- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What the F!!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the F!!!!!!

@Anonymous wrote:

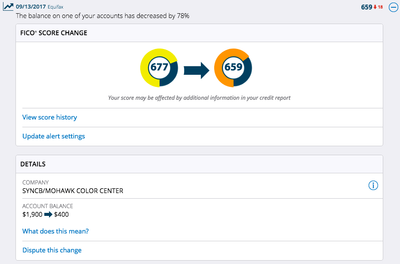

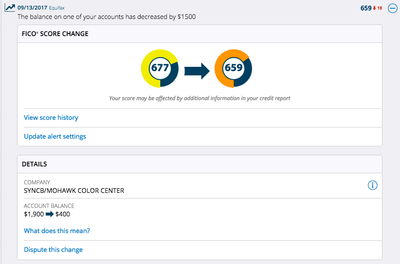

@Anonymous wrote:1) Synchronicity / Mohawk Flooring credit card with $2000 limit. Went from $1900 to $400 and my EQ score went from 677 to 659. Yay me!

2) Another Synchronicity / Mohawk Flooring credit card with $2000 limit. Went from $1527 to $327 and my Experian score went from 666 to 662. Why? WHY? WHYYYYY?? (I know 4 points is negligible, but why a drop when I go from 76% utilization to 16%?

Under FICO scoring, neither paydown that you gave above could possibly lower your credit score. The only time paying down a revolver would lower your credit score is if you paid it down to $0 and that resulted in ALL of your revolvers reporting $0 balances at the same time. Since with both illustrations you gave above all you did was lower your balance(s), they would have still reported as positive (non-zero) balances and thus your scores cannot drop from that. I'm not saying your scores didn't drop, I'm just saying it wasn't from paying down your cards. Paying down utilization aside from all zero balances reported can only do one of two things to your score. One, raise it. Two, keep it exactly the same. It would raise it if lowering the utilization resulted in crossing a utilization threshold. If not, it would stay the same.

For the alert MyFico sent where my scores went down, the MyFico alert said this:

The other was similar. It is wrong to tie the score drop with the event when reported in the same Alert?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the F!!!!!!

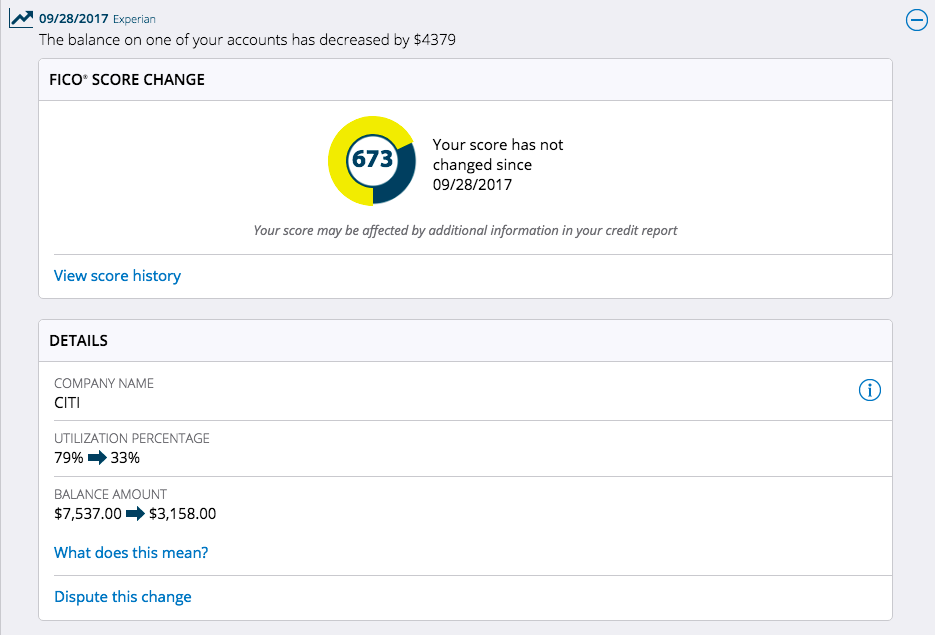

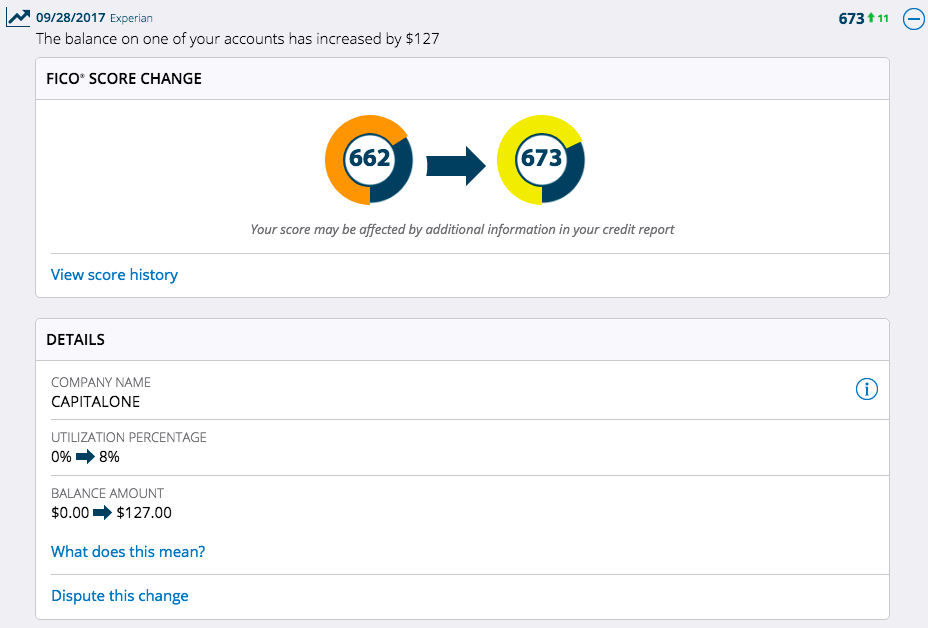

And who can explain this... I pay down a big chunk of debt on a card and no movement from Experian. But see below...

I go into debt on a card for $127 measley bucks and my score goes up by 11 points?? What the what??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the F!!!!!!

@Anonymous wrote:It is wrong to tie the score drop with the event when reported in the same Alert?

That's right.

The alert is describing a way your report has changed. (In this case, one of your credit card balances went down.) When an "alertable" event occurs, the MF 3B monitoring product pulls your score again.

The message is explaining what the alertable event was. But there are a lot of events that are not alertable. What must have happened (with 100% certainty) is that something else changed on your report, either on the same day or in the previous several weeks. That other thing is what is causing your score to go down. It's just that this bad thing apparently wasn't alertable, so your score wasn't pulled at the time.

Again, it's really important to understand what these alerts are and what they are not. Most of us assume that when our score changes then MF sends us an alert telling us why. This is not what the alerts are. What the alerts do is tell you -- in a very limited set of circumstances, not all the time -- when the report has changed. The alert is telling you what alertable event happened.

You should congratulate yourself that you are coming to understand scoring well enough to realize that a credit card balance going down would be very unlikely to cause your score to go down. (The only exception would be if the balance decrease brought all your cards to $0.)

Some people find an "alert" based system confusing and unhelpful, since it cannot be relied on (even most of the time) to explain why your score has changed. Such people switch to a system like CCT, which enables you to control when your score is pulled or (like me) they just use free tools to get their monthly FICO score and credit reports.

Some things are definite gray areas in credit scoring, where nobody knows for sure how FICO is working. But CC balances are not one of them. All credit profiles are optimized when having most of the credit cards reporting at $0 and a small positive balance on one. CC balances going down (by themselves) either keep your score stable or it improves it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the F!!!!!!

Thanks CGiD... I pay for MyFico so I can keep close tabs on what's going on while I'm rebuilding my credit. I suppose at some point it won't be necessary, and the free tools I get with a couple of my cards will suffice.