- myFICO® Forums

- This 'n' That

- myFICO® Product Feedback

- FICO 3-Bureau Credit Monitoring FAQs about Monitor...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO 3-Bureau Credit Monitoring FAQs about Monitoring and Alerts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO 3-Bureau Credit Monitoring FAQs about Monitoring and Alerts

We’ve noticed a lot of questions surrounding a few specific features in our 3-bureau monitoring products—FICO® 3-Bureau Credit Monitoring and FICO® Identity Ultimate. Because of this, your admins have put together a series of FAQS that you can reference at any time. We will likely be adding a few more questions next week and then periodically as necessary.

EDITED 9/18/14 TO ADD: New alert comparison chart, two new FAQS.

EDITED 9/26/14 TO ADD: Updates for TransUnion Balance Change alerts

EDITED 10/13/14 to add updates to balance change alerts in first two questions

EDITED 1/21/16 to update Experian monitoring to $1 threshold

EDITED 2/21/18 to update new monitored data chart with more products

EDITED 4/03/19 to update new monitored data chart with new product names

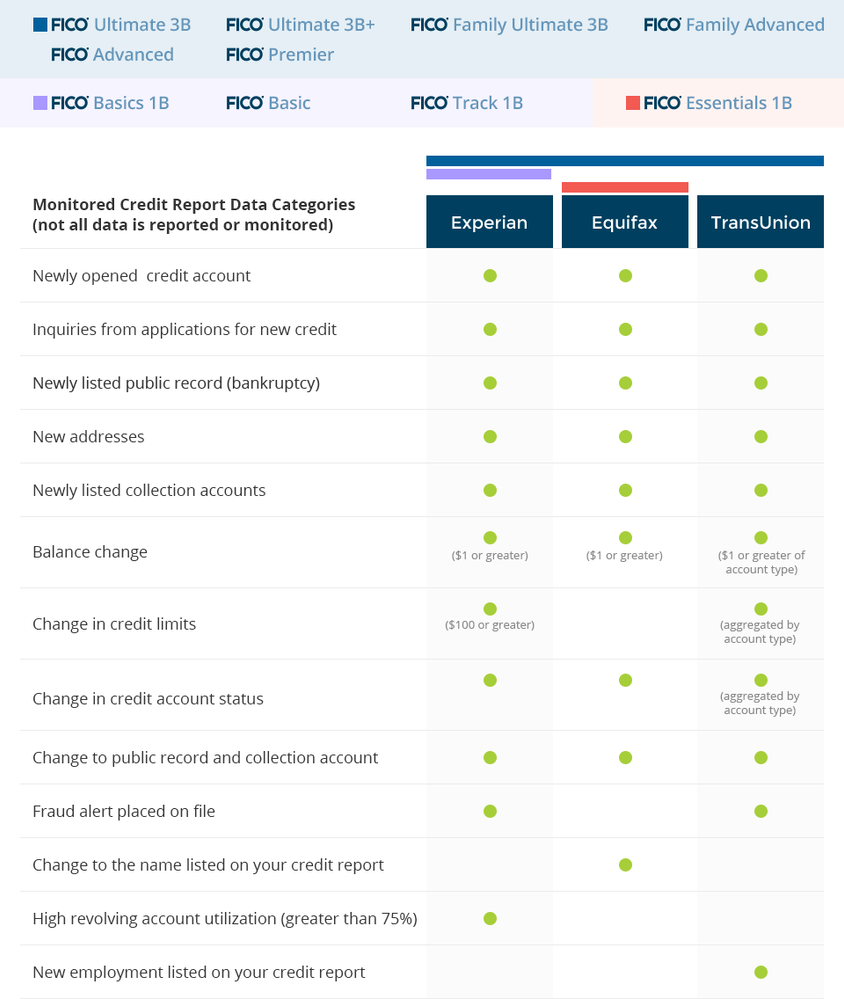

What types of alerts do I receive with the FICO® 3-Bureau Credit Monitoring product?

How long does it take before I start receiving alerts?

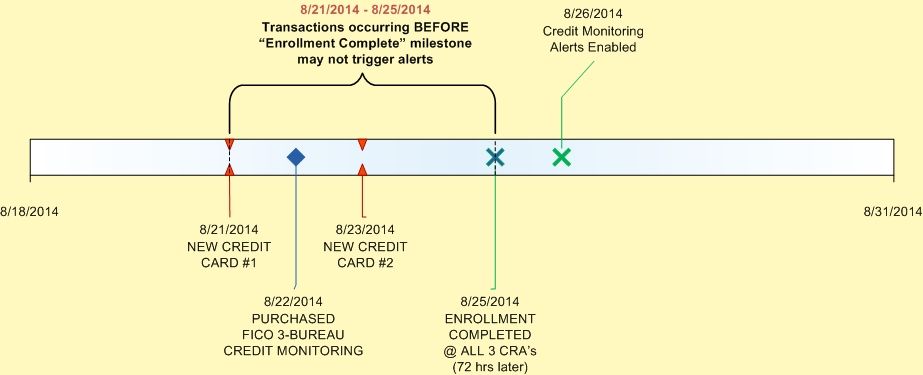

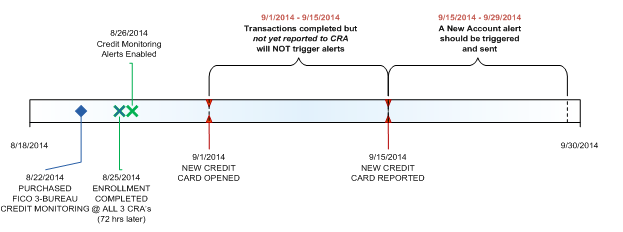

As soon as you are enrolled in FICO® 3-Bureau Credit Monitoring, you may start receiving alerts as soon as the next day, though the credit event triggers and thresholds can vary from bureau to bureau. Credit events that occur prior to the purchase (example NEW CREDIT CARD #1) of the product will not generate alerts. Credit monitoring for Experian and TransUnion may not begin for up to 72 hours (or more in the case of TransUnion) after purchase. As a result, credit events that occur during this enrollment window (example NEW CREDIT CARD #2) may not trigger alerts as your enrollment into the monitoring service is not yet complete. For TransUnion, credit events that occur even after the enrollment window may not trigger alerts because TransUnion alerts are triggered only after a baseline (i.e., your first post-enrollment credit event) is established in TransUnion’s systems - so this may result in a further delay in receiving your first alert. Once your first post-enrollment credit event baseline is established for TransUnion you will begin to receive TransUnion alerts for subsequent credit events. [see FAQ: When do I receive alerts about my FICO® Score?]

How does the FICO® 3-Bureau Credit Monitoring product monitor my FICO credit score?Note: For Experian and TransUnion, the credit monitoring service may not begin for up to 72 hours.

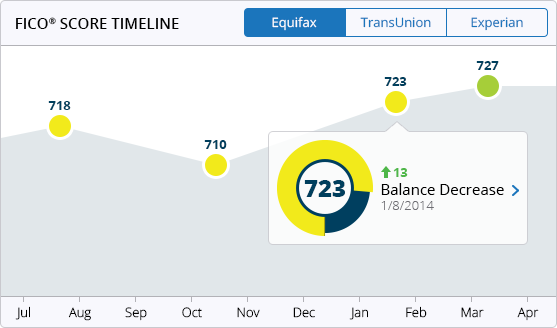

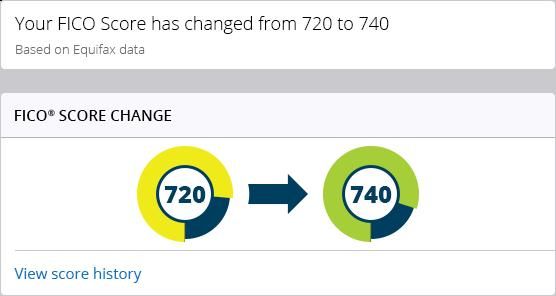

Every time a monitored credit file change is detected by the FICO® 3-Bureau Credit Monitoring product, your current FICO® Score is also included with the alert (please note that it is possible to have the current FICO Score be the same score as you previous score). When you pull a new credit report, a FICO Score is also included with the report. As an active subscriber, your FICO Scores are updated and tracked on the FICO® Score Timeline.

With the FICO® 3-Bureau Monitoring product, do I receive an alert every time my score changes?

No, the FICO® 3-Bureau Credit Monitoring product only provides score updates that are the direct result of a change to a monitored credit file. This happens through the credit file monitoring feature of the product. By monitoring a consumer’s credit file for key changes, the product detects changes to this file which triggers an alert containing details about the credit file change. This alert also contains an updated FICO® Score (please note that it is possible for the current FICO Score be the same as your previous score).

When do I receive alerts about changes in my FICO Score?

The FICO® 3-Bureau Credit Monitoring product provides daily monitoring of all 3 CRAs for key changes in a consumer’s credit file. Subscribers will receive alerts containing the credit file change and an updated FICO® Score for the following scenarios:

1. When a change on a monitored item is detected at TransUnion, Equifax or Experian, an alert with an associated current FICO Score is sent.

To illustrate this, consider the following example:

ACTION: You apply for a new line of credit

CREDIT FILE IMPLICATION: A new line of credit is now reported on your credit file and should be reported to one or more of the credit bureaus.

FICO 3-BUREAU CREDIT MONITORING ALERT: Once the new line of credit is reported to one of the credit bureaus and the credit bureau notifies myFICO of the change in your credit file, the FICO 3-Bureau Credit Monitoring product generates a credit alert informing you of the change to your credit file. This alert also contains the current FICO® Score.

NOTE: It is possible for the current FICO Score to be the same as the previous score and therefore, no actual increase/decrease to the FICO Score will have occurred even though the score is current. In this case, the alert will indicate that the “Score has not changed.”

2. When a FICO Score Alert is triggered specifically based on Equifax credit data

- Get notified when your FICO Score based on Equifax data reaches your target score

- Get notified when your FICO Score changes and puts you into a different estimated interest rate band on one of 3 types of loans.

- Get notified based on customized criteria set by users (default settings can be changed within the member center via Alert Settings) to alert for an Account Balance Change (increase or decrease) based on $ dollar amounts or % percentage amounts.

3. An alert for an Account Balance Change (increase or decrease) based on Experian credit data will be triggered when an account utilization change of 5% or more of the account’s credit limit has been detected.

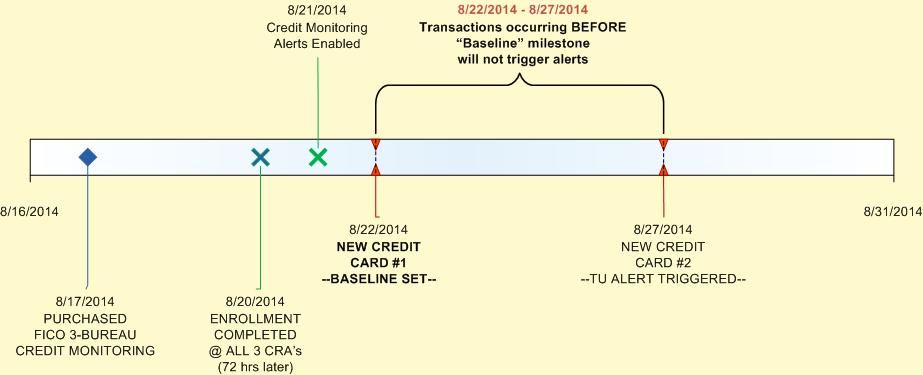

4. After enrolling in the monitoring service, a baseline has been set at TransUnion. The initial or first credit event will set a baseline against which all future changes are measured and alerted against. So using the example below, the first NEW CREDIT CARD #1 will set the baseline and no alert will be triggered. The second NEW CREDIT CARD #2 will result in a change to the monitored baseline and should trigger a New Account Alert. What this means to you is that there will likely be a delay of when you start receiving account balance change alerts for TransUnion.

What triggers an account balance change alert?

Account Balance Change alerts are triggered based on changes in an account’s balance and is triggered differently for each bureau. Please refer to the chart below for the specific trigger thresholds used by each bureau.

|

CREDIT REPORTING AGENCY |

TRIGGER THRESHOLD DEFAULT |

CONFIGURABLE |

|

TransUnion |

Change (increase or decrease) in an aggregated account balance across all accounts greater than $1 |

YES - Users can set notifications based on a $ dollar change. Default settings can be changed within the member center via Alert Settings |

|

Experian |

Change (increase or decrease) in account balance amount greater than $1 dollar |

YES - Users can set notifications based on a $ dollar change. Default settings can be changed within the member center via Alert Settings |

|

Equifax |

Change (increase or decrease) in account balance amount greater than $1 dollar |

YES – Users can set notifications based on a $ dollar change. Default settings can be changed within the member center via Alert Settings |

I opened a credit card over 10 days ago and I haven’t received a credit monitoring alert or associated score update yet – why not?

Sometimes, credit events that occur after your enrollment into the FICO® 3-Bureau Monitoring product are not immediately reported to credit reporting agencies. Because some merchants/card issuers only report on a monthly basis, this can lead to a “lag” of over 30 days from the time the transaction occurred to the time it appears on your credit report.

EXAMPLE:

- I enrolled into the FICO 3-Bureau Credit Monitoring product on 8/22 and the enrollment was complete as of 8/26.

- The merchant did not report the new line of credit to the Credit Reporting Agency until 8/30.

- The credit reporting agency then updated its systems with the reported data on 8/31

- As a result, the New Account alert should trigger on or sometime after 8/31

It seems like I receive a lot more Equifax alerts – Why is that?

Each bureau has different thresholds for sending an alert. Equifax alert thresholds are much lower than the other two bureaus, resulting in more alerts. However, you can customize your alert settings, a feature only available for Equifax alerts, so you receive less alerts. Simply head to the member center and configure the exact dollar or percentage amount for which you would like to trigger a credit alert along with a current FICO® Score. You can even set a target FICO Score so that when it is reached, you will receive an alert.

As a new subscriber, the default settings for Equifax is set at the lowest threshold possible to enable the generation of credit alerts with minute credit file changes. As a result, you may notice a difference in the number of alerts generated for the same accounts across the different bureaus.

Default settings can be changed within the member center via Alert Settings:

|

CUSTOM SETTING |

DESCRIPTION |

DEFAULT SETTING |

MONITORING INTERVAL |

CONFIGURATION OPTIONS |

|

FICO Score – Target Score |

Get notified when your FICO Score based on Equifax data reaches your target score. |

ON - your FICO Score on subscription date |

Weekly |

Set a target score between 300 and 850. |

|

FICO Score – FICO Score change qualifies you for a different interest rate |

Get notified when your FICO Score changes and may qualify you for a different interest rate on one of 3 types of loans.

|

ON -30 year mortgage |

Weekly |

30 year mortgage, 15 year home equity loan, 48 month auto loan |

|

Account Balance Change – By $ dollar amount |

Get notified when your account balance changes (increases or decreases) by more than $x dollar(s).

|

ON - $1 |

Daily |

Set a balance change of $1 - $99,999 |

|

Account Balance Change – By % dollar amount |

Get notified when your account balance increases by more than x%.

|

OFF |

Daily |

Set a percentage of 5%, 10%, 15%, 20%, 25%, 30%, 40%, 50%, 100%, 200% |

|

Account Balance Change - Newly Active Accounts |

Get notified of new activity on an inactive account (defined as an account that has been inactive for more than specific period of time that you set). |

ON – 3 months

|

Daily |

Set an inactive period of 3 months, 4 months, 5 months, 6 months, 12 months, 18 months, 24 months |