- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- How is this possible, and where do I go from here?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How is this possible, and where do I go from here?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is this possible, and where do I go from here?

@ezdriver wrote:

@simi_go wrote:

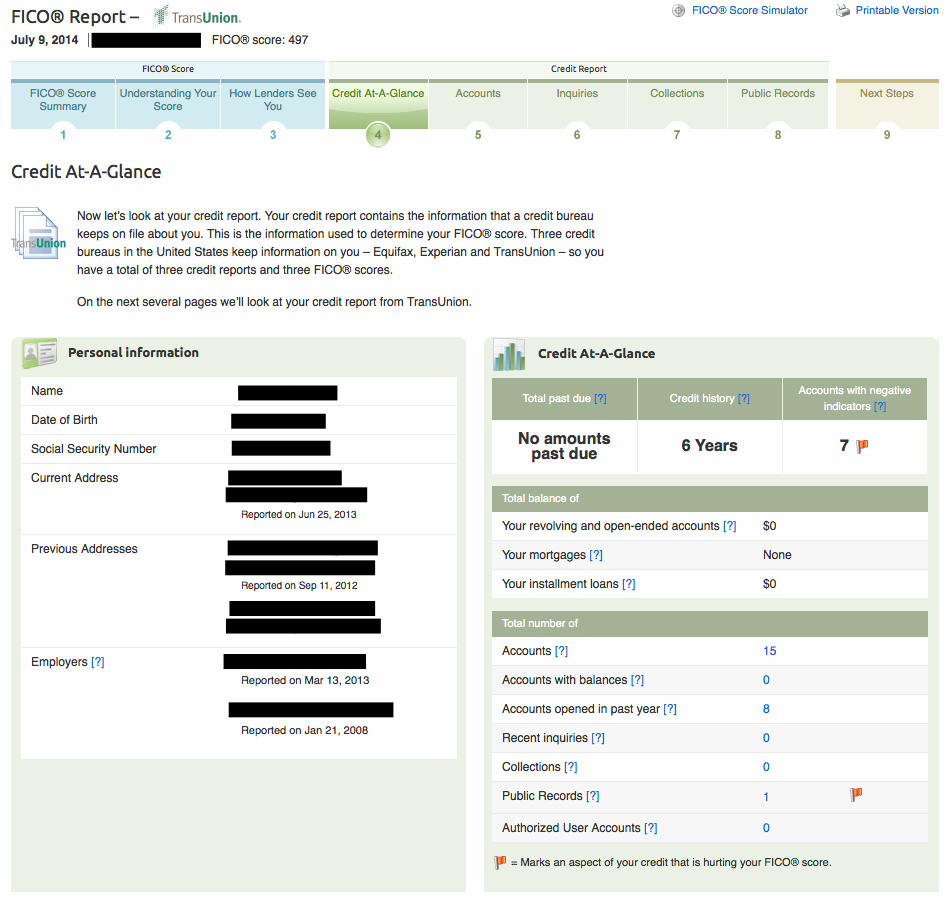

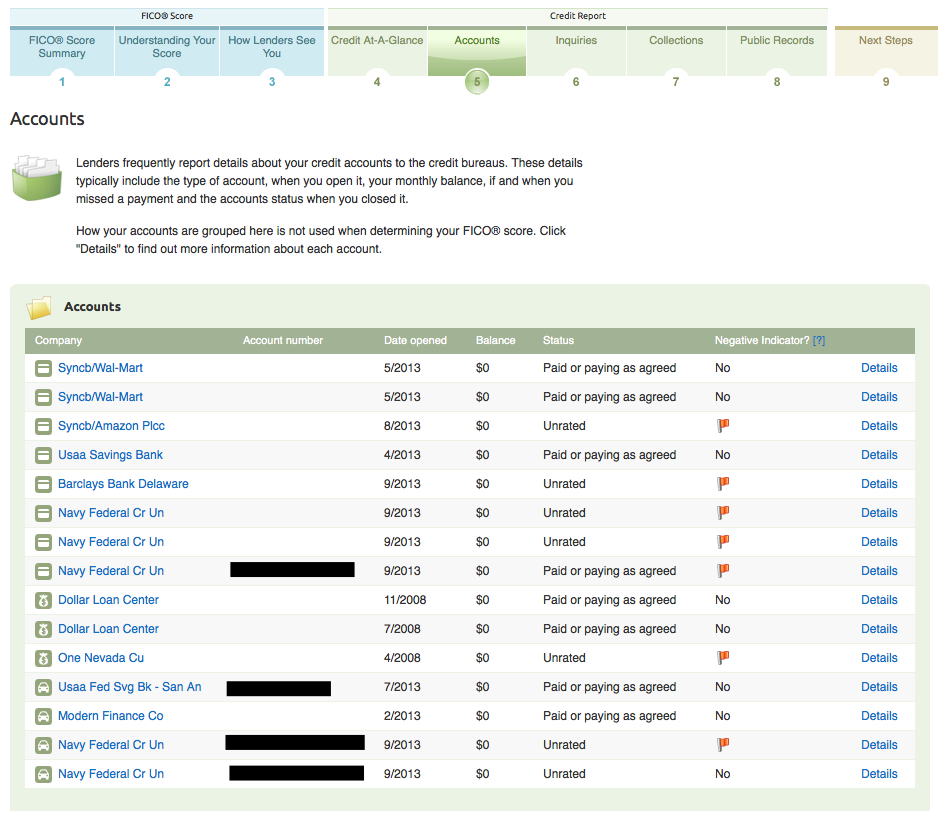

Actually I pulled from TU dispute today and every single account is listed as IIB and $0 balance. Experian is also completely updated. Only EQ has one account still not updated. I am assuming the myFico report shows unrated because TU deletes the payment history and just puts everything IIB with $0 balance.

So correcting my reports is not the problem. So what else could be?In your original post, you asked about "unrated" status of items on your credit reports. If your reports were not secured through annualcredit.com or a lender-pulled credit report, then we cannot address anything on those reports to which you refer. Let us know when you have reviewed reports from either of the two sources that I listed here.

Ok. So let me try to explain this one more time.

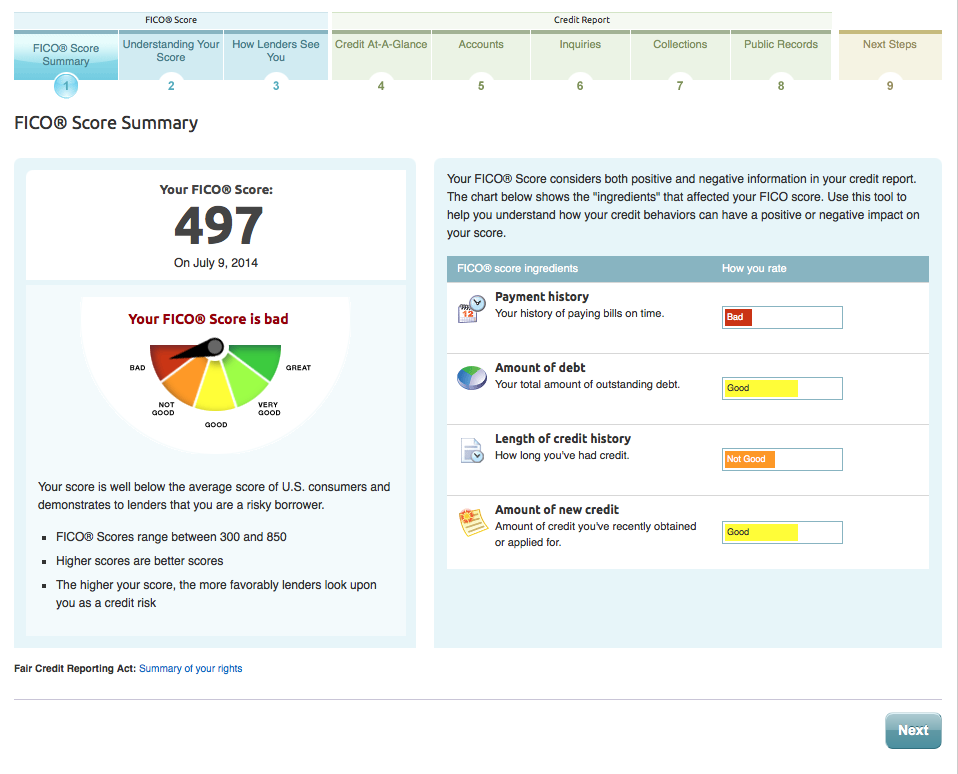

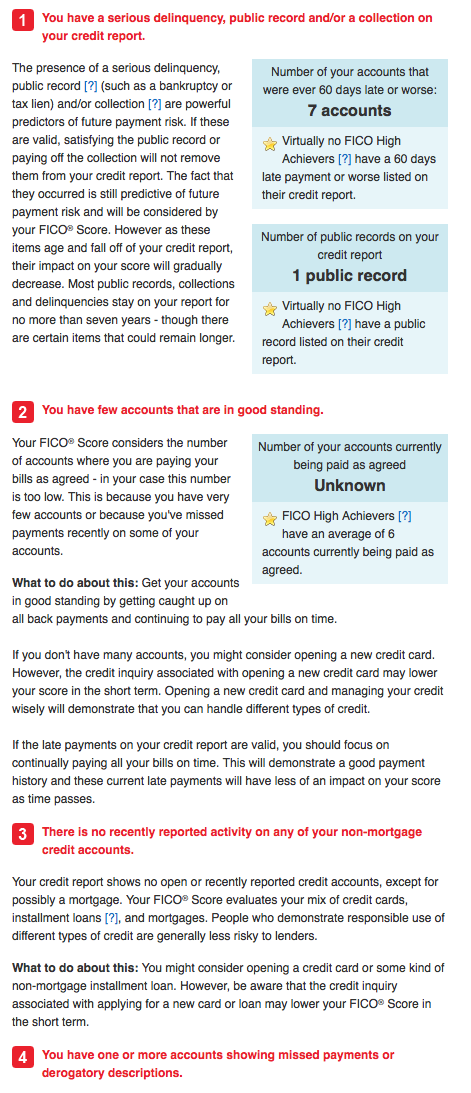

I purchased se my report from myFico. On that report the status of everything included in bankruptcy was "UNRATED". I then made the original post. Afterwards I went to dispute on TU, which pulls the EXACT report that comes from annualcreditreport.com, and the status on it reports as included in bankruptcy. Correctly as it should. So all I am hoping to find out is why is my FICO score 497. With EVERYTHING reporting correctly? Most people fresh out of BK range from 575-610, from what I have read on here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is this possible, and where do I go from here?

@Delia72 wrote:

Also myfico pulls EQ. If there are still accounts not showing IBB and $0. That could be the problem.

MyFico is not only EQ. You can get all 3 FICO scores here. And as previously stated all accounts show $0 balance and IIB.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is this possible, and where do I go from here?

I was under the impression that the other scores were FAKOs, with the exception of EQ.

You said the following: "Only EQ has one account still not updated".

I was basing my answer on that. if the EQ is not updated, and it's also the one giving you problems, that may be the culprit. Maybe not.

Quizzle Score EQ 585 as of 7/14

TU 637 as of 7/14

Credit Sesame EX FAKO 653 as of 7/10/14

Goal 700 + home purchase

Cap 1 Unsecured Plat PC'd to Quicksilver

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is this possible, and where do I go from here?

801 EQ FICO 06/2022

797 TU FICO 04/2022

793 EX FICO 04/2022

$30k NFCU Platinum | $30.7k NFCU cashRewards Sig | $15k NavChek | $7.1k Cap1 Quicksilver | $10k Amazon Store | $19k Cap1 VentureOne | $16k Barclay Aviator | $5k Chase Freedom | $5k Chase Sapphire Preferred | $9k Costco Visa | $20k AMEX BCE | AMEX Gold | NFCU Platinum #2 $19.3k | Apple $8.5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is this possible, and where do I go from here?

@Delia72 wrote:I was under the impression that the other scores were FAKOs, with the exception of EQ.

You said the following: "Only EQ has one account still not updated".

I was basing my answer on that. if the EQ is not updated, and it's also the one giving you problems, that may be the culprit. Maybe not.

Nope since TU is the only one that has completely updated perfectly that is the only one that I concerned myself with for now. The others will hopefully be done by next week. And yes ALL the scores you get directly from myFICO are true FICO scores. Just about anything else is a FAKO, so anyways anybody else want to chime in and tell me why it is only 497?

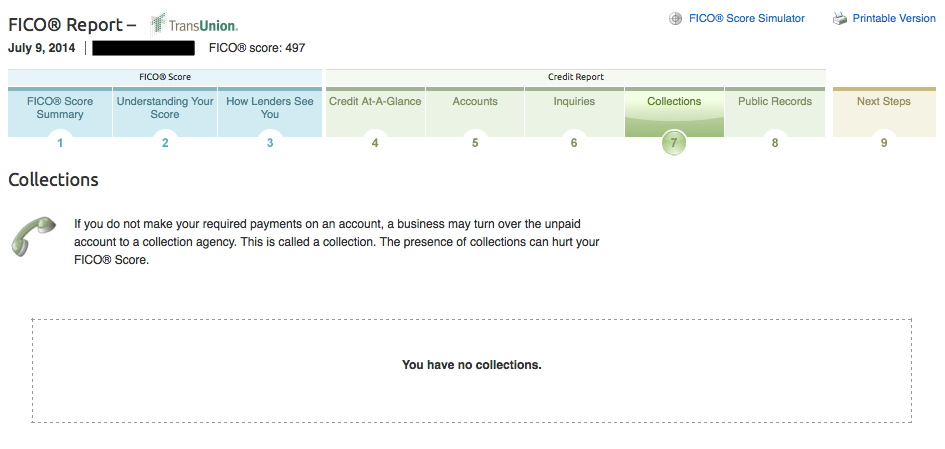

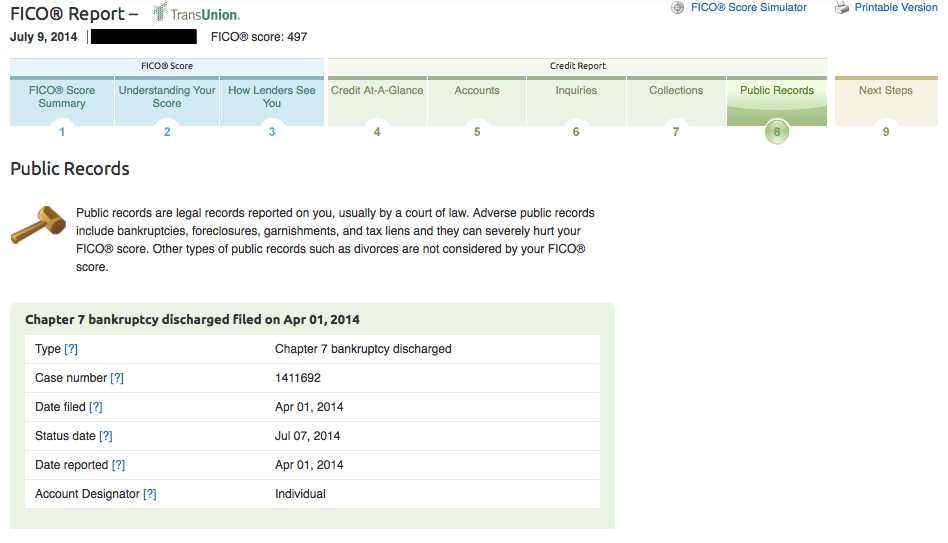

Here is the myFico report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is this possible, and where do I go from here?

@simi_go wrote:so anyways anybody else want to chime in and tell me why it is only 497?

Here is the myFico report.

I'd have to wager that it's the public record that is giving you the 497 score. Your BK 7 is fresher than the carton of eggs I bought the other day.

Hard INQs last 12 months: EQ: 5 | TU: 8 | EX: 9

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 27% --- AAoA: 5.5 years --- Income: $200k

Last app: 4-6-24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is this possible, and where do I go from here?

My last 2cents...

Forget the score ... it is not a lender-pulled score anyway so it is meaningless. Focus your efforts on rebuilding onece yur discharge has been received. A robust credit profile will deliver good scores.

To rebuild your credit profile [I don't talk scores!], you need about three tradelines reporting ontime payments and none to have a balance exceeding 3% of the credit limit.

There you have it. All the best with your rebuilding efforts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is this possible, and where do I go from here?

@ezdriver wrote:My last 2cents...

Forget the score ... it is not a lender-pulled score anyway so it is meaningless. Focus your efforts on rebuilding onece yur discharge has been received. A robust credit profile will deliver good scores.

To rebuild your credit profile [I don't talk scores!], you need about three tradelines reporting ontime payments and none to have a balance exceeding 3% of the credit limit.

There you have it. All the best with your rebuilding efforts.

THIS!! We all get so caught up in scores. Build a healthy profile and your score will follow.

801 EQ FICO 06/2022

797 TU FICO 04/2022

793 EX FICO 04/2022

$30k NFCU Platinum | $30.7k NFCU cashRewards Sig | $15k NavChek | $7.1k Cap1 Quicksilver | $10k Amazon Store | $19k Cap1 VentureOne | $16k Barclay Aviator | $5k Chase Freedom | $5k Chase Sapphire Preferred | $9k Costco Visa | $20k AMEX BCE | AMEX Gold | NFCU Platinum #2 $19.3k | Apple $8.5k