- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score increase 14 to 22 points after Hard Pull? Do...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score increase 14 to 22 points after Hard Pull? Don't get it.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score increase 14 to 22 points after Hard Pull? Don't get it.

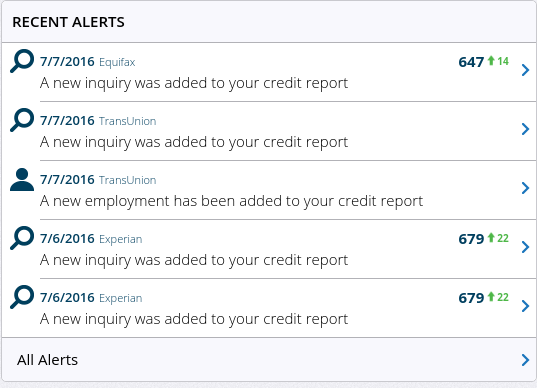

I don't understand this, I've submitted app for a car loan (with audi), they ran in for VW Financial & WellsFargo and I was expecting a drop, but CS actually was increased. Any ideas why would this happen? Is this some kind of a glitch? Will it drop afterwards? Anyone who had this before, I'd appreciate if you can share something...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase 14 to 22 points after Hard Pull? Don't get it.

@score_is_497_hehe wrote:

I don't understand this, I've submitted app for a car loan (with audi), they ran in for VW Financial & WellsFargo and I was expecting a drop, but CS actually was increased. Any ideas why would this happen? Is this some kind of a glitch? Will it drop afterwards? Anyone who had this before, I'd appreciate if you can share something...

The inquiry & the score change are unrelated.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase 14 to 22 points after Hard Pull? Don't get it.

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase 14 to 22 points after Hard Pull? Don't get it.

I actually had the same visceral reaction shortly after I was approved for my last cards. I guess the HP gave the CRAs a chance to rescore me and BOOM! a nice increase that actually made me feel like the all the time I spend on myFico has been worth it.

Phew!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase 14 to 22 points after Hard Pull? Don't get it.

I've recently seen the same thing: credit pull results in score increase. I have also seen the more traditional consequence: credit pull lowers score. I'm starting to suspect credit pulls have transitory, or otherwise indecipherable, changes on FICO scores like balance changes on credit cards: sometimes they lower and sometimes they raise the scores.

For example, I recently had a balance increase from zero to $3,300 on my Chase Visa and my score jumped 10 points on EQ and TU, with no change on EX. Prior to the Chase Visa balance increase I had total outstanding balances of maybe $1,000 on one of 6 credit cards with total limits of about $120,000.

Separately, I recently had a hard pull on all three bureaus. EX jumped 12 points with no change on EQ and TU.

There's an element of irrationality in FICO scoring or at least scores are fluctuating based on criterion unknown to the public. The FICO scoring model is a trade secret, unknown to the public, and could be taking factors into account that we, as members of this forum, are unaware. Maybe a credit pull is seen as grounds for a score increase on some profiles because it suggests the consumer is now active in his or her financial life which is a positive development from the view point of lenders because it suggests an opportunity for lenders to earn financing fees from a consumer that otherwise has not participated in the acquisition or use of credit. But the same credit pull, could signal increasing financial risk when coming from a consumer who is heavily in debt triggering a score decrease. Maybe a balance increase for a consumer with little outstanding debt is grounds for a score increase because it signals a greater willingness to make use of one's credit, while a balance increase on a heavily indebted consumer signals increased risk warranting a score decrease.

Though the details of the FICO model is unknown to us, its widespread use suggests it reliably predicts consumer credit risk and also suggests it is a sophisticated model that likely takes into account the circumstances of the particular consumer such that the same credit event can lead to differing changes in score depending upon the makeup of the particular profile. No one but FICO really knows and they are keeping it a secret to forestall competitors in the credit scoring business and protect an apparently lucrative business.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score increase 14 to 22 points after Hard Pull? Don't get it.

@SouthJamaica wrote:

@score_is_497_hehe wrote:

I don't understand this, I've submitted app for a car loan (with audi), they ran in for VW Financial & WellsFargo and I was expecting a drop, but CS actually was increased. Any ideas why would this happen? Is this some kind of a glitch? Will it drop afterwards? Anyone who had this before, I'd appreciate if you can share something...

The inquiry & the score change are unrelated.

This.. The inquiry triggered the alert and along came a score change.

801 EQ FICO 06/2022

797 TU FICO 04/2022

793 EX FICO 04/2022

$30k NFCU Platinum | $30.7k NFCU cashRewards Sig | $15k NavChek | $7.1k Cap1 Quicksilver | $10k Amazon Store | $19k Cap1 VentureOne | $16k Barclay Aviator | $5k Chase Freedom | $5k Chase Sapphire Preferred | $9k Costco Visa | $20k AMEX BCE | AMEX Gold | NFCU Platinum #2 $19.3k | Apple $8.5k