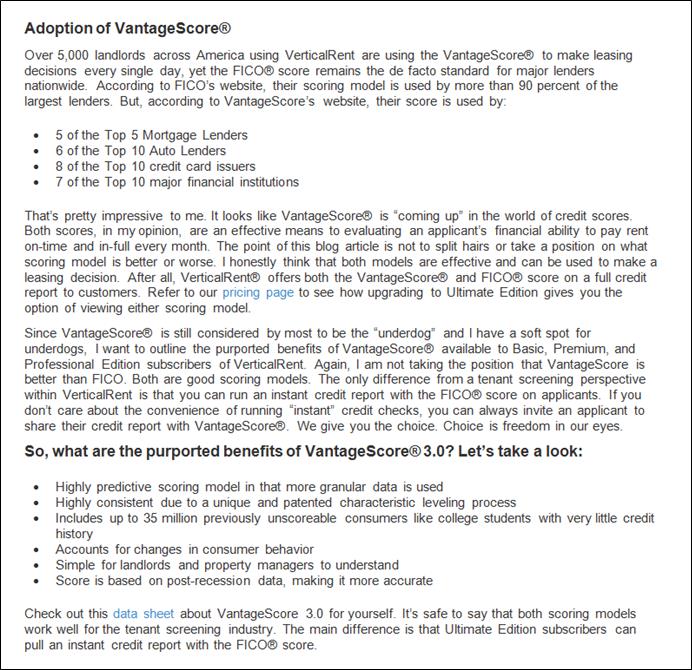

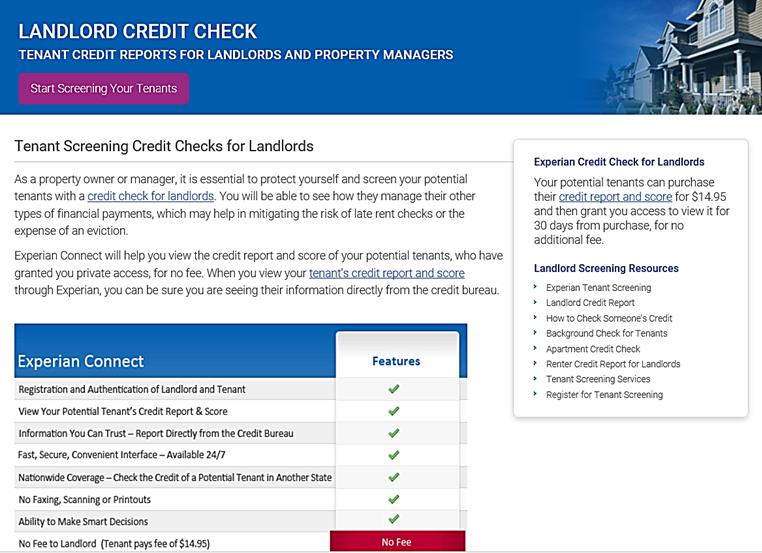

Yes I did and do say VS3 has a significant presence in the rental market space even though ABCD feels otherwise. I have posted screen shots from articles and links to providers of services for the rental market in the past [background checks & tenant screening]. A couple are VerticalRent and Experian Connect.

As many know, the insurance industry is another area where credit scores are influential. The primary players are LN and TU with Fico having a lessar presence.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

I've never heard of VerticalRent -- and most of my close friends are landlords like me and have been for decades. 5000 landlords is about how many landlords there are in literally the village I live in so I guess it proves that SOMEONE uses it, but it isn't a big group. In the major metropolitan area there are quite literally 100,000s of registered landlords. In one city. I certainly don't know a single landlord in my entire time as being one and working with them at condo board meetings that uses anything but FICO -- we pay a pretty penny for the score and basic report, but it's valuable and every credit pulling service for landlords that I am aware of also offers FICO. I'll check out VerticalRent the next time I have a tenant change. I'll have to ask some of my friends who rent if they've ever seen "VerticalRent" on their hard inquiries list. Doesn't ring a bell, and even though I am a landlord, I also have rented upwards of 30 properties myself for varying amounts of time that required a credit report pull (even for short 3 month rentals). Never recall seeing that name before in either position as landlord or renter.

As for the other quote regarding "8 out of 10 credit card issuers", that boilerplate text above is an outright manipulation of reality. It doesn't say those creditors use VantageScore to make lending decisions ANYWHERE. All it says is "used by more than 90 percent". Consider this: Capital One CreditWise offers people free Vantage Scores monthly. Capital One uses Vantage Score for that purpose, but for lending criteria? No. Other banks and lenders also offer free VantageScores to their customers, but they don't use them for credit worthiness. Chase Credit Journey also gives people their VantageScore and let me be honest here: I have the NEAR IDENTICAL Vantage Score on CJ this month as I did last month, last month I didn't get any pre-qualified offers but this month I did and it's because my FICO changed and Chase saw it. So while my Chase VS score dropped 20 points in 30 days, my FICOs went up almost 50 points. Chase didn't use VS for credit decisions, but they USE VS for offering their customers a useless credit score that they themselves don't care about.

VantageScore's marketing hype sounds really major, but when so many creditors are giving away free VantageScores to customers, it's easy to say "90% of lenders use us!" and avoid saying "90% of lenders use us to make credit decisions!".

I only saw this post about Chase once using Vantage Score but it ended up being an OP who was just confused it seems: http://ficoforums.myfico.com/t5/Credit-Cards/Chase-uses-their-own-scoring-system/td-p/1126755

I bet VS would have gotten in if it wasn't for FICO08 which appears to be better at predicting default and also doesn't allow people to use the AU bump as older versions did. Once FICO08 came around and started proving its value, it surpassed VantageScore 3's prediction ability over previous FICO models.

But VS will continue to be used billions of times a year -- mostly to give people free VS scores on free monitoring sites. There are over a dozen free VS sites already and I expect more to come soon. Pay 3 cents for a VS for a user, make $1 when they click a credit card app you "suggest" for them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

The new issue is starting soon so many bad things fom public records can no longer be reported by the big 3 those scores are not worth any thing for renters. When we had rentals we cared about evictions, liens,criminal records, judgements and bk and nothing else. We never had more than 20 rentals for us it just a sideline business of mostly lower middle class housing. Everything for us was on a case by case basis with no hard rules except drug dealers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

For me it's not too difficult to see if a rent applicant has been sued in my county or nearby counties as the court dockets are all on a public search and take 30 seconds to run. But not everyone has that access. If an applicant is from out of state I just ask them to put in their previous landlord's name and number -- that usually scares off applicants with baddies. I've never actually called an ex-landlord to verify someone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

@Anonymous wrote:

Alright my fellow credit achievers so yesterday I got a total shock. I've been working on my credit now for the past year. Recently I got a huge CLI on my JetBlue card for 3k so now it's at 6.5k. I'm like awesome my score will go up. NOPE. Went down a whole 35 points and nothing else changed. My credit ratio went down to like 29 points and was higher that's about it and everything has been paid on time with no hard or soft pulls. Can anyone explain this because I sure as he can't. Now the score I'm referring too it like the normal credit score you get off of credit karma and the like. My fico 9 score went up by 1 point though. Ugh why any answer would he appreciated. Thanks.

My Vantage scores are over 100 points lower than my Fico's. I have come to realize that Vantage is not happy with my getting new credit. I can't think of why it would have dropped that much for you though. No new accounts (SCT)? I pay attention to myFICO scores and just amuse myself with Vantage scores. My FICO 8 EQ hit 750 today, but Vantage score is 625. Go figure!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

@Anonymous wrote:

Yeah it's seriously weird i can't seem to figure it out except for when someone mentioned i may have been rebucketed. Which I had to look up. My fico 08 score is 680 and my vs 3 score is like 545 it's so bad I don't get it. All the same info is on both too.

Just ignore the VS score entirely. It has no purpose that matters to you. The sites that offer VS as well as credit monitoring may have some usefulness to warn you if you need to cough up money to pull a 1B or 3B report from a site that has more accurate information.

If you are looking to acquire new credit, first do some work and see what the vendor pulls and if anyone knows which FICO score they rely on. Then go find yours.

No lender is going to reference VS, so it's a useless score that just adds to confusion and annoyance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some a answers... count find this anywhere. Credit score dropped after CLI.

As someone who has owned property since I was 18, house hunting CAN be fun. I am always looking. My current home, which I love so much and is the smallest home I have ever owned (on purpose) took me almost 2 years to find. I also made over 60 offers on other homes I found but this one is 90% perfect and I am thankful I kept looking and comparing and learning more about the ins and outs of all the various homes I was looking for.

Even though I closed on this one in 2015 and love it in so many ways, I am already house hunting again because I realized I want my bedroom facing the south instead of the north. That's something I never grasped in 20+ years of owning homes and apartments, but I love that morning sun warning the room up in cold winters!

Keep house hunting, and make yourself a spreadsheet with all of the things you find you love about one house and hate about it. I personally prefer corner lots but some folks hate the extra lawn care required. I also don't drive so a big driveway is useless for me. If you have a tiny bladder, the layout and location of bathrooms may matter a lot (all my bathrooms are on one side of my home but it's so small that anyone can run and make it in time, haha). Measure your current clothes storage sitaution and make sure you find a place with the right size closets! I tore 3 closets out of my recent home because I don't use them but they were tiny and I can't imagine a family of 3 living in the space as the previous owners did with no storage anywhere.

Keep track of every detail, that way when you're ready, you can be more certain that a home you find and love is truly a good value for you now and in the future!