- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Question on letting $2 report...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question on letting $2 report...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question on letting $2 report...

@My_Fako wrote:Yes getting ready to pay account's. All to $0 but one. I just wasn't sure if it had to be a Major reporting 1% OR it could be a store card. If this makes sense...

It probably doesn't make a difference on one month set of reports. However the challenge with a store card is, you need to shop there every month to keep refreshing the new balance, so you can continue to have a small balance to manage to.

Using a regular credit card, you shop anywhere to keep the balance available to report.

If you use the store card, and decide later you want to use another card, you likely have a transition problem to get from a store card reporting to another store card reporting or a regular bank credit card reporting. (This presumes that the word "problem" is understood for what it is, a minor issue). If in that transition you end up with the first store card paid off before the next card reports, then all cards are at zero and the score drops some larger number of points. Score will recover once cards start coming back on line, but for those who are obsessive enough to want only one reporting, a store card is the most challenging to do this with.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question on letting $2 report...

If transitioning to another card, I would error toward having a balance report on 2 cards as opposed to zero cards. Either way, impact on score due to an overlap or gap is fleeting.

P.S. OP - not sure how many accounts you have but I would suggest you do some testing yourself to see how your file scores with one card reporting a small balance and then with two cards reporting small balances. Results do vary significantly by profile. By small balance, I mean under 5% of the card's CL (not a fixed $2).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question on letting $2 report...

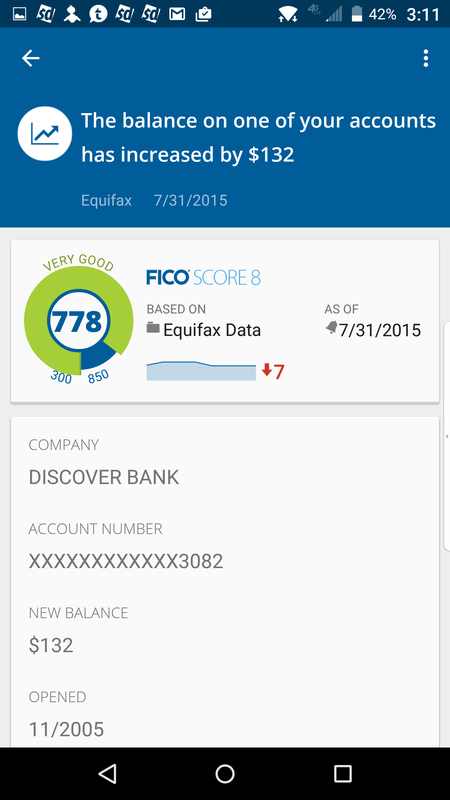

Look at these notifications when my balances changes even though they were way below 1% of the card's limit. I don't understand why i lost points with dollar amounts being so low. In this first example, I lost 7 point when my balance increase from $0 to $132 on a card with $5.8k limit

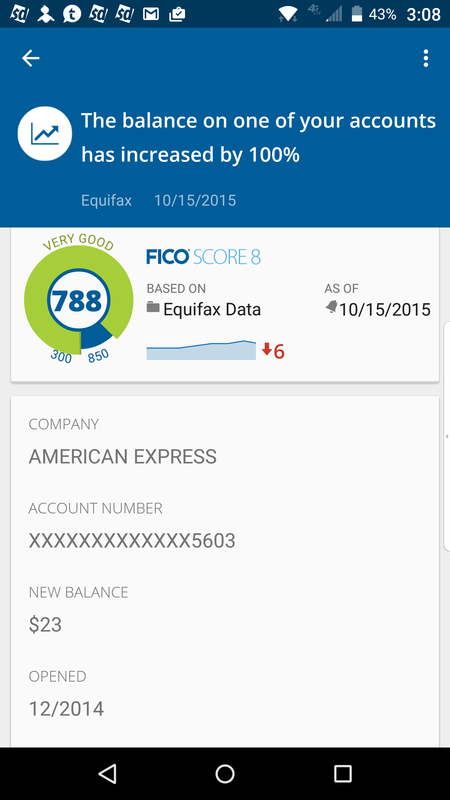

In this next example, my balance increase from $0 to $23 and i lost 6 points. To me it does seem small dollar amounts harm your score. What do you think?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question on letting $2 report...

A reported card utilization of 2.2%, per your 1st example, is not sufficient for any points deduct associated with a high utilization. The statement is just an event notification. The key point in both your examples appears to be a change in card status of not reporting => reporting a balance.

Fico has a scoring metric that looks at the # of open accounts reporting a balance. This is a count metric - independent of utilization. For count the balance could be $2 or $2,000, makes no difference - count is count. If the # cards reporting a balance increases, that often drops score. A 5 point to 8 point drop is typical when a count threshold is crossed. Thresholds are profile dependent. For example, if you have 3 to 5 cards, some porfiles report score changes going from 1 => 2 and 2 => 3. Others only see a change at 2 => 3.

Key point: The models are also looking for indications you are using credit. Basically, a single card reporting satisfies this metric. If no cards report any balance, then score can drop quite a bit (20 to 35 points is typical). A score drop for zero cards reporting appears to be universal across all profile types.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question on letting $2 report...

@DU556 wrote:Look at these notifications when my balances changes even though they were way below 1% of the card's limit. I don't understand why i lost points with dollar amounts being so low. In this first example, I lost 7 point when my balance increase from $0 to $132 on a card with $5.8k limit

In this next example, my balance increase from $0 to $23 and i lost 6 points. To me it does seem small dollar amounts harm your score. What do you think?

As TT notes, these are not "balance change" notifications they are "card was zero, now has any balance" changes. There's a difference between the two.

With "card was zero, now has any balance", as you see, any balance is sufficient to trigger that point change, even two dollars.

If you let each of these cards change, increase, by the same amount the next month, there should be zero change in score for that small of a balance change, because the card is actually now consistently reporting some balance, it's not zero at the start of the comparison. Only if you got to a large absolute dollar amount change, and / or reached some higher utilization threshhold like 50% of the card CL would you see another points change in EQ.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765