- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- UPDATE - 100pt Mortgage Score Increase!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

UPDATE - 100pt Mortgage Score Increase!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

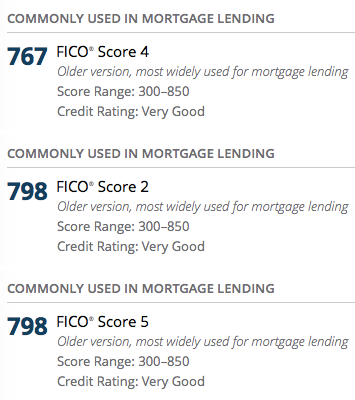

Re: What kind of score increase will I get?

@HeavenOhio wrote:CCID, if the ceilings on these scores are 818 and 839, do you have any idea why myFICO tells us that the ceiling is 850? What's the ceiling for EX?

It's disturbing that FICO should (via its subsidiary myFICO) state something that it must surely know to be false. I first found out about the fact the mortgage models had different scoring ranges than the 300-850 several years ago when a mortgage lender did a preapproval for me. They gave me a copy of my tri-merged report and scores, which also gave the true score ranges in fine print. I was stunned weeks later when I looked more closely and saw the actual ranges.

The actual ranges for the three mortgage scores are:

EQ FICO O4 = 334 to 818

TU FICO O4 = 309 to 839

EX FICO 98 = 320 to 844

FICO 08 does indeed have ranges of 300-850, though I am pretty sure that the 300 is not precisely accurate. I think I am have seen some published stuff that implies clearly that a score of exactly 300 or 301 (say) is impossible. That level of picky accuracy, however, would feel like overkill, so I am fine with FICO claiming a lower range of 300. It's the high ranges that I think FICO should be accurate about. FICO 8 really does have a top range of 850 and there are many people who get 850s.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of score increase will I get?

UPDATE:

I have a medical collection DELETED!! It was from 2011, and scheduled to fall off due to age in January 2018. The collection was with an attorney, not an agency. I've tried contacting them to see about payment and discovered the attorney is no longer practicing.

As of now, my Equifax report has one collection left from FCO, which has been paid and is at $0 balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of score increase will I get?

UPDATE:

Just got the alert on myFICO that my Experian FICO 08 score went up 15 points by paying the NFCU card down. I left a $75 balance on that one.

Equifax increased 10 points as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of score increase will I get?

Excellent news! So when is the FCO paid due to fall off reports?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of score increase will I get?

FCO is scheduled to fall off on January 2018.

The good thing is that pretty much all of my collections happened in 2011, so they are falling off between August 2017-January 2018 according to what's on the credit reports.

I'm now calling Experian everyday to get the early exclusion for National Credit Systems. Everytime they keep saying call back May 15th, but that is literally seven days away now, so I'm hoping for some good news now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of score increase will I get?

UPDATE:

Got a myFICO alert that my Equifax dropped 7 points. When the alert came through, it looks as if it's using the reason that my student loans were paid off through consolidation. So I'm getting dinged for not having any open installment loans reporting. My new servicer is FedLoan and I've heard stories that they can sometimes take up to 4 months to appear on your credit. I'm currently in school, so whenever the new loan appears it should have the remarks "student payment deferred".

My next full report is on May 13th, so that's also the date I will have updated scores.

On another note, my CK scores updated today and my Equifax jumped 50 points. Changes on my account include:

1. Now showing $0 balance on student loans. Previous balance was $65K.

2. Now showing 0 collections. If you remember I had a medical collection removed, and also asked for the FCO collection to be removed so I guess that happened?

3. CC Utilization dropped. NFCU card was at 63% and is now at 7%.

CK Transunion jumped 18 points due to NFCU card utilization going from 63% to 7%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of score increase will I get?

Thanks for the update. A month ago you had open loans on your report on which you owed 65k. What was the original amount borrowed on those open loans? (As it appears on your credit reports?)

I am guessing that the original amount was a bit more than 65k, but not much more, since you only took a 7 point hit on FICO 8 for the loan payoff.

If you can give us an exact number, that will be a help to the scoring geeks on this site. It will give us more insight into how FICO 8 scores installment loans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of score increase will I get?

@Anonymous wrote:Thanks for the update. A month ago you had open loans on your report on which you owed 65k. What was the original amount borrowed on those open loans? (As it appears on your credit reports?)

I am guessing that the original amount was a bit more than 65k, but not much more, since you only took a 7 point hit on FICO 8 for the loan payoff.

If you can give us an exact number, that will be a help to the scoring geeks on this site. It will give us more insight into how FICO 8 scores installment loans.

CGID, actually the original amounts were LOWER than the current balance. I only had two student loans on my account.

1. Original Balance $12,697

Date Opened: May 1, 2012

Payment Status: Current, was 120 past due (happened in Dec 2012)

Account Status: Closed

Balance: $17,307

Comments: Student loan payment deferred

2. Original Balance: $34,375

Date Opened: December 1, 2010

Payment Status: Current, was 90 days past due (happened Apr 2012)

Account Status: Closed

Balance: $45,182

Comments: Student loan payment deferred

The student loans are only on my Experian and Equifax reports. Both are reporting the same thing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of score increase will I get?

Very helpful. So you had an installment utilization well over 110%, and then that changed to no open loan at all.

A few more questions.

(1) You mention that your EX score took a 7 point hit when the loan payoff/closure appeared on that report. Has it appeared yet on EQ? If so, have you experienced a score change there?

(2) Is there anything else besides the loan payoff that could have occured close to the same time that might have contributed to the 7 point score loss? For example, did the number of credit cards showing a $0 balance go down? Or did your total utilization go up?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of score increase will I get?

@Anonymous wrote:

@HeavenOhio wrote:CCID, if the ceilings on these scores are 818 and 839, do you have any idea why myFICO tells us that the ceiling is 850? What's the ceiling for EX?

It's disturbing that FICO should (via its subsidiary myFICO) state something that it must surely know to be false. I first found out about the fact the mortgage models had different scoring ranges than the 300-850 several years ago when a mortgage lender did a preapproval for me. They gave me a copy of my tri-merged report and scores, which also gave the true score ranges in fine print. I was stunned weeks later when I looked more closely and saw the actual ranges.

The actual ranges for the three mortgage scores are:

EQ FICO O4 = 334 to 818

TU FICO O4 = 309 to 839

EX FICO 98 = 320 to 844

FICO 08 does indeed have ranges of 300-850, though I am pretty sure that the 300 is not precisely accurate. I think I am have seen some published stuff that implies clearly that a score of exactly 300 or 301 (say) is impossible. That level of picky accuracy, however, would feel like overkill, so I am fine with FICO claiming a lower range of 300. It's the high ranges that I think FICO should be accurate about. FICO 8 really does have a top range of 850 and there are many people who get 850s.

The range has been published everywhere for around two decades as 300-850; the fact that there were mutually exclusive things (as I understand it but no direct proof) which prevented an 850 from ever being reached in the highest scoring buckets I don't know is worth getting irritated about... gold plated is gold plated afterall.