- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Those with an 850 score, please provide DPs!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Those with an 850 score, please provide DPs!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@marty56 wrote:

My AAoA is 9.5 years. My oldest account is 33.4 years, until is 1%. 1 inquiry on TU. PIF mortgage reporting and a car loan.

I'm curious what's holding you back from 850s. Your AAoA and AoOA are already maxed out, your utilization is ideal and clearly you have no negative items. How about your AoYA? 1 inquiry shouldn't matter, as 0-1 are believed to be binned together. Do you have 2+ scoreable inquiries on EX and EQ?

Your installment loan at 56% shouldn't be the constraint here either IMO, as I believe people have reported perfect scores without the presence of an open installment loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

Yeah, Marty56 more data points! I can't imagine why you're not at 850s x 3...

Do you have a consumer finance loan anywhere on your profile? Is the card you're reporting a balance on showing utilization over 28.9% individually? Or do you possibly have tiny balances on more than 1/3 of your credit card accounts?

New account penalty + inquiries should be negligible for your scorecard.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

Good questions above from ABCD. I'm looking forward to hearing marty's response, as I'm very interested in these data points on 850 or nearing-850 type scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:Most important factor for 850s to me is "age of oldest account" as this is likely the basis for the scorecard/bucket tiering, not AAoA.

I've been at 850 month over month from 1/2014 to present on Fico 8 and on Fico 9 since it started reporting. Here are some low/high data points:

- Age of oldest installment loan (open or closed) [ 17 years in early 2014, 9 years in 2015 (closed loan mortgage aged off), 12 years now]

- Age of oldest credit card (open or closed, not AU) [ 30 years in 2014, 33 years now]

- Are any consumer finance accounts present? [never]

- Aggregate utilization on credit cards [ 0.5% to 8% - one time only TU on a 3B report (10/2016) reported a Fico 8 score drop to 845, other CRAs reported 850 and all Fico 9s were 850]. The 3B report only showed 3% AG UT at the time but I had captured an AG UT above 9% on CK the day before. Made me wonder if the 3B summary data pulled from a different source file than that sucked into the scoring model(s).

- Any high utilization credit cards (68.9%+?) - Yes 75% on BB store card with no impact on score.

- Age of the newest account reporting in months [ 30 months in 2/2014, over 72 months now]

- Number of inquiries under 12 months of age [most 1 on EQ and one on TU. None on EX. Chassic Fico 8 and Fico 9 scores do not change 0 => 1 INQ ... but VS3 score is impacted 5 points]

- Average age of all accounts [16 to 18 years - some accounts above average age have fallen off but remaining accounts have obviously aged up]

- Credit Mix: Number of open credit cards, number of open installment loans (and type) - [Fico credit mix includes closed accounts. It is a misnomer to categorize mix as open accounts. Lack of certain account types can impact points received in the amount owed category and possibly payment history. However by definitionj these are not the mix category]

- Mortgages 2/2014: 1 Open = 9 years, 1 Closed = 17 years (aged off in 2015); 1 open 11/2017

- Credit & charge cards: 2014 - 7 open & 6 closed; 2017 6 open and 2 closed with one open being an AU card- Currently total accounts = 9, total open accounts = 7.

Fico and other scoring algorithms rely heavily on a review of active accounts. Closed accounts and open accounts that are not active don't provide current data payment history and amounts owed. Thus loss in of potential points in critical scoring categories. As mentioned, mix itself is a different category.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

I will get an updated copy of my CR and post what I find out. Truecredit was down and MyFico is next month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

Fantastic data points! Thanks for sharing!

I'd love to see someone who JUST enters the 850 threshold too, especially folks with what may seem "derogatory" such as very low AoOA, AAoA, 2+ inquiries, etc. I'm curious what the absolute basement threshold is in each category to still get to 850.

Someone on FB sent me their sanitized 3B and they're at 84X with an AoOA of 16+ years. Everything else is perfect (balance on mortgage is under 7% left to pay, balance on car loan is under 5% left to pay, 5+ CCs, AAoA is over 6 years, very low utilization sub 2% aggregate and no individual balance over 8%, etc, etc, etc). I figured they'd be a shoe-in for 850 but maybe because they don't have one of those 20+ year old accounts is holding them back. Nothing else made sense, no inquiries, no accounts less than 2 years, etc, etc. Really bugs me that they're NOT at 850. He's also only 35 years old so he's done the credit game perfectly from what I can see.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

About point 3, consumer finance accounts.

http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/What-are-consumer-finance-accounts/td-p/1... #7/16 lists this as a relative minor ding. Has it changed since 2012?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:

Someone on FB sent me their sanitized 3B and they're at 84X with an AoOA of 16+ years. Everything else is perfect (balance on mortgage is under 7% left to pay, balance on car loan is under 5% left to pay, 5+ CCs, AAoA is over 6 years, very low utilization sub 2% aggregate and no individual balance over 8%, etc, etc, etc). I figured they'd be a shoe-in for 850 but maybe because they don't have one of those 20+ year old accounts is holding them back. Nothing else made sense, no inquiries, no accounts less than 2 years, etc, etc. Really bugs me that they're NOT at 850. He's also only 35 years old so he's done the credit game perfectly from what I can see.

It's not age of oldest holding back score - probably somewhere between 12 to 16 years AoOA is good enough for the old folks scorecard. Also, multiple scorecards can achieve 850 - so being on the elder scorecard is not critical. That being said the H-H-H scorecard almost certainly offers more potential buffer.

A limiting factor for the FB poster appears to be the low AAoA of 6 years. I'm sticking with 7 years or 7 years 8 months as a minimum AAoA to reach Fico 8, 850.

Also, for loans it's NOT all about remaining B/L - a lengthy payment history is meaningful as well.

BTW - as an added data point I let all charges report on statements and reported balances on 100% of my cards on three occassions. Fico 8 score stayed at 850 on all CRAs. Had 100% of cards report three different times.

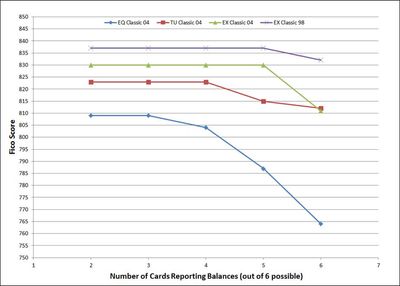

In contrast to Fico 8, EQ Fico 04 (score 5) punished my score severely. EQ Fico 04 dropped to 765 one time and 764 the other time I checked mortgage scores with 100% of cards reporting balances - AG UT under 6% both times. [score shift: 809 => 764 and 809 => 765]. EQ Fico 8: 850 => 850 by comparison

Note: My EQ Fico 04 is 809 with 2 or 3 cards reporting. Never had only one card reporting. I suspect my Fico mortgage scores would benefit but, since my AU card counts with Fico 04/Fico 98, I won't be getting down to one card only reporting.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content