- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: The many flavors of FICO:__Editions, versions,...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The many flavors of FICO:__Editions, versions, and variations

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

I am not sure why, but my Experian Score 2, also known as EX 98, is now 842.

Remember Psychic, back when Score 2 was the EX version that myFICO offered. He was at 842, and I think someone was at 844 and someone else at 843, but that was it. Does anyone remember?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

@vanillabeanwrote:I am not sure why, but my Experian Score 2, also known as EX 98, is now 842.

Remember Psychic, back when Score 2 was the EX version that myFICO offered. He was at 842, and I think someone was at 844 and someone else at 843, but that was it. Does anyone remember?

Congratulations! You are only 2 points away from the 844 maximum score. I'm stuck at 839 on EX Fico 98 and suspect that is as high as my profile will go without reporting AZEO, reducing my mortgage B/L or adding something like a car loan to the mix. Ialways have at least one personal card report a balance and the card I am AU on always reports a balance. So best case I am AZE2 and usually AZE3/4.

Curious, how is your EX Fico 04 (Ex score 3)? Supposedly EX 04 can go to 850 but I'm stuck at 830 on it.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

@Thomas_Thumb wrote:

Curious, how is your EX Fico 04 (Ex score 3)? Supposedly EX 04 can go to 850 but I'm stuck at 830 on it.

I am at 830 too, did reach 831 briefly during the recent month when I was without a reported mortgage due to a transfer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

Hello All,

I have a question as I am new to MyFico and just now getitng familiar with the different scores, etc. I guess my one question is, when can I expect my mortgage scores to change. My score 8's were updated, but my mortgage scores are still the same. Thoughts? I know it's a pretty vague question, but I am 5 points shy of a preapproval and it is driving me nuts.

Mike

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

Mortgage scores update quarterly. Example, I ordered mine on 9-1-17 and my profile shows the next update will be 12/1/17.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

So in reading this thread am I to assume that paid collections don't hurt like in Fico8? If that is correct I would like to think that my Fico9 score would be higher, but it is about 20 points lower than Fico8. I wouldn't worry about it, but now more and more lenders are starting to use or think about using it.

Currently: EQ 620 TU 654 EX 627

in the garden since 6/16/2021

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

FWIW - from CK

https://www.creditkarma.com/advice/i/new-vantagescore-4-0-explained/

Credit factor | VantageScore 4.0 | VantageScore 3.0 | FICO Score 8 | FICO Score 9 |

Utilization rate | Very important | Very important | Very important | Very important |

Historical utilization rate and payment info (trended data) | May affect your score | No impact | No impact | No impact |

Collection accounts | Ignores paid collection accounts. Ignores medical collection accounts that are less than six months old. Weighs unpaid medical collection accounts less than other types of collection accounts | Ignores paid collection accounts | Ignores small-dollar “nuisance” accounts that had an original balance of less than $100. Treats medical collection accounts, including those with a zero balance, like other collection accounts | Ignores paid collection accounts. Weighs unpaid medical collections less than other types of collection accounts |

A tax lien or judgement | Are less important than before, but can still have a significant impact | Can have a significant impact | Can have a significant impact | Can have a significant impact |

There are certainly other differences between Fico 8 and Fico 9 that can cause score offsets between the models. For example, rental history can influence Fico 9 but not Fico 8.See links and pastes below

All You Need to Know About FICO 9

September 9th, 2014 by Alice Bryant

http://www.creditnet.com/blog/all-you-need-know-about-fico-9

FICO is the source most lenders use to determine a borrower’s credit score. FICO uses an extensive formula intended to assist financial organizations with making high-volume, complex financial decisions. However, FICO recently announced a new formula called FICO Score 9. Unlike the current model, FICO 9 will remove collection agency accounts which were settled or paid in full. The new formula also distinguishes between medical debt and other forms of unpaid debt.

Many consumer advocates suggest this new formula will provide a fairness to lending decisions which is long overdue. Additionally, the advocates commend the change and praise its efforts. It is important to note that more than 75 million people in the United States have acquired some form of debt. This is debt which is currently in collection on an up-to-date credit report.

Benefits of FICO 9

FICO scores generally range from 350 to 850. The scores are calculated using the payment information offered by the three main credit reporting bureaus. TransUnion, Equifax, and Experian provide credit scores used to determine eligibility for credit cards, automobile loans, and other types of consumer loans.

The FICO 9 formula attempts to apply the concept that as consumer behaviors change, credit scores must change. For example, since 2009, credit card balances have decreased considerably and delinquencies on loans have fallen. Paying debt that is in collection marks a change in the consumers risk level. FICO 9 understands that the credit score needs to reflect this. Although the risk was apparent before, the current risk is not as relevant and this is a result of a behavioral change.

The new FICO 9 credit score formula plans to improve the scores of consumers with medical debts or consumers who have paid off other debts. However, consumers with unpaid debts on their report which are not healthcare related will witness a drop in their credit scores. This will make it more difficult to obtain a credit card or personal loan. In some cases, this will raise interest rates for millions of consumers.

For that reason, it is important to note that the new FICO 9 formula will potentially affect millions of consumers. Although the formula has several benefits, consumers will not witness the changes in credit immediately. The new credit score is expected to become available to lenders toward the end of the year. Additionally, lenders generally take months to apply new scoring formulas to existing loan portfolios. While waiting for the benefits to begin, there are a few aspects of FICO 9 most consumers should attempt to understand.

FICO will not decide FICO 9 availability.

FICO does not sell their scores and as a result they are unable to control availability. Many credible sources suggest FICO 9 scores will become available late Fall 2014 or early 2015. It is important to remember that the three major credit bureaus sell FICO scores and the software is installed on the bureau mainframes. For that reason, the availability of FICO 9 scores is based on the relevant credit bureau.

There is more than one score.

FICO 9 is a combination of credit scores, rather than one all-encompassing credit score. There are four different versions of the FICO score. These versions include a generic FICO score, FICO Auto, FICO Mortgage, and FICO Bankcard. Each of the credit bureaus use a distinct combination of FICO scores each time. Therefore, it will be 12 new FICO scores. i.e. 3 credit bureaus x 4 new scores = 12 new FICO scores

Zero balance collections are ignored.

The FICO 9 score will ignore any collections that have a zero balance. The FICO press release states that any “paid” collections will be ignored. Additionally, collections that have been settled will also be ignored. According to the FICO press release, all collections with a zero balance will be ignored. For some consumers, this acts as an incentive to settle or pay all collections.

Collections remain on credit report.

Collections which currently have a zero balance are ignored by the new FICO 9 formula. However, ignored collections will remain on the credit report until the seven-year limitation is reached. Although the new scoring formula will ignore the collections, lenders may not. In most cases, lenders will continue to notice any consumer debt that has reached collections. Moreover, lenders may continue to hold consumers accountable and deny credit.

Rental history is reported.

Over the last couple of years, residential rental history has been added to consumer credit reports. Equifax was the first credit bureau to add rental history followed by TransUnion. The addition of rental history is an ideal feature for consumers with no credit or a minor credit history. Paying rent on time can improve credit scores and the credit report will now reflect this improvement. The previous FICO score models, prior to FICO 9, did not include rental history. The new FICO 9 model will include this type of account which will help consumers improve scores.

Scores may vary considerably.

When a FICO score is released using the new FICO 9 model, consumers expect a different score from the previous model. Although the score is different, the consumer still expects the score to remain in a close range. For instance, a consumer with a FICO score of 750 under the previous model expects a slightly higher score under FICO 9. However, in some cases, consumers may witness a considerable difference in scores from previous models and FICO 9.

For instance, a consumer with an exceptional credit report with only a few paid collections less than two years old would have a poor credit score. This is typically under FICO 8 and previous FICO models. Under FICO 9, on the other hand, the consumer could have a significantly higher credit score as a result of the paid collections. For some consumers, the difference in scores will be drastically different. To lenders, this score can paint a completely different picture of the consumer. The score using previous models would suggest the consumer is a high-risk. The new score, under FICO 9, suggests the consumer is a reliable borrower.

The difficulty for FICO is communicating which score is the best representation of the consumer. Although the company has to suggest the newer FICO 9 score is an accurate depiction of the consumer, the score from previous models may help paint a different or more accurate picture.

Overall

The FICO 9 credit score has several benefits for the average consumer. The new formula has the potential to create a fair playing field for lending decisions. This FICO model allows current consumer behavior to reflect current scores. FICO 9 has the ability to change the way lenders view credit history and consumer loans.

Facts You Need to Know About the New FICO Score 9

The FICO Score-Three digits that have a big impact on most Americans’ financial life. FICO Scores are used in a large percentage of lending decisions. For the first time since 2009, FICO (formerly known as Fair Isaac Corporation) released a new version of its scoring algorithm called FICO Score 9. It contains several changes to how the score is calculated. This new formula offers hope to consumers whose credit reports contain certain types of negative information. These changes can have a big impact on consumers and many industries that rely on consumer reports. Here are some things you need to know about the new changes.

Non-traditional credit, such as residential rental history and utilities, will be taken into consideration. This means that consumers who have little to no credit history, often called a “thin” file, but pay rent, utilities and other non-traditional bills on time will get a boost. Since payment history and the length of that payment history currently account for approximately 50 percent of the FICO credit score, more consumers will have the opportunity to build a positive credit history through non-traditional means. This will help reduce the need for people to go out and get credit cards and incur unwanted debt just to get a score.

Collections-According to FICO, over 200 million Americans have a credit report and FICO Score. Of these, over one third has at least one collection on their report. Only about ten percent of all collections are paid. Of the unpaid collections, approximately 53% are medical-debt–related. Until recently, lenders and the credit bureaus have been using FICO 8 and older versions, which factor in all collections whether paid or unpaid and medical or non-medical. The new FICO 9 will separate collections into several categories.

All paid collections will no longer be factored into the new FICO score. They will still show up on the credit report for 7 years, they just won’t count toward the score. This includes medical, non-medical and collections where a settlement was taken. As long as the collection shows a zero balance, it will not be factored into the score.

Medical collections will no longer be factored into the FICO Score, whether paid or unpaid. This has long been lobbied for by many lenders and consumer groups. The thinking behind this is that many consumers have some kind of medical past-due account on their credit histories. This is in large part due to insurance companies paying late or not at all. Also, many doctors and hospitals will turn an account over to collections long before the insurance has even settled. Most medical debt is not self-incurred debt and has nothing to do with how good or bad a person is with their money. Medical bills happen, whether you want them to or not. It’s not like people go out and have a heart attack to spend money they don’t have.

Unpaid Non-medical collections will now have a greater impact on the score. Combine this with the fact that a paid collection will no longer be factored, consumers will have a greater incentive to pay past due collections to raise their score. This will change the long used premise that the older the collection item, the less impact it has on your score. Also, the old adage of “don’t pay back that five-year-old collection item and just let it age because activity on a collection item could make it appear more recent” is no longer true. Their score will benefit more if they pay it. This change removes all ambiguity. If you pay back your collection items, your score will benefit.

Many people will see a rise in their credit score while some will drop. For example, according to FICO, someone with a current 711 credit score whose only negative marks are a couple of medical collections will see an average 25 point rise in their score using FICO 9. This can make a big difference for someone who was on the cusp of getting approved for a loan or getting a better interest rate.

But don’t get too excited yet. Even though FICO and the credit bureaus have made the new formula available, it’s up to lenders to start using it for loan approvals. Past versions have taken up to a year or longer for lenders to adopt. It’s just like upgrading software on your computer. You have to want to do it and go through the process and expense to implement it. Because many of the most recent changes were requested by the lending community, and because of pressure to increase lending, many experts believe this formula will be implemented more rapidly than previous versions.

As consumer behavior changes, credit scoring should adapt. According to Experian, since the recession of 2009, credit card balances have fallen substantially and delinquencies on consumer loans have plunged, marking changes in consumers' risk levels. What may have been an indicator of risk several years ago, isn't any longer, or isn't as strong. The advances in FICO 9 provide significant incentives for lenders to upgrade from earlier versions of the FICO Score. Lenders can more consistently and precisely assess new applicants and existing accounts with a more robust credit score built on the most current credit data available.

These changes should make a difference with many consumers’ scores. How much though, and how long it will take, still remains to be seen. Remember, a credit score and a credit report isn’t the same thing. The score is derived from the report, which is why you still need to look at the report. The whole premise is to better assess a person’s ability to pay their debts. These changes should make it easier for lenders to approve more loans without taking on more risk.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

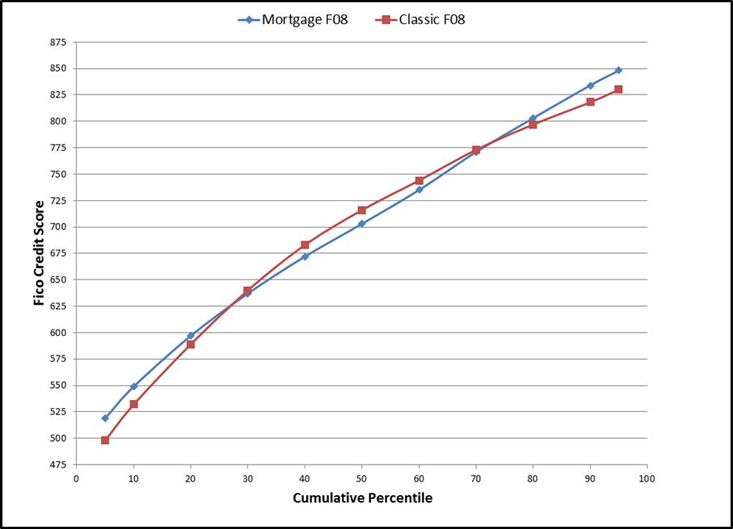

@Thomas_Thumb wrote:Did you know that Fico 08 classic and Fico 08 Mortgage are different models?

Fico 08 Classic has 12 scorecards and Fico 08 Mortgage has 17 scorecards - with 5 scorecards being allocated toward evaluating the future risk among mortgage consumers (according to the cashmoneylife article).

http://cashmoneylife.com/fico-8-mortgage-score-could-make-it-harder-to-get-approved/

Anyway, here is a score comparison graph and chart based on Experian data and some associated links.

EX percentile Mortgage F08 Classic F08 5 519 498 10 549 532 20 597 589 30 637 640 40 672 683 50 703 716 60 735 744 70 771 773 80 803 797 90 834 818 95 848 830

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

Do you know of any mortgage compaines using FICO 8 score for loans?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

@Anonymous wrote:Do you know of any mortgage compaines using FICO 8 score for loans?

I do not but others may have better insight regarding outlier mortgage companies. The Mortgage Fico 8 was an unsuccessful attempt.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950