- myFICO® Forums

- Types of Credit

- Auto Loans

- Honda Finance Denial no reasons

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Honda Finance Denial no reasons

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Honda Finance Denial no reasons

So I haven't been on in a while but find myself in a wierd situation. There's 2 issues.

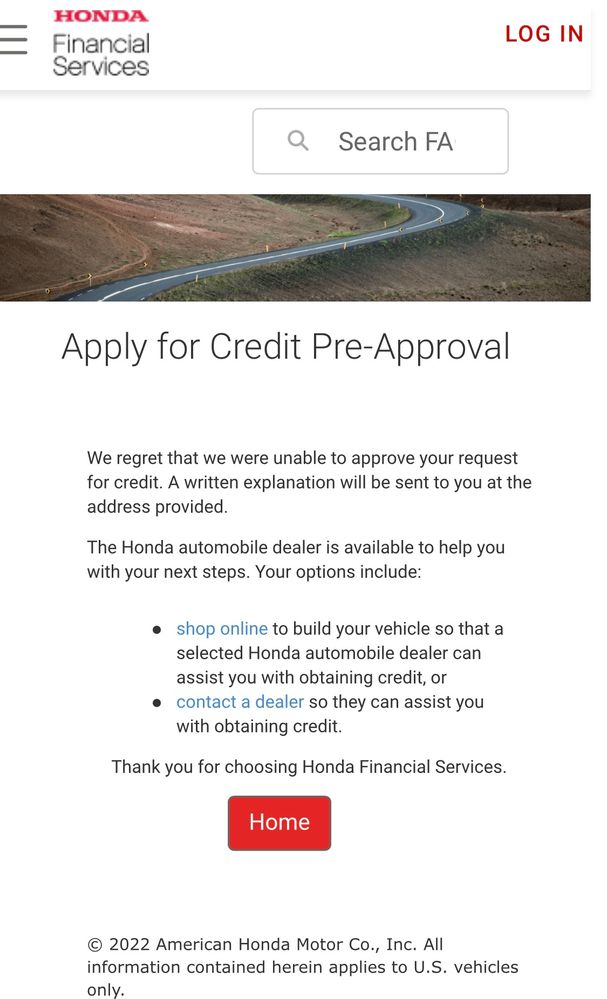

I applied with Honda online for pre approval and was denied. Allegedly they use Fico Auto9 and all of my auto 9's are well over 720. The only thing I can think of is perhaps my 3 year old chapter 7. As my current credit profile is spotless with a good account mix and barely any debt at all reporting as everything is paid off monthly and only small amounts ever report.

also Honda never sent a denial letter with a reason and upon calling the office listed on my credit report I was told to call the dealer (I've never even dealt with a dealer on this sale) who told me to contact Honda finance.

sooooo how do I compel somebody to provide me my denial reason?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Honda Finance Denial no reasons

@Bankrupt2019 wrote:So I haven't been on in a while but find myself in a wierd situation. There's 2 issues.

I applied with Honda online for pre approval and was denied. Allegedly they use Fico Auto9 and all of my auto 9's are well over 720. The only thing I can think of is perhaps my 3 year old chapter 7. As my current credit profile is spotless with a good account mix and barely any debt at all reporting as everything is paid off monthly and only small amounts ever report.

also Honda never sent a denial letter with a reason and upon calling the office listed on my credit report I was told to call the dealer (I've never even dealt with a dealer on this sale) who told me to contact Honda finance.

sooooo how do I compel somebody to provide me my denial reason?

Was this a formal application or just a pre-qualification ? If just a pre-approval then they're not technically accepting your application for credit so they don't have to give you any feedback. However, if you formally applied and Honda Fianance denied you then they're required to send a letter with denial details. How long ago did you apply ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Honda Finance Denial no reasons

@pizzadude wrote:

@Bankrupt2019 wrote:So I haven't been on in a while but find myself in a wierd situation. There's 2 issues.

I applied with Honda online for pre approval and was denied. Allegedly they use Fico Auto9 and all of my auto 9's are well over 720. The only thing I can think of is perhaps my 3 year old chapter 7. As my current credit profile is spotless with a good account mix and barely any debt at all reporting as everything is paid off monthly and only small amounts ever report.

also Honda never sent a denial letter with a reason and upon calling the office listed on my credit report I was told to call the dealer (I've never even dealt with a dealer on this sale) who told me to contact Honda finance.

sooooo how do I compel somebody to provide me my denial reason?

Was this a formal application or just a pre-qualification ? If just a pre-approval then they're not technically accepting your application for credit so they don't have to give you any feedback. However, if you formally applied and Honda Fianance denied you then they're required to send a letter with denial details. How long ago did you apply ?

I applied 3 weeks ago and the Honda website says I will receive a letter. They hard pulled my report. If it was a soft pull I wouldn't even be asking but they made an inquiry and denied me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Honda Finance Denial no reasons

If you actually applied for credit and they denied you they're required to provide reasons. How did the denial come through online, perhaps the reasons were hidden somewhere on the site where they showed that you we're approved ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Honda Finance Denial no reasons

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Honda Finance Denial no reasons

I'm guessing that the "written explanation" they mentioned will come in the form of a snail mail letter to your physical address. So I'd give it a while.

Assuming your income / requested borrowed amounts were in-line with their standards, my gut feeling is they didn't like the BK7.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Honda Finance Denial no reasons

@pizzadude wrote:I'm guessing that the "written explanation" they mentioned will come in the form of a snail mail letter to your physical address. So I'd give it a while.

Assuming your income / requested borrowed amounts were in-line with their standards, my gut feeling is they didn't like the BK7.

Yeah that's best I can come up with

Income is $125k

scores are good

my gut is something with the BK but it's hard to recon something when they won't even tell you why 🤣😂.

credit union will finance me today at as good a great rate (by current horrible standards) but I don't want to buy I want to lease. Up here in the salt belt it's better to just pay the piper and get a new car every 3 years than to buy one that rots out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Honda Finance Denial no reasons

@Bankrupt2019 wrote:credit union will finance me today at as good a great rate (by current horrible standards) but I don't want to buy I want to lease. Up here in the salt belt it's better to just pay the piper and get a new car every 3 years than to buy one that rots out.

Hmmm, I suppose that used to be true, but in this day and age, I don't think that is a good reason to lease. I live in New England and recently traded in a 16 year old car with over 200,000 miles on it and it had just this spring developed its first minor rust spot. Yes, I know not all cars are created equal, but virtually all late model cars will easily last 8 to 10 years before rusting out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Honda Finance Denial no reasons

@Horseshoez wrote:

@Bankrupt2019 wrote:credit union will finance me today at as good a great rate (by current horrible standards) but I don't want to buy I want to lease. Up here in the salt belt it's better to just pay the piper and get a new car every 3 years than to buy one that rots out.

Hmmm, I suppose that used to be true, but in this day and age, I don't think that is a good reason to lease. I live in New England and recently traded in a 16 year old car with over 200,000 miles on it and it had just this spring developed its first minor rust spot. Yes, I know not all cars are created equal, but virtually all late model cars will easily last 8 to 10 years before rusting out.

To be fair, I will still be driving my 18 year old 290,000 mile Volvo. My wife will be getting the new car. I have zero desire to work on anything anymore. The cost of the vehicle is mostly me paying to keep my sanity 🤣😂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Honda Finance Denial no reasons

Interesting in the denial. We in the past had 3 or 4 Honda's all financed through Honda Financial. We were in the middle of our first and only lease with them after those when we had to file BK7. We reaffirmed the lease and at the end of it although we didn't qualify for another lease according to the F&I manager we always dealt with at the dealer they did do a traditional loan again through Honda Financial and the terms weren't terrible. Somewhere around 4% IIRC . They did say past relationship helps a lot with Honda Financial in those situations

SOCK DRAWERED/ FNBO JEEP CARD $7700/ CAPITAL ONE QUICKSILVER $3000 SL/ APPLE CARD $6500/ / PAYPAL CREDIT LINE $1700