- myFICO® Forums

- Types of Credit

- Auto Loans

- Auto Loan Approvals!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Auto Loan Approvals!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

@Snorred wrote:APPROVING BANK: Bank of America

BUREAU PULLED: Experian

CREDIT SCORE: 834SOFT PULL/HARD PULL: Hard

CUSTOMER STATE OF RESIDENCE: Louisiana

NEW/USED: Used

YEAR OF VEHICLE: 2019

MAKE: Ford

MODEL: Taurus SHO

MILEAGE: 16500

FINANCE/LEASE: FinancePURCHASE PRICE: 27K

AMOUNT OF LOAN: 25K + ttl

TERM CONTRACTED: 72 months

APR/LEASE RATE: 2.69

MONTHLY PAYMENT: $456

ANNUAL INCOME: $75K

DEBT TO INCOME RATIO:

MISCELLANEOUS COMMENTARY: Local CU approved me @ 3.04%. Dealer said they could beat it and they did! $2000 down and added extended warranty. First car purchase in 8 years!!!

Decent rate but that's the best they could do with an 834 credit score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

@Gladius wrote:

@Snorred wrote:APPROVING BANK: Bank of America

BUREAU PULLED: Experian

CREDIT SCORE: 834SOFT PULL/HARD PULL: Hard

CUSTOMER STATE OF RESIDENCE: Louisiana

NEW/USED: Used

YEAR OF VEHICLE: 2019

MAKE: Ford

MODEL: Taurus SHO

MILEAGE: 16500

FINANCE/LEASE: FinancePURCHASE PRICE: 27K

AMOUNT OF LOAN: 25K + ttl

TERM CONTRACTED: 72 months

APR/LEASE RATE: 2.69

MONTHLY PAYMENT: $456

ANNUAL INCOME: $75K

DEBT TO INCOME RATIO:

MISCELLANEOUS COMMENTARY: Local CU approved me @ 3.04%. Dealer said they could beat it and they did! $2000 down and added extended warranty. First car purchase in 8 years!!!Decent rate but that's the best they could do with an 834 credit score?

I think that's BAMLs lowest used car rate but OP can confirm.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

APPROVING BANK: Toyota financial

BUREAU PULLED: all three

CREDIT SCORE: (auto 8) TU- 683, EQ: 625 EX: 622

SOFT PULL/HARD PULL: hard

CUSTOMER STATE OF RESIDENCE: DC

NEW/USED: New

YEAR OF VEHICLE: 2020

MAKE: Toyota

MODEL: RAV 4

MILEAGE: 175

FINANCE/LEASE: Finance

PURCHASE PRICE: $27,411

AMOUNT OF LOAN: 33,873 (had negative equity from trade in and added on additional free maintenance)

TERM CONTRACTED: 84

APR/LEASE RATE: 6.29%

MONTHLY PAYMENT: $505

ANNUAL INCOME: $46k

DEBT TO INCOME RATIO:

MISCELLANEOUS COMMENTARY: going to try to refinance in a few months with penfed or navy

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

APPROVING BANK: Audi Financial

BUREAU PULLED: all three

CREDIT SCORE: (auto 8) TU- 673, EQ: 662 EX: 706

cosigner: EQ-728 EX-770 TU-734

SOFT PULL/HARD PULL: hard

CUSTOMER STATE OF RESIDENCE: TX

NEW/USED: CERTIFIED PREOWNED

YEAR OF VEHICLE: 2017

MAKE: AUDI

MODEL: A3

MILEAGE: 19,759

FINANCE/LEASE: Finance

PURCHASE PRICE: $26,500

AMOUNT OF LOAN: 27,314.16 (had $350 negative equity from trade in and added GAP)

TERM CONTRACTED: 72

APR/LEASE RATE: 3.49%

MONTHLY PAYMENT: $421.63

ANNUAL INCOME: $21k indv $90k combined

DEBT TO INCOME RATIO:

MISCELLANEOUS COMMENTARY: Audi charges a lot for GAP VS. w the financing I had w Navy. But Audi did better on rate.

Chase Freedom Flex- $700

Navy Federal More Rewards Amex- $8,500

Navy Federal Cash Rewards- $1,000

PenFed Power Cash- $2,500

Macys- $800

Shell Mastercard- $800

Discover- $1,000

USAA Rewards Amex-$6,000

Best Buy-$6,000

AMEX BCP- $1,000

Target Redcard- $300

Navy Federal PLOC- $2,000

Penfed Auto- 4.04%

Discover Student Loan- 27k @ 26K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

Get JB4 + Water Methanol Injection for your M3

You'll thank me later....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

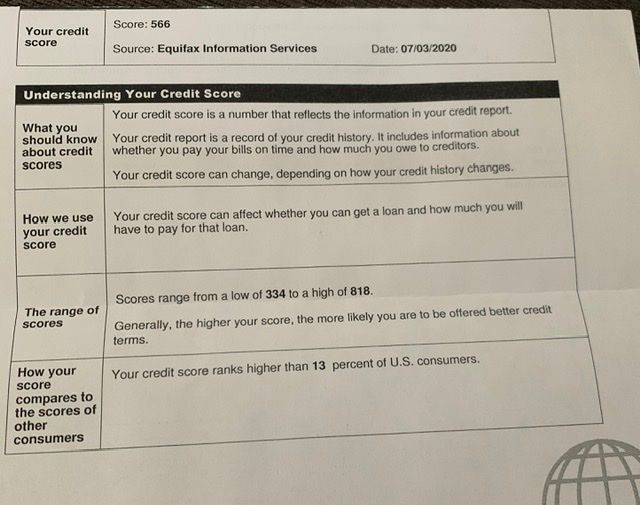

@Brian_Earl_Spilner @I found my credit report letter from Navy back in July - it was 566. My interest rate was actually 2.09 instead of 2.29. Still in shock. We picked up car about 10 days ago. DH was so suprised.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

APPROVING BANK: Chrysler Capital

BUREAU PULLED: Experian

CREDIT SCORE: (auto 8) 639 - Co signer 669 (wife)

SOFT PULL/HARD PULL: hard

CUSTOMER STATE OF RESIDENCE: MI

NEW/USED: New

YEAR OF VEHICLE: 2020

MAKE: Ram

MODEL: 1500 Big Horn

MILEAGE: 74 (Driven from another location due to non available local)

FINANCE/LEASE: Lease

Monthly: $520 (No Chrysler discount boo)

TERM CONTRACTED: 36

ANNUAL INCOME: $85k and 45k

MISCELLANEOUS COMMENTARY: Tier 1 with Chrysler but no family discount hurt. If I had that monthly would be $450.

Current

FICO8 March 2023: EQ: 703 - EX- 680 - TU: 671

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

@C_DUBYA wrote:APPROVING BANK: Chrysler Capital

BUREAU PULLED: Experian

CREDIT SCORE: (auto 8) 639 - Co signer 669 (wife)SOFT PULL/HARD PULL: hard

CUSTOMER STATE OF RESIDENCE: MI

NEW/USED: New

YEAR OF VEHICLE: 2020

MAKE: Ram

MODEL: 1500 Big Horn

MILEAGE: 74 (Driven from another location due to non available local)

FINANCE/LEASE: LeaseMonthly: $520 (No Chrysler discount boo)

TERM CONTRACTED: 36

ANNUAL INCOME: $85k and 45k

MISCELLANEOUS COMMENTARY: Tier 1 with Chrysler but no family discount hurt. If I had that monthly would be $450.

I hope you did some good research before pulling the trigger. $520 per month for that type of truck seems awfully high.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

@TC1212 wrote:@Brian_Earl_Spilner @I found my credit report letter from Navy back in July - it was 566. My interest rate was actually 2.09 instead of 2.29. Still in shock. We picked up car about 10 days ago. DH was so suprised.

Navy FCU must be the shiznit! Can't wait until this fall when I join up for an auto loan for my Tesla 3. A lot of people in NC are getting Tesla's. My brother-in-law says NC doesn't offer an EV rebates. Are you getting any federal rebates?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

@disdreamin wrote:Maybe off-topic, but I'm catching up on approvals and I'm not following where some of the DTI percentages are coming from. When I run even the car payment alone, I'm coming up with far higher DTI than what people are stating. Is there a place to look at how that number should be calculated?

Agreed. DTI's are all over the place. I've done it with auto loans and with just credit cards, mortgage, and installment loans. Both are all above 0%. lol