- myFICO® Forums

- Types of Credit

- Auto Loans

- Help getting prepared for the dealership

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help getting prepared for the dealership

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

I just checked the DCU requirements. I don't meet any of those. Not sure how I could get a membership

-------------------------------------------------------------------------------------------------

EQ 701, TU 685, EX ?

Wallet:

Amazon store $2500(10/12), Cap1 $1500 (10/12), Discover $1700 (11/1/12).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

@Sitori wrote:Where do I get my EQ auto 8 score?

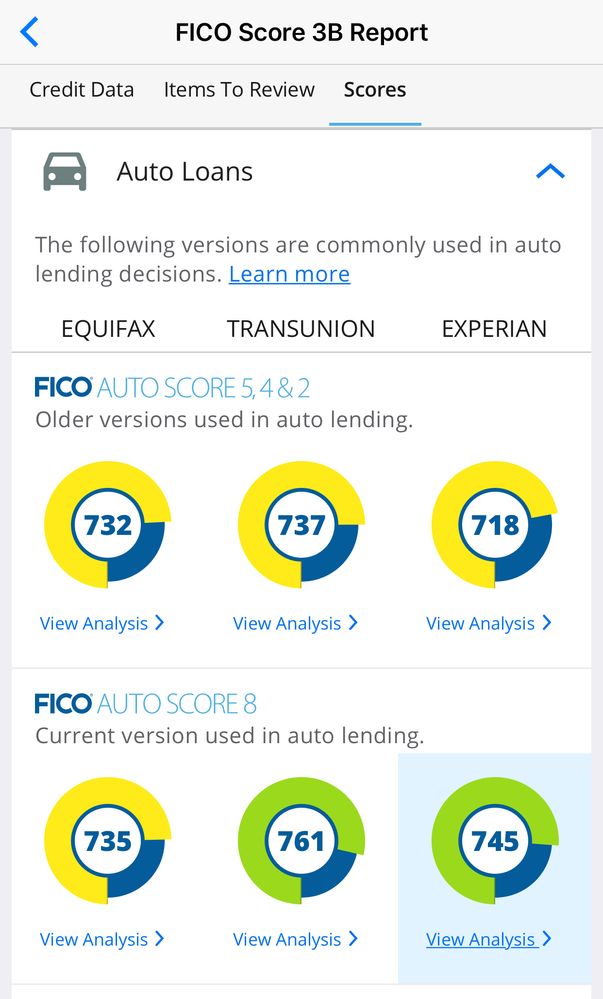

If you get a MyFICO 3B report, you will get all 28 scores, including EQ Auto 8. Below is a screenshot of mine from a few months ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

My opinion is that your utilization is what is killing your scores and making it hard to get approved for a loan. This of course is assuming there are no other negatives or derogs on your report.

As for advice, I would say do your homework before stepping foot at the dealer. Find all discounts and incentives available. Get quotes from a few dealers for the same car, and TRY to walk in with a preapproved loan if possible. Check out Capital One and see if they'll approve. If they do, they'll give you an interest range. That is your starting point. Also, try to do all the calculations before walking in. They'll try to entice you with a low payment. Make sure you know what you can afford per month, but don't tell them. When they ask how much do you want to pay a month, tell them you care more about getting the lowest rate. Will you have money down? Do you have a trade in? Make sure you know what everything is worth. Read everything before signing anything and insist on a breakdown of everything when getting price. My dealer just put a lump sum down without telling me what that included. I made them break it down and come back. When I noticed they didn't include the incentives I was qualified for, I sent them back until I saw the number I wanted. The key is to be educated and know your stuff. Don't let them pressure you. If you're not sure, walk away. Go to another dealer and see what they say. Be patient and keep level headed. Finally, don't expect to be at the same tier as someone with high 700's or 800 scores. But like you said, you can always refinance once you're in a better position.

ETA - if you have a co-signer, even better! But if not, maybe that person can make you an AU on a CC with low utilization and long age to help boost your scores. They can always remove you a few months before being approved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

@Sitori wrote:I just checked the DCU requirements. I don't meet any of those. Not sure how I could get a membership

https://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/DCU-Application/m-p/5782693

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

Thank you ![]()

yes the utilization is def what's killing me. I was on maternity leave for 3 months so my CCs got the usage. Good thing is that I only have 2, they're just on the 70% maxed side. I'm paying a good chunk each month so that I get the higher boosts each month. I'm going to attempt to try one more month of reporting and see if I can get closer to 660.

i do have a 10k down payment, and I have a trade in but prob only worth 2-3k.

how do I find out if there are incentives. Would it be on the dealer website? I definitely want to go in as educated as possible. My last car I didn't realize was stretched out 72 months and my interest was like 13%. Horrendous. I was just happy Bc my payments were only 330 a month.

I applied for the cap one to see where I'll be according to them. I just don't like how you have to use their own car buying tool. They don't have what I'm looking for but regardless I can see where I stand with them.

i appreciate all the advice. Thank you ![]()

-------------------------------------------------------------------------------------------------

EQ 701, TU 685, EX ?

Wallet:

Amazon store $2500(10/12), Cap1 $1500 (10/12), Discover $1700 (11/1/12).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

Then sell your car for $2-3k and now you have $12-13k and you buy a MDX with cash.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

$10k - $13k in hand will get you a VERY nice used car paid in full. This is a no brainer in my book when you have iffy credit. Crazy gymnastics to get into a loan don't make sense when you have that kind of cash.

You can keep rebuilding and if you still have your heart set on something newer/more expensive, be in a MUCH better position to buy in a year or two and probably sell whatever you bought outright for not a whole lot less than you paid.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

@Sitori wrote:Thank you

yes the utilization is def what's killing me. I was on maternity leave for 3 months so my CCs got the usage. Good thing is that I only have 2, they're just on the 70% maxed side. I'm paying a good chunk each month so that I get the higher boosts each month. I'm going to attempt to try one more month of reporting and see if I can get closer to 660.

i do have a 10k down payment, and I have a trade in but prob only worth 2-3k.

how do I find out if there are incentives. Would it be on the dealer website? I definitely want to go in as educated as possible. My last car I didn't realize was stretched out 72 months and my interest was like 13%. Horrendous. I was just happy Bc my payments were only 330 a month.

I applied for the cap one to see where I'll be according to them. I just don't like how you have to use their own car buying tool. They don't have what I'm looking for but regardless I can see where I stand with them.

i appreciate all the advice. Thank you

I used this website and it was a lifesaver: https://cars.usnews.com/cars-trucks

When I was looking for a new car, I didn't know where to start. They will give you what is a reasonable price range for each car, new or used. They compare models by year, giving you the pros and cons. They will also compare other cars that are similar to the one you're looking at. You can also see what incentives and deals each make has for that month. For example, if I look at the Mazda3 page, scroll to the bottom and it will tell you what they're offering this month. You can also look specifically in your zip code.

Click on buying advice and it will tell you how sales are doing. If sales are weak (such as with Mazda) you can use this to your advantage. My dealership had 3-4 of the same model and color that I wanted, so I knew they'd want to release their inventory. If you want to see the deals for ALL the models of a particular maker, you can search that way too. There is a Mazda deals page on this website showing you all the casback, financing, & lease deals offered for each model.

You can do this for any make or model. I'm just using Mazda as an example.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

@Sitori wrote:Thank you

yes the utilization is def what's killing me. I was on maternity leave for 3 months so my CCs got the usage. Good thing is that I only have 2, they're just on the 70% maxed side. I'm paying a good chunk each month so that I get the higher boosts each month. I'm going to attempt to try one more month of reporting and see if I can get closer to 660.

i do have a 10k down payment, and I have a trade in but prob only worth 2-3k.

how do I find out if there are incentives. Would it be on the dealer website? I definitely want to go in as educated as possible. My last car I didn't realize was stretched out 72 months and my interest was like 13%. Horrendous. I was just happy Bc my payments were only 330 a month.

I applied for the cap one to see where I'll be according to them. I just don't like how you have to use their own car buying tool. They don't have what I'm looking for but regardless I can see where I stand with them.

i appreciate all the advice. Thank you

Personally I would take the 10K and pay off your credit card debt and then get your scores up. Then go in dealer and take cosigner with you and put maybe 5k down and I am sure that you would get a good rate. Thats my personal approach.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help getting prepared for the dealership

@Harvey26 wrote:Personally I would take the 10K and pay off your credit card debt and then get your scores up. Then go in dealer and take cosigner with you and put maybe 5k down and I am sure that you would get a good rate. Thats my personal approach.

I agree! If you have $10k, why wouldn't you pay off (or at least pay down) your cards and get those scores up? You'll still have money for a down payment and can get a much better interest rate.