- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Our Forums' FICO High Achievers: Who has at least...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

Good to know, T T, I guess.

Think I'll just stick to My FICo scores. Less confusing but more meaningful.

Starting scores:2007 - TU-850; EX-850; EQ-850. JUNE 11, 2015 - TU-850; EX-850, EQ-850 - Also FICO 8.

LATEST SCORES: EQ: 850; TU: 850; EX: 850; FICO 9 - AS OF MARCH 7, 2016

LATEST SCORES AS OF Nov. 24, /2016 - TU- 850; EQ - 846; EX - 836.-

Scores as of June 1, 2017: EQ - 842; TU 841; EX - 842;

SCORES as of April 19, 2018: EQ - 834; TU - 841; EX - 832.

New numbers will be posted in 2021

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@Ubuntu wrote:

@iv wrote:

@Ubuntu wrote:I've never personally experienced it but I've read several times (no citations handy) that some businesses use FICO scores as a factor in the hiring process. I always assumed that was done as a measure of a persons character but there might be a statistical correlation between FICO scores and success in certain industries or certain job specific tasks.

No real point here just typing out loud.

I've never run into scores being used for employment. Reports? Frequently. But I've never seen scores used.

I stand corrected, it is indeed credit reports / files / history that employers use in hiring decisions. That said, while a report isn't a FICO score it is the basis for one. A potential employer won't get your actual FICO score from the credit bureau but they can certainly ballpark your score just from reading your file or use their own FAKO scoring model.

To bring this full circle my intention was to agree that a FICO score isn't in any way an indicator of what kind of human being you are but when your credit history is given to "Evil Corp" (Mr. Robot reference) or any other entity making automated decisions about you the behavior revealed in your credit history can certainly be used to judge your value to them.

I have received copies of "credit reports" and other records provided to my employers by their outsourced "detectives". In many states you are entitled to this information if you ask. The information is structured quite differently than what you see in standard CRA reports. Scores are not included.

My position at the time was operations management which had P&L responsibility. I believe the focus of the check was to verify:

1) I was financially solvent

2) I had a "clean" record with a solid history.

I was told effective cash flow management was an important part of the job, thus the deep dive into my background.

There really is no point in trying to assign a value to credit reports for employment. It's the fundamentals that matter. Frankly, it is not easy to look at a report and predict score with a high degree of accurately. As an example:

Two people can have flawless payment history and no negatives on file but, a significant difference in score. Consider the case of two people having the same # cards and the same total CL. Both PIF balances and have the same monthly expenditures.

Assume total CL is $100k and monthly expenditures are $15k. Each has 6 cards but they have different payment strategies.

1) The Fico optimizer puts charges onall 6 cards but pre-pays a majority of charges so only $500 reports on one card. The card is then PIF.

* 1 of 6 cards showing an arbitrary 0.5% credit utilization

2) The Cash Flow optimizer allows all charges tto post on all 6 cards, total $15k. All cards are PIF after statements cut.

* 6 of 6 cards showing an arbitrary 15% credit utilization.

The Fico optimizer will have higher Enhanced Fico 08 scores and potentially a higher Classic Fico 08 score. The optimizer's Fico mortgage scores will definitely be better.

From a business perspective, who would you hire? Both spend the same amount each month, have the same level of credit and always PIF. I'd go with the cash flow optimizer. Scores are not appropriate tools for employment decisions.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@Thomas_Thumb wrote:

@Ubuntu wrote:

@iv wrote:

@Ubuntu wrote:I've never personally experienced it but I've read several times (no citations handy) that some businesses use FICO scores as a factor in the hiring process. I always assumed that was done as a measure of a persons character but there might be a statistical correlation between FICO scores and success in certain industries or certain job specific tasks.

No real point here just typing out loud.

I've never run into scores being used for employment. Reports? Frequently. But I've never seen scores used.

I stand corrected, it is indeed credit reports / files / history that employers use in hiring decisions. That said, while a report isn't a FICO score it is the basis for one. A potential employer won't get your actual FICO score from the credit bureau but they can certainly ballpark your score just from reading your file or use their own FAKO scoring model.

To bring this full circle my intention was to agree that a FICO score isn't in any way an indicator of what kind of human being you are but when your credit history is given to "Evil Corp" (Mr. Robot reference) or any other entity making automated decisions about you the behavior revealed in your credit history can certainly be used to judge your value to them.

I have received copies of "credit reports" and other records provided to my employers by their outsourced "detectives". In many states you are entitled to this information if you ask. The information is structured quite differently than what you see in standard CRA reports. Scores are not included.

My position at the time was operations management which had P&L responsibility. I believe the focus of the check was to verify:

1) I was financially solvent

2) I had a "clean" record with a solid history.

I was told effective cash flow management was an important part of the job, thus the deep dive into my background.

There really is no point in trying to assign a value to credit reports for employment. It's the fundamentals that matter. Frankly, it is not easy to look at a report and predict score with a high degree of accurately. As an example:

Two people can have flawless payment history and no negatives on file but, a significant difference in score. Consider the case of two people having the same # cards and the same total CL. Both PIF balances and have the same monthly expenditures.

Assume total CL is $100k and monthly expenditures are $15k. Each has 6 cards but they have different payment strategies.

1) The Fico optimizer puts charges onall 6 cards but pre-pays a majority of charges so only $500 reports on one card. The card is then PIF.

* 1 of 6 cards showing an arbitrary 0.5% credit utilization

2) The Cash Flow optimizer allows all charges tto post on all 6 cards, total $15k. All cards are PIF after statements cut.

* 6 of 6 cards showing an arbitrary 15% credit utilization.

The Fico optimizer will have higher Enhanced Fico 08 scores and potentially a higher Classic Fico 08 score. The optimizer's Fico mortgage scores will definitely be better.

From a business perspective, who would you hire? Both spend the same amount each month, have the same level of credit and always PIF. I'd go with the cash flow optimizer. Scores are not appropriate tools for employment decisions.

For me, it would be a non-factor. Wanting to maximize one's cash flow in the present is nice. Wanting to have high scores, which helps one better manage cash flow down the road, is also nice.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

I guess my 772 on TU means I'm crossing the threshold into "high achiever" territory; I even had a 5-day visit to 800+ land before my recent auto loan reported. So I'll briefly take stock of what this forum has helped me accomplish.

About 2 years ago I had a "thin" file with only 2 credit cards open, no closed ones, and no installment loans open or closed. My scores were around 650.

The "educational information" attached to my Capital One Credit Tracker page (much reviled here but very informative to me) gave me the distinct sense, proved later to be correct, that adding accounts would, down the road, help me build something, in terms of number of accounts and available credit. It also made it clear to me that the process of doing that would, in the short run, bloody my nose; I'd take a hit for the inquiries and the new accounts. So I"ve weathered that, and now I have a "thick" file with an adequate "credit mix". I have a single derogatory public record in 2 of my 3 reports, which will fall off this year.

So I've reached the stage where the passage of time will heal all wounds; there's absolutely nothing I have to do from here on out except keep my spending down, and pay my bills.

That is a good feeling.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

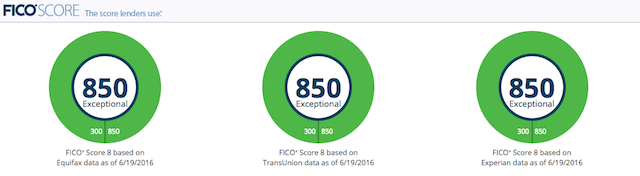

Have to share - finally made it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

Good work!

What's your AAOA and age of oldest account?

Did you purchase a 3B report be any chance? If so would you mind sharing the other scores. If you do, might be best to post on the many flavors of Fico thread.

Some of us like to compare models and full data sets (with supporting info on # cards reporting and total open cards, aggregate revolving utilization, loan balance to original ratio, AAOAetc... are always helpful.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@Thomas_Thumb wrote:Good work!

What's your AAOA and age of oldest account?

Did you purchase a 3B report be any chance? If so would you mind sharing the other scores. If you do, might be best to post on the many flavors of Fico thread.

Some of us like to compare models and full data sets (with supporting info on # cards reporting and total open cards, aggregate revolving utilization, loan balance to original ratio, AAOAetc... are always helpful.

AAoA is 121 months for EQ and EX, 111 months for TU, oldest account is a Citi card from 1990, now PC'd to DC [edited to fix what I'd originally posted - difference in AAoA is JCP card from 1991 that only shows on EX and EQ].

I did the 3B monitoring and would be happy to provide info - not sure how to format it (I looked at your signature, but I'm not seeing FICO 4 for all, one shows at FICO 2 [3 edited to correct type], one as FICO 4 and one as FICO 5 when I page through the bureaus. If you could point me to where to post and if there is a template of what info would be useful and how to present it, I'm game. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

I use an Excel table. A template is pasted below. However, the many flavors of Fico thread is probably a better place for this follow-up discussion.

Suggest posting your data there.

| 3B Report Data | 3/25/16 | ||

| Classic Scoring Model | EQ | TU | EX |

| AAOA (yr, mo) | 16 yr, 8 mo | 15 yr, 0 mo | 16 yr, 8 mo |

| Cards reporting | 3 of 6 | 3 of 6 | 3 of 6 |

| Card reporting % | 50% | 50% | 50% |

| Inquiries under 12 mo | 0 | 0 | 0 |

| AG revolving CC UT | 2.1% | 2.1% | 2.1% |

| Ag installment (bal/loan) | 36.0% | 36.0% | 36.0% |

| Classic Scoring Model | EQ | TU | EX |

| Fico Classic 09 | 850 | 850 | 850 |

| Fico Classic 08 | 850 | 850 | 850 |

| Fico Classic 04 | 809 | 823 | 830 |

| Fico Classic 98 | *** | *** | 837 |

| VantageScore 3.0 | 827 | 828 | 830 |

| Auto Scoring Model | EQ | TU | EX |

| Fico Auto 09 | 885 | 879 | 886 |

| Fico Auto 08 | 882 | 891 | 884 |

| Fico Auto 04, EX Auto 98 | 827 | 872 | 857 |

| Bankcard Scoring Model | EQ | TU | EX |

| Fico Bankcard 09 | 877 | 879 | 878 |

| Fico Bankcard 08 | 882 | 899 | 898 |

| Fico Bankcard 04, EX BC 98 | 826 | 858 | 862 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@Thomas_Thumb wrote:I use an Excel table. A template is pasted below. However, the many flavors of Fico thread is probably a better place for this follow-up discussion.

Suggest posting your data there.

3B Report Data 3/25/16 Classic Scoring Model EQ TU EX AAOA (yr, mo) 16 yr, 8 mo 15 yr, 0 mo 16 yr, 8 mo Cards reporting 3 of 6 3 of 6 3 of 6 Card reporting % 50% 50% 50% Inquiries under 12 mo 0 0 0 AG revolving CC UT 2.1% 2.1% 2.1% Ag installment (bal/loan) 36.0% 36.0% 36.0% Classic Scoring Model EQ TU EX Fico Classic 09 850 850 850 Fico Classic 08 850 850 850 Fico Classic 04 809 823 830 Fico Classic 98 *** *** 837 VantageScore 3.0 827 828 830 Auto Scoring Model EQ TU EX Fico Auto 09 885 879 886 Fico Auto 08 882 891 884 Fico Auto 04, EX Auto 98 827 872 857 Bankcard Scoring Model EQ TU EX Fico Bankcard 09 877 879 878 Fico Bankcard 08 882 899 898 Fico Bankcard 04, EX BC 98 826 858 862

Holy cow.

Questions:

1. How often do you update?

2. Isn't that a lot of work?

3. How do you insert the spreadsheet into your post on the forum?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

Starting Score: 734

Starting Score: 734