- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: So Wells Fargo is removing 4 of the 6 hard inq...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

I bank with Wells Fargo and when I pulled my credit last month they haad pulled 6 hard inquiries within 6 months on my Experian report. I wrote them a letter and recieved 4 letters from them today that they were contacting Experian and removing 4 of the 6 inquiries. My question is on MY FICO it states this as a reason my Experian Score is not as high is excessive Hard inquiries from Wells Fargo. What type of points gain should I expect to get once Experian removes this? Thank you for the assistance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

If these inquiries are less than 12 months old and you have NO others on file, then perhaps your EX score may jump 15 to 20 points.

My question is: Why is your TransUnion score so low? - that's what I would focus on.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

@Thomas_Thumb wrote:If these inquiries are less than 12 months old and you have NO others on file, then perhaps your EX score may jump 15 to 20 points.

My question is: Why is your TransUnion score so low? - that's what I would focus on.

I checked and my Transunion is reporting half of the accounts that i have open and have had in the past than my EX and EQ. There are inquiries from Wells on my Transunion that I am working on next. I can only speculate that alot of my CC and accounts are not reporting to Transunion for some reason.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

So I went and applied for things that pulled TU In hopes they also report to TU? If my theory is correct I should have about the same and hopefully my scores even out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

@Anonymous wrote:

@Thomas_Thumb wrote:If these inquiries are less than 12 months old and you have NO others on file, then perhaps your EX score may jump 15 to 20 points.

My question is: Why is your TransUnion score so low? - that's what I would focus on.

I checked and my Transunion is reporting half of the accounts that i have open and have had in the past than my EX and EQ. There are inquiries from Wells on my Transunion that I am working on next. I can only speculate that alot of my CC and accounts are not reporting to Transunion for some reason.

I would contact TU and tell them you suspect you have a split file due to a large discrepancy in the number of accounts being reported accross the bureaus.

As for the inquiries - I would not expect a lot of points if you have a decently thick file. Inquiries hit thin files much harder than thick ones. My understanding they are also scored in groups - that is 1-5 inquiries might be so many points, then 6-10, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

@Anonymous wrote:

@Anonymous wrote:

@Thomas_Thumb wrote:If these inquiries are less than 12 months old and you have NO others on file, then perhaps your EX score may jump 15 to 20 points.

My question is: Why is your TransUnion score so low? - that's what I would focus on.

I checked and my Transunion is reporting half of the accounts that i have open and have had in the past than my EX and EQ. There are inquiries from Wells on my Transunion that I am working on next. I can only speculate that alot of my CC and accounts are not reporting to Transunion for some reason.I would contact TU and tell them you suspect you have a split file due to a large discrepancy in the number of accounts being reported accross the bureaus.

As for the inquiries - I would not expect a lot of points if you have a decently thick file. Inquiries hit thin files much harder than thick ones. My understanding they are also scored in groups - that is 1-5 inquiries might be so many points, then 6-10, etc.

Thank you Norman, what exactly is a split file so I can be knowledgeable when I speak to them and thank you all for your responses. Great board here

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

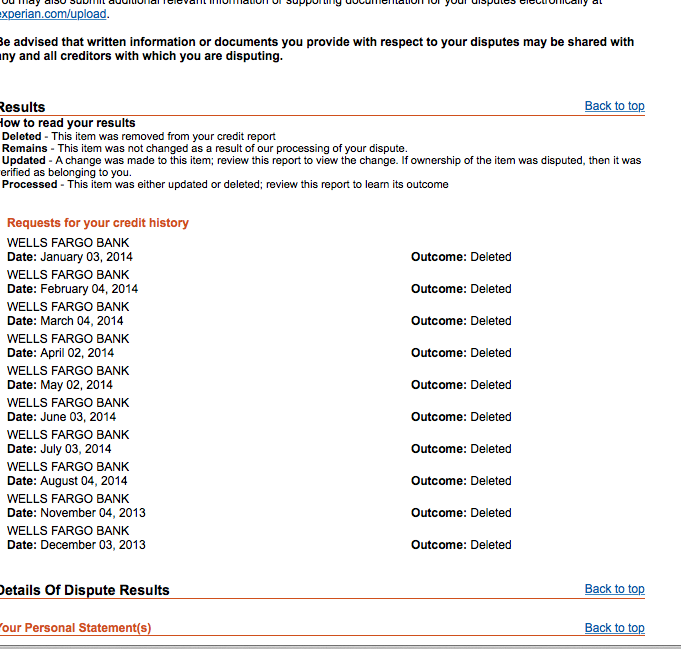

I called Experian today and the CS rep removed the following Wells Fargo inquiries and I sent her (uploaded) the letters from Wells Fargo 5 total with dates of the ones from recently to remove. This clears my Experian all but one paid account that falls off in Feb. This is alot of inquiries that were deleted. This should be a positive score boost especially when they remove the ones from the past 6 months next week. That will be 15 Wells Fargo Credit inquiries that will be deleted by next week.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So Wells Fargo is removing 4 of the 6 hard inquiries on my Experian report and?

@Anonymous wrote:

@Anonymous wrote:

@Thomas_Thumb wrote:If these inquiries are less than 12 months old and you have NO others on file, then perhaps your EX score may jump 15 to 20 points.

My question is: Why is your TransUnion score so low? - that's what I would focus on.

I checked and my Transunion is reporting half of the accounts that i have open and have had in the past than my EX and EQ. There are inquiries from Wells on my Transunion that I am working on next. I can only speculate that alot of my CC and accounts are not reporting to Transunion for some reason.I would contact TU and tell them you suspect you have a split file due to a large discrepancy in the number of accounts being reported accross the bureaus.

As for the inquiries - I would not expect a lot of points if you have a decently thick file. Inquiries hit thin files much harder than thick ones. My understanding they are also scored in groups - that is 1-5 inquiries might be so many points, then 6-10, etc.

Norman, I called Transunion today and reached a supervisor and she deleted the account that falls off in April of next year. She also said she did not see a split file .She also deleted several Wells Fargo inquiries so this clears Transunion completly of negative information so I am anxious to see what MY FICO scores jump to once this is processed. I am at 714 now and it stated excessive hard inquiries and that negative account as major contributors for my score drop.