- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: Rebuilder looking for a car loan...advice?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Rebuilder looking for a car loan...advice?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

@Brian_Earl_Spilner wrote:Well, what had happened was the transmission in his car was starting to slip so he wanted a newer car. Went to the dealer with down payment and a trade-in. After running his credit, the manager came out and told him they weren't able to finance him. He came out and we were gonna leave when he pointed out the manager and I knew him so I went in and asked him to do me a favor. That's when he mentioned CAC. We went back in and the application was sent to CAC with several cars. They kept rejecting the cars for one reason or another. Finally, they got an ok on a Ford Ranger and he filled out the paperwork. I don't remember what his APR was, but can find out. I believe it was in the 16s. He never saw or test drove the truck. When we came out they had a base model ranger with no options. He was crushed until the manager realized it was the wrong truck. 20 mins later they pulled up a fully loaded edge and he was stoked, lol. His scores were around yours and he got a call a few days later that they needed an additional $1500 down. He paid half and went back 2 weeks later to pay the other half. I believe his contract wasn't a standard length either. 34 or 36 months. I will say, CAC was willing to work with him when he ran into financial distress and started missing payments. I think he fell 2 or 3 payments behind for a while. They never talked about repo and set up a plan for him to catch up. He did and paid off the truck. This was back in, I want to say 2005 or 6. Back then you couldn't apply online. It had to be offered by the dealer to even be considered by them.

Wow! Great story. Is there a rhyme or reason why a specific car would not meet CAC's approval criteria? I understand Teslas are out of the question but seems absurd that they will boil it down to a few cars or only 1 car as in your friend's experience. The only thing I can think of myself is they might be saving up better or nicer cars for folks who have a higher credit so they can appeal to that group and also they might offer you cars that have been sitting on the lot for the longest because they will think you're desperate and you will take anything as long as you're approved.

@Jannelo wrote:Please don't buy new since you will have a high interest rate with your score. So borrowing that much money is such a waste of money. when you look at all of the interest rate you are paying and buying new, unless you have a very large down payment. You can't have everything you want when rebuilding your credit. My car was three years old at 14,400, I think. I've already forgotten. LOL I was in the low 520s last year. I am now in the low 590s. Go on Capital One's Auto Navigator and see if you pre-qualify. I was stunned I did and at the interest rates offered depending on the cars I clicked on and downpayment. You can build your loan on there and get an idea as to what your payment will be. If you pre-qualify, you go on their site and check out all of the dealers connected to the Auto Navigator program. I also recommend when buying used to buy a car that retains it value for less repair problems and strong resell value. Toyotas are known for that, as are Hondas.

So two weeks ago, I bought through Cap One a 2016 black Camry SE with 40,000 plus miles on it in pristine condition, one previous owner, not rental car, no accidents. The APR offered to me by Cap One was 6.29 for 60 months or 6.99 for 72 months. For my credit history and baddies, I was delighted, thinking I would have to pay in the mid to high teens as far as interest to buy a car. And my payments are only 237 a month. I will pay it off sooner, hopefully, in four years, though. Cap One has been very forgiving to me, even with my past with them with charge-offs.

I would have loved to have bought a 30,000 car or even a low 20s used, but I felt I needed to be smart about this as I am in the rebuilding stage. And the car drives like new and looks new. My new, to me, car:

http://2-photos7.motorcar.com/used-2016-toyota-camry-4drsedani4automaticse-13231-16248756-1-1024.jpg

It won't hurt to see if you pre-qualify, as it's only a soft pull. And the interest rates I pre-qualified for stayed true once I took my pre-qual info and number assigned to me to the dealer and they ran it through Cap 1 Auto Finance. I didn't have to show proof of income or anything. It was painless. And Toyota dealerships are on their Auto Navigator site. Although, my used one happened to be at a Mazda dealership as a trade-in for an SUV. It gave me piece of mind and a sense of power knowing what I was approved for before I went to the dealership.

I visited the Cap One website and apparently it lets you browse for specific cars in your area and see if you can get pre qualified. Can I attempt to get prequal on any number of cars on their website without it affecting my credit score? At what point do they actually run a HP? Thanks for chiming in with this info!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

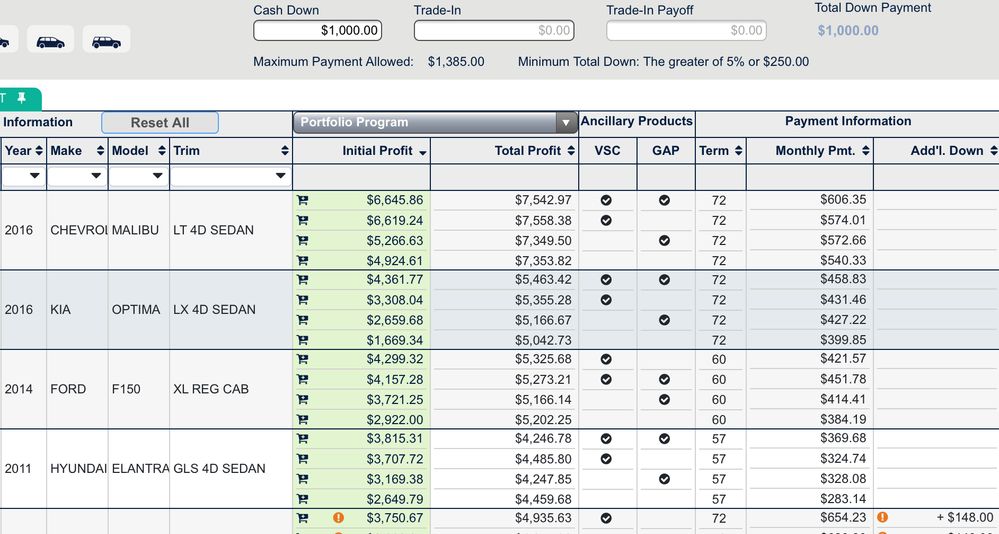

The screenshot below is a picture of my dealer portal for Credit Acceptance. As you can see what a dealer will do is enter in the amount of money you have available as a down payment and the system will automatically populate the entire inventory and tell you exactly which vehicles you’ll make the most money on with this particular customer. There’s no submitting an application on several different vehicles, it’s as simple as entering in the customer’s social, income and job time and CAC’s system will populate the initial profit on EVERY car in the inventory. The more cash down, the more initial profit. You can purchase any car with the right amount of money down with CAC. The initial profit column is what most dealers are worried about. A decent average per copy/deal is $2500, but a dealer will usually let a deal go with a $2000 profit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

Not sure why they could only qualify 1 car from 3 lots. There are minimum requirements like it can't be older than x years and mileage can't be above x which will weed out a bunch. Then comes the number crunching so they have to figure out loan to value, be able to fit it into what the person can afford, etc. In the end, the manager did me a solid because it took almost 5 hours to get him into that truck.

Cap1 prequal won't hurt your credit. It's only a soft pull. You can definitely try that. Another option would be carvana. It's owned by DriveTime which is the largest dealer in the country for people with bad credit. Carvana caters to all credit types, but you might be able to have a better chance at approval because of DriveTime. I looked at both when shopping for a new car. I actually found carvana to be around 2% lower with it's APRs than cap1. Cap1's prequal is good for, I think 60 days, and carvana is good for 30. I actually almost bought a Lexus from Carvana. Process is super simple and quick. All I had to do was upload my documents (ID, paystubs, etc.) and take the HP, but I backed out at the last second. Decided to shop around more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

To answer your question above, you get pre-qual'd once when you apply, and I think it's good for a month or six weeks and you can look at all of the cars on their site. Then you are in their Auto Navigator site. So you can play around with different cars and building loans for weeks. It will stop you if you click on a car and it's too high, with a low down payment. But, basically, I knew I wanted to stay around 15,000. You can do that all you want with no HP pull on your credit. Then if you like a car. I picked several to go look at. I called and got their fees. So I knew my car and dealership. So they informed me they had an $899 dealership fee. No other charges like destination charges, etc. Cap 1, when you are building you loan, shows you your tax and title fees. I knew I would have GAP insurance, so that wasn't figured out until I went to the dealership. So I picked my car on the Cap One site and printed everything off Cap One instructed me to and was to take to the dealership. Cap One assigned me a number. I called the dealership and told them I was interested in the car. They said they would have it ready for me. I went and fell in love quickly with it, surprisingly, since I always felt I was settling at staying so low in price. I informed them of the Cap one loan after I told them I was purchasing the car. They are a chill dealership and were fine with that. There is never a HP on your credit until the moment you decide you are going to purchase the car. Cap One Auto Finance tells you to give them your number assigned to them as the dealership is going to do the auto application, run it through Cap One and input that number given to my pre-qual'd loan. It came back just like the site said as far as interest rate. With the GAP insurance my estimated monthly payment was about $11 more on the monthly payment, which brought me up to the $239. So my building of the loan on their site came out very close. I wanted no extras and didn't purchase anything else they throw at you during the loan process, but Mazda really didn't even push that. I appreciated that. It was the most painless experience I've ever had in buying a car and fairly quick.

If you don't pre-qualify right at this moment, don't worry. You now have a second credit card, I read. So build a few more months of now paying on two credit cards timely and try again in a few months. I waited until my scores came up a little. It never hurts to see if you pre-qualify on there because it's always soft pulls.

As an add, I didn't even see my car on their site. Although, it was there. They have so many dealerships attached, I missed it in my search. I went on Cars.com also and looked for Camrys and cross-checked to make sure a few I liked were at dealerships I knew were on Auto Navigator's list.

Green Dot Primor Secured (5/18) - $450 CL (CLOSED 2/2020)

Capital One Platinum (8/18) PC to Quicksilver (9/19) - $3800 CL

Capital One QuicksilverOne (3/19) - $4800 CL

Merrick Bank DYL VISA - No AF (6/19) - $1400 CL

Discover it Cash Back (9/19) - $2800 CL

Amazon Prime Store Card (4/20) - $10,000 CL

NFCU cashRewards (4/20) - $4500 CL

BB&T Spectrum Cash Rewards (5/20) - $3500 CL

Navy Federal More Rewards American Express® Card (3/21) - $9700 SL - at 9.65 %.

Experian FICO Score - 8/2018: 528

Experian FICO 8 Score - 9/2022 - 720

Equifax FICO 8 score 2/2022- 692

TransUnion FICO 8 score 10/2022 - 728

Experian FICO Mortgage Score - 725

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

@Anonymous wrote:The screenshot below is a picture of my dealer portal for Credit Acceptance. As you can see what a dealer will do is enter in the amount of money you have available as a down payment and the system will automatically populate the entire inventory and tell you exactly which vehicles you’ll make the most money on with this particular customer. There’s no submitting an application on several different vehicles, it’s as simple as entering in the customer’s social, income and job time and CAC’s system will populate the initial profit on EVERY car in the inventory. The more cash down, the more initial profit. You can purchase any car with the right amount of money down with CAC. The initial profit column is what most dealers are worried about. A decent average per copy/deal is $2500, but a dealer will usually let a deal go with a $2000 profit.

Man, I wish they had that back when he got his truck. I was so over being at that dealer by the end. I just wanted to leave him there and go home.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

So much stuff to look at now, thanks to everyone!! I really appreciate it and I hope to share my experience to help others in a similar boat.

As far as looking at Carfax reports, what are the big things I should look for? I was looking at one car right now and it had no damage reported, no total loss, no airbag deployment, etc. but 4 owners in 7 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

Four owners in seven years? I would be very leery on that one. What year is the car? I had picked out a few to look at at Hertz Rental's sales program. I called my trusty mechanic, and he put his foot down. I couldn't get him to budge, so I tossed away that idea. Buying used, they say to have a mechanic look it over. I was adamant I was going to do that if I didn't buy a certified car. But the previous owner's records were all left in the glove box, and he was diligent in taking care of his car, so I didn't do it. The car was garaged and kept up to date on all maintenance. Clean CarFax (very important). And for a black car, I couldn't find a scratch on it. I didn't follow my own advice about taking it to a mechanic.. You have five days to return a car. So you can have a mechanic check it out if you buy and it's older. Really, the smart thing is to do that for piece of mind and ensuring your purchase is a smart one.

This time I did not pay any extra for an extended warranty. I did that on my previous Lexus I bought used and never needed it. That's just more money on the loan with interest on it. But that's just my feeling.

I would stop at two owners depending on the age of the car. Make sure that owner isn't a rental car company.

Green Dot Primor Secured (5/18) - $450 CL (CLOSED 2/2020)

Capital One Platinum (8/18) PC to Quicksilver (9/19) - $3800 CL

Capital One QuicksilverOne (3/19) - $4800 CL

Merrick Bank DYL VISA - No AF (6/19) - $1400 CL

Discover it Cash Back (9/19) - $2800 CL

Amazon Prime Store Card (4/20) - $10,000 CL

NFCU cashRewards (4/20) - $4500 CL

BB&T Spectrum Cash Rewards (5/20) - $3500 CL

Navy Federal More Rewards American Express® Card (3/21) - $9700 SL - at 9.65 %.

Experian FICO Score - 8/2018: 528

Experian FICO 8 Score - 9/2022 - 720

Equifax FICO 8 score 2/2022- 692

TransUnion FICO 8 score 10/2022 - 728

Experian FICO Mortgage Score - 725

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

@Jannelo wrote:Four owners in seven years? I would be very leery on that one. What year is the car? I had picked out a few to look at at Hertz Rental's sales program. I called my trusty mechanic, and he put his foot down. I couldn't get him to budge, so I tossed away that idea. Buying used, they say to have a mechanic look it over. I was adamant I was going to do that if I didn't buy a certified car. But the previous owner's records were all left in the glove box, and he was diligent in taking care of his car, so I didn't do it. The car was garaged and kept up to date on all maintenance. Clean CarFax (very important). And for a black car, I couldn't find a scratch on it. I didn't follow my own advice about taking it to a mechanic.. You have five days to return a car. So you can have a mechanic check it out if you buy and it's older. Really, the smart thing is to do that for piece of mind and ensuring your purchase is a smart one.

This time I did not pay any extra for an extended warranty. I did that on my previous Lexus I bought used and never needed it. That's just more money on the loan with interest on it. But that's just my feeling.

I would stop at two owners depending on the age of the car. Make sure that owner isn't a rental car company.

The specific car I was looking at is 2012 and it's actually exterior black. Maybe the previous owners didn't know what they were getting into by getting a black exterior? Personally I wouldn't mind scratches and such on a paint job like that. I would know that going in by going with black. Really at this point I just need wheels from A to B.

How do I check that it's not a rental car? Is there a specific word on the Carfax to look for? This one I was looking at all say Personal for the 4 owners, except the 1st owner which says "Personal lease".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

Yeah, you are going to see scratches on a used car usually. And black is the worst for that. I should know. My Lexus was black. But I love a black car. I guess that's why I was drawn to the black Camry, when I swore I was looking for a silver one. "Personal lease" is when a person leases the car from the dealership instead of buying. There's really no problem with that. They are going to take care of the car like they own it or else be hit with extra charges when turning it in. Plus the dealership takes care of car issues when under lease. Still, seven years, four leases. I would still get it checked out by a mechanic since it's a 2012. People do it all the time. The mechanic puts it up on the lift and gives it a good once over and you can at least buy it knowing there's no big ticket item looming that is going to break down and cause you money out of pocket while paying a car payment. You, obviously, can't go and spend a hundred to two hundred for a mechanic checking it out for every car you are looking at, so it's once you really narrow it down to a specific car you are buying. If someone else has done that, they can give you more information and why it's important. But for a 2012, I would say you reallys should, unless it's a certified vehicle or under extended warranty still, etc. My brother-in-law bought a used 2013 Toyota Avalon this year and the miles were barely higher than mine and it's given him no problems. He didn't have his mechanic check it out until after he bought it. But it was also a one-car owner. His mechanic said he got a great deal.

What you want is reliable at this point. What is the car you are looking at? I picked my mechanic's brain while I was looking at cars on the internet.

Regarding knowing if the car is a rental, on Carfax, it says "rental," so you will know when it's been a rental car for a rental car agency.

Others might not agree with me, but for me buying used, out of warranty on most of it, I did not want a car with CVT transmission. I wanted to make sure it was automatic transmission. I've had Nissans with it with no problem, but they were new and I traded cars frequently back then. I've read up on it and the issues with CVT transmissions (not in the newer years with lower miles). So buying used with miles on it, I did not want that. I checked with my mechanic about that and he reiterated not to buy one with a CVT transmission since I'm buying used with over 40,000 miles on my car. He says it's still flawed and they have never really perfected it. He deals with that all the time. He specializes in foreign cars, Hondas, Toyotas, Volvos, etc. I didn't want to be dealing with transmission repairs only three years down the road. I'm sure many have no problem as they hit higher miles and would disagree with me. My luck, I would be the one. But that's just me. I truly wanted a car that would run and run causing me no issues, hopefully, keeping costs down. I loved the Nissan Altima, but it's ultimately why I didn't look at them as a used car.

Green Dot Primor Secured (5/18) - $450 CL (CLOSED 2/2020)

Capital One Platinum (8/18) PC to Quicksilver (9/19) - $3800 CL

Capital One QuicksilverOne (3/19) - $4800 CL

Merrick Bank DYL VISA - No AF (6/19) - $1400 CL

Discover it Cash Back (9/19) - $2800 CL

Amazon Prime Store Card (4/20) - $10,000 CL

NFCU cashRewards (4/20) - $4500 CL

BB&T Spectrum Cash Rewards (5/20) - $3500 CL

Navy Federal More Rewards American Express® Card (3/21) - $9700 SL - at 9.65 %.

Experian FICO Score - 8/2018: 528

Experian FICO 8 Score - 9/2022 - 720

Equifax FICO 8 score 2/2022- 692

TransUnion FICO 8 score 10/2022 - 728

Experian FICO Mortgage Score - 725

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rebuilder looking for a car loan...advice?

@Jannelo wrote:Yeah, you are going to see scratches on a used car usually. And black is the worst for that. I should know. My Lexus was black. But I love a black car. I guess that's why I was drawn to the black Camry, when I swore I was looking for a silver one. "Personal lease" is when a person leases the car from the dealership instead of buying. There's really no problem with that. They are going to take care of the car like they own it or else be hit with extra charges when turning it in. Plus the dealership takes care of car issues when under lease. Still, seven years, four leases. I would still get it checked out by a mechanic since it's a 2012. People do it all the time. The mechanic puts it up on the lift and gives it a good once over and you can at least buy it knowing there's no big ticket item looming that is going to break down and cause you money out of pocket while paying a car payment. You, obviously, can't go and spend a hundred to two hundred for a mechanic checking it out for every car you are looking at, so it's once you really narrow it down to a specific car you are buying. If someone else has done that, they can give you more information and why it's important. But for a 2012, I would say you reallys should, unless it's a certified vehicle or under extended warranty still, etc. My brother-in-law bought a used 2013 Toyota Avalon this year and the miles were barely higher than mine and it's given him no problems. He didn't have his mechanic check it out until after he bought it. But it was also a one-car owner. His mechanic said he got a great deal.

What you want is reliable at this point. What is the car you are looking at? I picked my mechanic's brain while I was looking at cars on the internet.

Regarding knowing if the car is a rental, on Carfax, it says "rental," so you will know when it's been a rental car for a rental car agency.

Others might not agree with me, but for me buying used, out of warranty on most of it, I did not want a car with CVT transmission. I wanted to make sure it was automatic transmission. I've had Nissans with it with no problem, but they were new and I traded cars frequently back then. I've read up on it and the issues with CVT transmissions (not in the newer years with lower miles). So buying used with miles on it, I did not want that. I checked with my mechanic about that and he reiterated not to buy one with a CVT transmission since I'm buying used with over 40,000 miles on my car. He says it's still flawed and they have never really perfected it. He deals with that all the time. He specializes in foreign cars, Hondas, Toyotas, Volvos, etc. I didn't want to be dealing with transmission repairs only three years down the road. I'm sure many have no problem as they hit higher miles and would disagree with me. My luck, I would be the one. But that's just me. I truly wanted a car that would run and run causing me no issues, hopefully, keeping costs down. I loved the Nissan Altima, but it's ultimately why I didn't look at them as a used car.

I had to look up a CVT transmission. It looks like it's still considered an automatic transmission or like a variation of it? I thought auto was auto. I'll have to make sure to ask that question as well when shopping around to make sure that if they are listing auto transmission it's not actually a CVT transmission.

The car I'm looking at is actually an Altima. The price looks great for it having only 45k miles on it and being 2012. But it got me wondering why it was lower than the market price. So I looked at the car reports on websites called iseeCars and VehicleHistory (never heard of these websites before but they were pretty detailed. Carfax wanted payment to view report). Reports show it has a "Junk and Salvage record and Total Loss record reported by insurance company" in 2017. What are these records saying? The way I read it is the car was involved in a collision in 2017, and it was deemed a total loss by the insurance company. The remaining part of the car was sold and restored after that. Now the reports don't say how many owners have there been after the collision but my guess is 0 because there have only been about 20 miles added after the collision happened. I looked at the car pictures again and I must say the car looks great (inside and out)! However of course it could have issues internally because of the collision. The dealer does offer free 3 mos/3k miles limited powertrain warranty and a 5yr/100k miles extended service agreement is also available. I would welcome any opinion on this particular car based on these details. I don't think anyone is salivating at getting this car with a total loss on its record. However for someone like me just needing wheels (and reliable wheels at that which won't cost money down the road for repairs), it could possibly put me in a good spot to negotiate a better price. Records show this car has been at this dealer for the same price as listed today since January 2019. Of course a car like this would definitely require an inspection by a mechanic.

By the way I did the Cap One pre qualifier on the Auto Navigator page and they couldn't prequalify me. Not really surprised. I apped for a Cap One secured card a few weeks ago and was denied for that. I think Cap One won't get my business or triple HPs going forward.