- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: No FICO negative reason code for AoYA drop to ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

No FICO negative reason code for AoYA drop to 0?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

BBS, we thougt this was strange. I don't think this is the norm. I have no idea why. This was on Fico 8 There were no other changes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

Have you tested going from 4% to 2% back to 4% back to 2% a couple of times to nail down that it was the utilization decrease and increase that caused the score change? Since there are so many variables that go into a credit score, a single data point can often be masked by something else going on. If you tested this several times though, it would give a much stronger data point regarding your file.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

She hovers in this area. I can't mico more closely because we use her Amex card BCP alot and one of our biz cards is Cap 1 Spark. With these two alone her usuage can vary the whole thing by several percentage points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

@iv wrote:

@Anonymous wrote:I indirectly got the answer to my first question above from another thread where CGID and TT chimed in. Basically, a score over 800 with different credit monitoring software often won't present any negative reason codes because you're within 50 points of the max score. So, when my AoYA dropped to 0 months, since my score was still over 800 it didn't generate a negative reason code because the monitoring software (CCT) simply doesn't provide them at that score.

Yup. It's important to note that the reason codes are still generated at any score level, just suppressed from display.

If you have a myFICO monitoring subscription, a useful trick is to look at the TU Alerts for "Score Change" - those (accidentally, I assume) still list the FICO8 reason codes in the "Details" section, even when the score is in the 800-850 range.

For example, my most recent FICO8 TU alert (from 842->845, with two new accounts opened in the last 6 months) showed:

- Too many accounts with balances.

- Too many inquiries last 12 months.

- Length of time accounts have been established.

- Proportion of loan balances to loan amounts is too high.

And the "Length of time accounts have been established" code is clearly based on AoYA in this case, given that AAoA and AoOA are above any reported threshold.

Mind you, with the same report data, EX has been pinned at 850, and EQ has been bouncing back and forth between 850 and the 840s... so either the AoYA penalty is tiny, or the buffer over 850 is pretty large.

(The only reason TU seems to be bouncing just under 850 is a slightly higher number of HPs than the other two.)

Actually fairly certain that's the short history one in the myFICO interface; not "you opened this account too recently"

There's 4 different new account / short history reason codes in the algorithm, but I've had that one previously even on my former dirty file and my data and reason codes suggest AOYA ain't a thing there. I'll try to take a look this weekend and see if I can figure out what it translates too, did that with the tax lien file, haven't yet recently. Pro-tip on the TU interface, that's actually been a factor in their service for the last decade, product feature not a mistake anyway. MF is just built on the OEM products.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

@Revelate wrote:

@iv wrote:

@Anonymous wrote:I indirectly got the answer to my first question above from another thread where CGID and TT chimed in. Basically, a score over 800 with different credit monitoring software often won't present any negative reason codes because you're within 50 points of the max score. So, when my AoYA dropped to 0 months, since my score was still over 800 it didn't generate a negative reason code because the monitoring software (CCT) simply doesn't provide them at that score.

Yup. It's important to note that the reason codes are still generated at any score level, just suppressed from display.

If you have a myFICO monitoring subscription, a useful trick is to look at the TU Alerts for "Score Change" - those (accidentally, I assume) still list the FICO8 reason codes in the "Details" section, even when the score is in the 800-850 range.

For example, my most recent FICO8 TU alert (from 842->845, with two new accounts opened in the last 6 months) showed:

- Too many accounts with balances.

- Too many inquiries last 12 months.

- Length of time accounts have been established.

- Proportion of loan balances to loan amounts is too high.

And the "Length of time accounts have been established" code is clearly based on AoYA in this case, given that AAoA and AoOA are above any reported threshold.

Mind you, with the same report data, EX has been pinned at 850, and EQ has been bouncing back and forth between 850 and the 840s... so either the AoYA penalty is tiny, or the buffer over 850 is pretty large.

(The only reason TU seems to be bouncing just under 850 is a slightly higher number of HPs than the other two.)

Actually fairly certain that's the short history one in the myFICO interface; not "you opened this account too recently"

There's 4 different new account / short history reason codes in the algorithm, but I've had that one previously even on my former dirty file and my data and reason codes suggest AOYA ain't a thing there. I'll try to take a look this weekend and see if I can figure out what it translates too, did that with the tax lien file, haven't yet recently. Pro-tip on the TU interface, that's actually been a factor in their service for the last decade, product feature not a mistake anyway. MF is just built on the OEM products.

Actually haven't seen the reason code for new account in FICO 8; possible it got combined into short history which I see on both FICO 04 / 8? Guess need more data, it does match though in my case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

@Anonymous wrote:

Are you referring to FICO 08 scores above? I have not heard of a 4% util to 2% causing a 7 point drop before, actually any drop to be honest. Has anyone else heard of this happening?

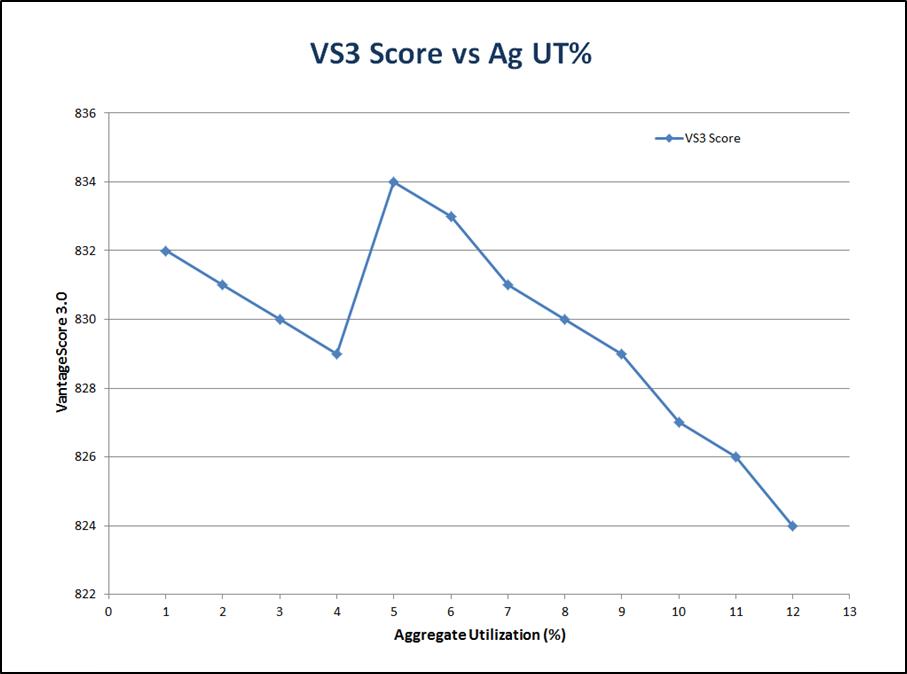

Yes, this happens. Once you are under 9% reporting on 1 card, each percentage point below that can change your score slightly up or down. It has been tested many times in this forum just not recently that I recall. Most people have a sweet spot somewhere between 1% and 9% but it takes time and a lot of work to find it. Reporting at 1% does not ensure that is your best score but it is close.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

My scores are impossible to track due to tons of rebuilding work but I feel my scores should be relatively stable now, and the alert should at least show me what movement happens when the balance updates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

I guess the "sweet spot" stuff with respect to aggregate utilization must be very profile-specific. I don't recall ever experiencing a score change at all when at any single-digit reported utilization. Mine usually is 1%, but it's been 2%-5% a handful of times and I've never seen a score change related to the utilization. Then again, my profile isn't even impacted by the number of cards reporting balances it seems, so maybe I'm somewhat bullet proof to these things. Who knows. I would definitely like to hear from others though that have found different scores based on utilization fluctuations in the single-digit aggregate range.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No FICO negative reason code for AoYA drop to 0?

^ agreed

I let my balances report naturally. Aggregate utilization has reported anywhere from 0.5% anf 7%. Not seen any impact on Enhanced Fico 8 scores in this range of utilization. I do see a minor impact associated with # cards reporting balances and that could mistakenly be attributed to a minor change in utilization - if not isolated.

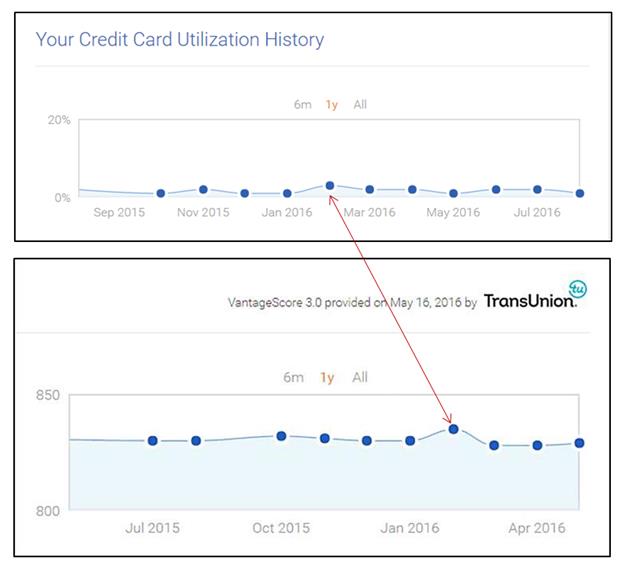

In contrast to Fico, I have received my highest VS 3.0 score (835) with aggregate utilization around 4.5%. In the prior month when AG UT% was between 0.5% and 1%, my actual score was 3 points lower (832). I also see a drop with AG UT% in the 5% to 6.5% range. Over the last 6 to 9 months I have maintained AG UT% in the 0.5% to 3.0% range. VS3 score fluctuated between 828 and 833 - unable to get back to 835 at the lower UT%.

Note: TU VS3 simulations based on my profile (which is what CK uses) showed similar results. Extended range simulation results (presented previously) are pasted below.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950