- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: One card at 52% or two cards at 29%?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

One card at 52% or two cards at 29%?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

One card at 52% or two cards at 29%?

I'm going to be taking advantage of a 0% interest promotion from Cap 1. Total amount will be about $7850.00. Would it be better to let that sit on one card that has a $15K limit (52%) or break it up between two cards. $4350 on the card with a 15K limit (29%) and $3480 on a card with a $12K limit (29%)? I know I'm going to give up some points. Which option would have less of an impact or would they both be about the same?

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One card at 52% or two cards at 29%?

Is it 0% APR on both cards? Each card has the same offer of 0%? if so the split between the cards would be best, not having the one card over 50%.

If only the one card has the 0% offer, then the 52% on that one card would be money saving, so the better choice.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One card at 52% or two cards at 29%?

Yes, the same 0% APR is on both cards.

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One card at 52% or two cards at 29%?

What about paying one down to single-digit utilization which would allow you to get the other below 49% (say, 45%)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One card at 52% or two cards at 29%?

FYI - For individual cards, UT demerits are based on the highest UT of all cards with balances, not card count above "optimum".

The other factor is #/% of open accounts reporting a balance. I'd opt for getting all cards below 49% and once there reduce # cards reporting a balance as finances permit.For best score potential cards that do report a balance should be under 29% UT and with the further condition that aggregate UT is less than 9%.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One card at 52% or two cards at 29%?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One card at 52% or two cards at 29%?

@Anonymous wrote:

Much better one card. The credit company is not only looking at your debt ratio, they also consider how many accounts are in good standing. So if you split the balance with 2 3 cards, it shows that you have open balances on few cards and it's lower the rank of each of those accounts. Credit score wise is better all in one account, even with 53%

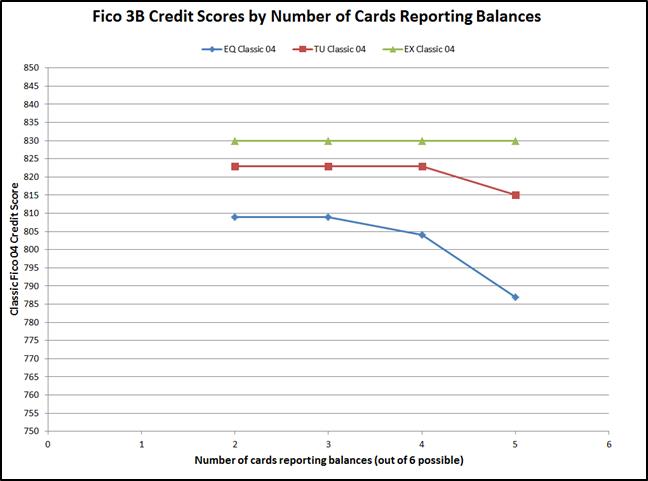

That generality is NOT necessarily true. Given the OP has 10 cards, reporting balances on 3 or even 4 cards should not negatively impact score if individual card utilizations and aggregate utilization is kept low.

For example, having a card in maxed out condition (90% or above) can be a major hit on Fico 8 score. If one has two cards with the same CL, it is better to have both at 45% UT than one at 90% and the other at 0%. The impact of both cards reporting balances will be minor.

Many profiles can report balances on 50% or less of their cards without hurting score as long as individual card utilizations are maintained below 29% and aggregate utilization is held under 9%. So, if someone has 9 cards, reporting "small" balances on 4 cards would have only a minor (or no) impact on score.

Here is what I saw testing my profile with "small balancs" on cards while maintaining aggregate utilization under 9%. EQ is most sensitive to # cards reporting (score started to drop at 66% reporting) followed by TU (score started to drop at 83% reporting a balance) then EX (score only dropped at 100% reporting a balance).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One card at 52% or two cards at 29%?

@NRB525 wrote:Is it 0% APR on both cards? Each card has the same offer of 0%? if so the split between the cards would be best, not having the one card over 50%.

If only the one card has the 0% offer, then the 52% on that one card would be money saving, so the better choice.

+1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One card at 52% or two cards at 29%?

Agreed with the deciding factor here coming down to the number of cards that the OP has. Percentage of cards reporting balances here is key. If he's only got 2 or 3 cards, having 2 of them with balances reported is going to be more noteworthy than if the OP has 5+ which would keep him at 40% or less of cards reporting balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One card at 52% or two cards at 29%?

20% (2) of my cards will be reporting balances. Utilization for each card will be around 29%, maybe a little higher. No more than 35-40%.

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500