- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- No score change from 6 yr to 7 yr AAoA

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

No score change from 6 yr to 7 yr AAoA

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No score change from 6 yr to 7 yr AAoA

@T_Thumb.....I really do not understand how credit scores make me more likely to have an accident in a vehicle. The really amazing thing is I have had a very horrific accident in the past involving in the death of a very intoxicated pedestrian who was wearing dark clothing on a rainy night in the middle of the highway. Believe me when I say a pickup truck hitting a human being is not something you wish to see, and definately do not want to be the driver of the pickup. It was however ruled 0% my fault, and resulted in no increase in insurance rate. This accident did 8000 dollars damage to the pickup, so you can likely imagine the damage to the pedestrian. The memory of this night is something I wish I could erase.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No score change from 6 yr to 7 yr AAoA

@sarge12 wrote:@T_Thumb.....I really do not understand how credit scores make me more likely to have an accident in a vehicle. The really amazing thing is I have had a very horrific accident in the past involving in the death of a very intoxicated pedestrian who was wearing dark clothing on a rainy night in the middle of the highway. Believe me when I say a pickup truck hitting a human being is not something you wish to see, and definately do not want to be the driver of the pickup. It was however ruled 0% my fault, and resulted in no increase in insurance rate. This accident did 8000 dollars damage to the pickup, so you can likely imagine the damage to the pedestrian. The memory of this night is something I wish I could erase.

Sarge12,

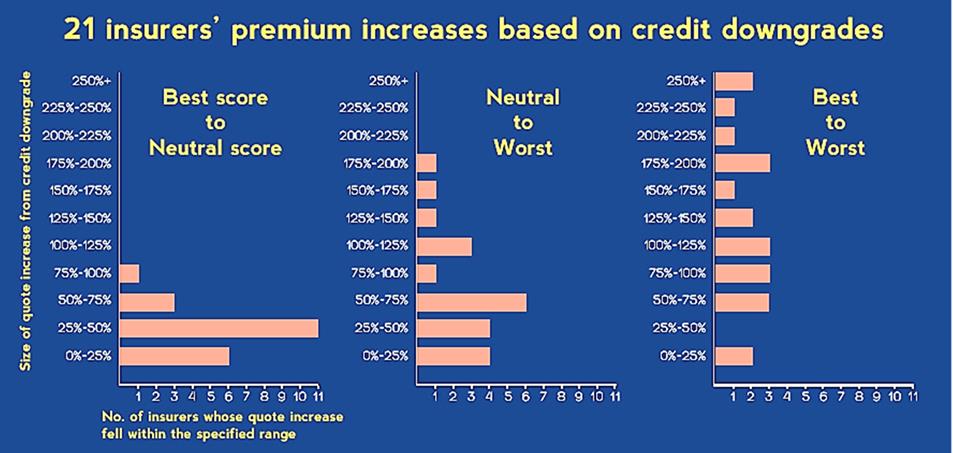

There is no real correlationship between driving capability and CBIS. However, the relationship between CBIS and claims is profound. Numerous studies show those with lower CBIS are more likely to file a claim. Also, fraudulent personal injury claims can be very expensive to fight in court or to settle out of court.

I recall an incident back in 2010 where I started to back out of a parking space at McDonalds when a rusted out early 80s van passed by. My passenger side bumper made contact with the passanger side back panel behind the rear wheel. The driver of the van had a passanger. The driver said: "my vehicle is old and damage is minimal". We agreed to handle this outside of insurance. We exchanged information and he drove off. Later we talked and I agreed to pay $200 as compensation for incidental damage.

I drafted a letter for him to sign as a condition of payment. The letter described location of incidental damage and that acceptance of the $200 payment constituted agreement to a settlement in full. A couple months later I received a phone call from the passanger's attorney stating that the attorney's client had suffered substantial personal injury and that a suit would be filed against me if I did not provide him with a contact at my insurance company. I told him to talk with the driver and anything would need to come through his insurance company.

A couple weeks later I received a threatening letter from this so called attorney. At that point I felt there was no choice but to involve my insurance company and turn the matter over to them. These types of fraudulent claims are a major cost to insurance companies.

CBIS has nothing to do with cabability of a driver but a lot to do with claims. Driving records are a primary consideration in insurability decisions and setting of premiums. Nonetheless, other factors (such as CBIS) provide essential data as part of a comprehensive evaluation of payout risk.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No score change from 6 yr to 7 yr AAoA

@Thomas_Thumb wrote:No your interpretation is correct regarding my statement for age of file influencing weight of AAoA. My assertion is that while the AAoA boundries may be the same the impact on score associated with crossing a 24 month mark may be different if age of oldest is 3 to 4 years vs age of oldest at 12 to 15 years.

We do know factors are given different amounts of weight depending on scorecard. Also, certain sub category factors may carry weight on a clean scorecard but, not a dirty one as shown in the below purposefully slide in a Fico presentation. Really no reason to have this slide except to inform the audience that indeed predictors (factors) carry different weight depending on the subpopulation (segmented scorecard)

<snip>

Neat, thank you for that.

Age of oldest account (age of file basically) we've always held to be a scorecard segmenter at least for clean files: any individual action on two different scorecards will have a different magnitude score, and that's pretty much guarunteed given they do not have the same scale. Your thoughts on trying to tease that out one way or another since oldest 3-4 might be a different scorecard entirely than someone 12-15 even if the rest of the information is effectively identical (within reason to hit AAOA thresholds).

My SWAG is that AAOA is the same everywhere in terms of it's boundaries, but with oldest account and tied into scorecard segmentation and maybe AAOA on that front too, I'm not sure we can really figure that out analytically?

I don't know, it's hard to make statements when we don't know that two files happen to be on the same scorecard or not... have to admit being on a dirty scorecard sucks but it's a lot easier dealing with fewer for testing some things concretely.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No score change from 6 yr to 7 yr AAoA

As it is obvious to me that this discussion is now over my credit IQ level, I will respectfully bow out gracefully...Where the heck do you get all these charts T_Thumb? When it comes to the workings of credit scores and such you are a god amongst men. Much respect, but not much I can add to the discussion. If you somehow veer off to discuss electrical theory, or mechanical blueprint reading, I can hang in with you...I was an electro/mechanical troubleshooter at a tire manufacturer...think Mr. Bib!!!

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No score change from 6 yr to 7 yr AAoA

@Thomas_Thumb wrote:

If your oldest account is greater than 14 years 7 months risk goes up as oldest account age increases further IF average age of accounts is less than 7 years 8 month time. Here is that 7 year 8 month number again - cool! Perhaps I received that in my Experian Plus info box because of my high, 33 year age of oldest.

Why is this the case? I'm trying to look at it from a risk perspective. I'm not understanding why the age of your oldest account being older would ever in any way increase your risk. I'm assuming it has something to do with AoOA relative to AAoA, but I'm not seeing the correlation between those two pieces of data and risk (score).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No score change from 6 yr to 7 yr AAoA

@Anonymous wrote:

@Thomas_Thumb wrote:

If your oldest account is greater than 14 years 7 months risk goes up as oldest account age increases further IF average age of accounts is less than 7 years 8 month time. Here is that 7 year 8 month number again - cool! Perhaps I received that in my Experian Plus info box because of my high, 33 year age of oldest.Why is this the case? I'm trying to look at it from a risk perspective. I'm not understanding why the age of your oldest account being older would ever in any way increase your risk. I'm assuming it has something to do with AoOA relative to AAoA, but I'm not seeing the correlation between those two pieces of data and risk (score).

Change in behavior (recent credit with a long history of no credit apps suggests life change)

AU abuse

CRA data set issues

Fraudulent report

Those come to mind anyway from most likely to least likely off the top of my head, there's probably more sophisticated stuff too but I need food ![]() .

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No score change from 6 yr to 7 yr AAoA

Note to the moderator: I'd respectfully offer that thread is a treasure trove of AAoA data, and (IMHO) is worth pinning (perhaps modifying the name to something along the lines of 'AAoA Insights').

2023 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 12-Feb-2024 ]

| EQ | 841 | 5 INQ (Auto, CC, HELOC, 2 mort) | 7y2m |

| EX | 812 | 5 INQ (2 CC, 2 mort, HELoan) | 6y11m |

| TU | 829 | 4 INQ (3 CC, 1 mort) | 6y6m |

| 5/24 | 3/12 | AoYA 0m | AoOA 23y6m | ~3% |