- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Oops... all cards reporting $0.00

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Oops... all cards reporting $0.00

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

@NRB525 wrote:

@jamie123 wrote:

@ZiggstergetsaREFI wrote:Hi Jamie123 - would you please advise me as well? My husband and I are also about to apply for a mortgage. We are working on tweaking every point we can out of my husband's FICO scores. He only has ONE CC with a low CL. How should we use your formula if there is only one card? I HAVE noticed that his score seems to go up when I don't pay it all off. Thanks for your advice!

Oh, also - would it make sense to get a prepaid cc? Would this help his score? We don't want to have a hard pull at this point by applying for a regular cc.

I need a bit more information about your husband's credit report to give you a comprehensive plan to raise his scores. As far as having only one credit card, you need to have it report a very small balance every month like $10. You will probably need to make 2 payments per month to achieve this. Make 1 payment at least 3 days before the due date to take the balance to $10. Do not use the card again until 5 days AFTER the due date. This will give the lender a few days to report the $10 balance. After the 5 days is up you can go back and pay the balance to $0 and start using it again.

A prepaid credit card does not report to the credit bureaus and if it did it would look bad on your report. You don't want super sub-prime items on your report.

What are his scores?

What else does he have on his reports? Auto loans? Student loans?

Does he have any baddies on his reports? What are they? How old are they?

When do you plan on applying for a home loan?

The last four points are the most important to understand. The perspective of the entire current credit file is important to have available before any recommendations.

Agreed, prepaid is not a credit card. A secured card is a credit card and can be an excellent rebuilding step to expand available "credit" that is reported. You can have multiple secured CC.

The specific strategy of $10 to report may or may not have an impact on FICO depending on the individual situation. If one is reaching a limit on the upside of what the FICO score could be given that individuals optimized (no negatives) history, then it may add some few points to the score. If rebuilding, the monthly act of making timely payments is more important, IMO. In the act of using the card, if one only has one unsecured card, the short term strategy can include trying to get the CL increased, because that can have a positive effect on score. The CLI most often happens when the relationship with that particular lender is optimized, through use of the card, testing the limit of the CL now and then without going over, and then paying down to a true zero balance, always paying on time. There are many opinions on this

Which credit card and limit does DH have?

You might personally have some questions about how utilization is calculated by FICO but most of us on this forum don't. It has been found time and time again that having a utilization of less than 10% will get you the highest scores. There isn't a question about it and you can lose A LOT of points if you don't do this! This woman is trying to get a mortgage soon so she needs to do this.

I personally have 7 credit cards and all except 1 had been reporting a $0 balance because I had just applied for new credit. I let my Chase Freedom report a high balance of $1225 on a credit line of $1500 trying to get them to auto CLI me. It is my lowest CL card and I'm trying to get this card up to the $5K to 6K range where most of my other cards are at. I lost 13 points when this card reported. Three days later I paid the card down to $0 and Chase reported it again and my score went up 13 points. (Yes, Chase reports $0 balances as soon as an account reaches $0 no matter what time of the month it is.) 13 points is not "a few points" when a home loan is in play. 13 extra points at that time will get you a lower interest rate that could save you hundreds and maybe thousands of dollars over the life of the loan.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

@jamie123 wrote:

@NRB525 wrote:

@jamie123 wrote:

@ZiggstergetsaREFI wrote:Hi Jamie123 - would you please advise me as well? My husband and I are also about to apply for a mortgage. We are working on tweaking every point we can out of my husband's FICO scores. He only has ONE CC with a low CL. How should we use your formula if there is only one card? I HAVE noticed that his score seems to go up when I don't pay it all off. Thanks for your advice!

Oh, also - would it make sense to get a prepaid cc? Would this help his score? We don't want to have a hard pull at this point by applying for a regular cc.

I need a bit more information about your husband's credit report to give you a comprehensive plan to raise his scores. As far as having only one credit card, you need to have it report a very small balance every month like $10. You will probably need to make 2 payments per month to achieve this. Make 1 payment at least 3 days before the due date to take the balance to $10. Do not use the card again until 5 days AFTER the due date. This will give the lender a few days to report the $10 balance. After the 5 days is up you can go back and pay the balance to $0 and start using it again.

A prepaid credit card does not report to the credit bureaus and if it did it would look bad on your report. You don't want super sub-prime items on your report.

What are his scores?

What else does he have on his reports? Auto loans? Student loans?

Does he have any baddies on his reports? What are they? How old are they?

When do you plan on applying for a home loan?

The last four points are the most important to understand. The perspective of the entire current credit file is important to have available before any recommendations.

Agreed, prepaid is not a credit card. A secured card is a credit card and can be an excellent rebuilding step to expand available "credit" that is reported. You can have multiple secured CC.

The specific strategy of $10 to report may or may not have an impact on FICO depending on the individual situation. If one is reaching a limit on the upside of what the FICO score could be given that individuals optimized (no negatives) history, then it may add some few points to the score. If rebuilding, the monthly act of making timely payments is more important, IMO. In the act of using the card, if one only has one unsecured card, the short term strategy can include trying to get the CL increased, because that can have a positive effect on score. The CLI most often happens when the relationship with that particular lender is optimized, through use of the card, testing the limit of the CL now and then without going over, and then paying down to a true zero balance, always paying on time. There are many opinions on this

Which credit card and limit does DH have?

You might personally have some questions about how utilization is calculated by FICO but most of us on this forum don't. It has been found time and time again that having a utilization of less than 10% will get you the highest scores. There isn't a question about it and you can lose A LOT of points if you don't do this! This woman is trying to get a mortgage soon so she needs to do this.

I personally have 7 credit cards and all except 1 had been reporting a $0 balance because I had just applied for new credit. I let my Chase Freedom report a high balance of $1225 on a credit line of $1500 trying to get them to auto CLI me. It is my lowest CL card and I'm trying to get this card up to the $5K to 6K range where most of my other cards are at. I lost 13 points when this card reported. Three days later I paid the card down to $0 and Chase reported it again and my score went up 13 points. (Yes, Chase reports $0 balances as soon as an account reaches $0 no matter what time of the month it is.) 13 points is not "a few points" when a home loan is in play. 13 extra points at that time will get you a lower interest rate that could save you hundreds and maybe thousands of dollars over the life of the loan.

Wow! Thanks for all the replies and wisdom. Let me answer your questions.

First: I misspoke. We are getting ready to apply for a REFI on our home mtg. JUST for the current balance, NOT to get money out. We were turned down 2 yrs ago due to DTI ratio. (we own a small business, and sales were down). Our LTV is excellent. Our DTI is now right on the margines, so our Credit needs to be as good as possible. My scores are in the 700's, but lender has to use DH's because tax returns show business in HIS name. We are currently subscribed to the 3 Bureau Score and Monitoring.

When do we plan to apply? As soon as we know we can get approved. Ideally within the next 2 months. We are in a fixed 6.875% loan, and could be saving over $1000/month with current rates.

His current scores: EQ 673, TU 581, EX 655

October 28, 2014 report showed a medical collection on TU and EX. That trade line has since been PIF and removed – not reporting on any CRA’s. At that time TU Fico score was 581, and I have not had an alert as to a change in score, but not sure whether I would get an alert for the account being REMOVED. The EX FICO score went up from 594 on October 28 to 655 on December 3. The MyFico alert that allowed me to see that score change was triggered by a “balance increase” on the credit card. I spoke to customer service at MyFico to find out why there weren’t alerts triggered on EQ or TU – because I knew that the COLLECTION trade line had been removed. The rep told me that an account removal doesn’t trigger an alert.

No inquiries on any reports.

Long credit history.

1 Baddie showing on all 3 CR's. We are in the process of CFPB complaint regarding that, and based on the experience another user on the MyFico (ndkblondie), who had the exact same situation (SBA loan/US Bank charge-off which US Bank is reporting, but shouldn't be), the CFPB complaint should result in that baddie being removed from all 3.

1 other baddie showing on TU. This is a CC, closed, but TU is showing "worst delinquency as 60 days late 1 time in Jan 2008 and 1 time in 2009) And shows this account with a “negative Indicator”. EQ and EX don’t seem to list it as a negative indicator. -- I have not taken any action on this trade line lately, as I don't want to stir up trouble.

There are NO open auto loans, no student loans. Unfortunately no mortgage loans on his reports, as when we refi'd in 2001 we did it in my name, because my scores were better.

I know when that baddie comes off his scores should go up - I'm assuming quite a bit - since everything I've read here says CO's are the worst.

I ALSO misspoke when inquiring about openning a new CC. I did mean "secured", not "prepaid".

His one and only CC is with our credit union, Premier America CU. The limit is $1000. We have a very good relationship with them, and I have made email contact with a person in the higher tiers there - and am thinking to ask her if it's possible to get a CLI w/out a hard pull.

I agree completely with you that we need to squeeze every point possible, to take advantage of the best interest rate, so I'm digging for everything I can find.

So - Given that info - what's your advice? Increase CL if possible w/soft pull? How much should I ask for? Keep using card, but don't pay off completely (keep a $10 balance)? Get secured CC?

Also, I realize that different types of credit are good or bad. Some of the accounts have discrepancies – such as accounts being labeled as “installment”, “revolving” , “line of credit”, “credit card”, etc. Which of these things should I try to clean up? Or should I leave them alone?

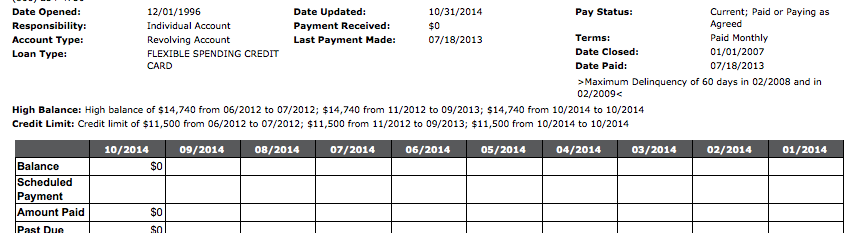

Oh, that reminds me. TU is showing something I don't understand. I think it's incorrect. This is from the US Bank CREDIT CARD - not the SBA loan. It says the "High Balance" of $14,740.... It's incorrect, if I'm understanding it. The limit on that card was $11,500. And in 2012-2014 the balance was in the 1000-3000 range. Here's a screenshot:

so, is that description affecting the score?

It is possible that the TU score is higher now, based on what I've read today in the product FAQ's board regarding when/ how often TU will show an alert.

Thanks for all the input!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

Wow! Thanks for all the replies and wisdom. Let me answer your questions.

First: I misspoke. We are getting ready to apply for a REFI on our home mtg. JUST for the current balance, NOT to get money out. We were turned down 2 yrs ago due to DTI ratio. (we own a small business, and sales were down). Our LTV is excellent. Our DTI is now right on the margines, so our Credit needs to be as good as possible. My scores are in the 700's, but lender has to use DH's because tax returns show business in HIS name. We are currently subscribed to the 3 Bureau Score and Monitoring. Please be aware that most of the scores found on this site and most other places on the web are FICO 08 scores. Credit card lenders use FICO 08 scores but most mortgage lenders use FICO 04 scores. Most people have lower FICO 04 scores when compared to their FICO 08 scores.

When do we plan to apply? As soon as we know we can get approved. Ideally within the next 2 months. We are in a fixed 6.875% loan, and could be saving over $1000/month with current rates. You have very little time to change his scores in 2 months. Major credit score improvement usually takes at least 6 months and really, much longer.

His current scores: EQ 673, TU 581, EX 655

October 28, 2014 report showed a medical collection on TU and EX. That trade line has since been PIF and removed – not reporting on any CRA’s. At that time TU Fico score was 581, and I have not had an alert as to a change in score, but not sure whether I would get an alert for the account being REMOVED. The EX FICO score went up from 594 on October 28 to 655 on December 3. The MyFico alert that allowed me to see that score change was triggered by a “balance increase” on the credit card. I spoke to customer service at MyFico to find out why there weren’t alerts triggered on EQ or TU – because I knew that the COLLECTION trade line had been removed. The rep told me that an account removal doesn’t trigger an alert. You need to be vigilant about making sure the medical collection does in fact get removed from all 3 reports.

No inquiries on any reports. This is good. Try to keep it this way.

Long credit history.

1 Baddie showing on all 3 CR's. We are in the process of CFPB complaint regarding that, and based on the experience another user on the MyFico (ndkblondie), who had the exact same situation (SBA loan/US Bank charge-off which US Bank is reporting, but shouldn't be), the CFPB complaint should result in that baddie being removed from all 3. You need to have this removed before applying for a home loan. This is really hurting his scores.

1 other baddie showing on TU. This is a CC, closed, but TU is showing "worst delinquency as 60 days late 1 time in Jan 2008 and 1 time in 2009) And shows this account with a “negative Indicator”. EQ and EX don’t seem to list it as a negative indicator. -- I have not taken any action on this trade line lately, as I don't want to stir up trouble. This is a negative indicator whether it is marked as such or not. This is also hurting his scores.

There are NO open auto loans, no student loans. Unfortunately no mortgage loans on his reports, as when we refi'd in 2001 we did it in my name, because my scores were better. Are there any "closed" auto, student or installment loans on his reports? Open installment loans help your scores quite a bit and closed installment loans help your scores a little bit.

I know when that baddie comes off his scores should go up - I'm assuming quite a bit - since everything I've read here says CO's are the worst.

I ALSO misspoke when inquiring about openning a new CC. I did mean "secured", not "prepaid". Opening a secured credit card at this point is a toss up. Some people see an initial small score drop and some people see a small score increase. I wouldn't risk it with the short time frame you are working with.

His one and only CC is with our credit union, Premier America CU. The limit is $1000. We have a very good relationship with them, and I have made email contact with a person in the higher tiers there - and am thinking to ask her if it's possible to get a CLI w/out a hard pull. A credit card's credit limit has ABSOLUTELY nothing to do with scores. It is the utilized percentage of available credit that matters. As long as you can get this card to report a $10 balance each month you will have EXACTLY the same score results as a card that has a $10,000 CL reporting $10. FICO uses percentages for ALL calculations and never dollar amounts.

I agree completely with you that we need to squeeze every point possible, to take advantage of the best interest rate, so I'm digging for everything I can find. ALL your efforts need to be on having baddies removed! Having 1 baddie removed will boost your scores higher than anything 1 year of credit building would do for you.

So - Given that info - what's your advice? Increase CL if possible w/soft pull? How much should I ask for? Keep using card, but don't pay off completely (keep a $10 balance)? Get secured CC? Forget about the CLI for the moment. IT IS EXTREMELY IMPORTANT THAT THE CC REPORTS ONLY A $10 BALANCE EACH MONTH. Forget about the secured card for the moment.

Also, I realize that different types of credit are good or bad. Some of the accounts have discrepancies – such as accounts being labeled as “installment”, “revolving” , “line of credit”, “credit card”, etc. Which of these things should I try to clean up? Or should I leave them alone? Leave them alone, work on the baddies.

Oh, that reminds me. TU is showing something I don't understand. I think it's incorrect. This is from the US Bank CREDIT CARD - not the SBA loan. It says the "High Balance" of $14,740.... It's incorrect, if I'm understanding it. The limit on that card was $11,500. And in 2012-2014 the balance was in the 1000-3000 range. Here's a screenshot: It is probably not very important but you could look into correcting this if you have time.

I'm switching back to black ink now. The red is making my eyes bleed!

Okay you have to understand a bit about how FICO scoring works....

If you have 1 baddie you might lose 50 to 100 points. If you have a second baddie, subtract another 20 to 30 points. If you have a third baddie subtract another 10 to 30 points. A fourth baddie might cost you 10 to 20 points. When you have baddies removed it works in the opposite direction. If you have the fourth baddie removed but still have 3 left on the reports you might only gain 10 points.

The last baddie remaining on your reports is usually worth the most points. You need to work diligently in having as many baddies removed as possible. This will give you the best point gain in a short time period.

You need to visit the REBUILDING CREDIT forum on MyFICO and read about how other people are doing it. It is not that difficult to do and once you do the first one you will wish you started doing it a long time ago. You need to read up on PFDs (Pay for Deletes) and GWs (Good Will) letters.

There really isn't anything else you can do at this point. Make sure the CC reports only $10 per month and work on getting the baddies removed.

A few other things...

Your credit card credit lines have ABSOLUTELY nothing to do with your scores. The NUMBER of credit cards that you have DOES impact your scores and in a good way. After this is over your husband and yourself should apply for 1 to 2 credit cards every year until you each have 5 or 6 credit cards. If you feel that you can't handle using them properly, get them, buy one small item and either sock drawer them or cut them up. Don't close them, let the lender close them for non-use. Credit cards are the building blocks of high credit scores that will be rock solid once they become about 4 years old.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

Jamie123 - Thanks so much for your detailed response. Regarding your advice about building credit - believe me, I've spent a lot of time the last 2 years on these boards learning a LOT - of course that was AFTER making mistakes along the way (like closing CC's and having them REMOVED from our files - DUH)!

Your advice has confirmed the direction we are heading in. The good news is - I pulled all 3 reports again today.

- The medical collection IS GONE from all three

- The scores are now: EX 655, EQ 679, TU 655.

He DOES have a couple of CLOSED installment loans on his reports. EQ is reporting 2 (one old car loan and one equipment lease) EX is reporting 1(the equipment lease), and TU is reporting none.

So, based on what I've learned from you, here's my plan

- Make sure the CC has a $10 balance.

- Get rid of baddies. Regarding this: I already have a process well underway for the big baddie - the charge-off of the SBA loan that US Bank is reporting. I will continue to diligently follow up with that. Regarding the other baddie - the US Bank CC that's showing lates in 2008 & 2009 - any advice on how to deal with those? I know that a "dispute" will bring the score down a bit - but I've heard that it's easy enough to get dispute remarks removed. I did try a Goodwill on that account a couple of years ago - unsuccessful - but I could try again. The account is already PIF, so I can't try a PFD.

- I know about the FICO 08 and FICO 04 being different. I would like to learn more about the 04. Do you have any idea approximately how much the difference in scores tends to be? Or point me in a direction where I can learn more about it?

Thanks a million for your help. I'll keep you posted regarding my efforts!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

@ZiggstergetsaREFI wrote:Jamie123 - Thanks so much for your detailed response. Regarding your advice about building credit - believe me, I've spent a lot of time the last 2 years on these boards learning a LOT - of course that was AFTER making mistakes along the way (like closing CC's and having them REMOVED from our files - DUH)!

Your advice has confirmed the direction we are heading in. The good news is - I pulled all 3 reports again today.

- The medical collection IS GONE from all three

- The scores are now: EX 655, EQ 679, TU 655.

He DOES have a couple of CLOSED installment loans on his reports. EQ is reporting 2 (one old car loan and one equipment lease) EX is reporting 1(the equipment lease), and TU is reporting none. These closed installment loans are helping his scores a little bit but most importantly the lender will feel better approving a home loan. Lending decisions for home loans are based on SCORES and HISTORY. It is really good that he has these loans in his history.

So, based on what I've learned from you, here's my plan

- Make sure the CC has a $10 balance. Yes, this is important.

- Get rid of baddies. Regarding this: I already have a process well underway for the big baddie - the charge-off of the SBA loan that US Bank is reporting. I will continue to diligently follow up with that. Regarding the other baddie - the US Bank CC that's showing lates in 2008 & 2009 - any advice on how to deal with those? I know that a "dispute" will bring the score down a bit - but I've heard that it's easy enough to get dispute remarks removed. I did try a Goodwill on that account a couple of years ago - unsuccessful - but I could try again. The account is already PIF, so I can't try a PFD. Try the GW letters again and again and again until you get the results that you want. Research the company so you can send it to a person and not just the collection department. Explain that this is keeping you from getting a home loan. Do it now! They may be a bit more charitable during the holiday season! Tell them how much it would mean to your family! Pour it on! (Do not do a dispute at this time!)

- I know about the FICO 08 and FICO 04 being different. I would like to learn more about the 04. Do you have any idea approximately how much the difference in scores tends to be? Or point me in a direction where I can learn more about it? The difference in 08 and 04 scores depends on the individual. It can be a rather large difference of up to 40 to 50 points but it really depends on the individual's report. An 04 score is very difficult to get for free. You have to be a member of one of the few organizations that offer it. You can however purchase the EQ 04 score directly from EQ. It is their SCORE POWER score. Look here: EQ Score Power Every CRA offers an 04 score but the EQ version is the only one that I'm aware of that you as a consumer can purchase.

Thanks a million for your help. I'll keep you posted regarding my efforts!

Good luck! You can do this!

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

Thanks again for your guidance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

hmm, I'll have to try this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

@masscredit wrote:

I was going to try the opposite end this month and let all of my cards report a balance to see what happens. I just can't do it. I can't bring myself to do it.

I am right there with you! I have really thought about doing that, out of morbid curiosity, however after working so hard the last two years to rebuild, I cannot being myself to do it! Even though I know it should immediately recover when I go back down to just one account showing a balance, I cannot bring myself to doing it. ![]()

April 2024: EX8: 840; EQ8: 832; TU8: 842 -- Middle Mortgage Score: 822

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Oops... all cards reporting $0.00

12pts on TU lost for 0 bal here. And of course they updated things in the wrong order. US bAnk reports consistently last biz day of the month, my credit union last monday of the month... Yet the us bank shows almost 2 weeks before the CU. Turn the TU bureau over to trained monkeys, things would work more consistently. ![]()