- myFICO® Forums

- Types of Credit

- Auto Loans

- Help: Lender is possibly charging more interest

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help: Lender is possibly charging more interest

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help: Lender is possibly charging more interest

My monthly payment for my car is $260

I have only been making the monthly payment on the 2nd of every month.

During April $45 went to interest and the rest went to principal. During May $44 went to interest and the rest went to principal. It makes sense that the payment portion going towards the interest keeps going down every month since the balance keeps going down. Anyway in the middle of May I made a big payment towards the principal around $850. So I was expecting that during June the portion going to the interest will drop down quite a bit and not just a dollar. However it only went down to $43 which is consistent with how much it goes down every month when I am only making the monthly payment. But like I said in May I paid a lot into the principal. I called the lender and they said the whole thing is automated and they won't give it a second look.

Am I missing something here ?

My lender is Toyota financial and according to their website the interest is calculated on daily basis and I am good with numbers so according to their formula this is wrong.

What do you guys think ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help: Lender is possibly charging more interest

This is interesting. I always thought with car loans the bulk of your payment goes to interest first until the interest calculated for the loan is paid almost completely down, and then the payments direct to the principal. I didn't know you had an option in car loans to make payments directly towards principal. Please keep us posted on any changes on this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help: Lender is possibly charging more interest

It all depends.

Some car loans extra payments go towards principal, others your next payment, others like my Chase one let you specify.

I have a wealthy friend that once got in trouble with his car loan because he would pay 6 months at a time and then not make payments for a bit. He figured he paid Jan-Jun but in Feb got a call where is your payment.

It's not a matter of how they calculate interest it's how they apply overpayments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help: Lender is possibly charging more interest

If you give as much information about the loan as possible, we can model it and figure out what happened.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help: Lender is possibly charging more interest

I suggest you should ask financial details of your payment to your lender and make sure that you understand the details. Do not also hesitate to ask questions if you don't understand anything. Sometimes, you need to check the details of those payments and make sure what are those payments intended for. After your clarifications, you can go back here and post what did you find out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help: Lender is possibly charging more interest

Some car loans are stuctured in a way where paying extra on your monthly payment only prepays towards the next payment(s).

When I was with Wells Fargo, I had to make a *separate* payment from my regular payment if I wanted it to be applied directly to principal. If I just paid double my normal payment, the overage would have gone towards the following month's payment, this not saving much on interest.

NFCU MR: $25K | Venture: $21K | Amex ED: $18K | NFCU CR: $18K | Amex BCE: $15K | IT #1: $17.5K | PNC Core: $15K | PPMC: $12K | Wells Fargo: $11K | Savor: 12K | Cap1 QS: $8.5K | Barclays Rewards: $7.75K | IT #2: $7.3K | MLife: $9.5K | Sportsman's Guide: $8.7K | PenFed PR: $5.5K | Elan Plat: $2.3K | TRV: $3.6K | BotW: $3K

Current FICO 8 Scores: EQ: 828| TU: 805 | EX: 814

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help: Lender is possibly charging more interest

I think I can give you some more information on this.

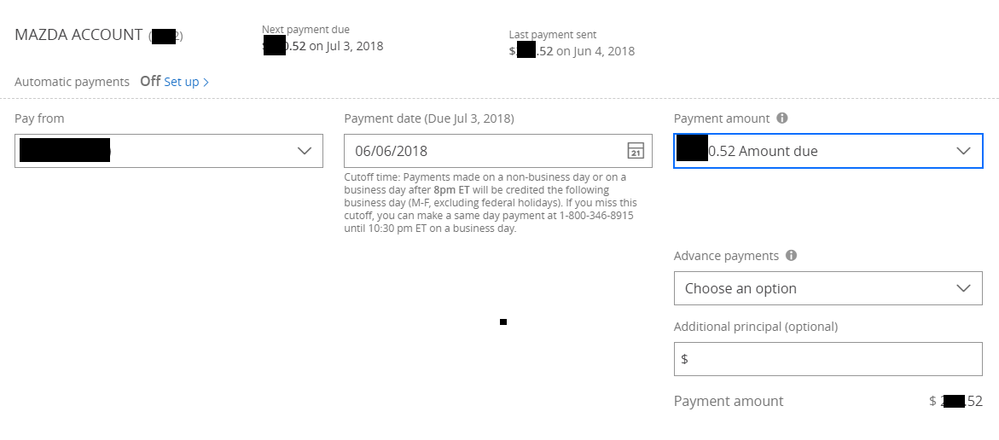

Toyota Financial uses simple daily interest. This means that interest is calculated daily.

As an example let's say your principle amount on 01/01/2018 is $10,000 at an APR of 5%.

This means that the interest is calculated at $1.36 day

10000*0.05/365=1.36

So if you made a payment on 01/01/2018 and that brough the principle down to $10,000 If you make an additional payment 1 day later $1.36 will go to interest the rest towards principle. So your scenario makes perfect sense. Since your payment in May was the normal amount the amount of interest accrued in the last month was the normal amount. Next month you will find the interest getting a bit smaller.

Toyota also treats payments over the normal amount towards future payments. What this means is if say your monthly payment is $250 and you pay $1000. Toyota will continue to send you bills for the next 3 months with a $0 payment due. However if you wait until the 3 months is up and your next normal payment is due you can expect 3 months worth of daily interest based on the last updated principle.

Source: I religiously track my auto payments and interest amounts and can accurately predict the principle amout years out based on this information. It is also covered in their "How do we calculate interest" PDF that is found on the account history page.

https://www.sc.toyotafinancial.com/web/tfs/pub/contents/tf_simple_interest.pdf

12/07/17