- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Our Forums' FICO High Achievers: Who has at least...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@marty56 wrote:One could easily gain 60 or more points just by lowering util. No apps or CLI requests either.

Yep, depending on how high utilization is on even one card + all your cards, you can easily lose 60 points overall. The new account penalty early on (0-3 months) plus the cost of a few inquiries and a punch to AAoA can bring you down another 40 points overall.

I've seen a few folks go from 650 to 750 in a year with NO derogatory accounts reported ever. Just because they had 2-3 cards with insanely high utilization, plus a few new accounts, and a bunch of inquiries. Gardening for a year can have a massive effect if combined with AZEO utilization management.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

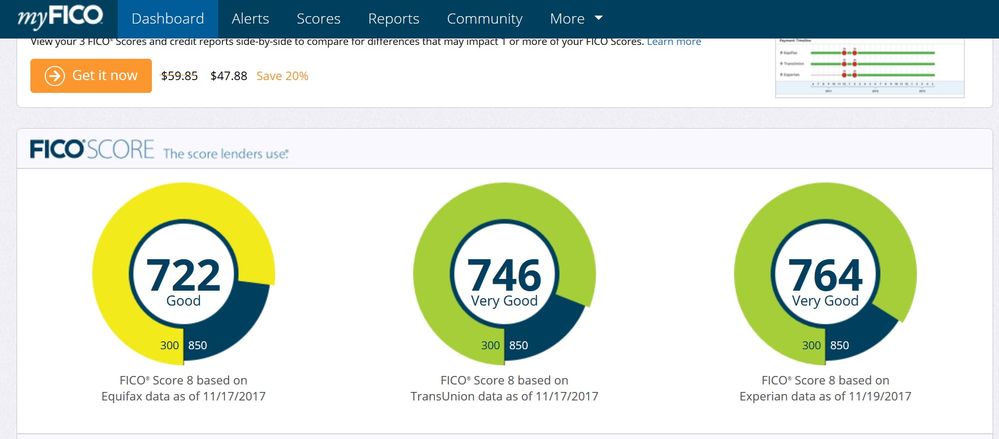

I have not applied for credit in 2017 and boy does it show in my scores. I finally made my goal on EX of 770+ with a 2.5 yr AAoA.

:]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

7/2020: EQ - 842; TU - 832; EX - 848

10/2017: EQ - 823; TU - 835; EX - 824

05/2016: EQ - 712; TU - 706; EX - 710

11/2015: EQ - 694; TU - 651; EX - 653

5/2015: EQ - 670

5/2014: EQ - 653

11/2013: EQ - 645

05/2013: EQ - 656

11/2012: EQ - 646

Eight CCs ($179,500 CL, 0%-1% UTIL)

AoOA = 18.6 years, AAoA = 60 mos., AoYA = 18 mos.

One mortgage, one HELOC, no car loans.

Derogs from 2009 and 2010 now gone after 7 years. I started paying attention to credit scores in about 2014. It's taken a few years but credit scores are now good after starting in the high 500s back in 2011

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

Hello Again

I was a member of this exclusive club for many years; but then deadbeat renters, real estate lawyers’ fees, and Hurricane Irma bumped me off. While I always maintained my payment history status perfect (never late or other derogs.) I did kill myself (out of necessity) with my DTU.

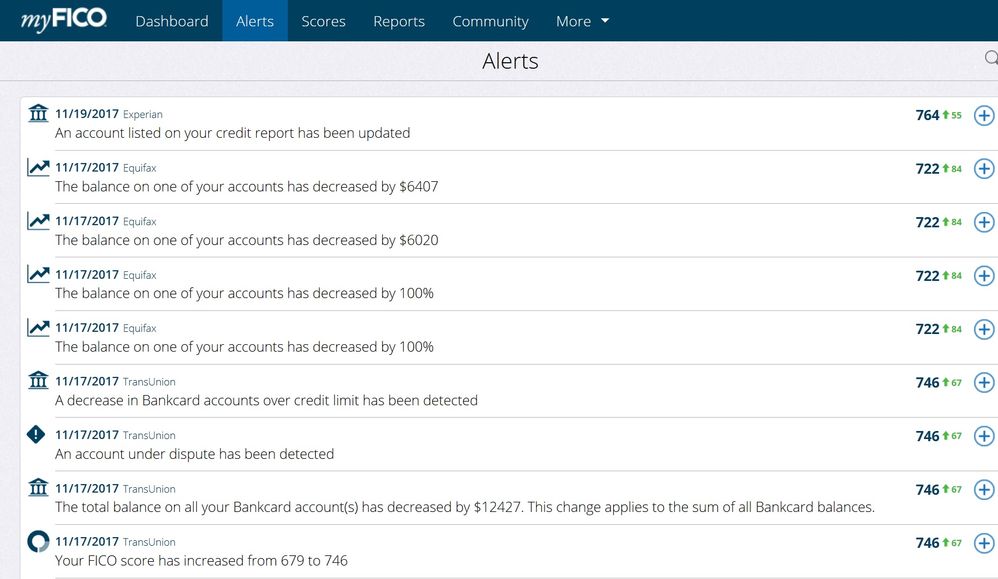

THE SYSTEM WORKS! My CS dropped like a rock off a skyscraper when I used my CCs and personal loans (DTU); but rebounded as soon as I lowered my CC DTU again once all was solved. My scores jumped in one report 55, 67, and 84 points with the 3 CRAs. They should jump another 40 to 50 points as soon as my payoffs for personal and auto loans are reported cleared/reduced (installment loans). No, I did not hit myself by reducing my credit mix, but I will have to wait another month to get rid of those pesky inquiries and raise the score even more above the next anticipated increase. Nevertheless, I’m back in the 760 club (albeit with only one CRA today). Check with me in a week and everything should be above 760 and probably EX and TU above 800.

Y

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

PS

The "account under dispute' mentioned in the TU Alerts section above pertains to my argument that I was never over my limit (also stated as “A decrease in bankcard accounts over limit…”). I won this case with TU (the only one stating so) and thus it shows a score increase accordingly. Now if I prevail with the “account close, paid in full as agreed, balance is zero” and “incorrect balance reported” cases; I should get the next bump that I mentioned. The rest is gardening until 800+ across the board by January 2018.

Y

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

My scores ranged from 674 EX to 724 TU earlier this year. My UTI was 90%. Then I paid it down to 8%. All my scores jumped over 800 within 45 days. Recent scores noted in my signature. Prior to this year the last time my credit report saw a flurry of activity was 2012 - I secured a mortgage and 3 months after added a new credit card and charge account. My EX has taken a hit in the last few months because I upgraded to several prime lenders while slowly shedding the subprimes that leeched me for years on interest - which was of course my fault, and good for them for making a profit. Oddly 760 doesn't make me think of myself as a high achiever. Considering how low I've been over the last 2 decades, hitting 800 with all 3 CRAs did give me a feeling of euphoria. Getting approved for quality cards that I wanted - and thus dropped my EX - returned the same feeling.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

@Anonymous wrote:My scores ranged from 674 EX to 724 TU earlier this year. My UTI was 90%. Then I paid it down to 8%. All my scores jumped over 800 within 45 days. Recent scores noted in my signature.

Oddly 760 doesn't make me think of myself as a high achiever. Considering how low I've been over the last 2 decades, hitting 800 with all 3 CRAs did give me a feeling of euphoria. Getting approved for quality cards that I wanted - and thus dropped my EX - returned the same feeling.

Nice work! I would guess your files are currently free from any delinquencies - yes?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

Holy C!!P, I just did the $1 trial at Experian and saw that my Fico 8 as of today is 830!!!! First time in my life that my score was over 790. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Our Forums' FICO High Achievers: Who has at least one FICO Score of 760 or above?

In early January I had a bankruptcy fall off after 9 1/2 years. My score went up 80 points, overnight to 798. It has been going up a point every 2 or 3 days as other accounts that have been PIF are being recorded and I show an 803, today. On February 1st I will have my utilization at 0%. I don't see what else I can do to raise my score, but doing so would be nice.

I'm worried that not using my cards and carrying a $0.00 balance will hurt my score and I already had one card cancel my account because it wasn't used for a year, with a nasty note telling me to NEVER apply, again. Of course, last week I got a pre-approved solicitaion/invitation from that company for a card at half my previous CL. Don't hold your breath.