- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- Re: CapOne & BK 7

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CapOne & BK 7

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CapOne & BK 7

I was approved out of a CHP 7 BK for a CapOne Mastercard with a $300 limit that would auto increase after 5 payments to $500. I read here in the forums that if you asked for a CLI before your auto increase, it might be approved and then youd get a second increase on your 5th payment mark. I went ahead and attempted the early CLI.

I was denied for the following reasons :

- A payment on this Capital One account was recently returned (this was a auto-pay account number error which i corrected with a customer service representative who said this would have no impact on me)

- The credit reporting agency has reported a recent credit delinquency (I assume this would be the BK but they gave me a card right after the BK was discharged so it was already reporting)

- Recent use of this account's existing credit line has been too low

The last one is kind of like a slap of 'hey, youve been very responsible with your credit limit keeping it below 30% and PIF but we dont want to reward that'. Can I call for a recon?

Thoughts from more seasoned bk rebuilders?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne & BK 7

Congrats. The way it works now. After 90 days or so you can ask for a CLI. So they said you'll get a $200 CLI after credit steps ends. You may get CLI. But that will be deducted from your original credit step agreed amount. So early CLI or not. You'll still end of as promised when approved. There is no recon with Cap1. Also. Thats a farse about dont use more than 30% of your credit line. Best way with Cap1 is heavy usage and PIF each month. That will get you CLI's after credit steps. Even if you get close to your credit line. Pay it off and do it again. As long as your monthly statement is zippo.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne & BK 7

“I was denied for the following reasons :

- A payment on this Capital One account was recently returned (this was a auto-pay account number error which i corrected with a customer service representative who said this would have no impact on me)

- The credit reporting agency has reported a recent credit delinquency (I assume this would be the BK but they gave me a card right after the BK was discharged so it was already reporting)”

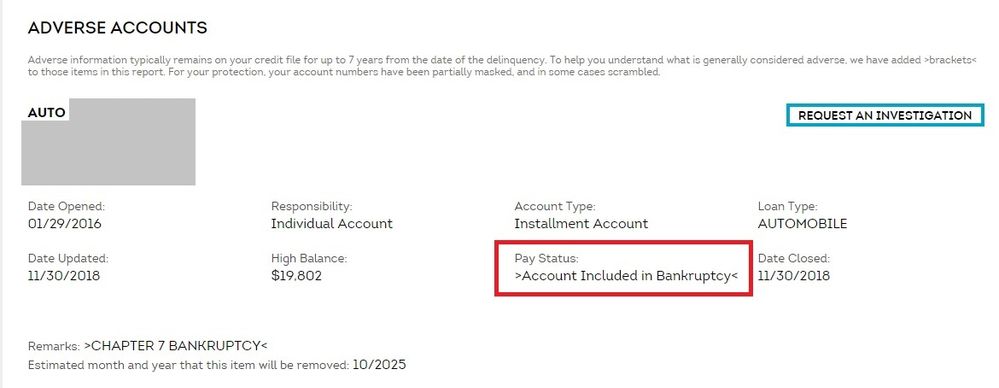

You need to be monitoring your credit reports when you’re rebuilding. Check your reports to see if all your accounts say “included in BK”. This is what they need to say otherwise they look like still outstanding debts.

Also the CSR was wrong. If you got the corrected payment in before 30 days, then yes it will not count agaisnt you on your credit report. But every bank keeps internal records and a “returned payment” even one caused by a mistyped account number is strike against you. A big one actually. If you have two in a short period, banks have been known to just shut down your card. That’s why they tossed it back at you when you tried for a CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne & BK 7

@FireMedic1 wrote:Congrats. The way it works now. After 90 days or so you can ask for a CLI. So they said you'll get a $200 CLI after credit steps ends. You may get CLI. But that will be deducted from your original credit step agreed amount. So early CLI or not. You'll still end of as promised when approved. There is no recon with Cap1. Also. Thats a farse about dont use more than 30% of your credit line. Best way with Cap1 is heavy usage and PIF each month. That will get you CLI's after credit steps. Even if you get close to your credit line. Pay it off and do it again. As long as your monthly statement is zippo.

Forgive my ignorance here in this...

When I look at my actual TransUnion report for example via the TransUnion website, this is what it shows for the Pay Status on ALL of my accounts.This is what I want it to say correct?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne & BK 7

Yes, that is correct.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne & BK 7

I burned them for about $2700 on a platinum and QS. My discharge was on Monday. I just tried the pre-qual site just out of curiosity on it said it couldn't qualify me. Does everyone get that and apply anyway, or should I hold off a bit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne & BK 7

Usually around a year out they'll let you back in. You could check the pre-qual in say around 6-8 months out. Some get back in sooner. Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne & BK 7

@ALLgoodABQ wrote:I burned them for about $2700 on a platinum and QS. My discharge was on Monday. I just tried the pre-qual site just out of curiosity on it said it couldn't qualify me. Does everyone get that and apply anyway, or should I hold off a bit?

I burned them for about $28k and they let me in after a year with a $3k limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne & BK 7

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne & BK 7

I am almost 3 full years post BK7 and have not pre-qualified with Capital One a single time. I have tried many times

I burned them for $750 and $1000 (both were quicksilver rewards cards).