- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Next step on FICO rehab...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Next step on FICO rehab...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Next step on FICO rehab...

Wow it's been forever since I've been online -- I ended up spending most of my summer on a boat or outside at the parks and don't do much posting from my phone...summer is a poor time for me to be online, it's been far too nice out for me.

Haven't been doing much FICO monitoring this summer as I was just letting new accounts age/garden and focus on other things -- plus there's no card I want that I will get approved for right now, so I figure next spring/summer I'll hopefully be at the next FICO tier...

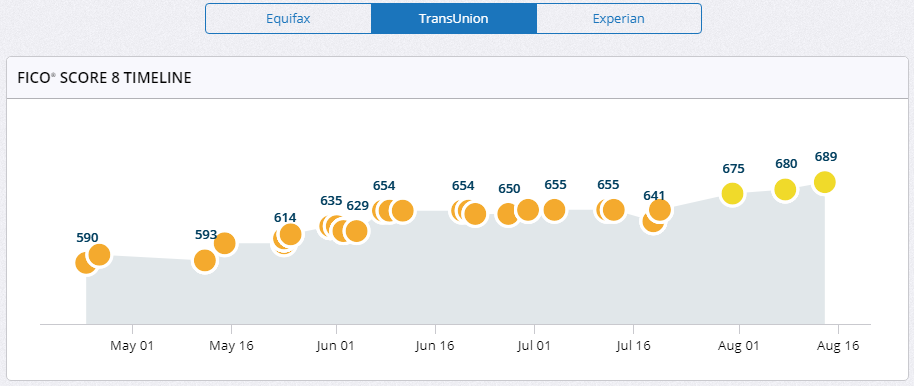

Good news all around -- my FICO scores of 560/570 around March are now 644EQ, 680TU and 658EX -- almost 100 point increase which I attribute almost entirely to actually opening new accounts. I rehabbed one 5 year old CC with 90D lates to "never late" with goodwill, one of my CRAs dropped my tax lien entirely (but the other two didn't). Went from 1 CC ($1000 CL) to 5 CCs with $8300 CLs, added the Alliant SSL (sub 9% utilization) and also recently got a boat loan for $22,500 at a crazy low interest rate to see how it would affect FICO scoring (it shows up as an auto loan, 98% utilization). I also let 1 card report at 38% and then had a month where two cards reported at 38% but it didn't have much of an effect on my FICO scores overall. As of today, I have only 1 card reporting at 38% and waiting for the CRAs to update it to 8%.

My plans the rest of this year:

- Pay off the boat "auto" loan entirely if it makes sense -- I have the funds to do it, I just wanted to see the effect of the loan and the $300 I'll pay in interest doesn't bother me. I didn't need the loan to begin with but since they basically approved me with a seller guarantee, I took it.

- Naturally keep my CC utilization to below 9% on one card -- I always PIF so I will just keep a $5 balance on one card and call it a day.

- Finally pay off my one collection (utility) which is the last negative on one credit report that dropped the tax lien. I am not sure what to expect there, it's a 7 month old collection from many years ago and I could have paid it at any time but was waiting for some PFD confirmations to come in to pay it off.

- Pay off my tax lien regardless of status on my CRAs -- it's only $1000 and was filed in 2010.

Next year I want to get the remaining rewards cards where I know I'm leaving cashback on the table. I travel all the time but I fly subprime coach and stay in airbnb's so there's no benefit of a travel rewards card for me. Cashback is king in my budget.

I am a bit shocked at my FICO boost overall -- AAoA reports "oddly" on MyFico and CCT both because with an ancient closed account I should have an AAoA of close to 3 years but they both tell me it's 12 months. Not sure what the conspiracy is there, don't really care because that ancient account closed in 2008 so next year it'll delete anyway. I'm going to work on getting my AAoA to 24 months if possible before the end of 2018. Also will probably pay down my boat loan to 64%, 48%, 8% and 0% this year to see if there's any effect on FICO for me. I am not sure how my FICO keeps going up every month with my AAoA plummeting, my installment loan utilization going from 8% (SSL only) to 98% (boat loan), and many new accounts popping up (Chase FU and Amazon store card being the newest ones), but I'm glad to see the "good" tier in sight on all 3 CRAs.

Here's to 700s in 2018, I hope.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next step on FICO rehab...

Welcome back! Looks like you're on a great path. Question for you though. You referenced a 90 day late account that you fixed to never late with GW and then a tax lien. Do you have any other negative items? With your current scores, I'm thinking you must as even your best score (I'm assuming the bureau the tax lien was removed from) is 680. With low utilization, decent AAoA and an open installment loan for credit mix I would assume your scores would be into the 700's already if you didn't have any negative items present.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next step on FICO rehab...

@Anonymous wrote:You referenced a 90 day late account that you fixed to never late with GW and then a tax lien. Do you have any other negative items?

My negatives:

- Collection posted on 1/17 from a utility bill that is truly "not mine" but there's no way out of this one because I legally was on the account and I have zero record of the letter I wrote to take me off the joint account when I moved out years and years ago. That account was paid in full for years and only in 2015 or so did it go delinquent -- but I was still on it. That's on all 3 CRAs. Have been negotiating with the OC and the CA for a PFD and only recently got the letter I wanted.

- Tax lien posted in 2010 on 2 CRAs -- it's off of EX but on TU and EQ. Funny that TU is so much higher than EX even though TU shows the lien. I do plan on paying this in full, but was hoping it would fall off all 3 before payment. I'm going in to pay it off in October when I'm in the neighborhood of the tax place.

- One negative chargeoff showing on one CRA (EQ) that shows CO status from June 2014 to July 2015. This was a bad idea card that I set up with someone who was a business partner years ago and I forgot about after we split up. They never once notified me about it (duh, I moved) and I wasn't checking my credit scores back then at all. Zero credit pulls. Once I discovered it, I did my research on the creditor and realized they had violated laws and the CFPB fined them, so I sent disputes to the CRAs and 2 of them deleted it immediately, but EQ did not. I will be writing to the OC and the CFPB demanding removal since the account falls under the settlement agreement. It stopped reporting in July 2015, no idea if it's been sold to a CA/JDB or not, but no letters or phone calls. Still in SOL but I know I can knock them out per the CFPB settlement.

So basically I am looking at:

- EX = 658 (8/15) = No tax liens, 1 collection, no other negatives,showing < 9% utilization overall and 28% utilization on one card which will fall to $5 overall utilization this month

- EQ = 644 (8/13) = 1 tax lien, 1 collection, 1 chargeoff (2015), showing < 25% utilization overall and two cards at under 40% utilization which have already been paid off but didn't report in time.

- TU = 680 (8/8) = 1 tax lien, 1 colllection, no other negatives, showing < 25% utilizatoin overall and two cards at under 40% utilization

Not sure which reports are showing the new auto/loan yet -- I have a 3B to pull but waiting a few more days for things to settle in if possible.

I think I can actually get to 690 on TU in the next 30 days once utilization shows as $5, but not sure. Also not sure why TU is so much higher than EX since EX dropped the lien, maybe a different scorecard? Wonder if TU will FICO drop if the tax lien falls off.

Either way, I'm pleased as punch since my main insurer told me they will re-soft pull my credit report on demand to reprice me and I was told 660 will be enough to get a nice price drop, so as soon as utilization updates across all 3 I will have them soft pull and save me some cash.

I definitely want:

- Citi DC (2%) card

- Amex cashback card (whatever the grocery one is, annual fees don't bother me since my annual credit card spend is over $100,000 a year and I never pay interest)

- Possibly a 5% rotating category card (either Discover or Chase Freedom) to maximize cashback and get some sign-up bonuses

I'm not in a rush for any of these, but I hate leaving money on the table. With $100,000 per year spend I am positive I am leaving hundreds of dollars behind right now and that is frustrating. I don't need a mortgage ever again (never had one, never will) and I didn't even need the boat "auto" loan but got it as a favor to a friend who went into the boat sales business and he needed one more finance deal so we worked it out so the interest isn't really costing me anything plus it gives me data points. The only thing I "need" is a lower insurance price and I would "want" some more cash back cards to rotate to my benefit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next step on FICO rehab...

Do you plan on continuing to target those negative items to see if you can achieve removal with persistence? Since you only have a couple of things on there, it seems like a doable goal and as I'm sure you know your scores would probably all jump some 50-100 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next step on FICO rehab...

@Anonymous wrote:Do you plan on continuing to target those negative items to see if you can achieve removal with persistence? Since you only have a couple of things on there, it seems like a doable goal and as I'm sure you know your scores would probably all jump some 50-100 points.

I am one of the few credit rebuilders who doesn't target negatives with fake disputes. All my disputes are written, and all of them include whatever legal information I've discovered based on my interpretation of the laws, regulations, requirements and past instances of why I think the tradeline is either faulty or incorrectly reported in whole.

The tax lien I will dispute because my reading of all of the various consumer protection laws tells me that this was never a consumer credit tradeline -- yes I know people say that's not a requirement but that's not how I read the various requirements. I think once its paid it will probably drop off but I am not going to attack it majorly because I doubt it's a big deal.

The utility collection will fall off once paid, at least the PFD letters I've finally received speak to that. If they don't, oh well. Not too concerned there.

The last remaining chargeoff on EQ will come off with a lawsuit I will personally file whenever I have time to. I will send the OC an ITS and then I will follow through on it immediately after their deadline to purge it. I figure I can win $1000 from them, and I have all the time in the world to chase a penalty once I put my mind to it. Plus the courthouse is really close to me, haha. I won a 5-figure settlement once from an OC for faulty reporting many years ago, I'm really good in court going pro-se and I have access to legal libraries to help me impress the judge with my filing and writing skills.

Other than that, I just plan on monitoring reports for any CA/JDBs that might decide they want to play with me. I love suing JDBs in court and even if it's just $500 or $1000 in my pocket, I'd have no issue with people selling old debts and re-reporting them because in my experience, they always violate the law in their careless reporting. I like free easy money, too.

At this point, the only thing I really care about is getting the lowest insurance costs. As a landlord I am paying more than I should, and that bugs me. I have enough residual income coming for the next 5-6 years that I don't really care about credit other than cashback maximizing and lower insurance costs. If it takes 3-4 years, so be it. I admit to screwing up on tax filings, on forgetting I was a joint on a utility bill for an old apartment, and on getting a secured credit card for a useless business partner who cost me $100,000 in losses so the $300 charge off doesn't compare in any way. Those were 100% my fault for making stupid decisions, compounded with NOT monitoring my credit for 4 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Next step on FICO rehab...

TU just updated -- one of my < 40% TLs is now 0% and just reported, so it's TU 689.

TU still probably not reporting the boat "auto" loan, and still probably reporting one TL at < 40% instead of < 9%, so I wonder what will happen when the boat "auto" loan reports and the total utilization is $5/$8000.

Kinda nutty that TU still shows an unpaid tax lien (2010) and an unpaid collection (01/2017) -- I wonder if I can get into 700 with both of those. Would be nice to see 700 for the first time in many years!