- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Not too happy with the Holidays

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Not too happy with the Holidays

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Not too happy with the Holidays

@Anonymous wrote:No, i did not indicate that, i just shared the cards that reported balance and are responsable for the score drop, i do have a card that i use one a month to report balance and is PIF right after.

I see, you didn't list all of your cards and balances. While you didn't say it was all of your cards and balances, typically when people list everything out like that the list is all inclusive; I thought you were implying that it was everything. Naturally if it wasn't it greatly changes the nature of the discussion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Not too happy with the Holidays

@Anonymous wrote:

@Revelate wrote:Nah, all zeros is a comparitively minor penalty. 100% utilization across everything is way worse for example.

Well yeah, maxing out everything I can understand but I was talking more in the zero verses single digit vs 11% utilization department which is the only range that should be considered for the OP under this example. That said, all zeros from my experience results in a greater ding going from single digit utilization than the ding associated with crossing from single digit to double digit utilization

Well at least with the dirty file (think may have to start throwing out my data as now I'm getting "wierd" result codes now that my tax lien came off EX) I lost 13 points with all zeros on FICO 8, and old school EQ FICO 5 I lost 14 points just for maxxing out a single credit card with aggregate util 13% and similarly 27% (same 14 point loss both times).

Actually more recently I managed to beat my EX FICO 8 down to 726 from 740 (14 points again) just for having $180.11 on a $200 limit card. I'm little surprised by that and I lost it in two steps -8 apparently at 75% (or some breakpoint below that) and then another -6 at 90%.

Aggregate util some <1% amount. So comparitively when it appears a maxxed tradeline can lose more points than all zeros at least on EX FICO 8 dirty file, I would suggest said all zeros is a pretty minor penalty in the grand scheme of FICO scoring. Not optimal to be sure, but things could be worse.

Trying to pretty everything up for a January pull and get comparisons from September with spotless revolving util ($10 on one card but w/tax lien and lates) today with maxxed tradeline, lates, and *maybe* a shift in numbers of cards with balances which I didn't see on my dirty scorecard though I think FICO 8 is still the same, FICO 3 has wierdness, and then January clean sans tax lien and just the smattering of lates from 2010. Seriously wierd to be looking at a score north of 750 for the first time though already, gained +26 for the tax lien deletion apparently with the current utilization pattern.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Not too happy with the Holidays

On my file reporting all zero balances results in a 14-22 point drop on FICO 08 scores depending on the bureau. In going from single digit utilization to 10%-11% utilization I lose less points than that. I'm in a dirty bucket and my FICO 08's range from 751-793.

I'm sure these things vary by profile / bucket quite a bit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Not too happy with the Holidays

@Anonymous wrote:On my file reporting all zero balances results in a 14-22 point drop on FICO 08 scores depending on the bureau. In going from single digit utilization to 10%-11% utilization I lose less points than that. I'm in a dirty bucket and my FICO 08's range from 751-793.

I'm sure these things vary by profile / bucket quite a bit.

Dirty bucket at 793? ![]() What dirt?

What dirt?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Not too happy with the Holidays

I guess you're right, the 793 score would be from a clean bucket on EQ I suppose since that bureau only sees a 60 day late where EX and TU are still seeing a 120 on that account (and they're also seeing a 90 on another). I hadn't actually thought about that prior to this moment; my 90 just got removed from EQ 2 days ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Not too happy with the Holidays

@Anonymous wrote:I guess you're right, the 793 score would be from a clean bucket on EQ I suppose since that bureau only sees a 60 day late where EX and TU are still seeing a 120 on that account (and they're also seeing a 90 on another). I hadn't actually thought about that prior to this moment; my 90 just got removed from EQ 2 days ago.

I sorta doubt a 60 day late is a clean bucket, it's just a surprisingly high score for a dirty one.

I have on my EX FICO 8 as of today which suggests I'm not clean yet which since you also have a worst deliquency of 60 days, presumably you aren't either ![]()

1. You have one or more accounts showing missed payments or derogatory indicators.

Front and center on my reason codes, though that's better than PR / collection apparently.

I'm sitting at 756 as of right now but that's with a maxxed out tradeline and all sorts of revolving utilization complaints in the reason codes on Experian on the various scoring models with a 30 and 30/60 pair of lates from 2010. I lost 14 points on the way down on FICO 8 with a tax lien which had to put me in one of the dirtier scorecards of the 4 presumably, I might get more on the way up in what is presumably a cleaner scorecard, maybe.

The myFICO simulator (FWIW) for giggles does show me jumping to 810ish once my lates are excluded based on their time slider which I thought was pretty interesting, but I'm not sure that's achievable unless I start hammering my installment utilization down; I was expecting to get to 780 once clean but I'll take ~770 with no tax lien and pretty balances just fine ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Not too happy with the Holidays

In theory those 30/60's shouldn't be impacting your score at 6 years though, right? I always thought that 30/60's impacted score for 2 years.

Sounds like you're relatively close to turning the corner on really nice scores!

I never knew if a single 60 day late put one into a dirty bucket or not. I'm 99% sure a single 30 day late doesn't, but I don't know about 60's. I know both are considered minors rather than majors, but that doesn't necessarily coincide with bucket assignment I don't think. My 60 on EQ is nearing 4 years old; I always assumed it wasn't impacting my score at this point since it's > 2 years old.

Hoping to get that 90 dropped off of TU and EX within the next week or two which will be interesting since both of those bureaus still see my 120 day late (on the account that EQ only sees a 60). I'd venture to guess that those scores will bump up to somewhere around the midpoint between my 751 and 793 scores, maybe 770ish but we'll see.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Not too happy with the Holidays

@Anonymous wrote:In theory those 30/60's shouldn't be impacting your score at 6 years though, right? I always thought that 30/60's impacted score for 2 years.

Sounds like you're relatively close to turning the corner on really nice scores!

I never knew if a single 60 day late put one into a dirty bucket or not. I'm 99% sure a single 30 day late doesn't, but I don't know about 60's. I know both are considered minors rather than majors, but that doesn't necessarily coincide with bucket assignment I don't think. My 60 on EQ is nearing 4 years old; I always assumed it wasn't impacting my score at this point since it's > 2 years old.

Hoping to get that 90 dropped off of TU and EX within the next week or two which will be interesting since both of those bureaus still see my 120 day late (on the account that EQ only sees a 60). I'd venture to guess that those scores will bump up to somewhere around the midpoint between my 751 and 793 scores, maybe 770ish but we'll see.

I've seen posts on various such comments regarding 30/60 not counting at various time periods from years ago but it's hard to say; what I recall was 30 days stopped after 2 years, and 60 days at 5 years, but we both know the issues with testing cleanly and I never saw the data heh.

I do know that on TU after a year had passed since my 30 day stupid w/JCB, my score went right back to where it was before the 30 day stupid but that is with the 30 and 30/60 still on there from 2010 as well. FICO 8 isn't the best for trying to determine this but when the lates and the tax lien fall off, I'll be clean EX/EQ but 30 day late at some age on TU; if there's a marked score difference then I can reasonably asssume the late is factored... if there isn't, maybe not. It's going to be on there a while though (another 6 years) and if I don't beat up my credit too badly I should be able to get into the upper echelons before it falls off especially if I follow through as planned and start throwing non-trivial cash at my mortgage loan.

FICO 9 assuming I get the occasional pull beyond the once a year funsy should tell a more complete picture and it probably applies to earlier models since it appears to be more forgiving anyway in some respects on negatives and is far closer to the same score from a design perspective between bureaus for effectively identical files.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Not too happy with the Holidays

Guys,

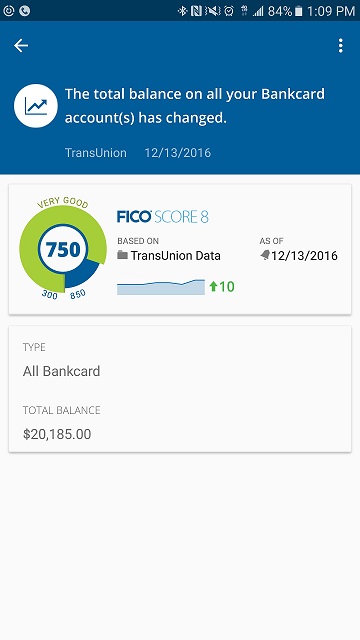

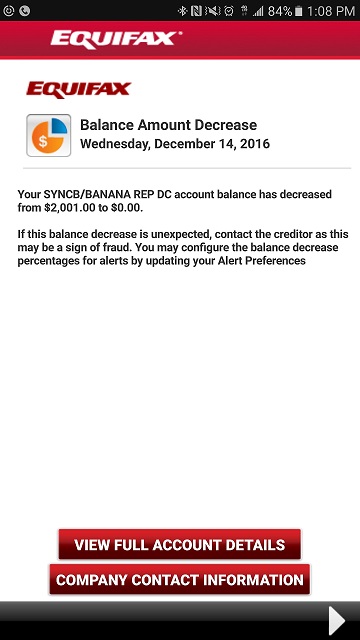

Received an alert in the morning from EQ, my BR visa reported $0 balance, I was really surprised because my statement day is Jan 4 so, later I got 2 alerts from MyFico and I was like “OMG”, my TU went up 10 points, my BR util was at 67% and now is $0 balance so my util changed.

Anyways, I will have a better picture in few weeks from now, as I mentioned before I already PIF all those cards with high balance so those cards will report $0 balance.

Before:

1: FICO08: EQ: 753 - TU: 753 - EX: 750

After:

2: FICO08: EQ: 734 (-19) - TU: 740 (-13) - EX: 734 (-16)

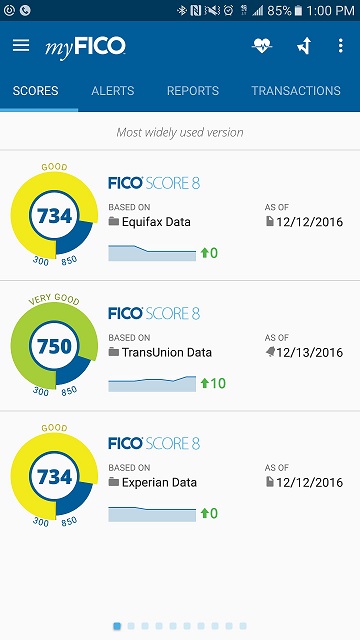

Today:

FICO08: EQ: 734 (-19) - TU: 750 (+10) - EX: 734 (-16)

** Also, is this normal with Synchrony Bank to report every time your balance goes UP/DOWN?, if it's, does Synchrony Bank reports to EX and EQ as well??

EQ Alert:

MyFico Alerts: