- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Used over $100,000 in credit, here is what hap...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Used over $100,000 in credit, here is what happened to my score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

Congrats on the raise! I can't wait to see how all of this concludes, which is to say what creditors remain faithful to you. It will be a good lesson learned for all of us who utilize credit and wonder which are the best cards to carry. I've long since decided that AmEx isn't one of them, no matter the form it comes in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

I just found this thread and found it absolutely a must read. Subscribing and waiting for your future updates, especially as you pay back the one in Sept. and the one in Oct. When you pay those, what will your UTIL be at?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@baller4life wrote:

Very interesting thread! I've subscribed to see which creditors will stick by you through it and who will kick you to the curb. We already see Amex isn't down. Which is precisely why I NEVER carry a balance with them. I don't trust them. I have read too many horror stories of cld or closure for carrying a balance too long.

I had an AMEX Costco card from 2001-2014. I had maxed it out at $14,500 for several years. They did do an AA against me in 2010 (thanks to Kohl's posting a 30 day late in 2010 that I recently found out about and got fixed). However, they did not close the card on me even with the maxed CL. Once I PIF the card I closed it in December. Then in April I applied for the BCE and got a low $2,000 CL which ticked me off because it's the lowest CL that I had received when I started apping this year.

It is very interesting that AMEX was the first to close down the O.P.s cards, even with a $0 balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@baller4life wrote:

Very interesting thread! I've subscribed to see which creditors will stick by you through it and who will kick you to the curb. We already see Amex isn't down. Which is precisely why I NEVER carry a balance with them. I don't trust them. I have read too many horror stories of cld or closure for carrying a balance too long.

I've watched this thread from beginning. I had 2 other Amex cards on my list. This has swayed me a lot. I never did app for another. Only keeping the one. I charge and pif when I get home with Amex like you. After all, what is the point of having a cc if not to use when you really need to?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@Anonymous wrote:After all, what is the point of having a cc if not to use when you really need to?

Exactly, the possibility that all of our discipline can put us in no better place than the person that actually uses their credit card in a financially irresponsible way. Think about all the extravangances you didn't take on, the things you didn't charge because of your utilization, the limits you shouldn't have been so happy to achieve. All of it giving you no more flexibility than the person that apped for every store card and charged it all on that shopping spree, without any awareness of their credit report.

With respect to building and maintaining credit worthiness, my experience should make it clear what things are worth doing and which things are not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@MercyMe wrote:Congrats on the raise! I can't wait to see how all of this concludes, which is to say what creditors remain faithful to you. It will be a good lesson learned for all of us who utilize credit and wonder which are the best cards to carry. I've long since decided that AmEx isn't one of them, no matter the form it comes in.

Thank you ![]()

So my main concern is what someone mentioned about being CLD chased. Basically their credit limits were lowered as they were paying off their cards. This would be a major inconvienence to me, as my utilization becomes unpredictable. For example, even if I planned to drop my utilization to 50%, if I get CLD chased my utilization could remain at the same high percent, or higher.

This hasn't happened to me, but I'm looking out for it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@Anonymous wrote:I just found this thread and found it absolutely a must read. Subscribing and waiting for your future updates, especially as you pay back the one in Sept. and the one in Oct. When you pay those, what will your UTIL be at?

Should be ~60%

Having high utilization really does make me self conscious.

I was talking with a bank teller and they pulled up my account, which had my credit card linked alongside the checkings and savings, and they freaked out "SIR SIR DO YOU KNOW HOW MUCH INTEREST YOU ARE PAYING ON THAT!" he couldn't see that it was a balance transfer promo his institution had offered me.

I've also heard my boss mention how people with low credit are the most untrustworthy. I don't think he's doing soft pulls on my account though hahaha.

Having high utilization with no missed payments will give you low credit. But if someone saw that on a credit report, what would they think? Practically, if you are making all your payments on time, then you are the most trustworthy! The freaking Lannisters would have a low credit score, despite their quip about always paying their debts ![]()

Anyway, I don't like being in a situation where I have to rationalize this kind of thing, or possibly having to explain it like a felon applying for a job.

But I am committed to the experiment.

All goes well and all the creditors will see how much I plan to spend and triple my limits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

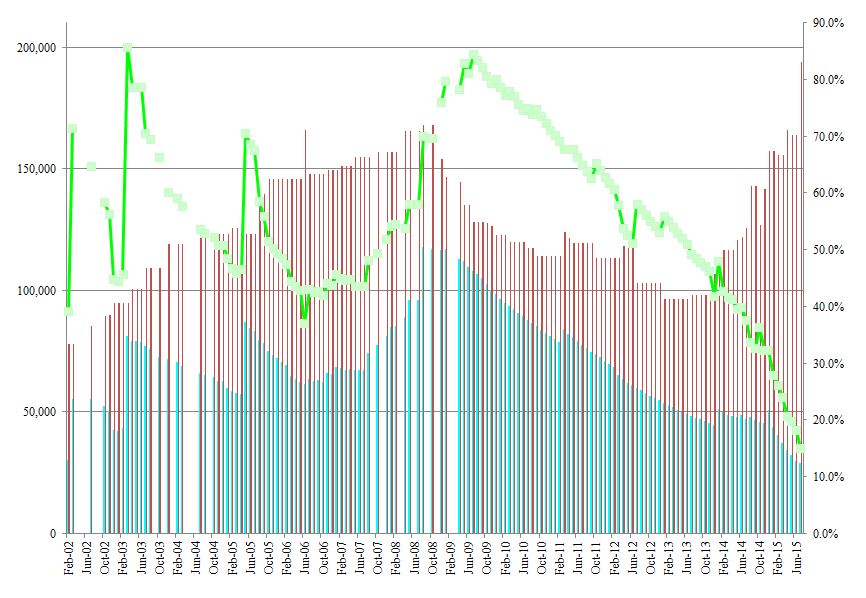

Thanks for the updates. Regarding my own high balances and CLD, in order to manage that much debt, I have a spreadsheet that I roll forward a new tab every month to make sure I know what the payments have to be, and the day of the month each is due. From that I've listed the monthly Credit Limits, Open Balances, and then calculation of estimated Utilization (excluding some of the closed cards limits in recent months which aren't realistic).

In this graphic, the green line is the utilization percentage, using the right scale. There is a "baby peak" at 86% utilization but only 81k of actual open balances in March 2003.

The real peak at 84% utilization was when the combination of CLD / Account Closures from $168k (70% utilization) comes rushing down on the open balances decreasing from $117k.

Blue bars are total open balances, including closed accounts. This is now in the range of $29k. Red bars are the available credit card CL, reduced lately for $20k of not really available closed CL. There's a nice change in mid-2013 as I started getting new cards, and a blip at the end with the latest $30k Venture that is not yet reported, which will put me at $193k of available CC + LOC. TU Utilization should be under 15% when the Venture first reports.

Through all this, as far as I know, my FICO scores never went below 690. I was able to get a condo mortgage in 2005, then a house in 2007. Some of that is as much a function of the same credit bubble that lead to getting these cards, but also with never missing any payments. With the recent focus on paying down balances, and keeping individual cards below 70% then below 50%, has made a significant difference just in the last 45 days to my scores. At the start of June, I hit some sort of favorable combination of aged new accounts, overall utilization decline, and reduced individual account utilization (each below 50%) that let my scores really start climbing. Even the Venture app could not bring the scores down.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@NRB525 wrote:Thanks for the updates. Regarding my own high balances and CLD, in order to manage that much debt, I have a spreadsheet that I roll forward a new tab every month to make sure I know what the payments have to be, and the day of the month each is due. From that I've listed the monthly Credit Limits, Open Balances, and then calculation of estimated Utilization (excluding some of the closed cards limits in recent months which aren't realistic).

That was all very insightful. I keep a spreadsheet too.

Originally to see the limits and keep track of what the cash advance limits were. Basically my theoretical maximum liquidity.

I extended this table to start showing payment due dates and related data.