- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- [Final update 12/11] Car loan & installment loan t...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

[Final update 12/11] Car loan & installment loan thresholds

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@oilcan12 wrote:TT,

Doesn't the number of accounts with balances, on your Myfico screenshots, include your mortgage? Myfico has always included my installment loan in the number of accounts with balances.

It will be very easy to verify if you have a CreditKarma, Wallethub or savvymoney pull from the same day.[not necessary, info is correct. I have 5 cards and one mortgage showing balances]

You could also go to the accounts page of the 3B report and count the balances. Since, you only have 6 cards it wouldn't take very long. In my case, it is absurdly time consuming. [I do and did check this - 5 cards show balances, one is the AU card]

So, wouldn't that mean that your had 4 cards with balances on TU and EQ and 2 cards with balances on EX. [It's 5 and 3, but I guess the AU card is not included in the 3B summary count]

When you click on "amount of debt" you get exactly what is shown on the screen below it - a revolving account summary (which includes AMEX in the card count and total amount but, interestingly the utilization calculation excludes the AMEX charge card).

I have few enough accounts that I do review them all in detail. The # cards reporting summaries match exactly with the individual account reviews. EX has two less cards showing balances (3 of 6) relative to EQ and TU (5 of 6). The other two CBs show balances of $249 and $74 on cards where EX shows $0 balance. The sum of these amounts matches the difference in aggregate scores [$2353 - $2030 = $323]

That is undoubtedly why I EX Bankcard Fico 08 had a 900 score - past results indicate I can't hold that score with more than 3 cards reporting.

As mentioned, the snapshot is a nice CC "revolving account only" quick summary to check reporting differences among CRAs. Clearly, these differences can be significant and thus should be looked when evaluating different scoring behavior by CB.

P.S. Although the snapshot lacks spend detail by account, it does show differences in aggregate. It's a nice quick check for SJ and others with a lot of CC accounts to compare revolving "amount of debt" by CB

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@Thomas_Thumb wrote:

When I click on "amount of debt" you get exactly what is shown on the screen below it - a revolving account summary (which includes AMEX in the card count and total amount but, interestingly the utilization calculation excludes the AMEX charge card).

I have few enough accounts that I do review them all in detail. The # cards reporting summaries match exactly with the individual account reviews. EX has two less cards showing balances (3 of 6) relative to EQ and TU (5 of 6). The other two CBs show balances of $249 and $74 on cards where EX shows $0 balance. The sum of these amounts matches the difference in aggregate scores [$2353 - $2030 = $323]

That is undoubtedly why I EX Bankcard Fico 08 had a 900 score - past results indicate I can't hold that score with more than 3 cards reporting.

As mentioned, the snapshot is a nice CC "revolving account only" quick summary to check reporting differences among CRAs. Clearly, these differences can be significant and thus should be looked when evaluating different scoring behavior by CB.

P.S. Although the snapshot lacks spend detail by account, it does show differences in aggregate. It's a nice quick check for SJ and others with a lot of CC accounts to compare revolving "amount of debt" by CB

Oilcan12 - You are partially correct. The mortgage must be included in the count if the AU card is not. But, I do have 5 of 6 cards with balances (4 of 5 if AU card not included)

I had always thought the count total included the AU card and not the installment loan. The AU card, like the open mortgage always shows a balance every month.

A further review of the account summaries indicates:

1a) A $576 balance that shows on my AU credit card is not included in the aggregate revolving debt totals for any of the CBs

1b) The AU credit card appears to be iincluded in the # accounts with balance total. [but is not included per MyFico]

2a) The AMEX charge card balance is included in the aggregate revolving debt total

2b) The AMEX card is included in the # accounts with balance total

2c) The AMEX card is not included in the % utilization summary.

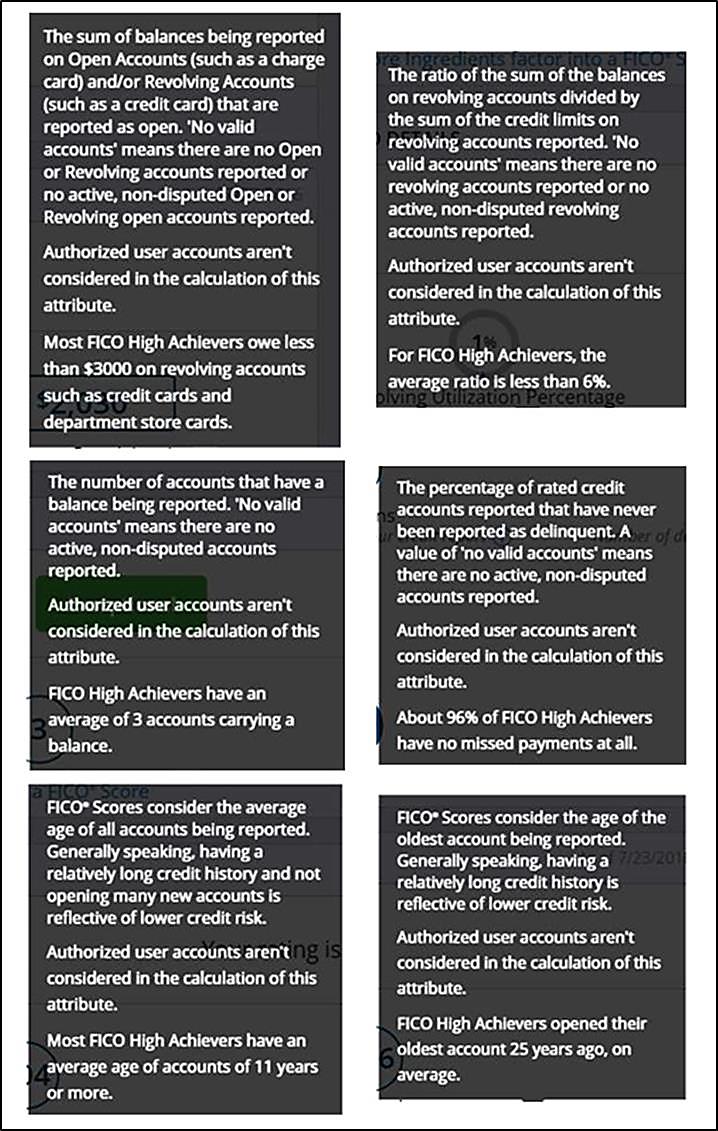

Text Box notes all state AU cards not considered in factor attributes:

* Are these old statements? I recall changes were made to include AU cards in some calculations (such as AAoA and file age after consumers complained)

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

Question: is there such a strong consensus that the only meaningful breakpoint on installment utilization is 10%, that i'm wasting my time going down in 10% increments?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

There is general belief that SSL loans may only have a breakpoint at 10%. Even if a higher breakpoint existed for an old loan, it's kind of a moot point as the purpose of the SSL is a quick boost to score - so what would be the purpose in extending time to score boost.

However, there remains a fairly widespread belief that an above 50% breakpoint exists for auto loans and mortgages - and that that breakpoint appears dependent on loan type. Masscredit data indicates an Auto loan breakpoint at 70% and CAPTOOL data supports a 70% level on an aggregate loan basis.

My personal belief is that payment history over time is a consideration in scoring. So, an older auto loan with over 12 months payment history may have a breakpoint above 50% that is not available to a "new" loan.

SJ, you need to do what makes sense for you. Stop paying off such large chunks each month if it makes sense financially.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@SouthJamaica wrote:Question: is there such a strong consensus that the only meaningful breakpoint on installment utilization is 10%, that i'm wasting my time going down in 10% increments?

My data shows that there is only breakpoint, 10% utilization, for a single secured installment loan. I am the only one who has demonstrated that there is only 1 break, at 10%, for installment loans. I have known this since July 5th of 2015. I proved in conclusively in early October of 2015.

No one has shown even 1 single data point to support that there are any other breakpoints for single SSLs. Perhaps TT could chime in.

I would say that your are wasting your time going down in 10% increments. I do, however, deeply appreciate your efforts. You are a very nice person and have contributed greatly to the effort.

Most of the insistence on an upper break point is based on the original thesis. It has been 1 year and no on has provided any evidence of an upper breakpoint for SSLs. I have provided conclusive proof that there is only 1 break point, for my profile, for a single SSL.

As far as aggregate's of SSLs and other types of installment loans. who knows?

It is very clear that Mortgage loans, at the very least, are scored extremeley different that SSLs. I think that TT probably has some of the best knowledge on this issue. It is his choice whether to chime in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@Thomas_Thumb wrote:There is general belief that SSL loans may only have a breakpoint at 10%. Even if a higher breakpoint existed for an old loan, it's kind of a moot point as the purpose of the SSL is a quick boost to score - so what would be the purpose in extending time to score boost.

However, there remains a fairly widespread belief that an above 50% breakpoint exists for auto loans and mortgages - and that that breakpoint appears dependent on loan type. Masscredit data indicates an Auto loan breakpoint at 70% and CAPTOOL data supports a 70% level on an aggregate loan basis.

My personal belief is that payment history over time is a consideration in scoring. So, an older auto loan with over 12 months payment history may have a breakpoint above 50% that is not available to a "new" loan.

SJ, you need to do what makes sense for you. Stop paying off such large chunks each month if it makes sense financially.

I agree with TT for the most part.

I tend to believe that there are 1 or 2 breakpoints for mortgate loans before reaching the 80% breakpoint. It seems that the 80% breakpoint is the coupe de grace for people with high FICO scores. This is very different that the theoretical upper breakpoint for SSLs. There could certainly be more breakpoints for Mortgage Loans.

The only thing that I disagree with TT, slightly (ever so slightly), is that payment history is a consideration. It would certainly explain some things and may actually be true. I'm just not convinced.

There seems to have been a complete transition from FICO 4 to FICO 8 in the scoring of installment loans. For FICO 4 it was all about age. For FICO it is all about %utilization. My personal belief is that this transition was based on regulatory compliance. I can't prove it. If anyone can prove the opposite, I am more than willing to listen.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@Thomas_Thumb wrote:There is general belief that SSL loans may only have a breakpoint at 10%. Even if a higher breakpoint existed for an old loan, it's kind of a moot point as the purpose of the SSL is a quick boost to score - so what would be the purpose in extending time to score boost.

However, there remains a fairly widespread belief that an above 50% breakpoint exists for auto loans and mortgages - and that that breakpoint appears dependent on loan type. Masscredit data indicates an Auto loan breakpoint at 70% and CAPTOOL data supports a 70% level on an aggregate loan basis.

My personal belief is that payment history over time is a consideration in scoring. So, an older auto loan with over 12 months payment history may have a breakpoint above 50% that is not available to a "new" loan.

SJ, you need to do what makes sense for you. Stop paying off such large chunks each month if it makes sense financially.

Actually I was thinking of paying off larger chunks, rather than smaller chunks, until I reach a sweet spot, at which point I would decide which I would enjoy more: (a) clean title or (b) nice credit score. I guess I'll just keep going down in 10% increments until I get to the promised land.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 7/6] Car loan & installment loan thresholds

@oilcan12 wrote:

@SouthJamaica wrote:Question: is there such a strong consensus that the only meaningful breakpoint on installment utilization is 10%, that i'm wasting my time going down in 10% increments?

My data shows that there is only breakpoint, 10% utilization, for a single secured installment loan. I am the only one who has demonstrated that there is only 1 break, at 10%, for installment loans. I have known this since July 5th of 2015. I proved in conclusively in early October of 2015.

No one has shown even 1 single data point to support that there are any other breakpoints for single SSLs. Perhaps TT could chime in.

I would say that your are wasting your time going down in 10% increments. I do, however, deeply appreciate your efforts. You are a very nice person and have contributed greatly to the effort.

Most of the insistence on an upper break point is based on Revelate's original thesis. It has been 1 year and no on has provided any evidence of an upper breakpoint for SSLs. I have provided conclusive proof that there is only 1 break point, for my profile, for a single SSL.

As far as aggregate's of SSLs and other types of installment loans. who knows?

It is very clear that Mortgage loans, at the very least, are scored extremeley different that SSLs. I think that TT probably has some of the best knowledge on this issue. It is his choice whether to chime in.

Having said all of that, I can't dispute that Revelate is popular. If you want to continue to search for nonexistant breakpoints based on Revelate's original thesis that is your choice.

In my case the data consists of 2 loans, the new auto loan and the SSL loan.

When the auto loan first reported, with aggregate utilization at 87.7%, my FICO 8 scores took a hit.

When it went below 80% the FICO 8's went up a little and when it went below 70% they went up a little. Maybe they were small breakpoints, or maybe they were nothing. I don't know.

I have found Revelate to be very reliable.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 9/3] Car loan & installment loan thresholds

09-3-16

60% Threshold...tested.

Effect on FICO 8 scores of paying down car loan, reducing overall installment loan utilization from 68.8% to 58.4%:

EQ 699 +-0 TU 784 +-0 EX 707 +-0

I.e., no effect whatsoever

History:

Auto loan reporting with overall installment utilization 87.7%: EQ -30 TU -41 EX -20

Crossing 80% (from 87.7% to 79.1%) : +2 in each: EQ, TU, and EX

Crossing 70% (from 79.1% to 68.8%) : +3 in EQ, +8 in TU, and no change in EX

Note: I've decided to stop bothering with the other FICO models since I can only access them once a month. It's impossible for ,me to isolate what change or lack of change is attributable to a change in installment loan utilization.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: [Update 9/3] Car loan & installment loan thresholds

Thanks for the update.

I remain an advocate of a 70% threshold for certain types of installment loans (including auto but not share secured). Again, I wonder if length of payment history affects the scoring impact associated with crossing a high end threshold. [extended payment history => increases points allocated to high end threshold/reduces points associated with low end threshold with total available points being a constant].

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950