- myFICO® Forums

- Types of Credit

- Auto Loans

- I Did A Thing! Refinance Success

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I Did A Thing! Refinance Success

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I Did A Thing! Refinance Success

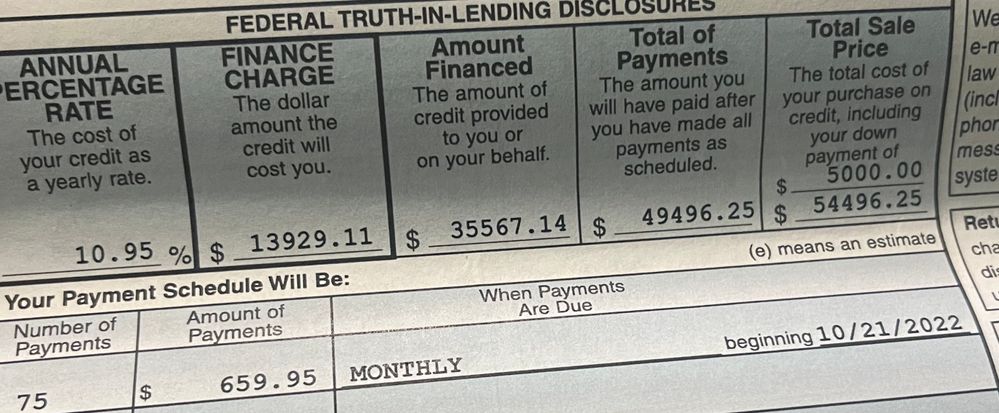

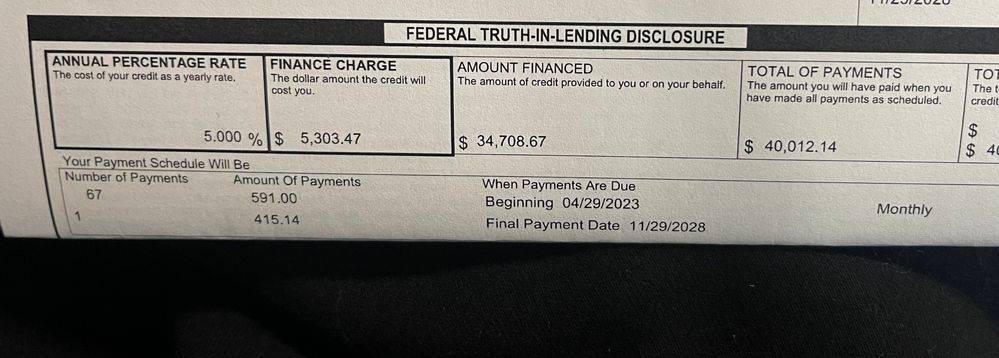

Yesterday i refinanced my 10.95 apr to 5% apr at my local CU! I'm a year post bankruptcy as of February 2023. I am so so proud of me.

Celebrating how much money i'm about to save :

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I Did A Thing! Refinance Success

Congrats on all your hard work and success post BK!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I Did A Thing! Refinance Success

Congrats! I plan on doing the same at NFCU with my Bronco financing later this year when my reports go clean.

Hard INQs last 12 months: EQ: 5 | TU: 8 | EX: 9

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 27% --- AAoA: 5.5 years --- Income: $200k

Last app: 4-6-24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I Did A Thing! Refinance Success

Thank you! I literally just joined and the same day i applied! Navy told me no and pen fed told me 9.3% 😩

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I Did A Thing! Refinance Success

I wasn't a year post discharge maybe that's why Navy told me no. I'll definitely see if doors open after June with Navy. Good luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I Did A Thing! Refinance Success

Thanks man!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I Did A Thing! Refinance Success

@Newbie2018 wrote:Thank you! I literally just joined and the same day i applied! Navy told me no and pen fed told me 9.3% 😩

Yeah I got the same treatment when I joined Navy and PenFed last year. I am building a relationship with both though as we speak... Penfed CC and Navy CC with direct deposit.

I prefer Navy by far and just waiting for my baddies to fall off later this year for the best possible refi rate.

Hard INQs last 12 months: EQ: 5 | TU: 8 | EX: 9

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 27% --- AAoA: 5.5 years --- Income: $200k

Last app: 4-6-24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I Did A Thing! Refinance Success

@TRC_WA wrote:

@Newbie2018 wrote:Thank you! I literally just joined and the same day i applied! Navy told me no and pen fed told me 9.3% 😩

Yeah I got the same treatment when I joined Navy and PenFed last year. I am building a relationship with both though as we speak... Penfed CC and Navy CC with direct deposit.

I prefer Navy by far and just waiting for my baddies to fall off later this year for the best possible refi rate.

Definitely! I do hope rates somewhat go down i'd like a 2-3% apr. My secured graduated with Navy and i'm just awaiting on my 6 months to request the cli. I'm all done with Cards. I'm in the garden now that i've refinanced and gotten enough cards to show a good rebuild. Wouldn't mind the 25k hype but i'll wait til after next year when i start/finish home buying (can't wait)

Pen fed denied me a CC because of "thin file"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I Did A Thing! Refinance Success

You sound exactly like me. ![]() Good luck!

Good luck!

Hard INQs last 12 months: EQ: 5 | TU: 8 | EX: 9

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 27% --- AAoA: 5.5 years --- Income: $200k

Last app: 4-6-24