- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Should I or Not? Need input.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Should I or Not? Need input.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I or Not? Need input.

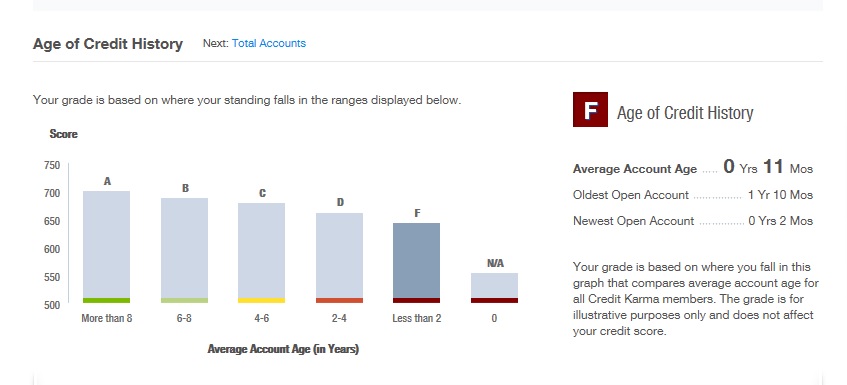

Current Aaoa is 11 mo

Current UTL is 84.31

DH has a CC opened in 2003 with 0 lates but at 93% UTL which will be lowered in 4mo or less.

Adding as AU will increase my Aaoa but will increase my UTL to 85.95

Pros? Cons? Worth it? Should I ass my self as AU on his CC to utilize it?

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I or Not? Need input.

@ktl72455 wrote:Current Aaoa is 11 mo

Current UTL is 84.31

DH has a CC opened in 2003 with 0 lates but at 93% UTL which will be lowered in 4mo or less.

Adding as AU will increase my Aaoa but will increase my UTL to 85.95

Pros? Cons? Worth it? Should I ass my self as AU on his CC to utilize it?

I would stay away for the moment. .... ideally pay down DH account and then add as AU. I cannot see that AAoA will benefit with such a high util. In 2013 I cut my AAoA from 18yrs to 4 yrs and score did not change but util % remained the same with higher amounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I or Not? Need input.

You say your AAoA is 11 months. In your signature it's listed as 5 years 11 months. Not clear which it is.

You mention both derogatories and high utilization, and in general, these are the dominant factors in a score. If there's a way to address these issues, then I'd focus on that.

If you have a 15K NFCU card, can you consolidate your balances using their BT offer?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I or Not? Need input.

Lowering util will assist scores greater than a longer AAOA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I or Not? Need input.

This is from Credit Karma today

I used my NFCU and did a BT on one of his accounts that was charging 29.99% interest.

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I or Not? Need input.

@bettercreditguy1 wrote:Lowering util will assist scores greater than a longer AAOA.

+1, by a substantial amount. AAoA is a minor component when compared to revolving utilization. I'd second LG's suggestion and stay away for now. If in the future it's lowered you can add the AU then for zero loss (other than if it's an Amex).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I or Not? Need input.

@ktl72455 wrote:

This is from Credit Karma today

I used my NFCU and did a BT on one of his accounts that was charging 29.99% interest.

Credit Karma only looks at open accounts; FICO AAoA's calculation takes into account closed ones as well.

If someone has any closed accounts on their report at all, one has to ignore CK on this point like so many others: it's an excellent service for monitoring your report (and I absolutely use it for that, cost-benefit best in the industry in my opinion), but the advice should be unilaterally ignored in my experience as should some of their interpretations of the report data.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I or Not? Need input.

OK thats what I was thinking too but wanted a 2nd input before I did it. Working on UTL now and I know the Aaoa will grow with me.

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I or Not? Need input.

Well CK is good for the Alerts :-)

Thisi s my Old Orchard CC now with cap 1 with a 400.00 limit.

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I or Not? Need input.

@ktl72455 wrote:OK thats what I was thinking too but wanted a 2nd input before I did it. Working on UTL now and I know the Aaoa will grow with me.

Best idea....and Good Luck in your journey!

EQ 817, EX 815, TU 813 (Updated 1/5/18: TU 843

EQ 817, EX 815, TU 813 (Updated 1/5/18: TU 843