- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: Denied after preapproved (Cap1 Auto Navigator)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Denied after preapproved (Cap1 Auto Navigator)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied after preapproved (Cap1 Auto Navigator)

Auto Navigator is soft pull for pre-qualification only. It's not a pre-approval. Those who get approved as a result would have been approved had they gone straight to the dealership and the dealer sent them through Capital One. That's why the instructions say to show the letter, then fill out the dealerhip's credit app. Their deal with member dealerships is as a lead generator with the hope that they'll be in the mix to earn the financing. Member dealers pay Capital One a flat for the right to have those leads generated.

Pre-qualification simply means the algorithm accepts the possibility that you'll be able to finance the car. Pre-approvals are much stricter and often require very specific criteria the algorithms identify such as previous car credit, DTI, not too many inquiries/new accounts, etc.

Bottom line is this: that Capital One pre-qualified you doesn't mean they pre-approved you. In fact, Capital One doesn't offer pre-approvals on auto loans. Most credit unions, some banks, and nearly all brand-captive lenders do, as will some of the other auto-specific lenders, but Capital One and the majority of other auto lenders only offer pre-qualification as a way to get you in the door.

The best advice is what many have already said: go through a credit union. Even if you have to show six consecutive payments (as compared to 6 months) before refinancing at DCU, PenFed, or another credit union, so be it. Drive the car, make your payments, and refinance it later.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied after preapproved (Cap1 Auto Navigator)

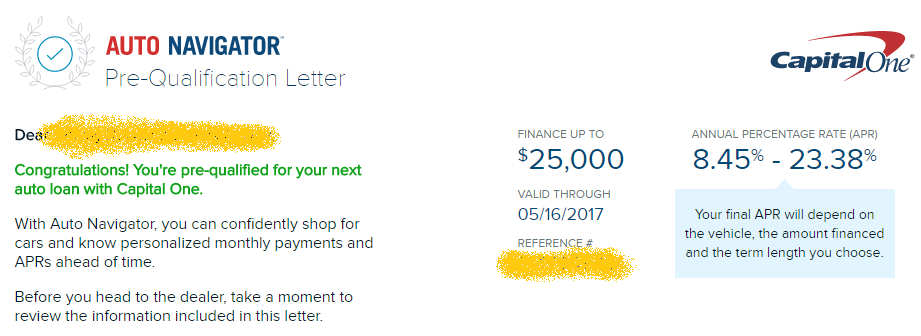

Here's the prequal my wife did the other day.

Notice that it's a prequalification and not a pre-approval.

As a soft pull, it made sense to have all our ducks in a row. They ended up going through GM Financial and didn't even send it to Capital One, which is fine by me. Now I have a reason to get a GM BuyPower card, after which I'll refinance with DCU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied after preapproved (Cap1 Auto Navigator)

I would argue that the Cap One Nav it is as close to a pre-approval as you can get.

Mine literally went up and down in APR depending on the VIN number and price of the car before I even went to dealership.

I knew exactly what I was getting, the terms, the APR, and documents needed (none) before I went to even drive the car.

I bought a new car and got a fantastic price so it bottomed out at 2.49% for 72 months.

Took 72 since it was same rate as 60, 48, 36, so why not. Simple interest loan anyway.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied after preapproved (Cap1 Auto Navigator)

*Update* After having 3 different people in the dealership tell me that CapOne never comes back declined if pre-qualified, someone finally looked into it. The first finance guy put in my SSN wrong. The finance manager grabbed it today, ran CapOne, and it came back with actually a slightly better rate (half a percent) than the pre-qualification paper. Approved in seconds. The past week of going back and forth with them was all because of a typo.

Discharged: August 24, 2020

Scores At Discharge

EQ: 595

TU: 577

EX: 575

Rebuild Cards:

Credit One - $400

Cerulean - $1050

Mercury - $3000

Survived BK:

Samsung (TD Bank) - $300

Capital One Auto - Reaffirmed final year of 5-year loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied after preapproved (Cap1 Auto Navigator)

Well, glad that worked out for you. I would be hard pressed not to let them know a thing or two given what they put you through.

So, congrats on the good rate and getting the deal done!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied after preapproved (Cap1 Auto Navigator)

You can believe it was a typo if you want...![]()

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied after preapproved (Cap1 Auto Navigator)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied after preapproved (Cap1 Auto Navigator)

Congrats!!

Btw, that was NOT a typo!! It was a shady finance guy trying to make money!!

It's a trick thats pretty easy for them to pull on you... When my GF bought her truck last summer, and used CapOne, there was a question with the rate we had on the prequal... Called them on my cell from the finance office and everythng was fixed very very fast!

Total CL $398600, plus car and RV loan.

Ooh. Ooh. Getting closer to that $500K mark!