- myFICO® Forums

- This 'n' That

- myFICO® Product Feedback

- Re: When will the report be available?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

When will the report be available?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the report be available?

Last month my monthly report was available by around 9:00 AM the date it stated it was available. Is there a particular time the reports become available? I see the charge as pending, but no new report.

I pay for the monthly 3b. I feel that once my card is charged, the report should be available.

9/17: EQ - 542 / TU - 535 / EX - 506 // Mortgage: 553, 545, 486

10/ 17: EQ - 558 / TU - 563 / EX - 586 // Mortgage: 554, 568, 536

11/17: EQ - 630 / TU - 589 / EX - 614 // Mortgage: 606, 606, 572

12/17: EQ - 630 / TU - 624 / EX - 619 // Mortgage: 584, 612, 671

9/18: EQ - 676 / TU - 676 / EX - 643 // Mortgage: 652, 628, 606

Journey Milestones: Completed Federal Student Loan Rehab in Sept 2017. Settled First Premier Bank CC in August 2017. Constant uphill battle with Navient incorrect reporting on seven (7!) private student loans. No TLs listed in delinquency. Obsessively keeping 2 CC UTI @ 7-9% monthly.

End Goal: Pre-Approval for FHA Spring/Summer 2018 (COMPLETED)

New End Goal: 700+ Spring 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will the report be available?

I actually NEVER pull a fresh report right away. I time when I pull my 3B versus when I know all my accounts are updated.

So I pay for my 3B on the 24th or so, but then don't pull a fresh report for almost 4 weeks (around the 19th) -- this gives me a good idea of where I am since all my accounts SHOULD update by then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will the report be available?

That's nice but thats not how this service works. It's an automatic update of the report.

Back on track... can anyone tell me when the the reports actually refresh in the system and are accessible? Thanks so much!

9/17: EQ - 542 / TU - 535 / EX - 506 // Mortgage: 553, 545, 486

10/ 17: EQ - 558 / TU - 563 / EX - 586 // Mortgage: 554, 568, 536

11/17: EQ - 630 / TU - 589 / EX - 614 // Mortgage: 606, 606, 572

12/17: EQ - 630 / TU - 624 / EX - 619 // Mortgage: 584, 612, 671

9/18: EQ - 676 / TU - 676 / EX - 643 // Mortgage: 652, 628, 606

Journey Milestones: Completed Federal Student Loan Rehab in Sept 2017. Settled First Premier Bank CC in August 2017. Constant uphill battle with Navient incorrect reporting on seven (7!) private student loans. No TLs listed in delinquency. Obsessively keeping 2 CC UTI @ 7-9% monthly.

End Goal: Pre-Approval for FHA Spring/Summer 2018 (COMPLETED)

New End Goal: 700+ Spring 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will the report be available?

@LindysMom wrote:That's nice but thats not how this service works. It's an automatic update of the report.

Back on track... can anyone tell me when the the reports actually refresh in the system and are accessible? Thanks so much!

Mine isn't an automatic update at all. That's weird that yours is.

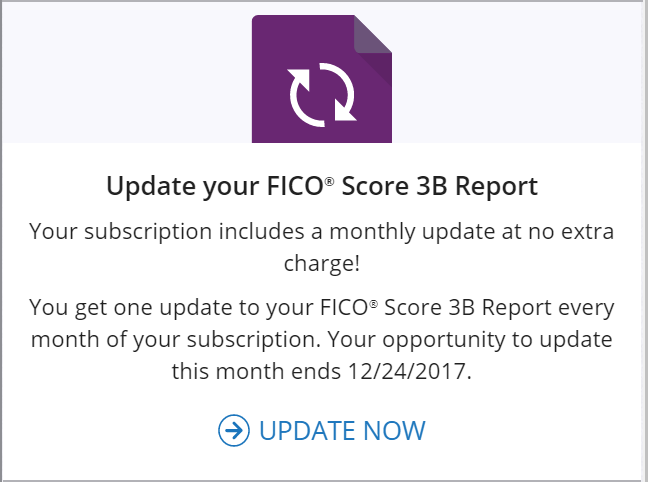

Here is my screenshot of my MyFico monitoring service:

So my card was charged on 11/24 and it gives me an update that I can pull whenever I want to between 11/24 and 12/24.

Not sure what your issue is, you expect your pull to happen on a specific day at a specific time but there are 24 time zones around the world and right now it's two different days in two different parts of the world even. So you have a good question: what time zone is the report availability based on, and how long does it take for a credit card charge to be accepted by MyFico.

I assume that their accounting department (that charges your card) and their monitoring service department (that lets you pull a fresh 3B) aren't the same group, so maybe there's some communication lag.

As far as I'm aware, the first 3B was available immediately after I processed my first card charge, but then I realized I didn't WANT a report on the 24th, I wanted it a little earlier, so the next cycle I just delayed pulling the reports by a few weeks and it works better for me that way.

Maybe confirm that you get an automatic report, because I never saw that on my end, and I've helped over 200 people use MyFico monitoring local to me in my credit repair meetings and I've never seen any of them actually get an automatic report -- everyone I know and have helped have to actually click the "update now" button.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will the report be available?

I have the ultimate 3b+. I think my service subscription is different than yours. I only get a message of the date my next report will be available (10th of each month).

Not sure what your issue is, you expect your pull to happen on a specific day at a specific time but there are 24 time zones around the world and right now it's two different days in two different parts of the world even. So you have a good question: what time zone is the report availability based on, and how long does it take for a credit card charge to be accepted by MyFico.

Touche.

9/17: EQ - 542 / TU - 535 / EX - 506 // Mortgage: 553, 545, 486

10/ 17: EQ - 558 / TU - 563 / EX - 586 // Mortgage: 554, 568, 536

11/17: EQ - 630 / TU - 589 / EX - 614 // Mortgage: 606, 606, 572

12/17: EQ - 630 / TU - 624 / EX - 619 // Mortgage: 584, 612, 671

9/18: EQ - 676 / TU - 676 / EX - 643 // Mortgage: 652, 628, 606

Journey Milestones: Completed Federal Student Loan Rehab in Sept 2017. Settled First Premier Bank CC in August 2017. Constant uphill battle with Navient incorrect reporting on seven (7!) private student loans. No TLs listed in delinquency. Obsessively keeping 2 CC UTI @ 7-9% monthly.

End Goal: Pre-Approval for FHA Spring/Summer 2018 (COMPLETED)

New End Goal: 700+ Spring 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will the report be available?

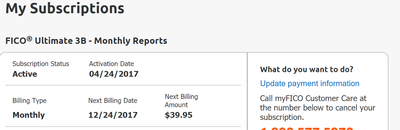

I have this subscription, not sure how it differs!

You mentioned Ultimate 3B+ whereas mine says Ultimate 3B.

Is your monthly pull $29.95 or $39.95? I wonder if the $29.95 monthly Ultimate is an automatic pull whereas the $39.95 Ultimate is one I can manually time and request? No idea! Very very curious. Honestly if that happens to be the case (I'm just guessing), I'm not bothered anymore that I have to pay $10 more a month because I kinda like timing my 3B pulls based on my report schedule!

Report back, I definitely want to get to the bottom of this so I know for future reference.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will the report be available?

And obviously very haphazard updates.

It emailed me last month

9/17: EQ - 542 / TU - 535 / EX - 506 // Mortgage: 553, 545, 486

10/ 17: EQ - 558 / TU - 563 / EX - 586 // Mortgage: 554, 568, 536

11/17: EQ - 630 / TU - 589 / EX - 614 // Mortgage: 606, 606, 572

12/17: EQ - 630 / TU - 624 / EX - 619 // Mortgage: 584, 612, 671

9/18: EQ - 676 / TU - 676 / EX - 643 // Mortgage: 652, 628, 606

Journey Milestones: Completed Federal Student Loan Rehab in Sept 2017. Settled First Premier Bank CC in August 2017. Constant uphill battle with Navient incorrect reporting on seven (7!) private student loans. No TLs listed in delinquency. Obsessively keeping 2 CC UTI @ 7-9% monthly.

End Goal: Pre-Approval for FHA Spring/Summer 2018 (COMPLETED)

New End Goal: 700+ Spring 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will the report be available?

9/17: EQ - 542 / TU - 535 / EX - 506 // Mortgage: 553, 545, 486

10/ 17: EQ - 558 / TU - 563 / EX - 586 // Mortgage: 554, 568, 536

11/17: EQ - 630 / TU - 589 / EX - 614 // Mortgage: 606, 606, 572

12/17: EQ - 630 / TU - 624 / EX - 619 // Mortgage: 584, 612, 671

9/18: EQ - 676 / TU - 676 / EX - 643 // Mortgage: 652, 628, 606

Journey Milestones: Completed Federal Student Loan Rehab in Sept 2017. Settled First Premier Bank CC in August 2017. Constant uphill battle with Navient incorrect reporting on seven (7!) private student loans. No TLs listed in delinquency. Obsessively keeping 2 CC UTI @ 7-9% monthly.

End Goal: Pre-Approval for FHA Spring/Summer 2018 (COMPLETED)

New End Goal: 700+ Spring 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will the report be available?

Maybe you have to pay some sort of state sales tax on it, but we're both in the same payment ballpark so it's not that, either.

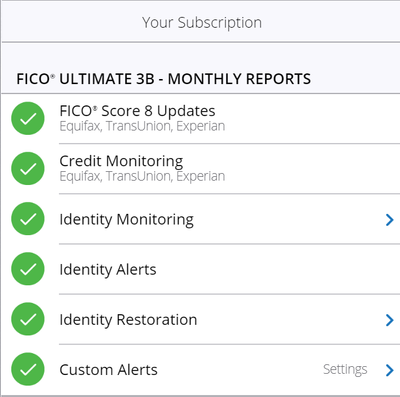

Obviously they have different credit monitoring services -- since yours is 3B+ maybe that + means identity monitoring, not sure. From what I can tell, I thinkhave identity monitoring, too, but honestly never paid it much attention:

So it appears we may have the same TYPE of subscription but yours forces you when it updates whereas mine gives me the option to delay an update up to 1 month.

No worries on the screen shot, I know what a pain mobile is on web forums. I do believe you, I'm just surprised they'd bother to code two nearly identical subscriptions but with different "features". To me, if the only difference between 3B and 3B+ is that you can't pull your report whenever you want to, that isn't much of a "plus" to me.

Since it's a Sunday I don't expect MyFico support to be around but I guess it wouldn't hurt to try their 800 number to see if someone is there, although weekend customer service reps in my opinion tend to be the ones who get slammed with the most phone calls at the worst time. Might be useful to call in tomorrow and see what they have to say about it.

I also wonder if the mobile site is different than the desktop site -- maybe on the phone app/website you can't manually time the pull but on desktop maybe you can?

So curious, hopefully someone else puts in their opinion so we can see what's up!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When will the report be available?

As an aside, I really like having a particular date each month otherwise I would be too eager to pull it. For example, my student loan lenders don’t report within close proximity of each other. Plus I feel it gives me a true picture of how my scores are evolving.

9/17: EQ - 542 / TU - 535 / EX - 506 // Mortgage: 553, 545, 486

10/ 17: EQ - 558 / TU - 563 / EX - 586 // Mortgage: 554, 568, 536

11/17: EQ - 630 / TU - 589 / EX - 614 // Mortgage: 606, 606, 572

12/17: EQ - 630 / TU - 624 / EX - 619 // Mortgage: 584, 612, 671

9/18: EQ - 676 / TU - 676 / EX - 643 // Mortgage: 652, 628, 606

Journey Milestones: Completed Federal Student Loan Rehab in Sept 2017. Settled First Premier Bank CC in August 2017. Constant uphill battle with Navient incorrect reporting on seven (7!) private student loans. No TLs listed in delinquency. Obsessively keeping 2 CC UTI @ 7-9% monthly.

End Goal: Pre-Approval for FHA Spring/Summer 2018 (COMPLETED)

New End Goal: 700+ Spring 2019