- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: Auto Loan Approvals!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Auto Loan Approvals!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

APPROVING BANK: JP Morgan Chase

BUREAU PULLED: Transunion

CREDIT SCORE: 718

SOFT PULL/HARD PULL: Hard

CUSTOMER STATE OF RESIDENCE: Nebraska

NEW/USED: New

YEAR OF VEHICLE: 2021

MAKE: Subaru

MODEL: Legacy Premium with Moonroof

MILEAGE: 15

FINANCE/LEASE: Finance

PURCHASE PRICE: $26300

AMOUNT OF LOAN: $21,000

TERM CONTRACTED: 60 months

APR/LEASE RATE: 0%

MONTHLY PAYMENT: $351

ANNUAL INCOME: $49,000

DEBT TO INCOME RATIO: ~17% (just this car)

MISCELLANEOUS COMMENTARY: Car stickers for over $29,000 but I used Truecar Unlimited Corporate pricing, as a employee of a large tech company, to just get a low no haggle price and the dealer accepted. Payment was only set to be $315 a month, but I rolled in the tax title reg fees. Super stoked to get 0% as a first time car buyer. Only credit I have had before hand was my AppleCard that I opened almost two years ago in July. Never missed a payment and I don't plan to start.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

APPROVING BANK: State Employees Credit Union

BUREAU PULLED: Equifax

CREDIT SCORE: 665

SOFT PULL/HARD PULL: HP

CUSTOMER STATE OF RESIDENCE: NC

NEW/USED: Used

YEAR OF VEHICLE: 2018

MAKE: Toyota

MODEL: Tundra

MILEAGE: 26,432

FINANCE/LEASE: Refinance

PURCHASE PRICE: 40,435

AMOUNT OF LOAN: 40,435

TERM CONTRACTED: 72

APR/LEASE RATE: 3.95

MONTHLY PAYMENT: 644

ANNUAL INCOME: 68,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

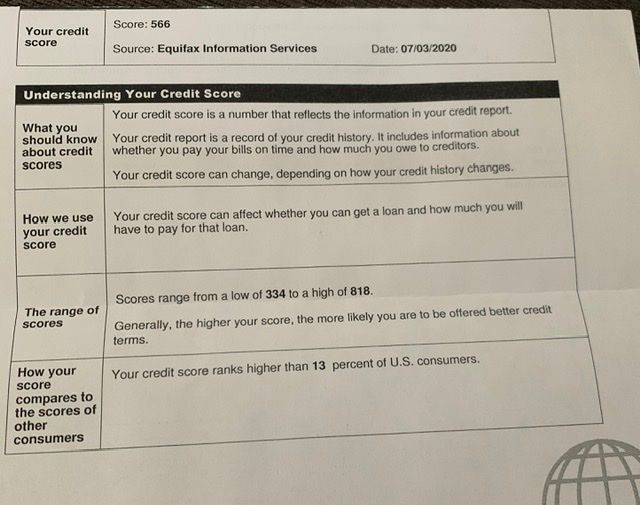

@TC1212 wrote:@Brian_Earl_Spilner @I found my credit report letter from Navy back in July - it was 566. My interest rate was actually 2.09 instead of 2.29. Still in shock. We picked up car about 10 days ago. DH was so suprised.

How did you get such a good interest rate ?

Experian: 671

Equifax: 666

Transunion: 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

@Keyluv44 wrote:

APPROVING BANK: Navy Federal BUREAU PULLED: Transunion CREDIT SCORE: According to NFCU 578 SOFT PULL/HARD PULL: Hard CUSTOMER STATE OF RESIDENCE: Florida NEW/USED: New YEAR OF VEHICLE: 2022 MAKE: HYUNDAI MODEL: TUCSON SEL with Convenience Package MILEAGE: 14 FINANCE/LEASE: FINANCE PURCHASE PRICE: 32K AMOUNT OF LOAN:30K TERM CONTRACTED: 72 APR/LEASE RATE: 2.9% MONTHLY PAYMENT:$465 ANNUAL INCOME: 55K

Why such the large discrepancy between what Navy has as your score and what you believe your score to be?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

I assume that his internal score with NFCU, which weighs heavily in favor of prior relationship, is a lot higher than his FICO score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

APPROVING BANK![]() CU, Gesa

CU, Gesa

BUREAU PULLED: Equifax

CREDIT SCORE:665

SOFT PULL/HARD PULL: Hard

CUSTOMER STATE OF RESIDENCE: Wa state

NEW/USED:Used

YEAR OF VEHICLE: 2016

MAKE:BMW

MODEL:4 Series M Sport

MILEAGE:23,000

FINANCE/LEASE:finance

PURCHASE PRICE: $26,000

AMOUNT OF LOAN:$35000

TERM CONTRACTED:84

APR/LEASE RATE:6.4 % DCU, 7.2 Gesa

MONTHLY PAYMENT:$553

ANNUAL INCOME:$70,000

MISCELLANEOUS COMMENTARY: probably should have applied with navy federal who I've been with for 5 years, but my equifax auto score was the highest of all bureaus. Saw this 4 series on Vroom.com and after shopping around locally I went with this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

APPROVING BANK: PenFed

BUREAU PULLED: EQ

CREDIT SCORE: 763

SOFT PULL/HARD PULL: Hard

CUSTOMER STATE OF RESIDENCE: UT

NEW/USED: Used

YEAR OF VEHICLE: 2015

MAKE: Tesla

MODEL: Model S P90DL

PURCHASE PRICE: $36k

AMOUNT OF LOAN: $36k

TERM CONTRACTED: 60

APR/LEASE RATE: 3.14%

MONTHLY PAYMENT: $649

ANNUAL INCOME: Mid $100k's

DEBT TO INCOME RATIO: 12%

MISCELLANEOUS COMMENTARY: We lost our Audi in an accident last month. Our mortgage lender gave us the thumbs up to take a loan out for a replacement so we could put the cash towards the house. It'll be titled and registered under our business so on the bright side the payments provide a bit of a write-off, plus switching over to an EV is great. I've already put 3,000 miles on the car and haven't paid a penny in gas or charging (free supercharging!).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

APPROVING BANK: RBFCU

BUREAU PULLED: TU

CREDIT SCORE: 808

SOFT PULL/HARD PULL: Hard

CUSTOMER STATE OF RESIDENCE: TX

NEW/USED: New

YEAR OF VEHICLE: 2022

MAKE: Mitsubishi

MODEL: Outlander

MILEAGE: 17

FINANCE/LEASE: Finance

PURCHASE PRICE: $33,000

AMOUNT OF LOAN: $27,000

TERM CONTRACTED: 72

APR/LEASE RATE: 2.44

MONTHLY PAYMENT: $415

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

@schsa210 Wow . . . great financing . . . thanks for posting . . . way to go Texas!!!

Current FICO 8 Score in 06/2021: EQ-796, TU-806, EX-812

Goal FICO 8 Score in 06/2022: EQ-825, TU-850, EX-850