- myFICO® Forums

- Types of Credit

- Auto Loans

- Recent Auto Loan - 100% of each monthly payment ap...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Recent Auto Loan - 100% of each monthly payment applied to interest only.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recent Auto Loan - 100% of each monthly payment applied to interest only.

Received a new auto loan with Ally Financial earlier this year. I have made 5 payments so far totalling about $2,500. According to the online info, my payoff amount is the exact same as what I originally financed. Down to the penny. When I look at each month's payment, it is showing 100% of each payment being applied to finance charges only. Zero is getting applied to the principal. My rate is 9.9%.

Because I bought the vehicle right at the Covid outbreak, I was able to defer 4 months of the first payments. No late fees would not be applied but interest would continue to accrue. Nothing stated about payments being applied to that interest first.

Does that sound right? I will call them but wanted to hear opinions here first.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recent Auto Loan - 100% of each monthly payment applied to interest only.

Payments always go to interest first, if you pay the bare minimum you won't see movement, progress like you were hoping/expecting you can make smaller payments throughout the month or early before the payment due date to help with that as you can and also if you make a little extra payment a month that will help as well ![]() It can be tricky thing to understand but if you can make over your payment I would recommend it or if it is due on the 25th for example paying it early in the month or split up payments can help

It can be tricky thing to understand but if you can make over your payment I would recommend it or if it is due on the 25th for example paying it early in the month or split up payments can help ![]() Any extra over your payment in the month will help as well

Any extra over your payment in the month will help as well ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recent Auto Loan - 100% of each monthly payment applied to interest only.

Payments on any loan are going to be applied to interest before principal, so you'll have to clear the interest accrued during your deferrment before you can bite into the principal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recent Auto Loan - 100% of each monthly payment applied to interest only.

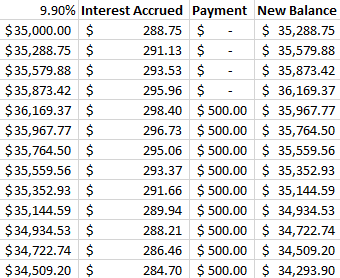

You're going to need to make probably 6 or 7 payments just to get through the interest that accrued due to deferred payments. Not sure what the original loan amount was for, but here's a $35k loan with simple interest accrued monthly:

Once you start making it through the accrued interest, you'll start making more and more progress on knocking out the principal every month.

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recent Auto Loan - 100% of each monthly payment applied to interest only.

Unless you make a principal only payment besides your regular payment, you are not going to see any movement on your payoff. Especially with your interest rate being that high, expect to make quite a few payments before chipping away at that balance.

B&H Payboo Card $15,000 | Amazon Prime Card $10,000 | PC Richard Card $15,000 | Target RedCard $2,000 | Walmart Store Card $1,400 | Shell Gas Card $1,200 | Overstock Store Card $7,000 | Kohl's Store Card $3,000

Spring Cleaning:

C̶a̶p̶i̶t̶a̶l̶ ̶O̶n̶e̶ ̶Q̶u̶i̶c̶k̶S̶i̶l̶v̶e̶r̶ ̶$̶1̶,̶0̶0̶0̶ | C̶r̶e̶d̶i̶t̶ ̶O̶n̶e̶ ̶V̶i̶s̶a̶ ̶$̶1̶,̶2̶0̶0̶ | M̶e̶r̶r̶i̶c̶k̶ ̶B̶a̶n̶k̶ ̶$̶2̶,̶7̶0̶0̶ | M̶a̶r̶v̶e̶l̶ ̶M̶a̶s̶t̶e̶r̶c̶a̶r̶d̶ ̶$̶1̶,̶̶2̶0̶0̶ | C̶o̶m̶e̶n̶i̶t̶y̶ ̶M̶a̶s̶t̶e̶r̶C̶a̶r̶d̶ ̶$̶1̶,̶1̶8̶0̶

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recent Auto Loan - 100% of each monthly payment applied to interest only.

9.9 isn't THAT high on a side note so don't feel bad?! Rule of Thumb anything under 10 is pretty good, of course GOAL is to be 5% and below but over 10% you definitely want to see about refinancing at 13 months of having your original loan I have seen people with 23, 25, 27, and over 30% APR which is SCARY!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recent Auto Loan - 100% of each monthly payment applied to interest only.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recent Auto Loan - 100% of each monthly payment applied to interest only.

Unfortunately the deferral is a double-edged sword. It helps with bill relief, but the downside is that interest continues to accumulate and you must get through it first before you start chipping at the principal. I had a similar situation; got a new truck in February, made 1 payment, got 4 months deferral, and when I began repayment in August all my payment went to interest. I should note however that I made an additional $500 payment in August ($673 regular payment), and finally a decent chunk of my payment is starting to go towards the principal balance now as of this last payment this month. So its just going to take some time, and if you can make additional principal-only payments, definitley do so.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recent Auto Loan - 100% of each monthly payment applied to interest only.

4 months of no payments would add over 3% to your original balance.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Recent Auto Loan - 100% of each monthly payment applied to interest only.

I have seen it done both ways. It depends on what the agreement was to cure the deferred interest. I have seen situations where the payment is applied like normal and the deferred interest is picked up on the back end of the loan. And other times the payments will cure the deferred interest before anything is applied to principal.