- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Something I'm not accounting for? Why did this go ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Something I'm not accounting for? Why did this go down?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Something I'm not accounting for? Why did this go down?

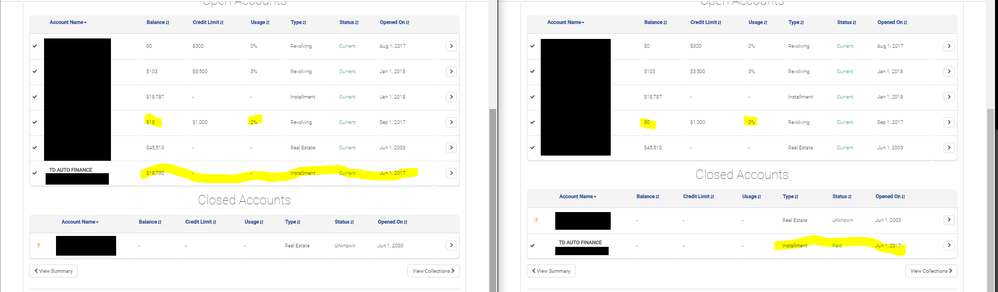

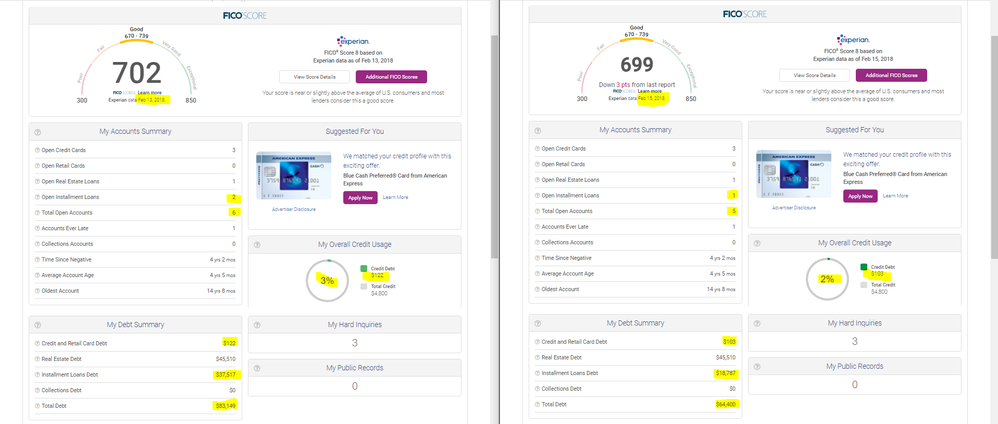

In January, I apped for two new cards and refinanced my auto loan. I completely expect my scores to be all over the place as the new accounts hit and settle, so I've been checking in on my scores with the EX paid service.

Left side is Feb 13. Right side is Feb 15. Between those two, my original auto loan was closed out, reducing my overall debt and my Discover reported a zero balance. I expected both of those to result in positive scoring changes.

Any ideas what happened here?

Yes, I know FICO is complicated. No, I'm not aware of any other changes, but will dig further if there are suggestions of what I might look at.

Note: I am on a dirty scorecard, as I have a 18-19 old 30, 60, 90, 120 day lates.

Requested details:

mortgage 45510 owed, 56000 original balance

no updates between these two reports

original auto loan: balance on 02/13 18730, original balance 20447

new auto loan: current balance 18787, orignal balance 18787

The new auto loan was already by the 13th, so is on both reports, with no update between the two reports

Total Installment Utilization:

2/13:

outstanding: 45510+18730+18787=83027

original: 56000+20447+18787=95234

87.18%

02/15:

outstanding: 45510+18787=64297

original: 56000+18787=74787

85.97%

Non-mortgage Installment utilization:

02/13:

outstanding: 18730+18787=37517

original: 20447+18787=39234

37517/39234 = 95.6%

02/15:

outstanding: 18787

original: 18787

18787/18787 = 100.0%

Revolvers: (no store cards)

02/13:

Discover 19/1000

OpenSky 0/300

Chase 103/3500

02/15:

Discover 0/1000

OpenSky 0/300

Chase 103/3500

The only accounts I can identify that updated between these two reports are the closed auto loan and the Discover (balance 19 -> 0).

2020-02-07 FICO 08: TU 789

2020-02-10 FICO 08: EX 752

Gardening, mostly, again until... soon(I need to replace my car)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something I'm not accounting for? Why did this go down?

Can you tell us whether you have any other loans or installment accounts? If you do, please list each one with the balance and the original amount of the loan. For the recently paid off loan, tell us what the balance was before the payoff (and the original loan amount).

If this was your only loan, then you went from having one partially paid off open loan (which FICO likes) to having no open loans of any kind (which FICO does not like). I am assuming that the new (refinanced) loan has not yet appeared.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something I'm not accounting for? Why did this go down?

Were you browsing on mobile? Most of that is in the pics I included. I'll textify what I have.

2020-02-07 FICO 08: TU 789

2020-02-10 FICO 08: EX 752

Gardening, mostly, again until... soon(I need to replace my car)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something I'm not accounting for? Why did this go down?

I can't see those images due to being on a mobile device with a tiny screen, but two things I'd look closer at:

* Installment loan (aggregate) utilization went up since one of your loans is closed.

* You are trying to do AZEO on a non-bank revolver maybe. I had points drop when my only card with balance was a Synchrony Amazon store card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something I'm not accounting for? Why did this go down?

Note: Orignal post updated.

@Anonymouswrote:I can't see those images due to being on a mobile device with a tiny screen, but two things I'd look closer at:

* Installment loan (aggregate) utilization went up since one of your loans is closed.

* You are trying to do AZEO on a non-bank revolver maybe. I had points drop when my only card with balance was a Synchrony Amazon store card.

2/13:

45510+18730+18787=83027

56000+20447+18787=95234

87.18% installment utilization

02/15:

45510+18787=64297

56000+18787=74787

85.97% installment utilization

I don't think that's it.

I have no store cards.

2020-02-07 FICO 08: TU 789

2020-02-10 FICO 08: EX 752

Gardening, mostly, again until... soon(I need to replace my car)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something I'm not accounting for? Why did this go down?

Saw your textify updates.

So your old report had:

Old Installments: $83,027 / $95,234 = 87.18%

New Installments: $64,297 / $74,787 = 85.97%

I'd double check my math, but from what I can tell your installment aggregate utilization went down so that can't be the issue.

The other issue is the theory that FICO looks at mortgages differently from all other installment loans, so it's possible that your non-mortgage installment aggregate utilization went up from 91.x% to 100% and maybe that caused a ding.

Also what credit card has a balance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something I'm not accounting for? Why did this go down?

@Anonymouswrote:I'd double check my math, but from what I can tell your installment aggregate utilization went down so that can't be the issue.

The other issue is the theory that FICO looks at mortgages differently from all other installment loans, so it's possible that your non-mortgage installment aggregate utilization went up from 91.x% to 100% and maybe that caused a ding.

Edit, somewhere I mistyped something, so my original math was wrong...

non-mortgage util:

02/13: 37517/39234 = 95.6

02/15: 18787/18787 = 100.0

Interesting... wouldn't that imply a breakpoint between 96 and 98.9?

I might be able to catch that on the way back down, but it would take some planning and throwing an extra grand at the loan(which I could do, but I don't want to).

2020-02-07 FICO 08: TU 789

2020-02-10 FICO 08: EX 752

Gardening, mostly, again until... soon(I need to replace my car)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something I'm not accounting for? Why did this go down?

What was your Average Age of Account prior to refi and apping, and AAoA now that they have hit the bureaus?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something I'm not accounting for? Why did this go down?

2020-02-07 FICO 08: TU 789

2020-02-10 FICO 08: EX 752

Gardening, mostly, again until... soon(I need to replace my car)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something I'm not accounting for? Why did this go down?

Something worth noting here. You went from 67% of your cards with reported balances to 33%, which generally speaking would result in score gain of say 6-8 points. Obviously the exact number is profile dependent and perhaps you have a data point on this yourself from your own profile from testing this in the past in going from 1 --> 2 of your 3 revolvers (or 2 --> 1) with reported balances? If so, sharing that could be helpful.

That being said, just to throw a number out there, let's say you should have gained 7 points [on your profile] from going from 2 cards with reported balances to 1 card with a reported balance. You actually had a net loss of 3 points, meaning that what you're really looking for is a reason why you lost 10 points, not just 3 points. Not that this helps at all in identifying the reason why, but it gives a slightly different perspective to know that you're looking for a 10 point reason over a 3 point reason, for example.