- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Study: AAoA and max FICO score (Forum Survey)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Study: AAoA and max FICO score (Forum Survey)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Study: AAoA and max FICO score (Forum Survey)

Hey All!

I know we are all curious as to how certain thresholds on our reports impact the potential top score/bucket we fall into. For example, maximum scores with a bankruptcy, minimum AAoA for a perfect 850, etc.

I'm conducting a study for which I need your help! If you'd like to contribute please fill out the following information and post to this thread. The goal of the survey is to understand more about the relationship of AAoA and Oldest accounts to maximum FICO acheivable. I'll compile all feedback and hopefully we can identify some key goals to help each other maximize scores. Feel free to share any of your experiences or banter along the way!

Note - the additional data points are not meant to capture a comprehensive look at your score. They are included to identify if there are any other significant factors impacting one's score. If you don't have all the information requested or don't want to share just leave blank.

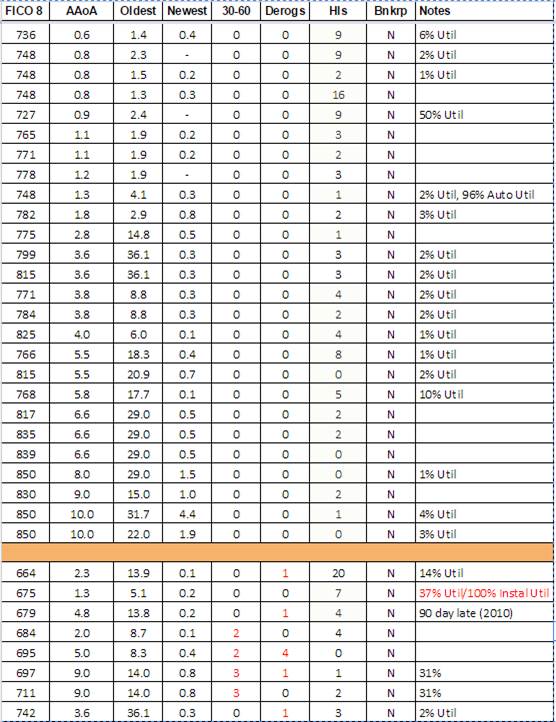

Instructions for each field (All fields should be totaled for a single credit report only, not total of all three)

- FICO 08 Score: Please only report a true FICO 08 score. Either from myFICO or an alternate site/source. Please no FAKOs (i.e. Credit Karma)

- AAoA: In years. Your average age of all accounts, open and closed, that appear on your report. Most scoring profiles calculate automatically.

- Oldest Account: In years. Age of oldest account, open or closed, apearing on your credit report.

- Youngest Account: In years, Age of most recent account reporting.

- # Major Derogs: Simple count of all major derogs on your CR, paid or unpaid. Examples: 90+ days late, collections, charge offs, public records, tax liens, etc.

- # 30-60 day lates <2 years: Sum of payments marked as 30 or 60 days late that occured in the last 2 years.

- # Inquiries <1 year: Hard inquiries appearing on your report that are less than 1 year old.

- Bankruptcy (Y/N): Simple Y or N if one is currently appearing on your CR.

Thanks in advance! ~olehammer

Example:

FICO 08 Score: 684

AAoA: 2.0

Oldest Acount: 8.7

Youngest Account: 0.2

# 30-60 day lates <2 years: 2

# Major Derogs: 0

# Inquiries <1 year: 4

Bankruptcy (Y/N): N

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

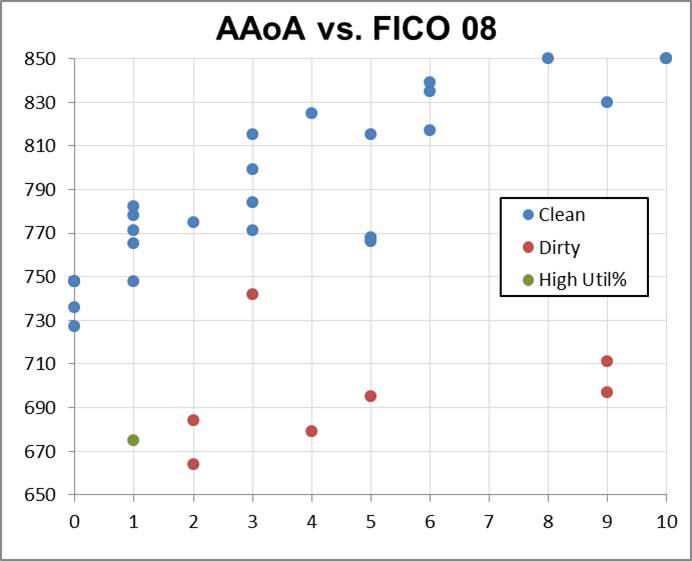

Updated 2/22 16:00

Summary

- Maximums by AAoA: <1 year: 748, 1 year: 771, 2 year: 775, 3 year: 784, 4 year: 825

- 675 lowest clean file impacted by Util of 37%. Data suggests potential for large score bump when brought below 9%.

- 800+ has required minimum AAoA of 3 years

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

See below link for background info that may be of some interest to you.

http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/SCORECARDS/m-p/4361047#M102264

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

@olehammer wrote:I'll add that I'm looking to run this across a wide range of scores. What I assume will be of most interest is what's the lowest AAoA that has acheived a 740 FICO (i.e. "best rates).

Are you asking the lowest AAoA crossing the 740 theshold with dereogatory information present? I mean, its pretty easy to be 740+ with 1-2 years AAoA and 3-5years oldest account and having no derogs. Once a derog drops after 7 years, one would have well enough account history to be over 740.

Anyhoo:

FICO 08 Score: EQ - 696 / EX - 684 / TU - 695

AAoA: 5 years

Oldest Acount: 8.3 years

Newest Account: 5 Months

# 30-60 day lates <2 years: 2

# Derogs: 3 90+ lates, 1 foreclosure

# Inquiries <1 year: 0

Bankruptcy (Y/N): No

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

JagerBombs89 wrote:

Are you asking the lowest AAoA crossing the 740 theshold with dereogatory information present? I mean, its pretty easy to be 740+ with 1-2 years AAoA and 3-5years oldest account and having no derogs. Once a derog drops after 7 years, one would have well enough account history to be over 740.

I'm more asking for sake of study. From a selfish standpoint, i'm curious with respect to my own profile in terms of AAoA and score ceiling when it comes to future mortgage app. It would be comforting to know that, for example, an AAoA under 2 years has a shot at 740+ with an otherwise well balanced and clean profile.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

@Thomas_Thumb wrote:See below link for background info that may be of some interest to you.

http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/SCORECARDS/m-p/4361047#M102264

Thanks TT! Based on this great summary I'm going to add "Age of Youngest Account" to the survey.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

+1 Agree, a score of 740 can be achieved with a short credit history and thin file particularly if utilization is low and there are no negatives on file.

I did a search on short/thin files previously on MyFico. A few posters reported scores in the 710 to 720 range with less than 1 year AAoA and just one or two accounts. Scores above 740 have been reported with less than 2 years AAoA.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

Hello OH! Always good to see you on here.

I have always wondered whether 740 = "best rates" is perhaps a meme. I have seen that repeated many times, but the internet is often its own self-reinforcing echo chamber. I'd be really curious to know wther there is any hard evidence that a FICO score of 750 or 760 has never given any borrower an edge over someone with a 740 -- not with any lender for any kind of credit (auto, home. personal, credit card, etc.). There's no doubt in my mind that at some point that must be true. I am certain, for example, that an 810 gives you no edge over an 800. But I am just not confident that all scores between 741 and 850 are functionally the same.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA / Oldest Account and max FICO score Survey

If you look at one of my other threads, I had a 825 TU08 score with 6years oldest, 4 years AAoA. On EQ04, not 08, I had a 755 FICO with 4 years oldest, 2 years AAoA. However, 08 scores are notoriously more generous than 04 scores for clean & thin files, so I would estimate my score back then to be anywhere between 770-785.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Study: AAoA and max FICO score Survey

I would say for the average home buyer 740 is a good threshold that if you're close to it you can save thousands of you achieve it. I like to keep the $1000s in mind when I'm tempted by at 50k points offer or a higher % cash back on groceries.