- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Paying off car using credit card. How will thi...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paying off car using credit card. How will this affect credit score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paying off car using credit card. How will this affect credit score?

Hello,

If I were to pay off my car loan (I owe 10k) on a credit card, what would/should I expect to happen to my score? My current score is 806, and the reason I would put the car balance on the CC is because I have 0% APR for 18 months. I'd have it payed off before interest kicks in. I currently have about 2k in CC debt, and probably around 100k in available credit on my cards.

I probably shouldn't worry about it so much, but now that my score is up over 800, I am all paranoid about it! It just needs to drop back to 799 and then I won't worry about it so much![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off car using credit card. How will this affect credit score?

I am curious.... how do you plan to transfer the debt on your car to your credit card? Is the 0% promotion also providing you with BT checks for which there is no BT fee?

As far as score impact, you don't indicate what the credit limit is on this card to which you are considering trasfering the car debt. If the card's credit limit is 12k and you currently have 1.5k on that card, then your plan will involving maxxing it out and it will cause a score plunge. If that card's credit limit is 30k, the impact will be vastly less.

One last question: what is the interest rate on the car loan presently?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off car using credit card. How will this affect credit score?

I imagine the utility on the card might take a hit, although thats not an issue if your score isn't that important to you for the foreseeable future.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off car using credit card. How will this affect credit score?

Does your card permit a balance transfer to pay an existing loan?

What is the balance transfer fee?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off car using credit card. How will this affect credit score?

My car interest rate is 3%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off car using credit card. How will this affect credit score?

@Anonymous wrote:

I can pay my balance using visa checkout through my credit union. Additionally, my USAA CC's promotion is no fees for balance transfers or for using the checks they sent so I could use one of them.

My car interest rate is 3%.

I thought the checks had a 3% fee or X amount of dollars whichever is more to use?

Then again I don't have the 0% offer. I also have USAA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off car using credit card. How will this affect credit score?

@Anonymous wrote:

I can pay my balance using visa checkout through my credit union. Additionally, my USAA CC's promotion is no fees for balance transfers or for using the checks they sent so I could use one of them.

My car interest rate is 3%.

That USAA promotion is awesome... I'm carrying a balance from when they ran it back in April, and I now have it again.

In my case the April offer (and my current one) is only for 12 months, but the no-fee for using the checks can't be beat. ![]()

You're getting great feedback so far... I'll only add that you also might consider your plans for the next 18 months; i.e. will it matter to you if your scores take a temporary dip?

If you have anything mortgage related on the radar in this time period I would consider that a hard-stop... the last thing you need is anything pulling your numbers down. If not, though, the interest saved might be worth the temporary dip, and any points losts will come back as the balance is paid down in any case (assuming everything else stays the same, of course.)

There are often other considerations (do you need to keep a 800+ score for other reasons?), but this would be the 'biggie' for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off car using credit card. How will this affect credit score?

@Anonymous wrote:

@Anonymous wrote:

I can pay my balance using visa checkout through my credit union. Additionally, my USAA CC's promotion is no fees for balance transfers or for using the checks they sent so I could use one of them.

My car interest rate is 3%.I thought the checks had a 3% fee or X amount of dollars whichever is more to use?

Then again I don't have the 0% offer. I also have USAA.

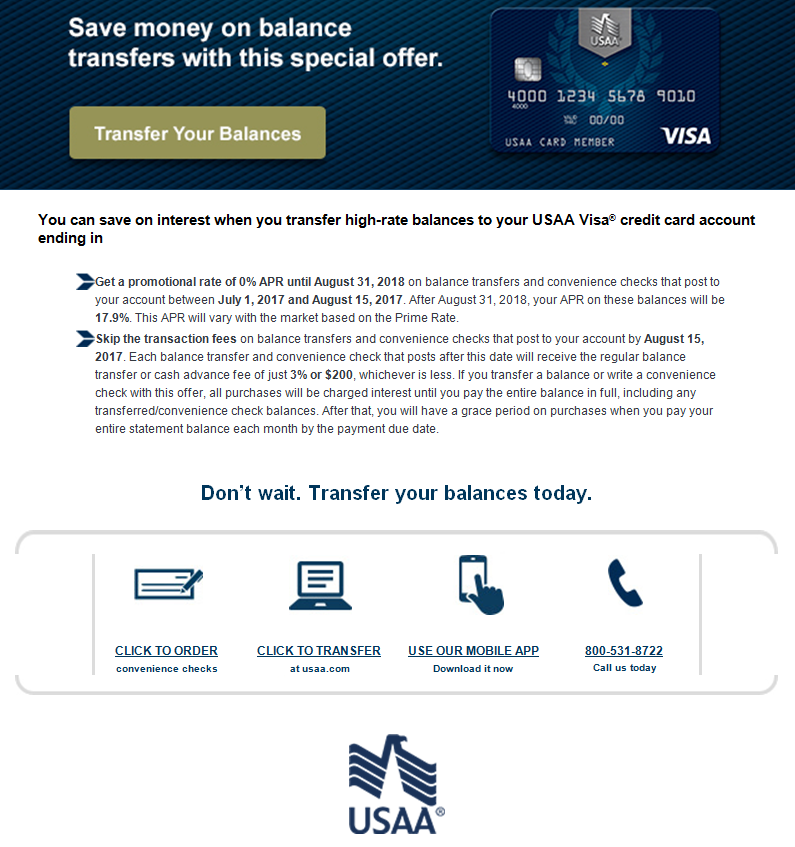

Here's the offer; there's no fee on the checks as long as they post by August 15.

Note that my offer is only for 12 months unlike the OP's offer, which is for 18 months:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off car using credit card. How will this affect credit score?

@UncleB wrote:

@Anonymous wrote:

@Anonymous wrote:

I can pay my balance using visa checkout through my credit union. Additionally, my USAA CC's promotion is no fees for balance transfers or for using the checks they sent so I could use one of them.

My car interest rate is 3%.I thought the checks had a 3% fee or X amount of dollars whichever is more to use?

Then again I don't have the 0% offer. I also have USAA.

Here's the offer; there's no fee on the checks as long as they post by August 15.

Note that my offer is only for 12 months unlike the OP's offer, which is for 18 months:

Ah I have the cash rewards cards. I might have to look into this one. Though I am trying to hold out for the USAA Limitless cash rewards card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off car using credit card. How will this affect credit score?

I'll hold off on the car for now! But I was also considering using my USAA card which has a 25k limit with zero interest until Dec 2018 to get the home improvements started until we figured out the home equity loan. I think what I need to do is get the ball rolling on the equity loan before we start racking up CC debt!