- myFICO® Forums

- Types of Credit

- Auto Loans

- New auto loan fico score question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New auto loan fico score question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New auto loan fico score question

I'm applying for a new auto loan soon, I'm doing AZEO currently, but not for my AU cards, they're showing AZ. I can make my AU AZEO on the 21st, I'm just wondering if this would affect my auto scores at all or just my regular fico (I'm assuming just regular fico and that it would go up?) I'm just trying to get the best score possible so I can try to be in tier 1 (some say 740, some say 720 some say 700 some say 760)

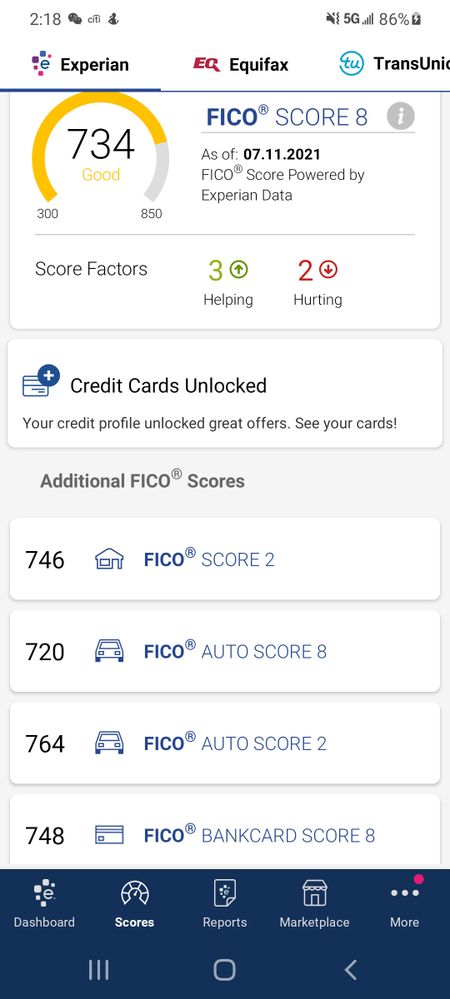

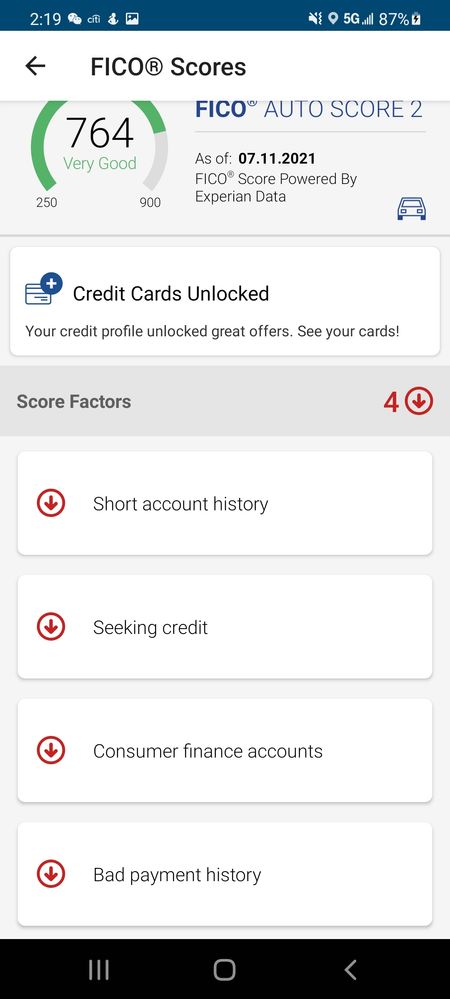

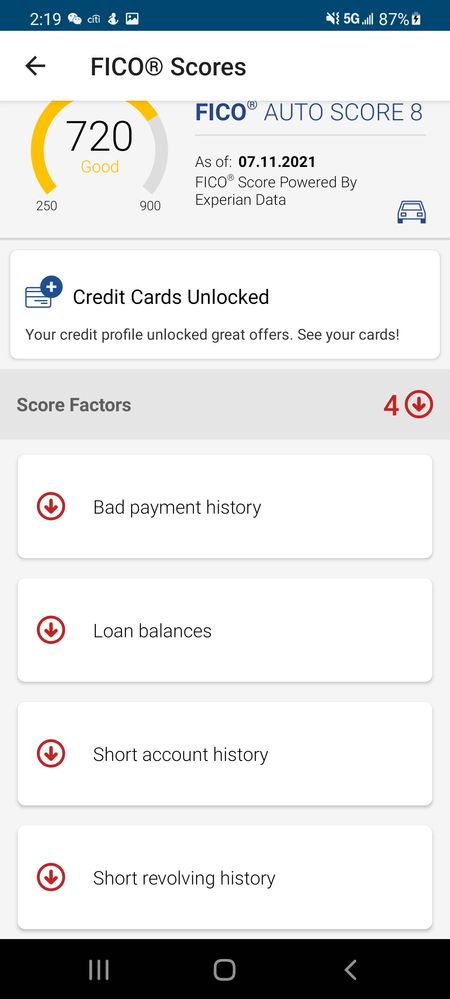

EX fico 8 is 734, auto 2 is 764 auto 8 Is 720, not sure about the other scores just yet, but was planning to buy them after I figure out what I'm doing with the AU cards.

1 30 day late is my only negative on an auto loan 3 years ago.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New auto loan fico score question

You seem to be in very good shape for an auto loan or lease based on my past cars with captive lenders.

Lease or finance should give you the best rates.

I'd try a SP Cap One Auto loan offer to see how much you can qualify for....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New auto loan fico score question

@4sallypat wrote:You seem to be in very good shape for an auto loan or lease based on my past cars with captive lenders.

Lease or finance should give you the best rates.

I'd try a SP Cap One Auto loan offer to see how much you can qualify for....

Good to know. Only thing I'm worried about is whether doing AZEO on the AU accounts is going to hurt the auto score or not. I know it's supposed to increase regular fico but I want to make sure I'm not going to hurt my chances.

Cap one is saying I qualify for like 80k or so which is a ways off of what I'm looking to purchase (165k) but we'll see what happens I guess... now to find a decent deal on the vehicle a couple dealerships I spoke to said I shouldn't have much of an issue even though I have a shorter history (since I'm young)

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New auto loan fico score question

@micvite wrote:

@4sallypat wrote:You seem to be in very good shape for an auto loan or lease based on my past cars with captive lenders.

Lease or finance should give you the best rates.

I'd try a SP Cap One Auto loan offer to see how much you can qualify for....

Good to know. Only thing I'm worried about is whether doing AZEO on the AU accounts is going to hurt the auto score or not. I know it's supposed to increase regular fico but I want to make sure I'm not going to hurt my chances.

Cap one is saying I qualify for like 80k or so which is a ways off of what I'm looking to purchase (165k) but we'll see what happens I guess... now to find a decent deal on the vehicle a couple dealerships I spoke to said I shouldn't have much of an issue even though I have a shorter history (since I'm young)

AZEO on the AU should improve both FICO8 and FICO auto 8. The only one it may hurt, would be the mortgage scores and their auto variants which are used by almost no one in the auto industry (I believe there are some CUs that still use mortgage scores or their auto variants). I always keep a small balance on my AU account as FICO8 is more commonly used and it provides me at least a 6 point gain over letting it report 0 balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New auto loan fico score question

@Anonymous wrote:

@micvite wrote:

@4sallypat wrote:You seem to be in very good shape for an auto loan or lease based on my past cars with captive lenders.

Lease or finance should give you the best rates.

I'd try a SP Cap One Auto loan offer to see how much you can qualify for....

Good to know. Only thing I'm worried about is whether doing AZEO on the AU accounts is going to hurt the auto score or not. I know it's supposed to increase regular fico but I want to make sure I'm not going to hurt my chances.

Cap one is saying I qualify for like 80k or so which is a ways off of what I'm looking to purchase (165k) but we'll see what happens I guess... now to find a decent deal on the vehicle a couple dealerships I spoke to said I shouldn't have much of an issue even though I have a shorter history (since I'm young)

AZEO on the AU should improve both FICO8 and FICO auto 8. The only one it may hurt, would be the mortgage scores and their auto variants which are used by almost no one in the auto industry (I believe there are some CUs that still use mortgage scores or their auto variants). I always keep a small balance on my AU account as FICO8 is more commonly used and it provides me at least a 6 point gain over letting it report 0 balance.

So it wouldn't affect my auto 8 or auto 2 negatively right? I dropped about 12 points fico8 once my AU cards started hitting AZ.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New auto loan fico score question

@micvite wrote:

@Anonymous wrote:

@micvite wrote:

@4sallypat wrote:You seem to be in very good shape for an auto loan or lease based on my past cars with captive lenders.

Lease or finance should give you the best rates.

I'd try a SP Cap One Auto loan offer to see how much you can qualify for....

Good to know. Only thing I'm worried about is whether doing AZEO on the AU accounts is going to hurt the auto score or not. I know it's supposed to increase regular fico but I want to make sure I'm not going to hurt my chances.

Cap one is saying I qualify for like 80k or so which is a ways off of what I'm looking to purchase (165k) but we'll see what happens I guess... now to find a decent deal on the vehicle a couple dealerships I spoke to said I shouldn't have much of an issue even though I have a shorter history (since I'm young)

AZEO on the AU should improve both FICO8 and FICO auto 8. The only one it may hurt, would be the mortgage scores and their auto variants which are used by almost no one in the auto industry (I believe there are some CUs that still use mortgage scores or their auto variants). I always keep a small balance on my AU account as FICO8 is more commonly used and it provides me at least a 6 point gain over letting it report 0 balance.

So it wouldn't affect my auto 8 or auto 2 negatively right? I dropped about 12 points fico8 once my AU cards started hitting AZ.

Auto8 should improve if you do AZEO for AU accounts. Auto2 is a bit of a toss up, as it is a variant of the regular FICO2 score, it prefers less accounts with a balance and has no penalty for AZ on AU accounts. I wouldn't imagine that one additional account reporting a small balance would affect those scores, but there is always a possibility.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New auto loan fico score question

@Anonymous wrote:

@micvite wrote:

@Anonymous wrote:

@micvite wrote:

@4sallypat wrote:You seem to be in very good shape for an auto loan or lease based on my past cars with captive lenders.

Lease or finance should give you the best rates.

I'd try a SP Cap One Auto loan offer to see how much you can qualify for....

Good to know. Only thing I'm worried about is whether doing AZEO on the AU accounts is going to hurt the auto score or not. I know it's supposed to increase regular fico but I want to make sure I'm not going to hurt my chances.

Cap one is saying I qualify for like 80k or so which is a ways off of what I'm looking to purchase (165k) but we'll see what happens I guess... now to find a decent deal on the vehicle a couple dealerships I spoke to said I shouldn't have much of an issue even though I have a shorter history (since I'm young)

AZEO on the AU should improve both FICO8 and FICO auto 8. The only one it may hurt, would be the mortgage scores and their auto variants which are used by almost no one in the auto industry (I believe there are some CUs that still use mortgage scores or their auto variants). I always keep a small balance on my AU account as FICO8 is more commonly used and it provides me at least a 6 point gain over letting it report 0 balance.

So it wouldn't affect my auto 8 or auto 2 negatively right? I dropped about 12 points fico8 once my AU cards started hitting AZ.

Auto8 should improve if you do AZEO for AU accounts. Auto2 is a bit of a toss up, as it is a variant of the regular FICO2 score, it prefers less accounts with a balance and has no penalty for AZ on AU accounts. I wouldn't imagine that one additional account reporting a small balance would affect those scores, but there is always a possibility.

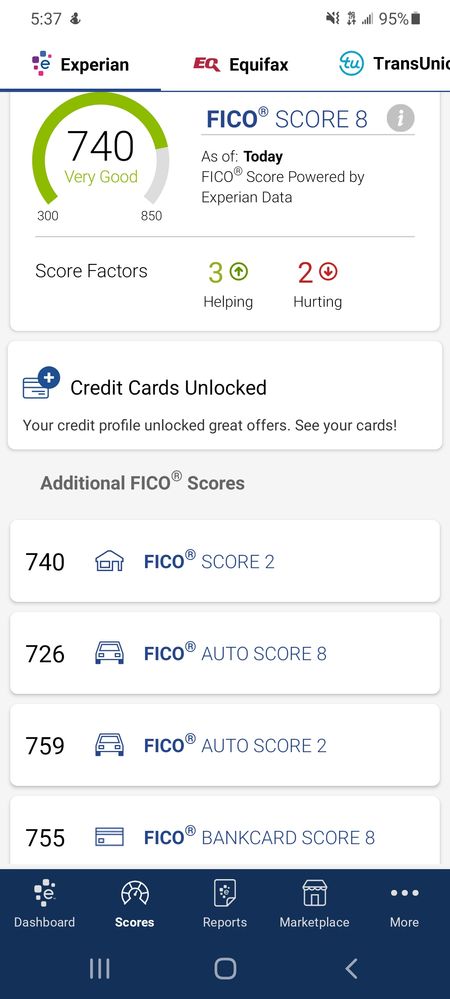

You were completely right, fico 8 went up 6 fico auto 8 went up 6 and I lost 5 on auto 2

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500