- myFICO® Forums

- This 'n' That

- myFICO® Product Feedback

- 3B Ultimate paying customer -- TransUnion backdate...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

3B Ultimate paying customer -- TransUnion backdated to June 8th score...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

3B Ultimate paying customer -- TransUnion backdated to June 8th score...

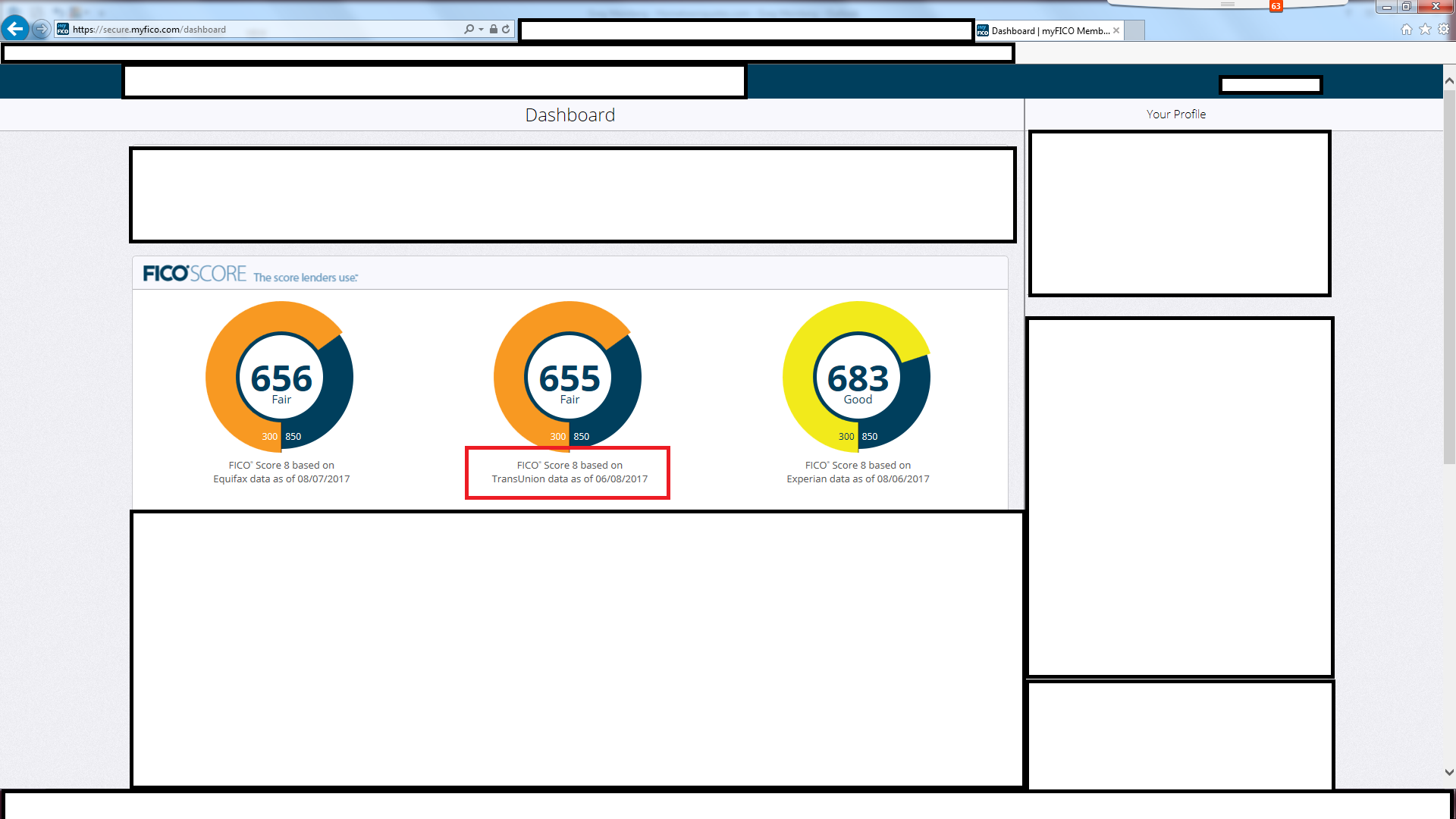

I've been emailing support on this. I'm not sure why this happened all of a sudden yesterday, but please see the screenshots below and notice the dates... Experian and Equifax are correct, but my TU updated Sunday and it was at 697. Come Monday (& today), it's reverted back to my score when I originally signed up for monitoring. The "Email Support" folks don't really seem to understand my issue. Is this just a glitch for a few days?

I ordered a CCT $1 trial yesterday to make sure my scores hadn't dropped and they haven't. I don't mind paying $30/month for this service to get instant (or next-day) changes to my score, especially as I rebuild. Not sure what's going on with this specific CRA. Please help!

Thanks!

What I have: NFCU | PenFed | General Electric CU | Wright Patt CU | Discover | BBVA | Apple Card (GS)

Total CL with Bank of America = $100,000 (Platinum Honors Merrill Client). I am a CERTIFIED FINANCIAL PLANNER™ practitioner, so feel free to message me if you have any planning/credit questions.

EQ 759, EX 765, TU 771 (06/10/2022)

I started with scores in the 400s in 2016. This forum is a Godsend--focus on the journey, be patient, and you'll definitely get there no matter the circumstances!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3B Ultimate paying customer -- TransUnion backdated to June 8th score...

Sorry for your problems but support is where you're going to have to try further to resolve this issue. Unfortunately no one here is going to be to provide that assistance,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3B Ultimate paying customer -- TransUnion backdated to June 8th score...

Yes, please call our support team for further assistance. 1-800-319-4433 from Mon - Fri 6am to 6pm Pacific Time and Sat 7am to 4pm Pacific Time

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3B Ultimate paying customer -- TransUnion backdated to June 8th score...

I can’t argue about accuracy, but something has drastically changed for the worse. It is along this same point.

I made heavy use of my credit cards to fix up a piece of rental property damaged during the hurricane. Immediacy was necessary for sake of my renters, and caused my utilization rate to climb over 80%. Once I received my insurance money I paid off all cards at once. These were large transaction well into 4 and 5 figures. As the system noted the payoffs reported by the various CRAs, NOTHING changed in my FICO score. For example, I would receive a notice stating “Your credit card balance decreased by 100%.” That would be followed by “One of your credit cards has decreased by $5,800.”

The point is that each of these values would be between 5% - 10% of my total available credit card limits. Over a long period, I would see my utilization drop in large degrees as the various CRAs reported the change. Yet, I had virtually no change to any FICO score (Equifax increased by 9 points one time). Nothing else changed (never late, no new credit, no derog remarks, excellent credit mix, etc.

Fundamentally, the only reason my credit dropped was the utilization – I understood that; however, it should have also risen appropriately (not as much I understand) as new data is supplied. BUT the new FICO has changed nothing. The old system would see that if your utilization increased from 5% to 80% you would drop a significant amount of points (let’s say 100 points for argument sake). But when it dropped from 80% back to 5% it should increase a significant number of points (let’s say 90 points).

Also the notifications would provide a play-by-play of CRA reporting. If TU showed that you lowered your utilization by 5% it would show your TU score increased (let’s say) 17 points. The next time TU showed that you lowered it another 9% your TU score would increase another 26 points (for example). Now you see nothing, but if you occasionally see something (like I did once) the new system does NOT change your dashboard, but makes you do the mental math!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3B Ultimate paying customer -- TransUnion backdated to June 8th score...

Going to call support Monday and let them have it. $40/month for days old alerts that are wrong isn't valuable.