- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Number of Cards Reporting

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Number of Cards Reporting

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Number of Cards Reporting

I noted this as part of another thread earlier, but decided to put the update here.

I have 16 cards reporting balances as of June and July. Through mix ups in keeping amounts on all the accounts, I ended up with a series of 3 of the cards reporting zeros in various combinations during late June and to late July when I was able to get them back to balances. 16 cards reporting is 100% of open and reporting credit cards. Two closed cards and Diners are not included in the TU numbers, AFAIK.

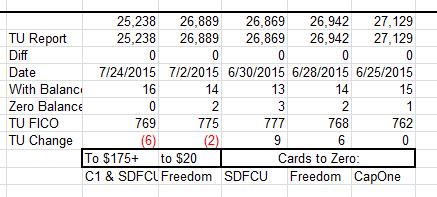

It appears the significant change factor for the TU score during this time was the number of cards reporting. The image below is read from right to left, increasing calendar days from right to left. I have removed columns where there was no score change, balances are within a $2k range the entire time, and utilization percentage is nearly the same, no CLI changes or new accounts reporting. June was a month where utilization dropping began to be realized, so some of the initial score increase is left over from that.

First row is balance being reported. Since TU is a jumble, I have to prove out which cards are making up that balance, so row 3, Diff, is the verification that I've got all the individual cards accounted for on that day.

The With Balance is the number, out of 16, which are reporting any non-zero balance. Add Zero Balance count on the next row, is always 16 total in this sequence.

The TU FiCO row is the score from the myFICO alert on that day. In all the gaps in days, there are no other TU score changes.

On 6/25 as the first card goes to zero, no score change.

On 6/28 after two cards have gone to zero, there's a 6 point bump.

On 6/30, as 3 cards are now zero, there's another 9 point bump. This is likely somewhat influenced by the remainder of the utilization improvements in June.

On 7/2 as one card comes back to report, a 2 point drop.

On 7/24 as the other two cards come back to report, then a further 6 point drop.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Number of Cards Reporting

Thanks for sharing the info!

So it looks like 20% of the cards reporting a zero balance, and the lower Util, gave you the biggest bump, correct?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Number of Cards Reporting

Looks like going from 3 cards not reporting (under 80% reporting) to 2 cards not reporting (over 80%). drops score. Other data appears to potentially be confounded with overall utilization. Threshold at 80%?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Number of Cards Reporting

Confounded with utilization changes is definitely affecting these.

Also missing is a complete run from 16 reporting to 0 cards reporting, then back, which I am in no position to try ![]()

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Number of Cards Reporting

@Anonymous wrote:Thanks for sharing the info!

So it looks like 20% of the cards reporting a zero balance, and the lower Util, gave you the biggest bump, correct?

Yes, in general number of cards reporting, as that is reduced, would lead to some score increase. How many useful points is always the question in my mind.

The utilization changes would have some impact here as well. Which is one of the caveats I try to raise; If one is going to go to 1 card reporting, then it's important to distinguish any utilization change from the number of cards change in that score improvement.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Number of Cards Reporting

My utilization is under 4% and will stay that way as my spending on my PRG doesn't count. My non Amex transactions go on my BoA travel and I typically have a little on my Amazon store card.

Not optimizing to app anything so I will let the PRG, BoA, and Amazon cards report, but the BCE should go to zero for the first time.

Score currently 726, let's see what 1 less card reporting but with the same general level of utilization results in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Number of Cards Reporting

All of my data suggests explicit ups and downs for number of revolvers reporting balances at least on Equifax. I never had enough balance size changes to trigger TU much.

7/2 being just after a monthly boundary, can you rule out any age factors that might account for the anomalous datapoint? Also aggregate utilization?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Number of Cards Reporting

I've added several accounts over the last year, so no, I can't rule out changes from aging of new accounts.

Aug 2014 (first report would be early September) US Bank Flex Perks. (closed a few momths later)

Nov 2014 CU LOC (shows as revolving, not term loan)

Nov US Bank Fred Meyer, first report January 2015

Dec Chase Marriott, first report January

Jan Chase Hyatt, first report February

April AMEX Hilton, first report May

Venture wasn't apped until July 8

There's a few other INQ in there which would also be aging down.

Utilization does change some, but no new accounts reported for the first time in this date range, to affect utilization percentage.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765