- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: Refinance or New Purchase with negative equity

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

--BEYOND SUCCESSFUL--Refinance or New Purchase with negative equity

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

--BEYOND SUCCESSFUL--Refinance or New Purchase with negative equity

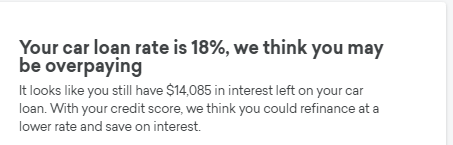

My car loan is currently with Prestige. 17.95%, currently down to 16.95% due to rate reduction plan with 1% more possible out of the rate reduction plan for a possible 15.95%.

We have been paying for 6 months the 7th payment due this week. We can make the payments we knew this going in the rate was high. We have not qualified for a refinance as a couple I want to keep my wife on the vehicle as she is rebuilding as well from the BK7. I qualified individually through CapOne at 13% a couple months ago. Credit Unions around won't touch us due to the recent BK7 (Dec 2017).

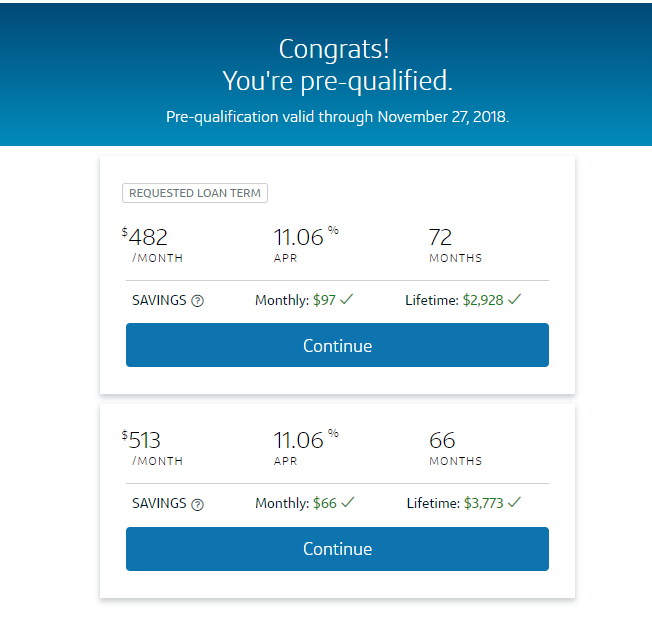

For S & giggles I attempted the pre-approval again and we were both pre-qualified full balance @ 11.06% for either 72 months or 66 months.

I know that this is not the BEST rate however with each payment to Prestige I am becoming more and more upside down on it and will have to put a down payment to be considered for a refi. I had already envisioned having to put $5k - $10k down on the refinance when I eventually decided to do it. Loan is on a 2017 Equinox Kelly Blue Book has the "fair market range at $18,586 - $20,965". My outstanding principal balance that included extended warranty and GAP is $25,251.12. CapOne is is allowing to roll the entire balance into the refinance.

I am asking does it make sense to take the Cap One offer? Should I wait until I have 1 year with Prestige I have heard 1 year is a magic number so to speak. How concrete is Cap One Refinancing Pre-Approvals? Will the refinance with CapOne improve over a loan with a subprime lender like Prestige?

Any help is appreciated and well umm needed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Current loan with Prestige (due to BK) looking to refinance.

Another idea would be to trade the car in and get the negative equity rolled into it but that process is completely new to me.

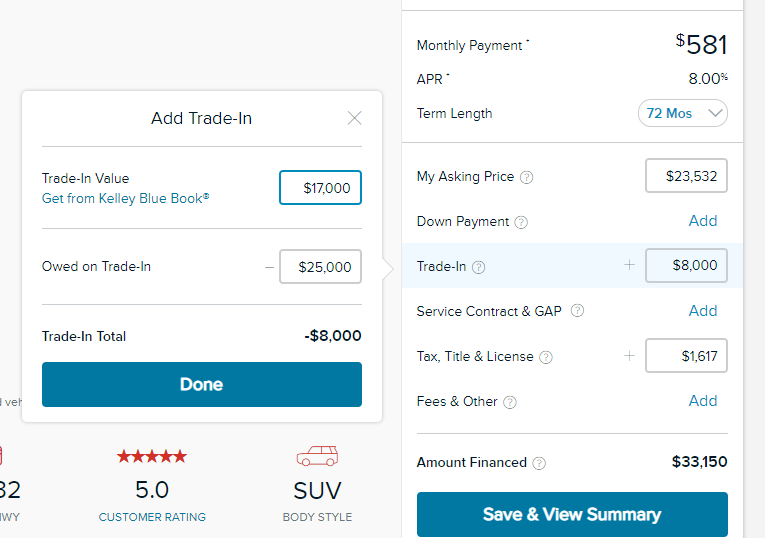

CapOne pre-qualified a new auto loan through Auto Navigator.

I can trade in our current 2017 and get a 2019. We can roll the negative equity into the 2019 get 8% and keep the payment just about the same. I am just not sure how "concrete" CapOne is on the pre-qualify.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or New Purchase with negative equity

There is no magic number for a refinance, in some cases, it should be done as soon as possible because of the subprime interest rate - at $18% I'd put you in this category to refi ASAP. Although I have never used Cap-1, from reading threads on MyFico, they tend to be solid if you entered correct information up front. Considering you have additional cash to put down to tweak the "Loan to Value" factor, I'd say you have a strong case to refi as soon as you can get the paperwork into Cap-1 (like yesterday).

One other factor as far as loan cost - you said you purchased GAP and an extended warranty - in general Gap through a dealer is WAY overpriced as are extended warranties and consider you are paying 18 percent apr on top of overpaying. Extended car warranties are available through many third-party companies and GAP is available through your auto insurance at much(!) less than a dealers quote.

Consider not including these costs in your refi and if you actually want them, acquire them outside of your financing.

Add: You should also consider the length of your car loan, vehicles financed for 66-72 months tend to be underwater for almost the complete loan if possible look at 48-60 month terms the shorter the better, but I understand the cash flow consideration.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or New Purchase with negative equity

@pipeguy wrote:There is no magic number for a refinance, in some cases, it should be done as soon as possible because of the subprime interest rate - at $18% I'd put you in this category to refi ASAP. Although I have never used Cap-1, from reading threads on MyFico, they tend to be solid if you entered correct information up front. Considering you have additional cash to put down to tweak the "Loan to Value" factor, I'd say you have a strong case to refi as soon as you can get the paperwork into Cap-1 (like yesterday).

One other factor as far as loan cost - you said you purchased GAP and an extended warranty - in general Gap through a dealer is WAY overpriced as are extended warranties and consider you are paying 18 percent apr on top of overpaying. Extended car warranties are available through many third-party companies and GAP is available through your auto insurance at much(!) less than a dealers quote.

Consider not including these costs in your refi and if you actually want them, acquire them outside of your financing.

Add: You should also consider the length of your car loan, vehicles financed for 66-72 months tend to be underwater for almost the complete loan if possible look at 48-60 month terms the shorter the better, but I understand the cash flow consideration.

Well it has been a day. However I am GLAD to say that there are good peeps in the world. Even car salesmen. Went in and received some resistance. First the young lady showed trim levels x3 what we wanted. Then after an eternity and fighting what felt like 13 rounds over the trade in value the "finance guy comes outand asks if we can put $600 down I said yes but it is not needed our deal with CapOne is zero down he said trust me ran off and literally an hour later (yes the entire ordeal spanned 5 hours) he comes back and said I got you financed at 4% with a credit union but they require the $600 down ... needless to say 45 min later wer are driving off in a 2019 Equinox LT LT2 and I got to see the 4 miles flip to 5 miles. I was financed through Amplify Credit Union, I have been in Austin over 23 years and never heard of them ...

"Amplify is a member-owned financial cooperative with more than 57,000 members and over $900 million in assets. We've been serving Austin since 1967, when we got our start as IBM Texas Employees Federal Credit Union."

@I know an Equinox is just an Equinox but considering where I was 12 months ago .. hell 24 hours ago (over priced 2017 Equinox @ 16.95%) it is nothing short of a miracle ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or New Purchase with negative equity

Happy ending - nice job! 4% is a very good rate and you should be able to get a refund of sorts on the GAP and Extended warranty on the old car - don't forget to at least try for those refunds.

BTW, personally, I think the Equifax is a nice product ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or New Purchase with negative equity

@pipeguy wrote:Happy ending - nice job! 4% is a very good rate and you should be able to get a refund of sorts on the GAP and Extended warranty on the old car - don't forget to at least try for those refunds.

BTW, personally, I think the Equifax is a nice product

Thank, I am still in shock and awe lol. I got the odometer disclosures and faxing them for the Extended Warranty/GAP refunds tomorrow. I heard this can be a battle though and can take months to resolve. But that is some money I can put towards that principal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or New Purchase with negative equity

That's a hell of a good refi story, right there. Going from 18% to 4% is fantastic!

Total Rev: $182,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: --BEYOND SUCCESSFUL--Refinance or New Purchase with negative equity

Congrats OP! No only did you get a loan with a lower interest rate...you got a BRAND new car in the process. Christmas came early!! Congrats again and enjoy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or New Purchase with negative equity

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or New Purchase with negative equity

@jl4 wrote:That's a hell of a good refi story, right there. Going from 18% to 4% is fantastic!

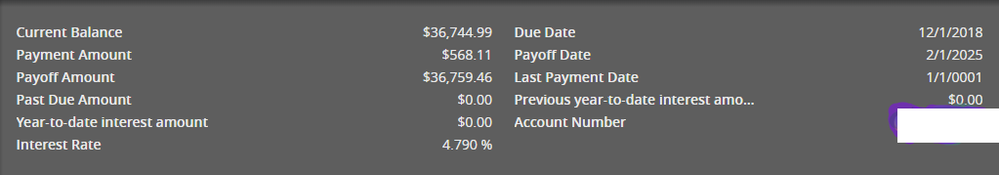

Thanks I really did not believe it until today though.. I was waiting for the call "umm sir there was an issue with the funding and you have to bring the car back in. We still have your Capital One offer" or something like that ..

But here is a before and after ...

I am speechless still.