- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: WHY DOESN'T MY SCORE MATCH???

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

WHY DOESN'T MY SCORE MATCH???

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WHY DOESN'T MY SCORE MATCH???

I see a lot of questions like the title over and over again and the same answer being posted repeatedly.

The answer is simple. There are more than one FICO scores.

How about we create one thread that answers all this same question that's being asked endlessly?

I know there is a stickied thread titled "Difference in Scores" but the answer isn't immediately apparent unless one reads through multiple pages.

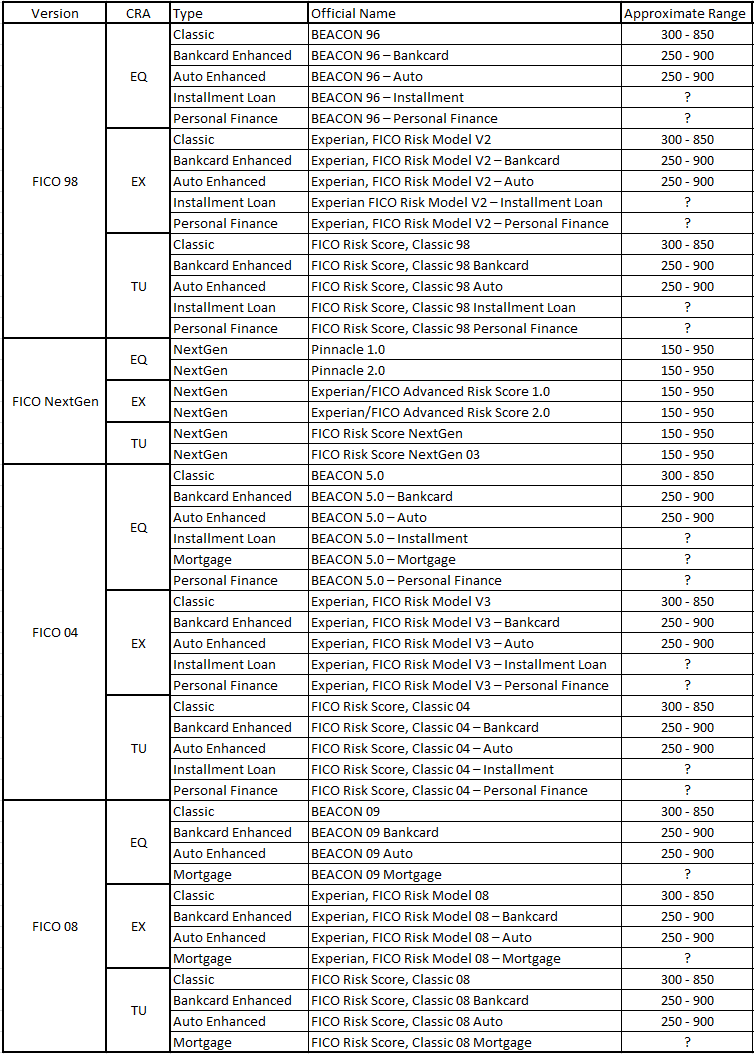

As a start, there are many different FICO scores. See pic below.

In fact, there are 49 different FICO scores from the 3 major credit bureaus: Equifax, Experian, and TransUnion.

17 Equifax

16 Experian

16 TransUnion

There are 4 model series. (in chronological order)

FICO 98

FICO NextGen

FICO 04

FICO 08

Within each model series, there are a few sub models namely,

Classic

Bankcard Enhanced

Auto Enhanced

Mortgage

etc.

(Not every model series has all of the above sub models.)

What is a FICO score?

FICO score is the most widely used measure of one's credit worthiness that lenders use to evaluate when making lending decisions.

As far as I know, a company called FICO is the one that makes the credit score algorithms named FICO scores.

Credit Bureaus are the ones that collect consumer credit data.

To get your score, they input your credit history data into the scoring algorithms to produce one of the 49 FICO scores.

It's like a function y = f(x). FICO makes the f( ) while credit bereaus provides the x and y is your credit score.

Why are there so many different FICO scores?

Credit scores evolve. FICO creates newer versions of their credit scoring model as time goes to better measure credit worthiness. The first FICO score I think was actually a FICO 95 score but that one is now completely out of the market. The oldest one now is FICO 98. The above table is all in chronological order with FICO 98 being the oldest and FICO 08 being the newest.

Which one will my lender pull?

As you may have guessed, the newer models hold more and more weight when applying for credit these days. Most prime credit card lenders use a variation FICO 08 models, usually FICO 08 Classic or FICO 08 Bankcard Enhanced while most if not all mortgage lenders use the FICO 04 Classic scores.

In my personal experience, these lenders use a variation of the FICO 08 model series for their credit card apps. (Note however, some may have their own internal scoring system that they use along side your FICO score and approval is not guaranteed with high FICO alone.)

Lender that use FICO 08 for credit cards:

Chase

Citi

Amex

Discover

Barclay's

Lenders that use FICO 04 for credit cards:

Capital One

US Bank

Lenders that use FICO NextGen for credit cards:

PenFed

Which ones does MyFico sell?

EQ FICO 08 Classic

EX FICO 08 Classic

TU FICO 08 Classic

Why doesn't the score my lender pulled match the scores I purchased on MyFICO?

Before asking this question, find out first which FICO score your lender pulled. If they're not one of the three FICO 08 Classic scores, then that's the reason the scores don't match. That doesn't mean one of the scores is fake. They're both real. It's just that there are 49 of them out there and the scores can differ significantly from model to model. I had my score differ by 96 points on the same day before.

Also, when a lender denies your application and sends you a rejection letter, look inside to find out what your FICO score is. Also pay attention to the range of the score.

If it says the score ranges from 300 - 850, it is likely a variation of a Classic score.

If it says the range is from 250 - 900, it is likely an bankcard enhanced score.

Sometimes, the three credit bereaus have slightly different credit histories which can cause your scores to differ.

Is Credit Karma or any other credit score providing service real FICO?

I find that the easiest way to tell whether a credit score is FICO or not is to look at the service provider's website and see if they say the word "FICO" in their product description. If not, you can be almost 100% certain that it is not a FICO score. AFAIK, over 90% of all lenders in America use FICO scores. They are the most covetted credit scores for consumers out there and if someone is selling FICO score, they will make damn sure to let everyone know that it's a FICO score they're selling and not some FAKO. The ones that sell FAKO tend to say stuff like "your real credit score". Whatever, if it doesn't say FICO, it's not FICO and it doesn't matter.

To answer the question, no Credit Karma score is not FICO last I checked. It was some score called the TransRisk score which doesn't count closed accounts towards AAoA.

I am running out of time so I will stop writing here. I may write more info later on. Please let me know if you have more information you would like to add.

But please people, before complaining and calling one of the FICO scores a scam, know there are 49 different FICO scores and compare apples to apples first.

[5%] Gas, Grocery, Amazon, Airline tickets, Drug Stores, Dept. Stores, Target, MyHabit

[3%] Restaurants

[2%] Everything Else

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WHY DOESN'T MY SCORE MATCH???

Anyone else have this problem?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WHY DOESN'T MY SCORE MATCH???

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WHY DOESN'T MY SCORE MATCH???

If your credit is bad, it is bad. Applying a different formula to get a different score will not change that fact. You need to address the reasons your credit is bad and then worry about the score. Check out the rebuilding forum and post your info there. Lots of folks will be glad to guide you through the process of rebuilding.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WHY DOESN'T MY SCORE MATCH???

Cap1 QS - 2k (4/21)

Mission Lane - 4k (11/21)

Venmo - 900 (11/21)

SavorOne - 2500 (12/21)

VentureOne - 2000 (7/22)