- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Real scoring advantage of 3+ revolvers over 1?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Real scoring advantage of 3+ revolvers over 1?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real scoring advantage of 3+ revolvers over 1?

Has this ever been quantified and is it even possible to quantify it really?

I know on this forum many of us give the advice to newcomers that having 3+ cards can offer a FICO scoring advantage over having just 1. I get the impression though that the perceived gain from this is often larger than the actual gain.

First, what exactly changes by going from 1 to 3 cards? Yes, you can now allow greater than 0% but less than 50% of your cards to report a balance. On a thin file, adding 2 more accounts could thicken it, which could also help. We are also aware that additional revolvers add more available credit, thus lowering utilization. I'm trying to take these other factors out of the equation though and look JUST at 1 card vs 3+ cards. Is there any actual scoring benefit to having more than one open revolver on your credit report simply based on number of revolvers? This I'm not sure about, but I've always thought the only real benefit was again allowing greater than 0% but less than 50% of your cards to report a balance.

That being said, would the benefit here be able to be quantified by someone with 3 cards allowing just 1 to report a balance, then 2 of 3 and finally 3 of 3? If that's the case, anyone could really perform the same test even if they had 10 cards if they went from AZEO to 5 reporting a balance, then all 10. I feel like the test needs to be done in reverse so that factors like overall utilization and number of accounts stay constant while changing number of cards reporting balances, where this can't be done when going from 1 revolver on your credit report to 3 or more.

I think a lot of the time the perceived gain of having 3 cards over 1 card is greater because of other factors. Utilization is a good example. Maybe someone is sitting at 40% aggregate utilization because they only have 1 card with a $500 limit. They scoop up 2 more cards, each with $2500 limits and their aggregate utilization drops to 4%. They see their scores go up from 680 to 730 (for example) and their perception is that adding 2 more cards gave them a 50 point boost. If I were to break down that 50 points, I'd say 40 of them probably came from crossing 2 aggregate utilization thresholds where maybe 10 of them came from AZEO on 3 cards [verses having just 1 card].

Does anyone have any thoughts on this subject, since it's talked about every day on this forum but never really dug into or quantified?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real scoring advantage of 3+ revolvers over 1?

I'm tracking my and DWs scores:

She just went from 0 to 1 revolver which gave her +27 pts on EX. Still waiting on her card to appear on TU and EQ. I can't make any more changes on this one right now, as I'm hoping for her collection(the only one on EX) to fall off. I'll add an additional card after that.

I don't have data for me before 1 revolver, and I messed up my UTI (0%) this month, so I don't have that yet. I'll have that fixed for comparison next month, with no other real changes(gardening). I plan to app for a couple of cards in Jan 2018. I'll be tracking those a little more closely.

2020-02-07 FICO 08: TU 789

2020-02-10 FICO 08: EX 752

Gardening, mostly, again until... soon(I need to replace my car)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real scoring advantage of 3+ revolvers over 1?

With collections, lates, chargeoffs AND tax liens (unpaid) in February I was around 540 FICO. With 1 card I went up to 550, two cards went up to 560/570, three cards to 580. With SSL added over 600. Then started removing derogatory.

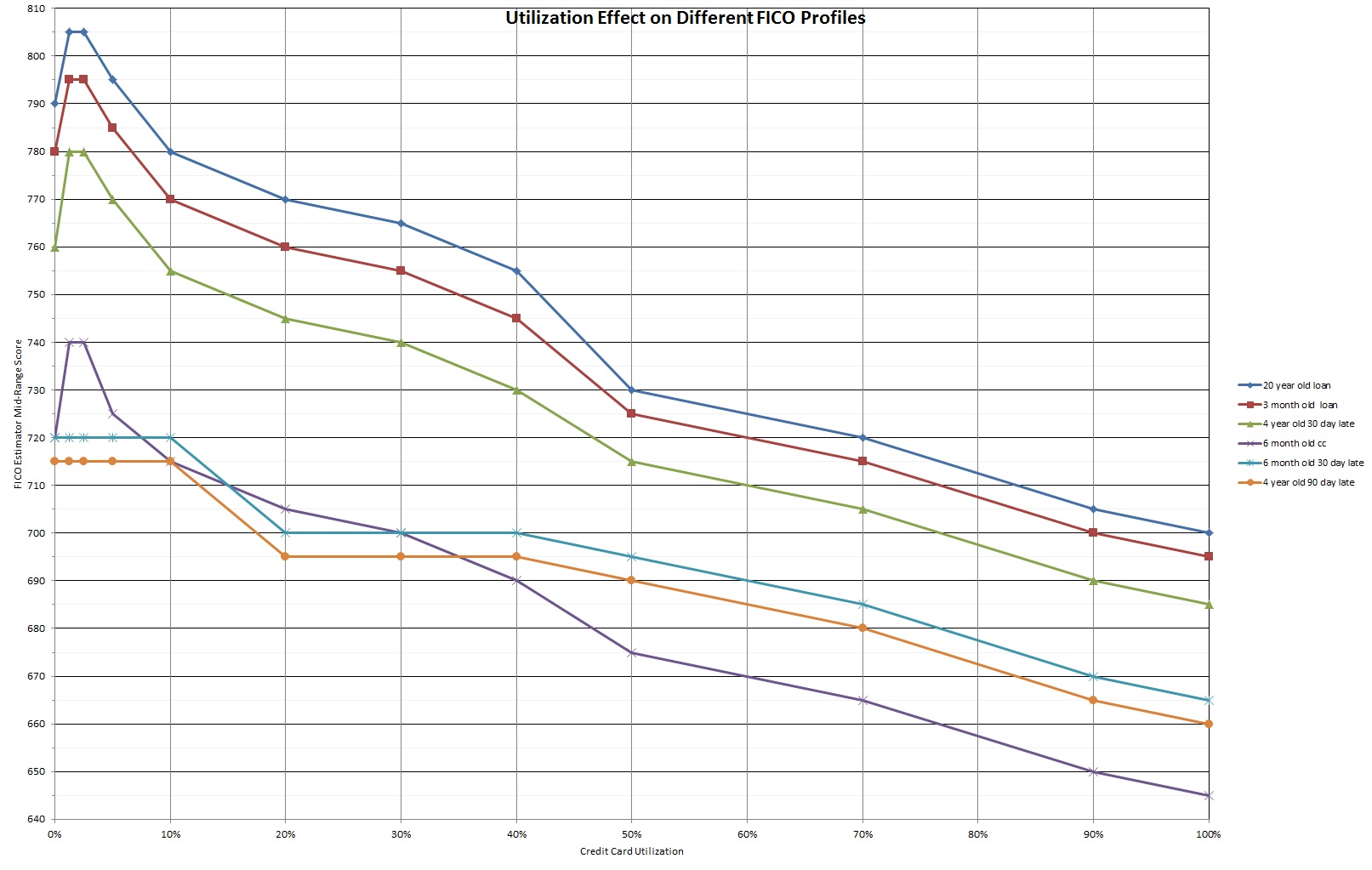

BobWang, a poster on another credit forum, has this graph:

The optimal number of cards for FREE FICO points is 3, but the optimal number of cards over time is 5+. Cards 4 and 5 need 2 years to age to get more points that without. Cards 1-3 are free boosts right away regardless of age.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real scoring advantage of 3+ revolvers over 1?

@Anonymous wrote:The optimal number of cards for FREE FICO points is 3, but the optimal number of cards over time is 5+. Cards 4 and 5 need 2 years to age to get more points that without. Cards 1-3 are free boosts right away regardless of age.

But what are the "boosts" from? Is it simply from number of open revolvers present on your credit report, not taking into account any utilization, number of cards reporting balances, etc? And, how are you quantifying the gain on cards 4 and 5 after 2 years?

What negative reason codes have we seen that point to just 1 revolver (as opposed to more) being adverse for FICO scoring?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real scoring advantage of 3+ revolvers over 1?

@Anonymous wrote:With collections, lates, chargeoffs AND tax liens (unpaid) in February I was around 540 FICO. With 1 card I went up to 550, two cards went up to 560/570, three cards to 580. With SSL added over 600. Then started removing derogatory.

BobWang, a poster on another credit forum, has this graph:

The optimal number of cards for FREE FICO points is 3, but the optimal number of cards over time is 5+. Cards 4 and 5 need 2 years to age to get more points that without. Cards 1-3 are free boosts right away regardless of age.

That is the board that I've been a member of since 2003, under a different name, and where I've gotten a good deal of my information regarding the 3-5 cards being optimal for rebuilding. I successfully rebuilt my credit back in 2003, but have had serious medical issues causing financial issues, and am rebuilding for the 2nd time. I haven't been active on that board in years but still read over there frequently.

I personally saw my score increase with the additon of a 2nd and 3rd card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real scoring advantage of 3+ revolvers over 1?

@Anonymous wrote:

@Anonymous wrote:The optimal number of cards for FREE FICO points is 3, but the optimal number of cards over time is 5+. Cards 4 and 5 need 2 years to age to get more points that without. Cards 1-3 are free boosts right away regardless of age.

What negative reason codes have we seen that point to just 1 revolver (as opposed to more) being adverse for FICO scoring?

"Too few accounts paid as agreed."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real scoring advantage of 3+ revolvers over 1?

My account will be a good measure of this. I had 1 cap 1 unsecured and 1 care credit, with no other real cc, applying for new accounts, I added 4 cards, 2 of which show on report (added August 2017) and Experian 1 statement in with new Chase card and 2nd statement in with Penfed Visa, still complains of t"oo few accounts paid as agreed. "Interesting enough I also have 2 new loans in 2nd statement reported so far. I await the impact of a 3rd month reporting with Penfed and 2 new amex's finally reporting what should be later this month.

I think there's more to how the measurements work. instead of viewing a min/max value of the x% of the pie avail for either new credit, or payments/etc, I think there are invisible breakpoints. In other words, while we look for visible breakpoints in cc util such as 29% or 9%, I think even if you pay your cards on time 100%, you didn't reach a potential breakpoint of y# of cards (4) vs an old x# of cards (2) and because of that, even with perfect credit, you would hit a ceiling with just one proper card. Just a theory I have had, I certainly can be wrong. Once you hit 3-5 cards, vs 1, your perfect payment history triggers another ceiling to get the most out of that 35% of payment history (as an example). Well, either way, I will find out if proper card #2-5 (I don't count care credit) have an impact.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real scoring advantage of 3+ revolvers over 1?

I used to get the reason code "too few accounts paid as agreed" all the time. I'm not exactly sure when it started to move down in importance or went away, somewhere around 5 or 6 cards. I have 8 cards now, so I don't see it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real scoring advantage of 3+ revolvers over 1?

That reason code suggests all accounts I would think, not just revolvers. I could be wrong, though. Back when I had just 1 CC and I started a rebuild I never saw that reason code, but I did also have 15+ accounts on my credit report, even though I only had 1 open revolver.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Real scoring advantage of 3+ revolvers over 1?

@Anonymous wrote:That reason code suggests all accounts I would think, not just revolvers. I could be wrong, though. Back when I had just 1 CC and I started a rebuild I never saw that reason code, but I did also have 15+ accounts on my credit report, even though I only had 1 open revolver.

Might only apply to open accounts rather than historical closed ones?

Do any of you recall what FICO model you had that tag on?