- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- >0% <9% utilization, one card FICO boost data poin...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

>0% <9% utilization, one card FICO boost data points: bank card versus store card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

The reason I looked at the score drop and thought "opps, must be the fact that the store card is the only one reporting" is that I had read AZEO advice here on more than one occasion that said when a single card reports a balance, it's better that it's a major card. So in response, I charged a pizza delivery to the next major card that would report, and the points came back. There were no changes to my report in the meantime, and the score stuck for several weeks until an entirely new card was added to my report.

Whether my experience qualifies as a data point or not, I think it's prudent to advise people that if they're aiming for optimum scoring, the one card that reports a balance should be something other than a score card. I don't say that on the basis of whether or not the data is solid or repeatable across lots of profiles. I say it on the basis of "better safe than sorry."

Unfortunately, I can't repeat this as a test because I recently closed both of my store cards. Even if I had still had them, it would have been difficult for me to find an opportunity to use them. They were stupid acquisitions to begin with, thus the closures.

Question… on the myFICO reports, where to I find "official" reason codes? In various spots, I've been told that my account age is both good and inadequate. And I've been told that my account mix is both good and insufficient. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

@HeavenOhio wrote:The reason I looked at the score drop and thought "opps, must be the fact that the store card is the only one reporting" is that I had read AZEO advice here on more than one occasion that said when a single card reports a balance, it's better that it's a major card. So in response, I charged a pizza delivery to the next major card that would report, and the points came back. There were no changes to my report in the meantime, and the score stuck for several weeks until an entirely new card was added to my report.

Whether my experience qualifies as a data point or not, I think it's prudent to advise people that if they're aiming for optimum scoring, the one card that reports a balance should be something other than a score card. I don't say that on the basis of whether or not the data is solid or repeatable across lots of profiles. I say it on the basis of "better safe than sorry."

Unfortunately, I can't repeat this as a test because I recently closed both of my store cards. Even if I had still had them, it would have been difficult for me to find an opportunity to use them. They were stupid acquisitions to begin with, thus the closures.

Question… on the myFICO reports, where to I find "official" reason codes? In various spots, I've been told that my account age is both good and inadequate. And I've been told that my account mix is both good and insufficient.

EX has been squirrley for me, but I wholeheartedly agree that better safe than sorry when optimizing and using a national bankcard to be sure.

MF gives reason codes under the additional scores, full for every model there; they give a truncated set for FICO 8 and those are in the red 1, 2, etc listing. The ones on the scales are bogus and corresponding 1-2-3 on positive side is bogus too, those aren't reason codes. It's awkward.

In the other thread where it gave that really shady high achievers have 6 cards, I did feedback that as well as the fact we only get two reason codes for FICO 8... my contact agreed with me so it'll be raised with the product team so maybe we'll see a change in the next iteration of the product which they're working on today. Baby wins heh.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

@Revelate wrote:

@Thomas_Thumb wrote:Actually, VantageScore 3.0 provides positive reason codes. It's part of their core principles. Their positive codes start with a "P". Helps differentiate them from Fico - and yes Fico only has a list of codes that relate to adverse action. Thus, no "official" list of positive actors such as a long payment history. Here is a list of VS3 positive codes.

Thanks senor for correcting me on VS3; with your godlike file have those ever come up on your VS3 pulls? Not sure if you have a place which gives Vantage reason codes, I get some from Alliant but to date even with a laudable VS 3 (EX 803) it's still 4 negative reason codes. Good find, much appreciated!

Yes - I signed up for a trial TU monitoring service back in late 2015 and received a 3B report and other stuff such as insurance scores as part of the package.

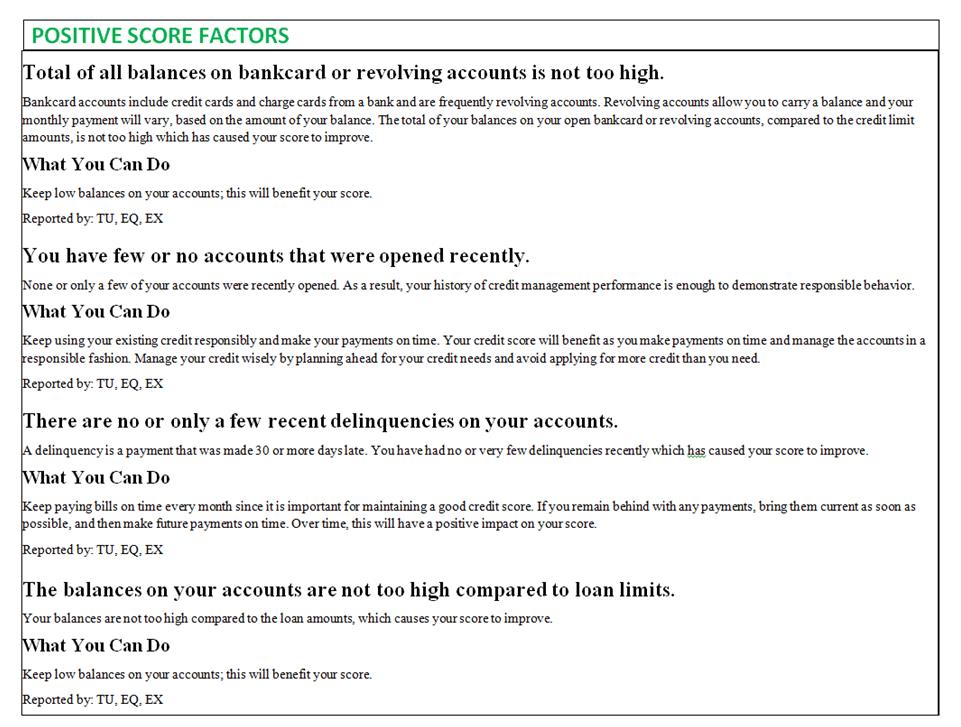

Pasted below are the positive reason statements [received a few negatives as well but, why air dirty laundry].

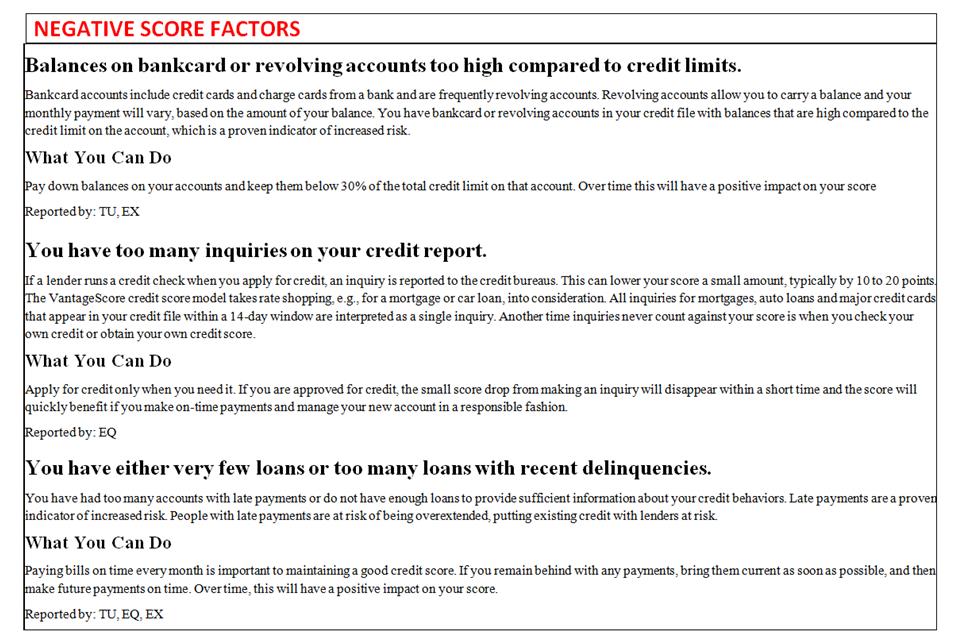

OK - for the sake of knowledge, here are the negative reason statements from the report.

P.S. VantageScores at the time:

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

@Revelate wrote:Probably because it was known. Check here or any of the other credit sites, it doesn't come up often as it's assumed to be universally understood.

I think "universally understood" is a gross exaggeration on your part. Maybe for 5+ year myFICO members. I've been a member for a year and have not read about this, so I'm sure there are far more members that have been here an even shorter amount of time that aren't aware of it either. My point is that it clearly isn't universally understood. I'm not saying you're wrong in your statements regarding negatives vs positive reason codes, but I think you should consider reevaluating your delivery on topics that may come as obvious or second nature to you and not necessarily to everyone else.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

@Anonymous wrote:

@Revelate wrote:Probably because it was known. Check here or any of the other credit sites, it doesn't come up often as it's assumed to be universally understood.

I think "universally understood" is a gross exaggeration on your part. Maybe for 5+ year myFICO members. I've been a member for a year and have not read about this, so I'm sure there are far more members that have been here an even shorter amount of time that aren't aware of it either. My point is that it clearly isn't universally understood. I'm not saying you're wrong in your statements regarding negatives vs positive reason codes, but I think you should consider reevaluating your delivery on topics that may come as obvious or second nature to you and not necessarily to everyone else.

*shrug* I admitted above that it was failure of the board, and you know what they say about assumptions. Also I would suggest you also re-evaluate your delivery in this thread; I'll admit I'm not at my best as I have a bout of tonsillitis that was driving a feriocious headache and I apologize for coming off more heavy-handed than was warranted or intended, but there's blame to go around here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

I'm not sure what the additional statements are that you're referring to. I just found your post to which spawned this discussion to be a bit abrasive... It came off as, "everyone already knows that, so you should too." Just my opinion and no doubt others didnt take it that way, but then again it was directed at me so naturally I have a different perspective. There's no animosity. I learned something new which is the main reason I visit this forum in the first place, so ultimately mission accomplished.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

@Revelate wrote:

EX has been squirrley for me, but I wholeheartedly agree that better safe than sorry when optimizing and using a national bankcard to be sure.

MF gives reason codes under the additional scores, full for every model there; they give a truncated set for FICO 8 and those are in the red 1, 2, etc listing. The ones on the scales are bogus and corresponding 1-2-3 on positive side is bogus too, those aren't reason codes. It's awkward.

In the other thread where it gave that really shady high achievers have 6 cards, I did feedback that as well as the fact we only get two reason codes for FICO 8... my contact agreed with me so it'll be raised with the product team so maybe we'll see a change in the next iteration of the product which they're working on today. Baby wins heh.

Thanks! I'll take a look at the reason codes and zero in on them. There's likely nothing I can do about any of them. Account age can only be addressed by only applying for credit I need or really want. That's something one would hopefully do anyway. And I'm not going to get an installment loan only to improve my mix of credit. as my scores don't need the bump.

My Experian report has been rock solid as far as predictabllity goes, but as I mentioned above, I wasn't surprised by the store card effect. TransUnion is boring; nothing happens.

My Equifax report has been more interesting. In the last two to three weeks, changes have gone like this:

- Store card closed (eight open cards to seven): 1 point ding

- Change from two cards with balances to one: 6 point bump

- Change from one card with a balance to two: 5 point ding (a point out of nowhere?)

- Another store card closed (seven open cards to six): 1 point ding

My file is really thin. Since I started watching my scores and reports on myFICO in February, I've gone from seven cards to eight to six. I have no negatives. And I have no loans. I have two accounts from local electric bills, one open and one closed. Both accounts show up on TU, only the open account shows up on EX, and neither shows up on EQ. With a file this thin, it's usually easy to tie a scoring change to an event.

Anyhoo, the dings related to the store card closures surprised me because I hadn't heard about that before. Could it be that the closures caused me to have a slightly greater percentage of cards reporting a balance?

The point out of nowhere was more of a surprise. It came with my AMEX card reporting an increased balance (zero to ~$1,300). Also, there was a CLI, but my utilization is well below 8.9%, both on individual cards and overall. It crossed my mind that the card would have reached three months old. Could that be the reason for the bump?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

@HeavenOhio wrote:

There's likely nothing I can do about any of them. Account age can only be addressed by only applying for credit I need or really want. That's something one would hopefully do anyway. And I'm not going to get an installment loan only to improve my mix of credit. as my scores don't need the bump.

I maintain my own AAoA calculation in my financial spreadsheet that I update at least once a week (mostly cashflow forecasts and utilization monitoring). I started off with only one positive account (5 years) in January and then used my AAoA calculation to schedule when to apply for credit and keep myself in certain tiers.

Since I knew I only had 1 open positive account at 5 years, I scheduled my new accounts to bring me into the 2 year AAoA range but eventually knew I'd be down in the 12-23 month range ("poor") eventually this year. I did the Alliant SSL just as my average would bring me to 13.0 months average when it reports, and my next account I'll add will re-average everything down to 12.9 months average when I open it and it reports.

The good news is that even though I'll be stuck in the 12-23 months average for a year, they'll all age well together and in 2 years I should be in a better place when it comes to AAoA -- with hopefully enough accounts reporting that a future new account won't lower the average much at all.

For those rebuilding credit, I think monitoring and estimating AAoA before opening accounts is a key element. I never want to get below 12 months average, and a lot of folks doing mass apps of SCTs and other soft pull new accounts may be hurting themselves more than they need to.

As for the 1 point bump of yours, did your AAoA or age of new account move enough to give you a tiny score boost?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

@Anonymous wrote:

As for the 1 point bump of yours, did your AAoA or age of new account move enough to give you a tiny score boost?

I don't think it's AAoA. I calculated them recently, plus I have info from myFICO that matches my calculations. I won't be crossing a yearly mark for another month or two. My recent new card caused me to go from six years to five on EQ and EX while remaining at five on TU. EQ will go back to six years in a month or two. EX will take another four months or so beyond that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >0% <9% utilization, one card FICO boost data points: bank card versus store card?

@HeavenOhio wrote:

I don't think it's AAoA. I calculated them recently, plus I have info from myFICO that matches my calculations. I won't be crossing a yearly mark for another month or two. My recent new card caused me to go from six years to five on EQ and EX while remaining at five on TU. EQ will go back to six years in a month or two. EX will take another four months or so beyond that.

Might just be new account aging is all. Just seeing a one point bump would annoy the heck out of me, tho.