- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- [Final update 12/11] Car loan & installment loan t...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

[Final update 12/11] Car loan & installment loan thresholds

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@SouthJamaica wrote:

@oilcan12 wrote:

Any idea why your TU 04 gained 14 points?

Not a clue

Is the same data currently being reported to each bureau?

1. An old public record which aged off of TU is still showing up on EQ and EX.

2. An Amex account which morphed into a Barclays account is still showing up as open on EX, while TU & EQ consider it closed.

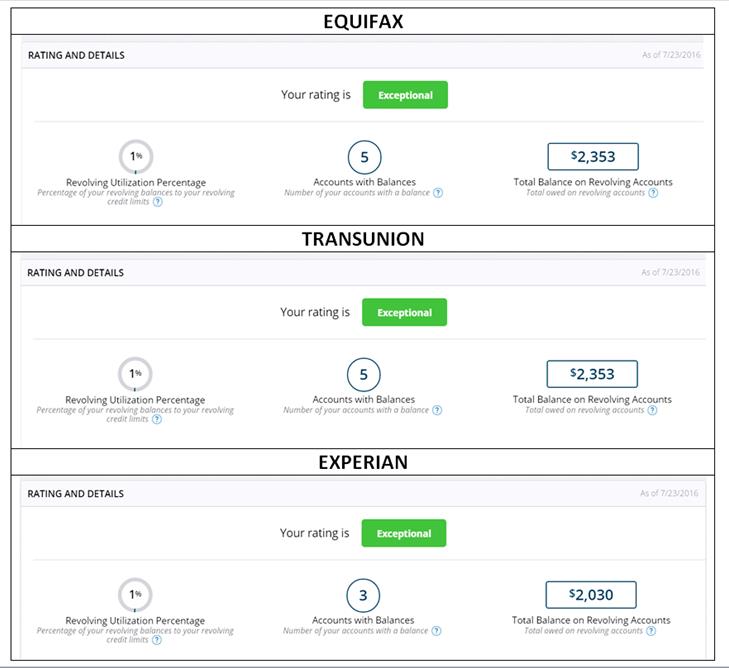

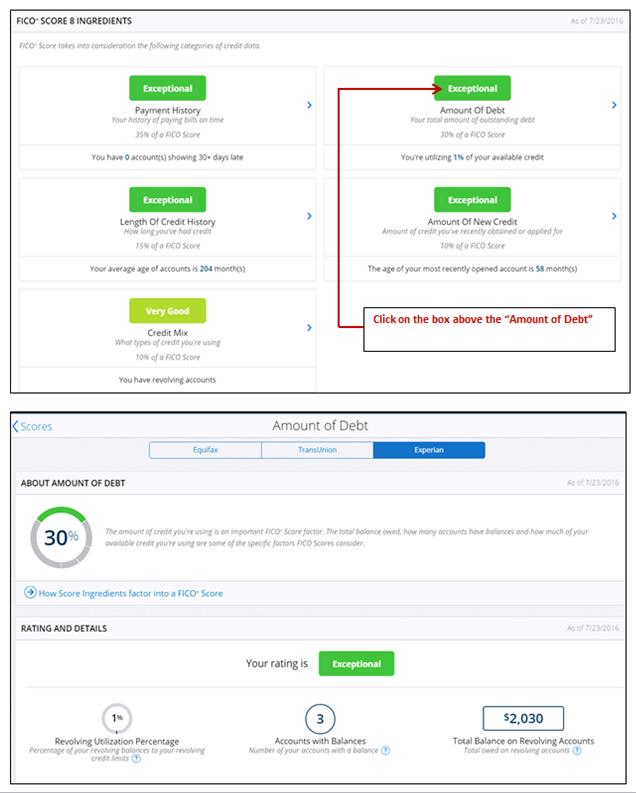

SJ - I saw differences in account data in the 3B report I pulled on 7/23. Didn't realize it until I looked at details for each CB. It ended up that EX listed balances on 3 of 6 cards instead of the 5 of 6 that EQ and TU showed. Also, EX had a lower aggregate balance across all CCs. Have you checked those details? - click on amount of debt tab to find details See below example

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@oilcan12 wrote:

Any idea why your TU 04 gained 14 points?

Not a clue

Is the same data currently being reported to each bureau?

1. An old public record which aged off of TU is still showing up on EQ and EX.

2. An Amex account which morphed into a Barclays account is still showing up as open on EX, while TU & EQ consider it closed.

SJ - I saw differences in account data in the 3B report I pulled on 7/23. Didn't realize it until I looked at details for each CB. It ended up that EX listed balances on 3 of 6 cards instead of the 5 of 6 that EQ and TU showed. Also, EX had a lower aggregate balance across all CCs. Have you checked those details?

I don't have the time; I have 19 to 20 open accounts ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

It's a quick check with current 3B reports (see above post for info).

Unfortunately I was unable to update my prior post with the quick check method before you responded.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@Thomas_Thumb wrote:It's a quick check with current 3B reports (see above post for info).

Unfortunately I was unable to update my prior post with the quick check method before you responded.

All balances are the same, except that TU is showing a 1202 balance on one account while the others are showing a 648 balance.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@oilcan12 wrote:

Any idea why your TU 04 gained 14 points?

Not a clue

Is the same data currently being reported to each bureau?

1. An old public record which aged off of TU is still showing up on EQ and EX.

2. An Amex account which morphed into a Barclays account is still showing up as open on EX, while TU & EQ consider it closed.

SJ - I saw differences in account data in the 3B report I pulled on 7/23. Didn't realize it until I looked at details for each CB. It ended up that EX listed balances on 3 of 6 cards instead of the 5 of 6 that EQ and TU showed. Also, EX had a lower aggregate balance across all CCs. Have you checked those details? - click on amount of debt tab to find details See below example

How do you get to this screen shot from a 3B report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@oilcan12 wrote:

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@oilcan12 wrote:

Any idea why your TU 04 gained 14 points?

Not a clue

Is the same data currently being reported to each bureau?

1. An old public record which aged off of TU is still showing up on EQ and EX.

2. An Amex account which morphed into a Barclays account is still showing up as open on EX, while TU & EQ consider it closed.

SJ - I saw differences in account data in the 3B report I pulled on 7/23. Didn't realize it until I looked at details for each CB. It ended up that EX listed balances on 3 of 6 cards instead of the 5 of 6 that EQ and TU showed. Also, EX had a lower aggregate balance across all CCs. Have you checked those details? - click on amount of debt tab to find details See below example

How do you get to this screen shot from a 3B report.

You can't get to that from the report, you go to it from the site. I didn't know TT was talking about that, yes I'm always looking at that but it just gives the totals.

Yes as mentioned in my case there was a difference in balances, but the one that had the highest balances was TU, the one that's treating me kindest ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

SJ - Sorry about the confusion on navigating to get this informatiom.

I had to purchase a 3B report - but this summary is not part of the report. It is found in the scores tab. See past below. Also, I cropped 3 screen shots and put them together into a single image for the above.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

Thanks TT.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

SJ's data doesn't seem to support an upper FICO scoring threshold for an aggregate of installment and auto loans. At least not without grasping at straws.

My own data shows that there is no upper break point for SSLs. My own data, along with my observations of other posters data, suggests that there is only one scoring threshold for SSLs. That is <10%. I don't see any evidence to support thresholds of 80%, 70%, 9% or 8%

Do we even know that auto loans have an upper break point for FICO 8?

There are currently 0 data points to support an upper scoring threshold for SSLs. There has now been over a year to accumulate that 1 data point. It seemingly doesn't exist.

There was 1 (arguably weak) data point, based on Captool's data, to support an upper break point for an aggregate of SSLs and Lending Club type loans. Who knows how FICO scores those type of loans? I'm not sure it is even worth the effort to make that determination.

Thank you SJ for your efforts in presenting your data. Your efforts are greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

TT,

Doesn't the number of accounts with balances, on your Myfico screenshots, include your mortgage? Myfico has always included my installment loan in the number of accounts with balances.

It will be very easy to verify if you have a CreditKarma, Wallethub or savvymoney pull from the same day.

You could also go to the accounts page of the 3B report and count the balances. Since, you only have 6 cards it wouldn't take very long. In my case, it is absurdly time consuming.

So, wouldn't that mean that your had 4 cards with balances on TU and EQ and 2 cards with balances on EX.