- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Used over $100,000 in credit, here is what hap...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Used over $100,000 in credit, here is what happened to my score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@gen-specific wrote:

@onstar wrote:

@baller4life wrote:

Very interesting thread! I've subscribed to see which creditors will stick by you through it and who will kick you to the curb. We already see Amex isn't down. Which is precisely why I NEVER carry a balance with them. I don't trust them. I have read too many horror stories of cld or closure for carrying a balance too long.I actually view things the opposite way. I respect Amex WAY MORE now because of this thread. They actually pay attention to your credit profile, and when things start heading south in a major way, they take action. Shouldn't all banks be doing that?

If it were me doing this experiment, then I would only keep cards where the creditor goes into a slight panic mode due to my excessive balance, whether it's CLD or some other AA. To all the banks where they took no AA even when my balance climbed from <$20K to >$100K out of nowhere, I'd kick them to the curb for not paying attention.

Anyway, interesting thread indeed.

Why?

Their retail credit card products have no impact on their solvency, they collect 18-21% interest which is over 51 times the fed funds rate that they borrow at which is 0.25%, they have private insurance for actual defaults so who cares? None of this affects you. These institutions will take the risk of extending you five figure credit lines because one interest payment means they've made a huge profit.

Even if they have insurance, it still affects everyone else that borrows from them. It's because of everyone that defaults that the interest rates are so high. It's because of all the churners that the bonuses are not as high as they could be. It's because of abusers (like MS) that are cash back % aren't as high as they could be. Etc. So I like banks that take a stand against people that abuse the system. I like banks with a LONG memory for people that burned them. I like banks that blacklist you for xx years (the longer the better) if you churn or MS or some other abuse.

But let's suppose that there were no repurcussions at all. That no matter how many defaulted, their insurance premiums didn't go up and that none of those extra fees actually trickled down to the consumers via higher AF or higher rates or whatever. Still, it's responsible banking to take AA against risky behavior. That's what I'd expect from banks.

I totally get that you want to hang on to banks that will stick by you when things are not good (at least on paper). I agree to that in personal relationships, but not in business relationships.

FICO 08 (4/9/2018): EQ 647 EX 609 TU 620

FICO 08 (10/16/2020): EQ 676 EX 659 TU 653

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

Very intresting Gen and thank you. To think I really wanted an AMEX once my credit allows it. I'm not quite so sure anymore.

Personal:

Personal:

Business:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

The bank may make "a lot" of money with one interest payment, but if that borrowed amount defaults, the bank loses "a lot" more.

19% APR collected for a few months is 1.5% x how ever many months.

A default for non-payment is 100% loss.

Now, how do you forecast that? It's nearly impossible. All you can do as a bank is watch data that you have available about the borrower, which is the point of the SP inquiries.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@Broke_Triathlete wrote:Very intresting Gen and thank you. To think I really wanted an AMEX once my credit allows it. I'm not quite so sure anymore.

Why should this change your outlook? AMEX is a quality CC provider, with many benefits. As long as you pay your bill, no issues. They may have a more dynamic credit line than other banks, but that works in CLI when you are doing well, and CLD if you show risky tendencies.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@NRB525 wrote:They may have a more dynamic credit line than other banks, but that works in CLI when you are doing well, and CLD if you show risky tendencies.

Risky tendency like needing credit at all?

People are living their lives here playing reindeer games to eek out 6 points in a credit score, just so they'll have something "in emergencies" or tougher times. I think this is why people are vocally evaluating what AMEX is doing in my experiment with such scrutiny, and their aspirations to have lines with AMEX. Interesting discussion though

I still have one pretty good card on the AMEX network (but issued by a bank) and it has a $30,000 limit and hasn't been CLD. It is still in a promotional period.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

So recall, after the Barclays CLD I got something in the mail about it and it showed my Transunion FICO score being 633. My Credit Karma Transunion Vantage Score is 553

Given the 80 point difference in my Transunion Vantage Score 3.0 and FICO score (who knows which one), I am now curious about my FICO Experian and Equifax scores. Anybody think this would be a good time to get my annual actual FICO scores?

Mid 550s vs a score above 620 makes a big difference in credit worthiness. I am reporting ~80% utilization and have at least one FICO score of 633. That is the difference between accepting any offer a lender makes up (and getting denied most of the time), versus just getting a higher interest rate. Mortgages still possible, supposedly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@gen-specific wrote:So recall, after the Barclays CLD I got something in the mail about it and it showed my Transunion FICO score being 633. My Credit Karma Transunion Vantage Score is 553

Given the 80 point difference in my Transunion Vantage Score 3.0 and FICO score (who knows which one), I am now curious about my FICO Experian and Equifax scores. Anybody think this would be a good time to get my annual actual FICO scores?

Mid 550s vs a score above 620 makes a big difference in credit worthiness. I am reporting ~80% utilization and have at least one FICO score of 633. That is the difference between accepting any offer a lender makes up (and getting denied most of the time), versus just getting a higher interest rate. Mortgages still possible, supposedly.

You aren't getting the updated dozen-or-so FICO scores here? Quarterly credit reports? As They Happen alerts on the FICO 8 scores? Identity theft monitoring if your info shows up on black market websites?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

@NRB525 wrote:

@gen-specific wrote:So recall, after the Barclays CLD I got something in the mail about it and it showed my Transunion FICO score being 633. My Credit Karma Transunion Vantage Score is 553

Given the 80 point difference in my Transunion Vantage Score 3.0 and FICO score (who knows which one), I am now curious about my FICO Experian and Equifax scores. Anybody think this would be a good time to get my annual actual FICO scores?

Mid 550s vs a score above 620 makes a big difference in credit worthiness. I am reporting ~80% utilization and have at least one FICO score of 633. That is the difference between accepting any offer a lender makes up (and getting denied most of the time), versus just getting a higher interest rate. Mortgages still possible, supposedly.

You aren't getting the updated dozen-or-so FICO scores here? Quarterly credit reports? As They Happen alerts on the FICO 8 scores? Identity theft monitoring if your info shows up on black market websites?

hahaha, blasphemy I know

I currently use Credit Karma, and a couple of the credit cards issuers are providing me with scores. They are mostly Vantage Scores. The Barclays one is providing me a transunion FICO score even online, I see.

I've had other services in the past, I'll think about it if my curiousity is piqued

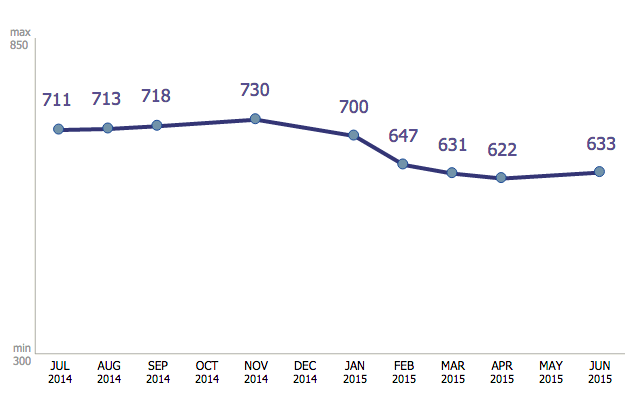

Here is my TU FICO over time, from ~0% utilization to 83% utilization.

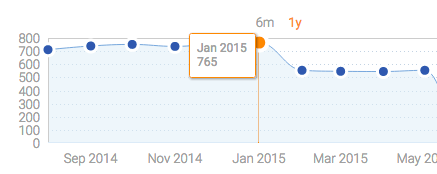

Here is my TU Vantage Score over time, from ~0% utilization to 83% utilization. A high of 765 to a low of 545. (There is a glitch in credit karma reporting a 0 score for June. Since that is not possible, consider the dip at the right side of the graph erroneous)

These scoring models are wildly different, while using the same scales.

Remember, my current Average Age of Accounts is less than 3 years. Although I have much longer history than that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

Just got an email from Citi mentioning they are offering free FICO Bankcard Score 8 reports from Exquifax. I got a 566 score.

FICO Bankcard Score 8 are not FICO 8 scores. FICO Bankcard Score 8 runs on a scale of 200 - 900 and also weights utilization more heavily than the FICO 8.

My Vantage Scores are lower.

I find it comical that my actual FICO 8 scores are higher than all, in a very beneficial way. (Although I only know my Transunion FICO 8 score). This is actually not good because lenders can be using any scoring model, and it is less and less likely they'll use just the FICO 8 at this point in time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Used over $100,000 in credit, here is what happened to my score

Citi Custom Credit Line decreased to $1000, from $12000

I'll be reapplying for that in the future since it was super convenient