- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score effect of inquires

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score effect of inquires

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

@RobertEG wrote:The FICO scoring algorithm only includes inquiries under year in its scoring.

That is not a rumor or a creditor decision, it is a fact.

The CRAs have an administrative policy that is not mandated by the FCRA to delete inquiries from consumer files once they reach approx 24 months.

It is not a statutory requirement, and could occur earlier or later, but the millions of inquiries clog up their datatbases, and they dont keep them for any extended period.

Side note: VantageScore (which was jointly developed by the 3 CRAs) looks at inquiries for 2 years in scoring. Thus, the need to retain them for 2 years. Otherwise, no real need even for 2 year retention.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

@Anonymous wrote:Great response as always by RobertEG. One additional observation about rate shopping and de-duping:

Suppose you go rate shopping for a car. 22 inquiries are made within a very small window. In theory they will be counted by FICO as if they were only one inquiry. But, in order to do that, the 22 creditors would have had to coded each of their inquiries as type AUTO. Suppose that most of them (16) did that, but 6 of them did not. The 16 inquiries would count as 1 inquiry and the other 6 would each count seperately, for a total of 7 inquiries.

This kind of thing is not common, but it isn't rare either. Bear in mind too that any time a car dealer asks you for your social security number, it means they are about to run a large number of inquiries on you, whether they say that or not.

I am not saying rate shopping is a bad idea, just bear in mind that there can be drawbacks to it too. Some of us therefore choosing to get our financing lined up with a CU before we walk into a dealership so that we can aggressively negotiate for the lowest price.

FICO is somewhat more sophisticated than that, which I have direct experience from my mortgage shopping and it appears to work similarly for consumer finance accounts so it almost assuredly holds true for auto lenders too.

They are partly determining de-dupe on the name of the reporting agency too, I have some inquiries which don't list anything about mortgage in their coding (whereas others do so this isn't a bureau idiosyncracy on the report) and they followed the de-dupe rules for both FICO 04 and FICO 8 explicitly and I got a sequence of events as a result of some near 1 year inquiries which fell off during my mortage process with FICO 04 (Beacon 5.0) going 693 -> 700 -> 693 -> 700 -> 693 explicitly trading between 2 (700) and 3 (693) inquiries on Equifax even with the sloppy coding.

You get financing arranged beforehand anyway, not to prevent their shotgunning your app, but to give you more leverage on the negotiation as you suggest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

@Thomas_Thumb wrote:

@RobertEG wrote:The FICO scoring algorithm only includes inquiries under year in its scoring.

That is not a rumor or a creditor decision, it is a fact.

The CRAs have an administrative policy that is not mandated by the FCRA to delete inquiries from consumer files once they reach approx 24 months.

It is not a statutory requirement, and could occur earlier or later, but the millions of inquiries clog up their datatbases, and they dont keep them for any extended period.

Side note: VantageScore (which was jointly developed by the 3 CRAs) looks at inquiries for 2 years in scoring. Thus, the need to retain them for 2 years. Otherwise, no real need even for 2 year retention.

It does? The bureaus retained inquiries from far longer than VS has even been in existence, no causality in it. Fact is lenders wanted the data so it's there, there's a lot of 2 year time frames (2 years tax returns on a mortgage for example) when it down to it.

Tried to search, did find this gem when I went quickly looking are VS:

Myth: Shopping for a loan hurts my VantageScore credit score.

Fact: Consumers are encouraged to shop for the best loan rates and conditions. Accordingly, the VantageScore model does not penalize multiple inquiries made within a short period of time. When several inquiries are made within a shortened timeframe, it is assumed that the consumer is shopping around for a rate and not opening up multiple lines of credit.

The VantageScore model uses a 14-day rolling window in which all credit inquiries are de-duplicated. All inquiries within that window are considered one inquiry regardless of the type of account. So regardless of whether the credit inquiry is made in response to a mortgage, auto or bank credit card application, it will be counted only once during that 14-day window.

That might be another reason why my VS has been happy over the years, as I app spree pretty much exclusively.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

Hi Revelate! I gave the coding example in my post based on what I have heard here on the forum. I have just heard this happen a bunch of times to people, who post about it. I don't know from personal experience, since it's been many years since I have had an auto loan.

It certainly made sense though, the way these posters described it. Obviously if a scoring model were to de-dupe on all inquiries made within a short window regardless of type (fascinating to hear that VS does that) then it wouldn't matter. I am pretty sure though that FICO wants to treat (say) 3 auto, 3 mortgage, 3 student loan and 5 credit cards all made within the same week as 8 inquiries (1 + 1 + 1 + 5) rather than 1. And it is plausible that the way FICO would do that is to look at the "type" associated with each loan. It's hard for me to see how they wouldn't need to look at whether a loan was of type Auto, if indeed they want to distinguish an auto loan from another type of loan (mortgage, credit card).

But as I say, it's nothing I can speak to from personal experience. I was just recapping what I had heard from others. Best....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

@Anonymous wrote:Hi Revelate! I gave the coding example in my post based on what I have heard here on the forum. I have just heard this happen a bunch of times to people, who post about it. I don't know from personal experience, since it's been many years since I have had an auto loan.

It certainly made sense though, the way these posters described it. Obviously if a scoring model were to de-dupe on all inquiries made within a short window regardless of type (fascinating to hear that VS does that) then it wouldn't matter. I am pretty sure though that FICO wants to treat (say) 3 auto, 3 mortgage, 3 student loan and 5 credit cards all made within the same week as 8 inquiries (1 + 1 + 1 + 5) rather than 1. And it is plausible that the way FICO would do that is to look at the "type" associated with each loan. It's hard for me to see how they wouldn't need to look at whether a loan was of type Auto, if indeed they want to distinguish an auto loan from another type of loan (mortgage, credit card).

But as I say, it's nothing I can speak to from personal experience. I was just recapping what I had heard from others. Best....

Which is honestly the weakness of the forum; anecdotal evidence taken word of mouth with very little control.

Sure, if you have a mortgage inquiry get coded as a bank card inquiry, yeah, but when we're talking mortgage vs. generic (or auto vs. generic aka miscellanous) it's a different animal. To be fair, and in full disclosure, I was one of those who talked about coding of inquiries back in early 2012 on the auto forum so it's not like I'm a saint on this, but we have better data now.

I take pretty much all reported data points with skepticism until they can be demonstrated as controlled which honestly very few people's are (people here have stupidly busy reports); my report is very very static compared to the majority, and I have to put some non-trivial effort into getting a good datapoint and at specific times and it's more hassle than it's sometimes worth. Finding the installment loan utilization metrics and their impact, some small benefit to humanity, figuring out the score impact of an inquiry. (Mod Cut). Fewer is better, duh!

An analogous example, the whole 1 card reporting <9% of it's balance for optimum scoring: we know that's not 100% complete, but it is accurate in the sense that will be optimal for virtually everyone's file or at least getting 99% of the way there which is pretty much the entire ballgame when we're talking inexact science which FICO strategy is. It's also simple, which along with being accurate, makes for the best type of advice. Feynman Technique even, can't really get any simpler than that.

TLDR: sure, it's not smart to rack up inquiries, but one shouldn't be afraid of letting a dealer run one's credit when auto shopping as getting that best rate is really all that matters (unless, maybe, you have a mortgage coming up within a year... every rule has an exception amiright? haha).

ETA: it takes years to correct misinformation, look at how many people still suggest one doesn't need an installment loan for optimal scoring ![]()

App sprees (in moderation, and instead of the old one account every six months thing) being smart FICO-wise which was another yours truly pontification, was about 3 years before it became commonplace on the forums.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

I have seen statements regarding inquiries counting for 2 years on VS. As I recall they were official from VS. I'll try to hunt them down.

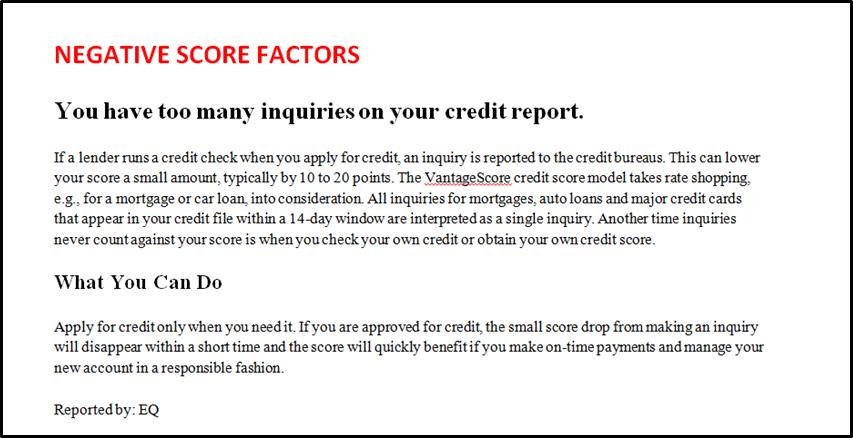

That aside, I have only one inquiry - on EQ from June 2014. I check CK scores monthly and no change in EQ offset when INQ crossed the 1 year mark. Also, purchased a 3B report from TU 10/28/2015 which shows the EQ inquiry. THis report includes VS scores. Pasted below is one of the negative reason statements - which references the inquiry [ side note - the 10 to 20 point drop mentioned is a wild exaggeration. The cost to me is 3 to 5 points max]

Anyway, you may have been right about how VS computes average age of accounts but, I think you will find evidence to confirn inquiries can impact VS score for up to 2 years. That does not mean the inquiry will or must impact score.

Don't forget to contact my-own-fico [for a possible introduction...to Liz]

Liz Weston

Edit add: OK - I came across the below for what it's worth. I pasted an exerpt with a link to the article

No. 4 in a Series: An inquiry into credit inquiries

By John Ulzheimer The Ulzheimer Group

The impact of an inquiry on your score will vary on a case-by-case basis, depending on the other data in your credit file. Consumers with excellent credit histories may not see any reduction in their scores after an inquiry.

Finally, assuming you continue to pay your bills on time, the impact on your credit score from credit inquiries will be short-lived. Inquiries resulting from credit applications will remain on your credit reports for 24 months, but barring late payments or more serious financial mishaps, your score will typically rebound to pre-inquiry levels within 90 days.

http://thescore.vantagescore.com/article/218

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

my-own-fico is Liz Weston? Hrm, I'm pretty certain I looked at that profile previously and didn't pick up on that when I was moderator but I don't have access anymore to check now. I did see what John posted with my own searching but like you didn't find anything specific in there as to when excluded.

Anyway I'd be interested in seeing if you can dig it up, just like 0->1 inquiry didn't ding me in FICO land one time, presumably 1->0 wouldn't impact me either so what you suggest isn't necessarily proof that it's being scored for 2 years. Really the only way I could conjecture would be to find an inquiry boundary in VS, then play with the file when you were likely to cross the threshold with an inquiry at the 1 (or 2) year mark.

Actually, I think I was still pulling CK reports religiously when I was going through my mortgage, I got the FICO Beacon 5.0 datapoints for inquiries, maybe I can do some napkin math and find out too... will try to look into that after this weekend when I catch a breather, though my file is a bit suboptimal with VS's de-dupe as I tend to cluster my applications.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

@Revelate wrote:my-own-fico is Liz Weston? Hrm, I'm pretty certain I looked at that profile previously and didn't pick up on that when I was moderator but I don't have access anymore to check now. I did see what John posted with my own searching but like you didn't find anything specific in there as to when excluded.

Anyway I'd be interested in seeing if you can dig it up, just like 0->1 inquiry didn't ding me in FICO land one time, presumably 1->0 wouldn't impact me either so what you suggest isn't necessarily proof that it's being scored for 2 years. Really the only way I could conjecture would be to find an inquiry boundary in VS, then play with the file when you were likely to cross the threshold with an inquiry at the 1 (or 2) year mark.

Actually, I think I was still pulling CK reports religiously when I was going through my mortgage, I got the FICO Beacon 5.0 datapoints for inquiries, maybe I can do some napkin math and find out too... will try to look into that after this weekend when I catch a breather, though my file is a bit suboptimal with VS's de-dupe as I tend to cluster my applications.

Heaven's no! ![]()

However, My-Own-Fico is a supporter of Liz. See link below

My bigger point on the 2 year argument is I show a reason statement for an inquiry that is well over 1 year old. If it is ignored completely by VS 3.0, it should not be listed at all!

Side note: When an unauthorized inquiry from PenFed showed up on EQ in 11/2015 my EQ score dropped 5 points and it rebounded when I had it removed in January. So, if one inq does not impact VS score, then my drop must have come from temporarily adding a 2nd one - which suggests the 17 month old INQ was still in play.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

Going back to the original post and first few posts. Hard inquiries stop impacting FICO score after 1 year even though they are displayed for 2 years typically. Question though. Does their impact vanish all at once 1 year from the time it lands on your report(s) or does their impact diminish slightly month after month for 12 months?

To apply some arbitrary numbers to it for the sake of discussion, say you have a 700 FICO score across the board and you apply for 4 credit cards. The following month you have a 680 FICO score across the board. With everything else staying exactly the same (which of course it doesn't, I get that) would the score bump back up 20 points in exactly 1 year or would it creep up from month to month... 680, 683, 685, 687, 688, etc? Just curious how FICO models treat this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score effect of inquires

@Anonymous wrote:Going back to the original post and first few posts. Hard inquiries stop impacting FICO score after 1 year even though they are displayed for 2 years typically. Question though. Does their impact vanish all at once 1 year from the time it lands on your report(s) or does their impact diminish slightly month after month for 12 months?

To apply some arbitrary numbers to it for the sake of discussion, say you have a 700 FICO score across the board and you apply for 4 credit cards. The following month you have a 680 FICO score across the board. With everything else staying exactly the same (which of course it doesn't, I get that) would the score bump back up 20 points in exactly 1 year or would it creep up from month to month... 680, 683, 685, 687, 688, etc? Just curious how FICO models treat this.

When you apply for (and then get) a group of new credit cards your score is affected by three factors [let's ignore CLs and UT% for now]

1) The inquiries and how many inquiry QTY bins you cross

2) Impact of the new accounts on average age of accounts

3) Impact of new accounts on age of youngest account.

The below scenario is based on a 25 point total drop associated with 4 new cards

A. To answer your 1st question - Inquiries in Fico scoring donot have a gradual tapering off effect. They count and then once they reach 12 months they no longer count.

* How much they count depends on your profile

* How much they count depends on how many inquiry bin thresholds you cross.

Example: Let's assume Bin 1 = (0 to 1 INQ), Bin 2 = (2 to 3 INQ), Bin 3 = (4 to 6 INQ), Bin 4 = (7 to 10 INQ), Bin 5 = (11 or more INQ), and each INQ bin costs 5 points.

* If you had zero inquiries and now have 4, the inquiries as a factor cost 10 ponts. The affect of these inquiries on score remains until 12 months at which point it goes from 10 points to zero points.

B. The 2nd part of the question, will all lost all the lost points when the inquiries age off? Answer - It depends on profile but it is highly unlikely all points would be regained due to a reduction in Average Age of Accounts (AAoA) - unless you have a well aged, thick file

Example: lets assume you had 1 card that was just over 5 years old (AAoA = 5). Now you add 4 newbie cards. This will drop your AAoA from 5 years to 1 year. That will cost you points [probably a lot more than we will look at in this example]. Anyway, it is generally understood that a minimum 2 years AAoA is needed to start getting a benefit point wise associated with AAoA.

* Again, let's assume the drop in AAoA to 1 year from 5 years costs 15 points. Once AAoA crosses the 2 year boundry you pick up 5 points. At the 3 year mark you pick up another 5 points and at the 4 year AAoA mark you regain the last 5 points.

I have not discussed how age of youngest account factors in to scoring. I think it's primarily a scorecard assignment factor. Depending on your scorecard assignment factors are weighed differently.

Key takeaway should be: Get the cards you want/need early on, grow CLs over time and allow the cards to age up. Down the road the cards will provide a nice buffer to AAoA if/when you need a new account (mortgage or car loan for examle).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950