- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Scratching my head over reason codes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Scratching my head over reason codes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scratching my head over reason codes

myFICO is showing me reason codes that I don’t quite understand. It’s saying that I have too many accounts with balances — and in one case — that my balances are high. I think it’s kind of strange because the number of cards I have reporting balances would seem to be in check, although Equifax always dings me for having more than one card with a positive balance. Also, my utilization isn’t particularly high.

I’m using mortgage scores for this example, but I can see these reasons on several of my scores. I closed two cards in late April, which is why fewer revolving accounts are listed for May.

May 2017

Card 1: Balance $1,325 / Limit $21,200 (7% util.)

Card 2: Balance $873 / Limit $10,000 (9% util)

Card 3: Balance $0 / Limit $5,000 (0% util)

Card 4: Balance $0 / Limit $4,000 (0% util)

Card 5: Balance $0 / Limit $2,800 (0% util)

Card 6: Balance $0 / Limit $2,700 (0% util)

———————

Total: Balances $2,198 / Limits $45,700 (5% util.)

Equifax (798): You have too many credit accounts with balances.

TransUnion (763): You have too many credit accounts with balances.

Experian (788): You’ve made heavy use of your available revolving credit.

April 2017

Card 1: Balance $0 / Limit $15,000 (0% util.)

Card 2: Balance $414 / Limit $10,000 (5% util)

Card 3: Balance $12 / Limit $5,000 (1% util)

Card 4: Balance $0 / Limit $4,000 (0% util)

Card 5: Balance $0 / Limit $2,800 (0% util)

Card 6: Balance $0 / Limit $2,700 (0% util)

Card 7: Balance $0 / Limit $10,300 (0% util)

Card 8: Balance $0 / Limit $4,000 (0% util)

———————

Total: Balances $426 / Limits $53,800 (1% util.)

Equifax (798): You have too many credit accounts with balances.

TransUnion (767): You have too many credit accounts with balances.

Experian (798): (nothing weird)

Does anyone have some insight on the reasons given?

And as an aside on this, could anyone remind me where to find reason codes for my FICO8s?

Thanks! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

FICO08 reason codes are not public and no one has leaked them yet.

Since you don't have an 850 score, FICO has to give some reason for it. In your case, they pulled it out of their rears and gave you that one.

How many of your CCs are less than a year old?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

Actually, when I have scores above 800, no reasons are given.

Five of the eight accounts are less than a year old, including the two I cancelled. I'm given reasons for accounts being new, but those make sense. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

I do believe that an otherwise clean profile will likely ding you for just having new accounts and that may be part of the reason code offered.

Might also be the reason you're not in the 800s -- what's your AAOA right now?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

I edited my post above while you were replying. ![]() My Equifax FICO 8 has been above 800 recently. Same with two of my mortgage scores. I was definitely dinged for opening a new account in March. I'm not concerned about the scores because they're all fine.

My Equifax FICO 8 has been above 800 recently. Same with two of my mortgage scores. I was definitely dinged for opening a new account in March. I'm not concerned about the scores because they're all fine.

I believe my AAoA is six years on Equifax and five years on the other two.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

I'm sure you will anyway but please do follow up once that reason code drops off -- maybe track how many months it's been since a new account was posted and see if it's some obvious number like 6 months or 12 months or something.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

Ah mortgage scores. Mea culpa I misread.

The too many accounts with balances could be a thing, 2/6 would've been a drop for me under FICO 8, and TT has reported on his own data that FICO 04 (which the mortgage scores for both TU / EQ are) is more sensitive for him than FICO 8 even though that wasn't my experience but that could be scorecard dependent.

Would be handy to see the full list of reason codes you're quoting from, order does matter and on very pretty files there isn't as much rhyme or reason to some of the codes. You opened an account recently or whatever it is I'm assuming factors prominently on your reason codes for those two anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

I posted about getting the same reason code a few months ago on the mortgage models when I had 2 cards showing a balance out of 12.

When Thomas Thumb and I talked about it I pointed out that I also had two open installment accounts, and thus a total number of four accounts showing a balance. He agreed that it could be that the old models care more about the actual raw number of accounts showing a balance than does FICO 8. (FICO 8 may ony care about percentages.)

How many accounts do you have showing a balance? (Including installment accounts.)

On the other hand, I also got the reason code about having high revolving utilization when mine was extremely low (just under 1%). So it seems clear that the reason statements can be completely divorced from reality, which I think is really unfortunate, since people use them to make decisions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

@Revelate wrote:Ah mortgage scores. Mea culpa I misread.

The too many accounts with balances could be a thing, 2/6 would've been a drop for me under FICO 8, and TT has reported on his own data that FICO 04 (which the mortgage scores for both TU / EQ are) is more sensitive for him than FICO 8 even though that wasn't my experience but that could be scorecard dependent.

Would be handy to see the full list of reason codes you're quoting from, order does matter and on very pretty files there isn't as much rhyme or reason to some of the codes. You opened an account recently or whatever it is I'm assuming factors prominently on your reason codes for those two anyway.

I have received the reason statement "too many accounts with balances" on both EQ Classic/Auto/Bankcard Fico 04 and EQ Fico 8 bankcard. Never from any other CRA except EQ. I get the reason statement on EQ Bankcard Fico 8 through Citi even though score is 887. The MyFICO 3B reports don't list reason statements for industry versions until score drops below 850 or for Classic versions until score drops below 800.

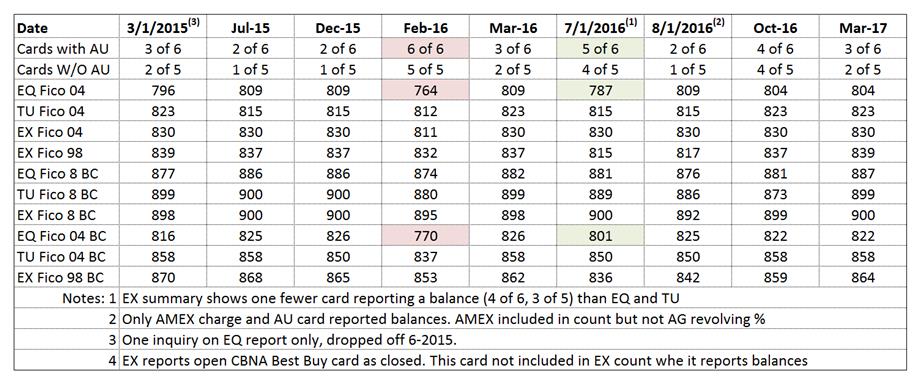

I plan to paste an spreadsheet of my 3B Classic Fico 04 scores + EX Classic Fico 98 and 3B Bankcard 08 scores to this post this evening - may add BC Fico 04 to the table as well. I saw zero movement on my Classic Fico 8 score regardless of the CRA even with all cards reporting balances. It's a buffer thing. However, I do see a few points drop on bankcard Fico 8 for all CRAs when 100% of accounts report balances.

When it comes to Fico 04 the impact of all accounts reporting balances drops my Classic Fico 04 scores 45 points on EQ, 11 points on TU and 19 points on EX relative to 2 of 6 cards reporting. The industry enhanced versions track with the classic score changes (but a bit more magnified) - posted graphs on this previously. [In the below table AMEX charge reported 100% B/HB in July and August 2016. This factor has a strong impact on Fico 98. Factor not looked at in Fico 04 or Fico 8].

My observations summarized:

1) EQ is more sensitive to # cards (or % cards) reporting a balance than is TU or EX.

2) EQ Fico 04 Classic and Industry enhanced options are much more sensitive to # cards reporting than their Fico 8 counterparts.

3) Dergoatory scorecards place less weight to # accounts with balances and # new accounts than do clean scorecards.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

Interesting that TT has only seen this reason code (too many accounts with balances) on EQ. Our OP saw it on both EQ and TU mortgage (FICO 04). Even more striking, I received it on both EQ and EX mortgage (thus in my case two different models, FICO 04 EQ and FICO 98 EX).

If the old models are looking partly at the actual integer number of accounts showing a balance (four in my case) it makes sense. If they are looking purely at percentage of accounts showing a balance it is silly, since the overwhelming majority of my open accounts are showing $0.

My three mortgage scores are:

EQ = 782 (ceiling 818)

TU = 796 (ceiling 839)

EX = 775 (ceiling 844)

I include the maximum ceiling achievable in the model to indicate that all of my scores are a good distance away from being perfect, which I know might be a confounder (as Revelate observes) when looking at squirrely reason codes.

TU and EX mortgage also include the completely unrealistic reason code of "You've made heavy use of revolving credit" (given my actual reported util of slightly under 1%). All my revolving accounts are plain credit cards: no charge cards, no AU accounts, no cards with big CLs, etc.