- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Why did I lose 14 points from this?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why did I lose 14 points from this?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did I lose 14 points from this?

Oilcan12

CAPTOOL's data is rather explicit in showing 2 breakpoints for aggregate installment loans:

CAPTOOL's event sequence viewed in aggregate:

(525+4558)/7050 = 72.1% => (125+4558)/7050 = 66.4% => 125/2050 = 6.1%

* ........score 712 @ 72% => score 723 @ 66%, score 722 @ 66% => score 741 @ 6%

The aggregate view suggests a breakpoint between 72% to 66% (at 70%?) and one with a larger impact going from 66% to 6% [at 9% per SJ data].

1) Essentially the 1st is at 70%

2) a 2nd one with larger impact at some lower B/L ratio. When coupled with SJ's data that 2nd breakpoint appears to be about 9%. Your data appears to support this lower breakpoint as well. Not able to rationalize how your data refutes a 2nd, higher, B/L breakpoint at 70%.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did I lose 14 points from this?

@Thomas_Thumb wrote:Oilcan12

CAPTOOL's data is rather explicit in showing 2 breakpoints for aggregate installment loans:

CAPTOOL's event sequence viewed in aggregate:

(525+4558)/7050 = 72.1% => (125+4558)/7050 = 66.4% => 125/2050 = 6.1%

@ * ........score 712 @ 72% => score 723 @ 66%, score 722 @ 66% => score 741 @ 6%

The aggregate view suggests a breakpoint between 72% to 66% (at 70%?) and one with a larger impact going from 66% to 6% [at 9% per SJ data].

1) Essentially the 1st is at 70%

2) a 2nd one with larger impact at some lower B/L ratio. When coupled with SJ's data that 2nd breakpoint appears to be about 9%. Your data appears to support this lower breakpoint as well. Not able to rationalize how your data refutes a 2nd, higher, B/L breakpoint at 70%.

If all goes well I will be testing each 10% potential threshold... hoping there are some thresholds in between 10% and 70%. For now I'm at 69%, testing the 70% level. Will have those results around August 11th.

As mentioned, 80% seemed to be either a minor event or a non event.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did I lose 14 points from this?

@Thomas_Thumb wrote:Oilcan12

CAPTOOL's data is rather explicit in showing 2 breakpoints for aggregate installment loans:

CAPTOOL's event sequence viewed in aggregate:

(525+4558)/7050 = 72.1% => (125+4558)/7050 = 66.4% => 125/2050 = 6.1%

@ * ........score 712 @ 72% => score 723 @ 66%, score 722 @ 66% => score 741 @ 6%

The aggregate view suggests a breakpoint between 72% to 66% (at 70%?) and one with a larger impact going from 66% to 6% [at 9% per SJ data].

1) Essentially the 1st is at 70%

2) a 2nd one with larger impact at some lower B/L ratio. When coupled with SJ's data that 2nd breakpoint appears to be about 9%. Your data appears to support this lower breakpoint as well. Not able to rationalize how your data refutes a 2nd, higher, B/L breakpoint at 70%.

Thomas_Thumb

You are talking about aggregate installment loans and applying that data to individual types of installment loans. I don't see the connection. To make that reach, you have to assume that all installment loans are scored the same. There is no evidence to suggest that is the fact.

I really didn't want to get into a long explanation. But, since you insist.

I gained 39, 38 and 34 points from going to approximately 12% to 8.5% on a secued installment loan. I took a second secured installment loan. There was an overlap of a couple of weeks where both loans were reporting. There was no score change.

Then, my SDFCU loan reported as closed.

I think by this time we should all agree that FICO 8 does not score closed installment loans.

There was no score change.

In other words, 12% to 8.5% resulted in the same scoring effect as 100% to <10%.

I consider this evidence to be conclusive that there is only one break point, at 10%, for my profile.

That does not mean that it is not possible that there is a 70% break point for dirty reports. And, I do not believe that data from aggregate loans can be applied to any type of installment loan.

Once again, I have to mention the fact that no one has demonstraped a 70% break point for a single secured installment loan. The 70% break point has only been demonstrated for aggregate loans. Making a connection between the two is a matter of philosophy, not experimentation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did I lose 14 points from this?

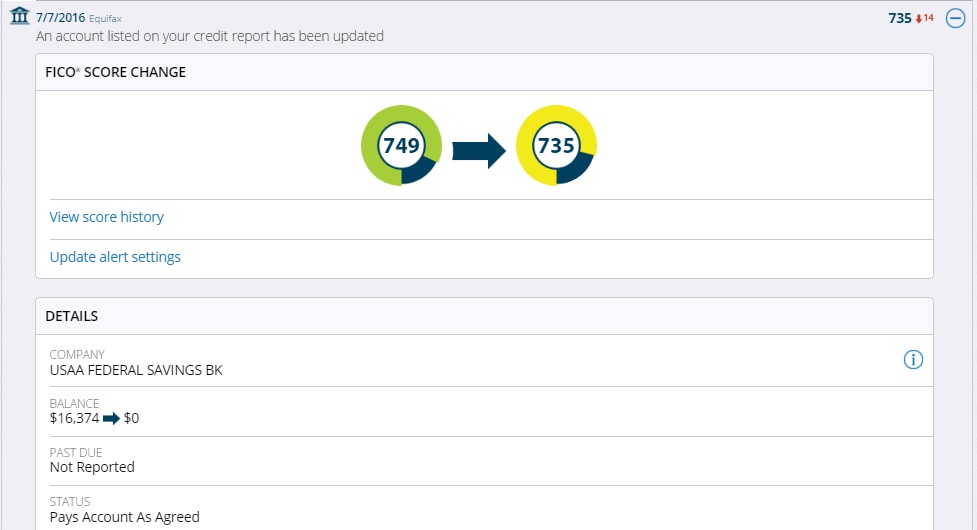

I got the exact 14 point drop on EQ 08 last week during a refi. The new loan is reporting at 100% utilization and the closed loan was at 78%. Both are reporting so I do have an open instalment loan on EQ.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did I lose 14 points from this?

oilcan12 wrote:

Thomas_Thumb

You are talking about aggregate installment loans and applying that data to individual types of installment loans. I don't see the connection. To make that reach, you have to assume that all installment loans are scored the same. There is no evidence to suggest that is the fact.

I really didn't want to get into a long explanation. But, since you insist.

I gained 39, 38 and 34 points from going to approximately 12% to 8.5% on a secued installment loan. I took a second secured installment loan. There was an overlap of a couple of weeks where both loans were reporting. There was no score change.

Then, my SDFCU loan reported as closed.

I think by this time we should all agree that FICO 8 does not score closed installment loans.

There was no score change.

In other words, 12% to 8.5% resulted in the same scoring effect as 100% to <10%.

I consider this evidence to be conclusive that there is only one break point, at 10%, for my profile.

That does not mean that it is not possible that there is a 70% break point for dirty reports. And, I do not believe that data from aggregate loans can be applied to any type of installment loan.

Once again, I have to mention the fact that no one has demonstraped a 70% break point for a single secured installment loan. The 70% break point has only been demonstrated for aggregate loans. Making a connection between the two is a matter of philosophy, not experimentation.

So perhaps shared secured has no scoring "impact" if you have other types of "higher commitment" open loans [auto, mortgage] on file?

I'll be interested to see what SJ's results show.

I have only ever had a mortgage and relatively high B/L ratios [50% to 70% range] are not harmfull to Fico 08 score. That is rational as mortgages are long term commitments. Demonstrating an ability to pay down to some extent is important but, negatively impacting score until B/L gets to a trivial, under 10%, level is not advantageous to borrowers not lenders.

Elim - Your data (mortgage related - yes?) appears to support Olican's 80% hypothesis for mortgages.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did I lose 14 points from this?

@Thomas_Thumb wrote:@oilcan12 wrote:

Thomas_Thumb

You are talking about aggregate installment loans and applying that data to individual types of installment loans. I don't see the connection. To make that reach, you have to assume that all installment loans are scored the same. There is no evidence to suggest that is the fact.

I really didn't want to get into a long explanation. But, since you insist.

I gained 39, 38 and 34 points from going to approximately 12% to 8.5% on a secued installment loan. I took a second secured installment loan. There was an overlap of a couple of weeks where both loans were reporting. There was no score change.

Then, my SDFCU loan reported as closed.

I think by this time we should all agree that FICO 8 does not score closed installment loans.

There was no score change.

In other words, 12% to 8.5% resulted in the same scoring effect as 100% to <10%.

I consider this evidence to be conclusive that there is only one break point, at 10%, for my profile.

That does not mean that it is not possible that there is a 70% break point for dirty reports. And, I do not believe that data from aggregate loans can be applied to any type of installment loan.

Once again, I have to mention the fact that no one has demonstraped a 70% break point for a single secured installment loan. The 70% break point has only been demonstrated for aggregate loans. Making a connection between the two is a matter of philosophy, not experimentation.

So perhaps shared secured has no scoring "impact" if you have other types of "higher commitment" open loans [auto, mortgage] on file?

I'll be interested to see what SJ's results show.

I have only ever had a mortgage and relatively high B/L ratios [50% to 70% range] are not harmfull to Fico 08 score. That is rational as mortgages are long term commitments. Demonstrating an ability to pay down to some extent is important but, negatively impacting score until B/L gets to a trivial, under 10%, level is not advantageous to borrowers not lenders.

This is something I have often wondered about.

I'm not saying that the secured installment has no scoring impact, but perhaps the aggregate loan utilization is scored according the the "higher commitment" open loan. At this point, I believe everything is up in the air.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did I lose 14 points from this?

I just checked my TU score. It's still at 729. It didn't lose any points and didn't gain any points. Then I jumped over to CK to view my TU and EQ reports. TU shows that jet ski loans that we were talking about as being closed in 2007/'08. EQ shows them before closed recently. So I'm sitting here wondering -

Why both reports don't show the same dates for when the loans were closed? I can see them being off a month but not 7-8 years.

Was the 14 point loss because EQ started reporting the loans as being closed?

Did my EQ score gain 13 points because my auto loan reported at 69%?

Was the whole thing a coincidence/fluke and we're never really going to understand scoring anyway?

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did I lose 14 points from this?

This has been really weird, I can 't wait to see what happens on my hubby's last installment payment oh goodness.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did I lose 14 points from this?

@oilcan12 wrote:

@Thomas_Thumb wrote:@oilcan12 wrote:

Thomas_Thumb

You are talking about aggregate installment loans and applying that data to individual types of installment loans. I don't see the connection. To make that reach, you have to assume that all installment loans are scored the same. There is no evidence to suggest that is the fact.

I really didn't want to get into a long explanation. But, since you insist.

I gained 39, 38 and 34 points from going to approximately 12% to 8.5% on a secued installment loan. I took a second secured installment loan. There was an overlap of a couple of weeks where both loans were reporting. There was no score change.

Then, my SDFCU loan reported as closed.

I think by this time we should all agree that FICO 8 does not score closed installment loans.

There was no score change.

In other words, 12% to 8.5% resulted in the same scoring effect as 100% to <10%.

I consider this evidence to be conclusive that there is only one break point, at 10%, for my profile.

That does not mean that it is not possible that there is a 70% break point for dirty reports. And, I do not believe that data from aggregate loans can be applied to any type of installment loan.

Once again, I have to mention the fact that no one has demonstraped a 70% break point for a single secured installment loan. The 70% break point has only been demonstrated for aggregate loans. Making a connection between the two is a matter of philosophy, not experimentation.

So perhaps shared secured has no scoring "impact" if you have other types of "higher commitment" open loans [auto, mortgage] on file?

I'll be interested to see what SJ's results show.

I have only ever had a mortgage and relatively high B/L ratios [50% to 70% range] are not harmfull to Fico 08 score. That is rational as mortgages are long term commitments. Demonstrating an ability to pay down to some extent is important but, negatively impacting score until B/L gets to a trivial, under 10%, level is not advantageous to borrowers not lenders.

This is something I have often wondered about.

I'm not saying that the secured installment has no scoring impact, but perhaps the aggregate loan utilization is scored according the the "higher commitment" open loan. At this point, I believe everything is up in the air.

This is only one possibility. It is conceivable 2 loans are simply scored differently than 1 loan. The scoring of the combination of loans doesn't necessarily have to be the same as either loan.