- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Started Using Upgraded Amazon Prime Visa - Score J...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

Definitely a perfect storm!

2 down, 1 to go.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

Here are some data points. I will add to this list as I gather them:

- Age of Oldest Account for each CRA from MyFICO:

- EQ 256 months

- TU 256 months

- EX 356 months (There is a closed (1987) store card showing on EX that was opened in April of 1987. It's not on the other reports)

- AAoA is different for each CRA. These were pulled from MyFICO: (see footnote below for info related to 5.5 year AAoA I reported yesterday):

- EQ 100 months (8.33 years)

- TU 88 months (7.33 years)

- EX 113 months (9.42 years)

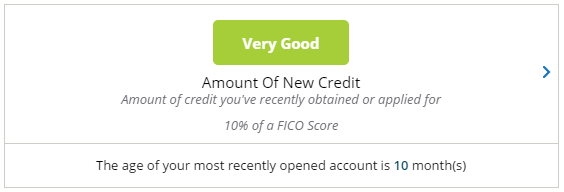

- Most recently opened account is 10 months for all three according to MyFICO credit factors screen, but most recent account was actually opened in Feb 2016 (Amex)

- Amount of Credit info is same across all 3 CRAs:

- 2% Revolving Credit Utilization Percentage

- 6 Accounts With Balances: (NFCU Signature Visa, 2 student loans, 2 auto loans (1 mine only, 1 with husband) and 1 HELOC)

- Total Balance on Revolving/Open-Ended Accounts $2,243

- Auto loan: Original loan amt $25,000 Balance $12,518.15 Opened December 2013

- Auto loan I share with husband: Original loan amt. $27,201.88 Balance: $22,517.58 Opened November 2015

- Student Loan #1: Original Loan Amt $4,616.29 Current Balance $3,738.70

- Student Loan #2: Original Loan Amt $13,331.64 Current Balance $10,796.66

- HELOC balance ($52,713.57) is 0.915 of credit limit ($57,600.00)

Overall Loan Balance to Loan Ratio (Autos Only, not including student loans or HELOC): 76%

Overall Loan Balance to Loan Ratio (Including HELOC, but not including student loans): 84%

FOOTNOTE: I had reported an AAoA of 5 years, 5 months earlier. I got that from Credit Karma. It's been pointed out to me that CK shows Avg Age of OPEN Accounts, not AAoA. Apologies for any confusion.

EX myFICO 850 - EQ myFICO 850 - TU myFICO 850

Goal Score: 800+ across the board! *DONE!!!*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

@gamegrrl wrote:

- On January 31st (just a few days ago) a payment was made on my car loan that took the loan balance down to 50% of the original note. It sure seems that this could be noteworthy. The timing is right, and 50% is a nice round number that would be a logical breakpoint for something.

That wouldn't be a break point. Your overall loan balance to loan ratio would be relevant.

Youngest account 10 months? I thought your Amex was 12 months old. Is the 10 month old account one of your loans?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

JLK93: Can you clarify "overall loan balance to loan ratio" for me and I'll do the math. [Edited to add: I have been updating my data post, so I added the original loan amounts for the two auto loans as well as their current balances.]

Regarding youngest account: My Amex was opened Feb 27, 2016, yet on the MyFICO "Score Ingredients" screen, it shows 10 months as the newest account for all three CRAs. I should have gone with the actual date, and not their calculated number I guess.

EX myFICO 850 - EQ myFICO 850 - TU myFICO 850

Goal Score: 800+ across the board! *DONE!!!*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

The total amount remaining on all your loans divided by the total original amounts of the loans.

It would be great if you could calculate this percentage with the heloc included and without the heloc included.

Are any on your loans 10 months old?

Credit Karma is Average Age of Open Accounts. That is why it is different. FICO scores Average Age of Accounts including closed accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

So now we know that the 850 is not with AAoA of 5.5 years. TU is 7.33 years.

I don't know why CK still report AAoOA (Average Age of Open Accounts), VantageScore and FICO use open and closed accounts. I guess they started with that formula to calculate the score, then changed to Vantage but they didn't update.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

@Anonymous wrote:

So AAoA is 7 years, not 5 years here as currently stated, correct?

Yes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

@gamegrrl wrote:

Overall Loan Balance to Loan Ratio (Autos Only): 76%

Overall Loan Balance to Loan Ratio (Including HELOC): 84%

Thanks gamegrrl.

You mentioned 2 student loans. Are these loans still open?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started Using Upgraded Amazon Prime Visa - Score Jumped 18 Points

@JLK93 wrote:The total amount remaining on all your loans divided by the total original amounts of the loans.

It would be great if you could calculate this percentage with the heloc included and without the heloc included.

Are any on your loans 10 months old?

Credit Karma is Average Age of Open Accounts. That is why it is different. FICO scores Average Age of Accounts including closed accounts.

Overall Loan Balance to Loan Ratio (Autos Only): 76%

Overall Loan Balance to Loan Ratio (Including HELOC): 84%

None of my loans are 10 months old. The most recent loan was a car loan opened in November 2015. The most recent credit card was the Amex in February of 2016.

I didn't know that about Credit Karma and that they post AAoOA. Thanks for the info.

EX myFICO 850 - EQ myFICO 850 - TU myFICO 850

Goal Score: 800+ across the board! *DONE!!!*