- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Tempting credit card offer vs. 750 score goal

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Tempting credit card offer vs. 750 score goal

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

@Anonymous wrote:There's evidence from a lot of data points that CC4 and CC5 actually help FICO after they age 12 months. So if you have fewer than 3, get to 3. If you are at 3, 4 and 5 will help within 12 months -- and the end of 2018 is about 16 months away!

Can you elaborate on this a bit more, as it's not something I've heard about. How exact do Card 4 and Card 5 help ones FICO score after 12 months? Which sector of the FICO pie are you suggesting has shown to be impacted by this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

@Anonymous wrote:Can you elaborate on this a bit more, as it's not something I've heard about. How exact do Card 4 and Card 5 help ones FICO score after 12 months? Which sector of the FICO pie are you suggesting has shown to be impacted by this?

Not the "close to 850" FICO pie for sure.

It's against forum rules to link to the credit forum where this has been discussed, with data points, but I've also seen in in friends I've helped reach a higher FICO score who otherwise had nothing negative at all.

I know at least 5 people in my real life social network who were bonking against a ceiling (good AAoA but not prime, low utilization, no inquiries, etc) who ended up breaking through that ceiling after adding a few more credit cards and aging them at least 12 months -- up to 24 months.

There is definitely a bunch of data points out there if you Google enough to find the thick forum threads elsewhere that show that 3 credit cards is the minimum for free FICO boost, and then 4 and 5 appear to give people another boost after a period of time.

All things being equal otherwise, having a thick aged file with no derogatories appears to give people a very high score even with fewer credit cards, but you can't easily expedite AAoA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

By sector of the FICO pie I meant which category that makes up your FICO score would be impacted by having 4-5 cards over say 3? With 3, one can keep their percentage of cards reporting balances under 50% (but not 0%) which can assist the "Utilization" sector of the FICO pie. I wasn't sure if you were suggesting that 4-5 cards also impacted this same sector, or if you were pointing to a different sector such as age of accounts or credit mix by having 4-5 revolvers that have hit the 1 year mark.

I would think data points on this topic would essentially be impossible to test, as at the exact same time a new revolver hits the 1 year mark (the point you suggest Card 4 and Card 5 may positively impact score) the inquiries for Card 4 and Card 5 become unscoreable, those new accounts reach 1 year of age meaning that AoYA is now 1 year and likely any adverse impact to AAoA from the new account(s) has already been recovered and exceeded.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

As far as our OP goes, what I am hearing is that tied up with this decision are an s-ton of feelings. Feelings of worry, then feelings of elation when he decides not to go with the Amex, then more worry and a need for ratification of feelings (tell me I'll be bad if I go with the Amex), and so on.

Feelings are a natural part of who we are. So I think trying to think all this out purely logically may not help our OP (as if he were Data or Mr. Spock from Star Trek). Making credit decisions in a cold rational manner is the ideal place to be, but our OP may not be there.

So I think he should think a bit more about how he will feel about some of these outcomes. For example, if he applies for the Amex and gets rejected, will that be a crushing experience for him? If so, don't do it. If the purely rational knowledge that one inquiry will make little difference and only for 365 days helps him, then great. But it may not. The rejection may overpower that and make him feel terrible.

If he thinks he'll be emotionally fine if a rejection occurs (after a brief twinge of hurt feelings) then he should now do his best to analye the benefit he'll get from the bonus. Incredibly important is being certain that he won't have to do extra spending to meet the minimum spend requirement and that the bonus will lead to him having markedly greater happiness (money in the bank or a huge restful trip that he needs).

Regardless he should definitely place the SSL technique on his agenda as well as exploring ways to eliminate all annual fees from cards (either by downgrading or closing them at month 11). Part of his plan for the next few years should include getting a total of five cards that he can keep forever.

PS. As a final note, the Amex should not be looked at as the fourth or fifth card to help him long term. I think five cards are a great idea, but unless he finds a magic downgrade path to a zero-fee charge card at month 11, the smart thing to do is close the Amex at month 11.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

Never thought about it actually. Probably "credit mix" I would guess -- what FICO pie category gets the boost from just opening the first 3? Because that's a definite boost immediately, and can be a significant one based on my own data points (dirty file).

The data points I've seen personally seem to confirm that 5 open cards seems to be a sweet spot for a lot of people after a year, but there's definitely no way to know for sure. I went for 5 total just so they can age together because my AAoA with just 1 card was around 8 years or so and dropped to either 12 months or 28 months depending on CRA but will age back to 36 months in the next 2 years and I wanted a bulletproof AAoA of 3 years by 2019. The initial hit of going from 1 card to 5 cards never happened to me -- my FICOs just go up and up every months with nothing else happening.

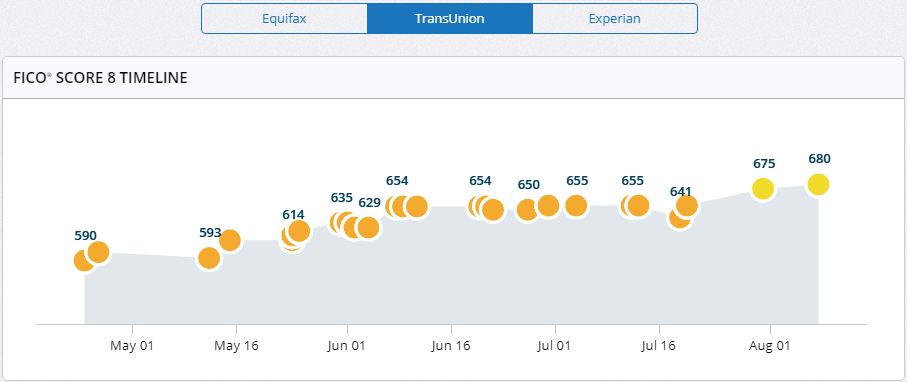

I don't have my ongoing credit spreadsheet handy to tell you what happened here to me, but in March I had literally 1 credit card, 1 chargeoff, 1 collection, 1 tax lien reporting and nothing else. No inquiries even. By middle of May, my Discover secured reported. By middle of June my Capital One secured reported, along with Williams Sonoma store. By beginning of June my SSL reported (HUGE boost). By middle of July my Chase FU reported and by end of July my Amazon store reported. And my FICO basically went up and up except for a few decreases which were honestly VERY temporary -- only a week or two, and probably inquiry related, not new account related.

The biggest drop was from running my Chase FU to 99.9% utilization at statement cut but when I paid it off the next day and it re-reported as 0% utilization, my score went up even higher -- I do this on purpose because there are anecdotes that letting Chase report a high balance can help with auto CLI, and Chase reports $0 midcycle whenever you pay it off, so FICO hit is only for 1-2 days at best.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

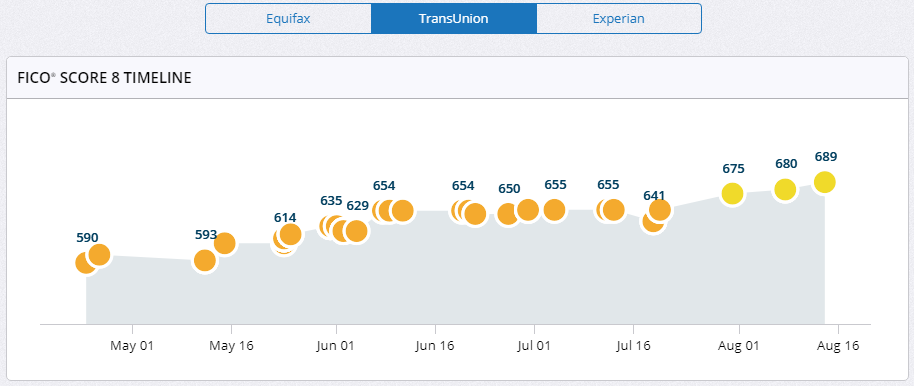

I can't win with FICO tracking. Literally seconds after posting that graph showing TU of 680 I got a MyFico notification that it's now 689 -- not sure why, probably one of my two balances reported $0.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

I should have added a tl;dr to my post from this morning as it was hilariously long:

tl;dr: yesterday, I got a prescreened offer for the FU in the mail. Applied, approved, $13k limit. Plan was to get it next anyway, so feel great about it. From a credit-building perspective, this is a good move.... right? And applying for the Amex in the next two days (i.e. before the offer expires) would be stupid for a number of reasons ... right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

@Anonymous wrote:I should have added a tl;dr to my post from this morning as it was hilariously long:

tl;dr: yesterday, I got a prescreened offer for the FU in the mail. Applied, approved, $13k limit. Plan was to get it eventually, so feel great about it. From a credit-building perspective, this is a good move.... right? And applying for the Amex in the next two days (i.e. before it expires) would be stupid for a number of reasons ... right?

I'd go for Amex unless both new accounts destroy your AAoA to a point that it would hurt any other apps you have in mind until the AAoA springs back!

Credit app sprees are done for a reason!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

@Anonymous wrote:I should have added a tl;dr to my post from this morning as it was hilariously long:

tl;dr: yesterday, I got a prescreened offer for the FU in the mail. Applied, approved, $13k limit. Plan was to get it next anyway, so feel great about it. From a credit-building perspective, this is a good move.... right? And applying for the Amex in the next two days (i.e. before the offer expires) would be stupid for a number of reasons ... right?

You may have missed my response to you 20 minutes ago. Go back up a few messages and you will see it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tempting credit card offer vs. 750 score goal

@Anonymous wrote:

@Anonymous wrote:I should have added a tl;dr to my post from this morning as it was hilariously long:

tl;dr: yesterday, I got a prescreened offer for the FU in the mail. Applied, approved, $13k limit. Plan was to get it next anyway, so feel great about it. From a credit-building perspective, this is a good move.... right? And applying for the Amex in the next two days (i.e. before the offer expires) would be stupid for a number of reasons ... right?

You may have missed my response to you 20 minutes ago. Go back up a few messages and you will see it.

Not missed -- misread. My bad. Still should have included the tldr though the first time around.

I wouldn't feel that bad if I applied and was rejected; I would, however, feel supremely stupid if I applied, got it, and watched my credit score fall from 730 to 700. (Already anticipating 730--->722 TU/EF drop from the new FU. Guess we'll see with FICO.)

The idea that my credit score may be higher in 12 months with 4CCs than it otherwise would with 3CCs is compelling, but sounds like there jury's out on that? (Or at least, confusing on that?)

But note on the cancel at 11 months plan - it sounds like Amex may take exception to that (i.e. Clawback the points.)? It looks like policy changes may be coming, based on the news from around July 26th. Why wouldn't a downgraded annual fee Amex not be worth holding onto as a 4th card long term, out of curiosity? Isn't having a charge card still a relatively good looking thing to have in your wallet?

And as just a note on the SSL -- I'm really aiming for 750 (760, I suppose) to make sure that I can get the best mortgage rate, if and when the time comes. Not so concerned about being able to build a wide CC portfolio (yet). I'm guessing the 30 point bump from the SSL would look great from a FICO standpoint, but I'm wondering if, to a mortgage lender (who is going to do a deeper dive into my credit history than an electronic CC application, I presume), a 750 achieved with the SSL method employed would look like it came with an asterisk when determining my interest rate. Which is to say, I did it to increase my FICO score, and it worked, but it obviously isn't a genuine needed-for-life loan, and would marginalize its the relevance accordingly.

Has anyone found that to be the case with the SSL? That is, good for credit score, meh for mortgage rates? I admittedly only read through it once, and this is an area that I'm _very_ unfamiliar with, so please feel free to tell me this is the wrong line of thinking.