- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: No reason codes for > 50% of cards with balanc...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

No reason codes for > 50% of cards with balances

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No reason codes for > 50% of cards with balances

I reported around a year ago that when I went from AZEO to AZE2 to AZE3 to ALL cards (4 at the time) reporting balances that I never saw a score decrease. At the time, I didn't really bother looking at reason codes, so I couldn't tell you what they said.

I went on a mini-spree for 3 cards early this month and by the 28th all 3 had reported. Of course, they all naturally reported a balance since I had no way of knowing when they would report. I now have a total of 8 cards, but only 7 are visible on TU and EQ since one of them is Blispay that's only seen on EX.

I always allow a small balance to report on my Discover card, so instead of 1 of 7 cards reporting a balance I went to 4 of 7 cards reporting balances with the 3 new accounts landing on my reports all in the last week. Interestingly, my Blispay also shows a small reported balance ($29) that I'm going to need to look into, as I was at $0 last cycle and didn't make any purchases to my knowledge. But anyway, that means on EX I'm at 5 of 8 cards with balances reported.

I just pulled my 3B scores/reports from CCT tonight and noticed my EX and EQ scores dropped 4 points apiece from the new accounts, which was to be expected. In looking at my reason codes though, I still have "no items to display" for factors hurting my score.

Does this verify that under FICO 08, at least with my profile, that going above 50% of my cards reporting balances does not impact my scores at all? I sort of thought this was the case last year when I let 100% of my cards report balances, but I feel stronger about the data having gone to 57%-63% of cards reporting balances again this year and not seeing any negative reason codes citing it as being an issue.

Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No reason codes for > 50% of cards with balances

Wow, that is a really interesting data point. Since I haven't had more than 1 CC reporting open in almost 10 years, I can't share any until all my CCs report and I can play with balances reporting to see if it matches up. I am going to let all my CCs report 8% in June, and then let just one report 28% in july and all of them report 28% in August and see **bleep** happens to my FICOs.

I know that TU is especially sensitive if you have more than 3-4 accounts of any type with a balance (including installment loans) but since my CRAs for the past 5ish years was basically ONE open CC, I never saw the "you have too many credit accounts with balances" code.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No reason codes for > 50% of cards with balances

@Anonymous wrote:Wow, that is a really interesting data point. Since I haven't had more than 1 CC reporting open in almost 10 years, I can't share any until all my CCs report and I can play with balances reporting to see if it matches up. I am going to let all my CCs report 8% in June, and then let just one report 28% in july and all of them report 28% in August and see **bleep** happens to my FICOs.

I know that TU is especially sensitive if you have more than 3-4 accounts of any type with a balance (including installment loans) but since my CRAs for the past 5ish years was basically ONE open CC, I never saw the "you have too many credit accounts with balances" code.

It's funny you mention TU as being especially sensitive, as that's my one score that's been an absolute rock and hasn't changed since October 2016. See my other post-spree dust settled thread I just started. My TU score was 764 pre-spree and 764 post-spree and evidently > 50% of cards reporting balances didn't bother my TU score either.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No reason codes for > 50% of cards with balances

I've never seen a reason code for it either TBH, but the 4 points is pretty much line item identical to my own drops crossing the 50% line, actually think mine was ~7 points in my old scorecard, only a handful not a big deal that can get lost in the noise, and not the massive drops we've had anecdotally reported in the past even on pretty files.

I don't know why people don't get reason codes in the highest brackets, makes it absurdly difficult to test some things. Run up a balance on one of them would ya? ![]()

Anyway when I'm mostly clean on EX / EQ except for some inquiries in Dec/Jan I will probably put a small balance on everything... sadly most of my accounts are similar statement dates so it's going to be awkward trying to figure it out but I'll be looking for 1/3 on EQ and 1/2 on EX/EQ on the way to 100% reporting a balance when my scores are somewhat stable again. Fortunately Chase makes it easier test this with their friendly report $0 on full payment policy in walking back and forth across breakpoints.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No reason codes for > 50% of cards with balances

I'll add to these data points here...

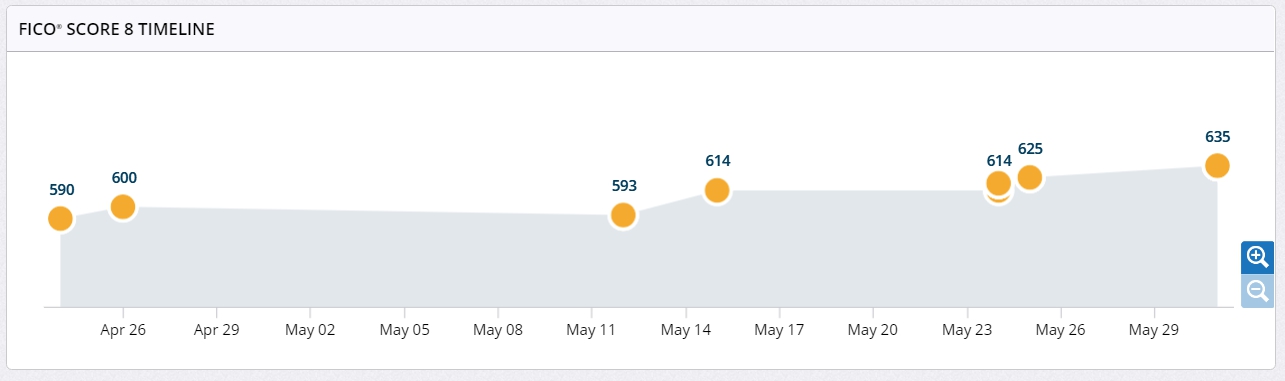

TU FICO was 597 with all cards at $0.

Williams Sonoma store card $5/$400 reported, score jumped to 611 per MyFico.

Let 9% on Discover Secured report but another charge posted so it went to 9.5% ($237/$2500). MyFico now with two balances goes up to 618.

Added a new card (Capital One Secured) $3000 credit limit and was going to report it as $0 but an autopay popped up early at $13 and reported. Score jumped to 625 with 3 out of 4 cards showing a balance.

Chase preapproved me for Freedom Unlimited ($500) yesterday. Figured I was denied for Amazon Prime store card twice this year so I apped for that cold and got approved ($400).

Amazon reported TODAY (day after approval), TU MyFico goes to 635 with 3 out of 5 cards showing balances.

This month I will pay AZEO leaving 8% on Capital One ($240) before statement closes at end of month and see **bleep** will happen. I am expecting my Alliant SSL to finally report this month so hopefully I can see what happens there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No reason codes for > 50% of cards with balances

@Anonymous wrote:I'll add to these data points here...

TU FICO was 597 with all cards at $0.

Williams Sonoma store card $5/$400 reported, score jumped to 611 per MyFico.

Let 9% on Discover Secured report but another charge posted so it went to 9.5% ($237/$2500). MyFico now with two balances goes up to 618.

Added a new card (Capital One Secured) $3000 credit limit and was going to report it as $0 but an autopay popped up early at $13 and reported. Score jumped to 625 with 3 out of 4 cards showing a balance.

Chase preapproved me for Freedom Unlimited ($500) yesterday. Figured I was denied for Amazon Prime store card twice this year so I apped for that cold and got approved ($400).

Amazon reported TODAY (day after approval), TU MyFico goes to 635 with 3 out of 5 cards showing balances.

This month I will pay AZEO leaving 8% on Capital One ($240) before statement closes at end of month and see **bleep** will happen. I am expecting my Alliant SSL to finally report this month so hopefully I can see what happens there.

How many cards did you start with?

I'm skeptical of datapoints on thin / new / busy files as a lot of stuff can happen early and there are some complexities around those which we really don't have a good grasp on. I pretty much had a upward trend on all scores for my first six months regardless of what happened it seemed like when I look at my old data, but I didn't really start zealously tracking scores until somewhat later.

My own testing deck was only as good as it was because I was flatlined for literally years on an identical score on FICO 5, and pretty similar on FICO 8 as well. Right now with so many changes on my reports, other than obvious things like lates or liens getting excluded it's hard, I can't even really tease out the inquiries falling off which I'd really like to do though I got the critical removal of seeking credit reason code once my final inquiry dropped out of scoring range on TU at any rate which was one of the primary ones I wanted as less inquiries = better inquiries QED.

It just isn't easy to test this crap well sometimes, I figure I'll try to reproduce my balance testing after I'm on a clean scorecard on EX/EQ though have to try to get that in the few months before inquiries are completely gone and AAOA possibly changes. I repeated my tests over and over again and always found a 1/3 breakpoint as a drop on EQ, and then another at 1/2 on all 3 bureaus for FICO 8 at any rate, and that was confirmed by a couple of people on other scorecards though there's been some variation too with other reports like yours.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No reason codes for > 50% of cards with balances

1 open card with charge-offs, one ancient closed card never late, one closed card with chargeoffs. I started around 566 or so (FICO08 average of the 3), got the closed CO card deleted, got the open card with CO goodwilled to never late. Scores bumped up to 577 or so. Added Discover secured, scores went up. Added Williams Sonoma, scores went up. This month Capital One and Amazon store reported for the first time (0 month aging), scores went way up. Chase FU hasn't reported yet, neither has Alliant SSL.

Just noticed today that my initial Amazon purchase during the store card acquisition updated the balance from $0 to $114/400 (29% which I planned just in case it reports, lol) and my score went down 2 points, probably utilization based. Right now I have the following balances reporting, which was NOT intended:

* Secured bank: $0/$1000

* Discover secured: $245/$2500 (9.8%)

* Capital One secured: $13/$3000 (0.4%)

* Williams Sonoma store: $5/$400 (1.3%)

* Amazon store: $114/$400 (28.5%)

Aggregate utilization is 5.2% -- last month I had only Discover and the old secured bank card reporting with zero balances. When Williams Sonomareported my scores jumped up 16-20 points across the board (AZEO style) but then all of these cards reported do to poor PIF planning/posting on statement cut date. Discover reported a planned balance while WS was still appearing and my score went up 2-3 points that day (I pull EX score daily on CCT). Capital One posted a balance that I didn't want and score went up again. Then Amazon posted zero balance new account, score went up, then today posted the $114/$400 balance and score dropped all of 2 points.

So I have 5 cards, 4 are showing balances, and my score went way up in a month but down 2 points assuming because of 29% utilization on one card.

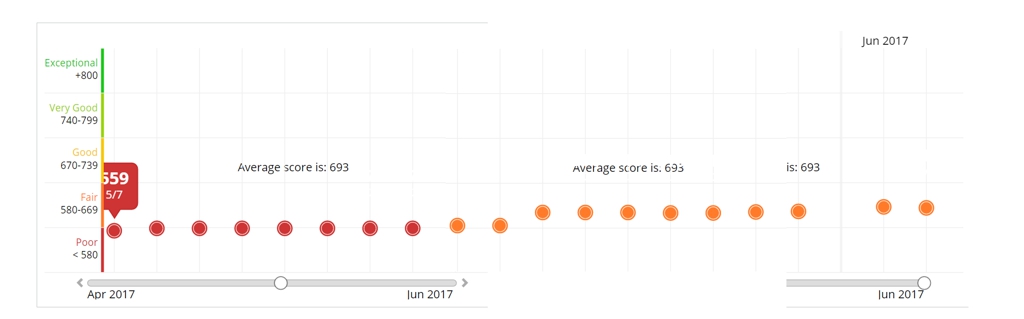

Here are some screen captures from my last month or so, this is CCT EX (mind the low quality crop and combine job, lol):

And here is one from MyFico for TU:

I agree that my file was and still is super thin. I also have an unpaid tax lien (2010), a recently collection from January and a charged off credit card from 2015 that isn't even 2 years old yet and still having the new accounts, inquiries, etc reporting boosted my scores significantly. And I even have balances reporting on more than half my cards. The TU score chart doesn't reflect balances on the Amazon card but it does reflect the Amazon card reporting as $0/$400. Will be interesting to see if MyFico updates a score today to reflect a balance update on that one to 29% and see if it drops a little or a lot. Or not at all.

I believe my new collection will delete this month, July at the latest. That will leave me with the 2015 CO and the tax lien. The CO is going to fall off per CPFB threat (which I am convinced will work, I just need to mail my final demand letter off this month) so I will only be left with a tax lien. Should keep me in the dirtiest bucket until I can figure out how to resolve that one, going to start attacking it in July -- don't want to pay it off until AFTER the July filters come through in case they re-report it properly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No reason codes for > 50% of cards with balances

Your data tends to support the finding that dirty scorecards (at least those with public records) don't really look at new accounts as a negative attribute in scoring. Other factors are allocated whatever weight (signal strength) is associated with "too many accounts opened recently" on clean scorecards..

On the other hand, there is significant data showing too many new accounts in a short time span (3 or more in 60 days?) are viewed negatively and will impact score on at least a subset of clean scorecards (young/thin specifically).

Those with both dirty and clean CRA reports are in the best position to test/compare impact of new accounts. Not that I advocate opening new accounts just to test. Last new account I opened was over 5 years ago.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No reason codes for > 50% of cards with balances

@Thomas_Thumb wrote:Your data tends to support the finding that dirty scorecards (at least those with public records) don't really look at new accounts as a negative attribute in scoring. Other factors are allocated whatever weight (signal strength) is associated with "too many accounts opened recently" on clean scorecards..

On the other hand, there is significant data showing too many new accounts in a short time span (3 or more in 60 days?) are viewed negatively and will impact score on at least a subset of clean scorecards (young/thin specifically).

Those with both dirty and clean CRA reports are in the best position to test/compare impact of new accounts. Not that I advocate opening new accounts just to test. Last new account I opened was over 5 years ago.

Sadly for this purpose my file isn't going to work for much longer potentially, but certainly for FICO 04 there wasn't a new accounts penalty and I don't see one on FICO 8 either on my old scorecard either. When I dropped to 3 reason codes on TU FICO 4 I think that may well be a referencable point... actually I should go collate the ones I had on my dirty scorecard over time, might be some interesting data there on what counts and what doesn't as it certainly appears there's a limited number of things that can go wrong on FICO 04 anyway in that tax lien + deliquency bucket. Collection/public record, short credit history, seeking credit, recent missed payment or missed payment, CFA, and revolving utilization issues.

I think to one of ABCD's suggestions in the past, maybe we should just start collecting reason codes and then some data around each, like the installment utilization one on FICO 8 goes away at 9% (assuming we have the rounding right) and seeking credit on FICO 04 goes away at 0 scoreable inquiries, that sort of thing.

ABCD: I never got individual tradeline utilization issues at 29% on my dirty scorecard, I had to be much much higher somewhere north of 70% at a minimum though I never did get a fantastic test on this (whenever I started testing utilization I either got a CLI or graduated, **bleep** it lenders! I did clearly see drops north of 90% though). If you have the time and your spending pattern supports it on Amazon say, once your file stabilizes it would be lovely if you could try testing it at various breakpoints.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No reason codes for > 50% of cards with balances

Amazon is a feast or famine spending cycle for me since I generally find better prices locally although I also have to factor in sales tax there. If Amazon has the best deals, I'll buy there but for the past 10 months Amazon spend has been creeping downwards a whole lot since they're exceedingly too expensive. I actually found a better value on something at HSN recently which totally blew my mind since they're usually 10-30% more expensive.

But if I see anything good on Amazon I will have to test out 30%, 50% and 90% and see what happens to my scores. I don't believe I'll be shifting scorecards or AAoA tiers any time this summer so I will definitely have time to test it.